EU indices slightly positive | TA focus on TUI

INDICES

Yesterday, European stocks suffered deeper losses. The Stoxx Europe 600 Index plunged 3.24%, Germany's DAX 30 tumbled 4.37%, France's CAC 40 slid 3.74%, and the U.K.'s FTSE 100 was down 3.38%.

EUROPE ADVANCE/DECLINE

96% of STOXX 600 constituents traded lower or unchanged yesterday.

26% of the shares trade above their 20D MA vs 52% Friday (above the 20D moving average).

51% of the shares trade above their 200D MA vs 58% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 7.23pts to 29.88, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail

3mths relative low: Insurance, Banks, Energy

Europe Best 3 sectors

utilities, health care, food & beverage

Europe worst 3 sectors

banks, travel & leisure, automobiles & parts

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.49% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -20bps (above its 20D MA).

ECONOMIC DATA

GE 10:40: 2-Year Schatz auction, exp.: -0.69%

UK 11:00: Sep CBI Industrial Trends Orders, exp.: -44

EC 15:00: Sep Consumer Confidence Flash, exp.: -14.7

MORNING TRADING

In Asian trading hours, EUR/USD remained subdued at 1.1761 and GBP/USD slipped further to 1.2813. USD/JPY retreated to 104.53.

Spot gold dropped to $1,909 an ounce.

#UK - IRELAND#

Whitbread, a hotel and restaurant group, posted a 1H trading update: "H1 total sales were significantly down year-on-year reflecting the closure of the vast majority of our hotels and restaurants for a large part of the period. (...) With market demand expected to remain at lower levels in the short to medium-term, we have now taken the very difficult decision to announce our intention to enter into consultation on proposals that could result in up to 6,000 redundancies for our hotel and restaurant colleagues (representing 18% of our total workforce). We expect a significant proportion of these redundancies to be achieved voluntarily."

Beazley, a specialist insurance company, said it has raised its cost estimate of Covid-19 claims for its first party business to 340 million dollars net of reinsurance from 170 million dollars previously, "with almost of all of the increase caused by further event cancellation losses".

Hikma Pharmaceuticals, a pharmaceutical company, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#GERMANY#

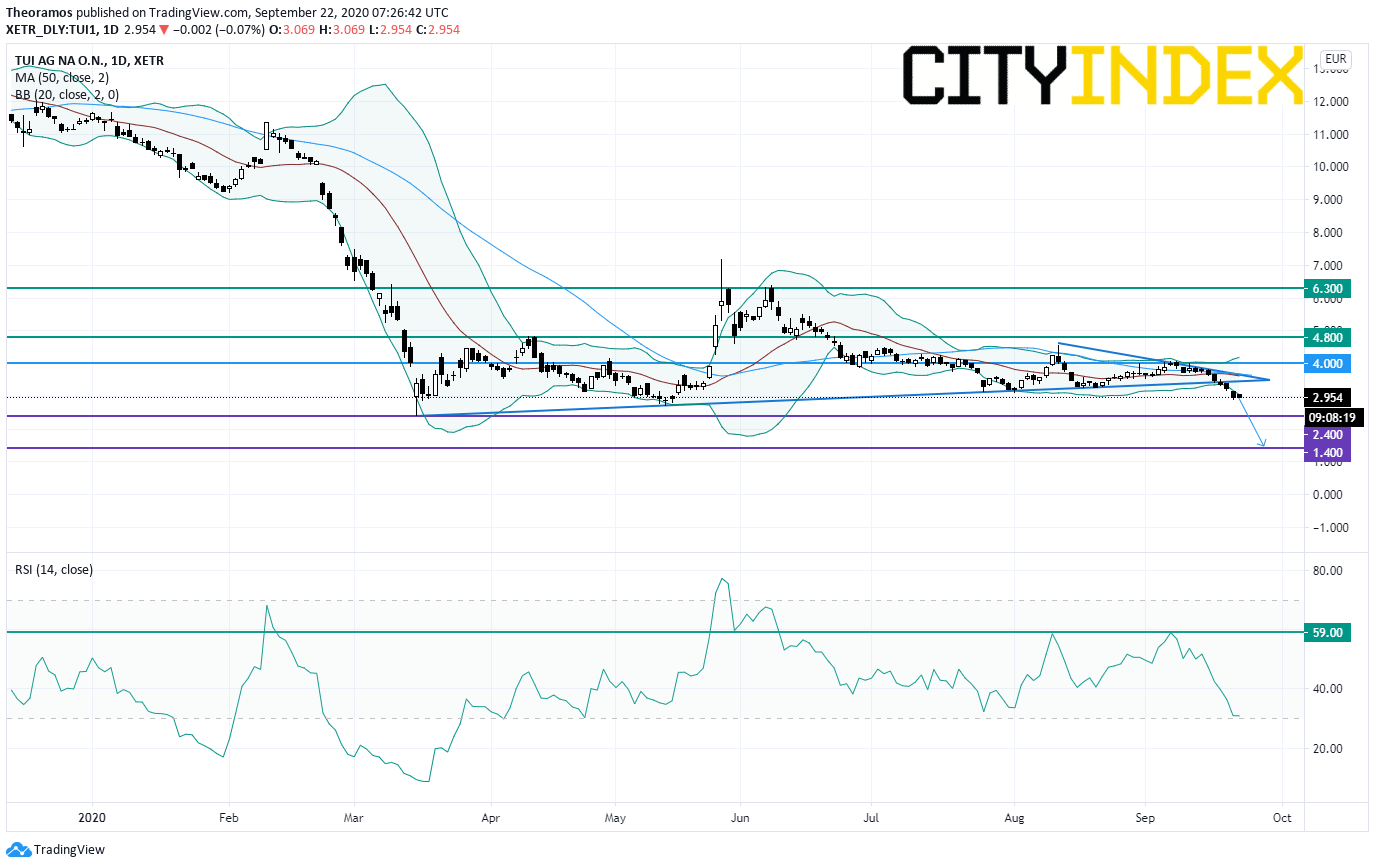

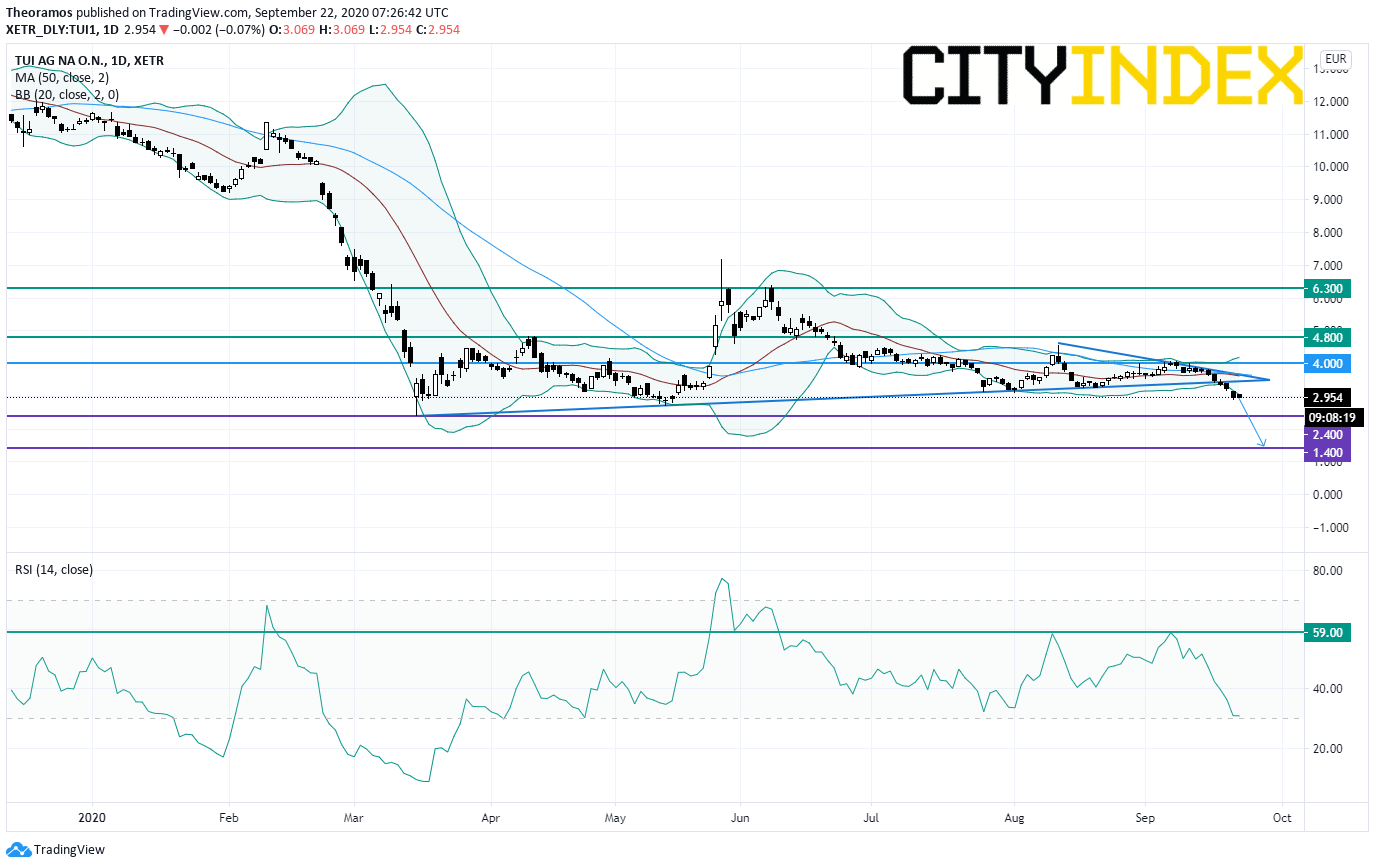

TUI, a travel and tourism company, released a full-year trading update: "We have initiated the main projects of our global realignment programme to address group-wide costs. The programme targets to permanently reduce our annual overhead cost base by 30% across the entire Group and potentially impacts 8,000 roles. We are targeting permanent annual saving of more than E300m, with the first benefits expected to be delivered from FY20 and full benefits to be delivered by FY23."

Source: GAIN Capital, TradingView

#FRANCE#

Suez, a utility company, said it plans ordinary dividends of 0.65 euro per share payable in 2021, increasing to 0.70 euro per share in 2022, and a potential addition of at least 1 billion euros extraordinary distribution in 2021. It added that it now sees recurring EPS at between 0.75 euro and 0.80 euro in 2021 and 0.90 euro and 1.0 euro in 2022. Meanwhile, the company reported that it has entered into exclusive negotiations for the sale of its Recycling and Recovery operations in Sweden for an enterprise value of 3.7 billion Swedish krona.

LVMH, a luxury goods conglomerate, said: "LVMH is fully confident that it will be able to defeat Tiffany's accusations and convince the Court that the conditions necessary for the acquisition of Tiffany are no longer met. In this regard, in the coming months, LVMH will demonstrate to the American justice system that the mismanagement of Tiffany during the COVID-19 crisis constitutes a Material Adverse Effect."

Safran, an aerospace-component and defense company, was upgraded to "overweight" from "equalweight" at Barclays.

#DENMARK#

Maersk, a Danish integrated shipping company, was upgraded to "overweight" from "neutral" at JPMorgan.

Yesterday, European stocks suffered deeper losses. The Stoxx Europe 600 Index plunged 3.24%, Germany's DAX 30 tumbled 4.37%, France's CAC 40 slid 3.74%, and the U.K.'s FTSE 100 was down 3.38%.

EUROPE ADVANCE/DECLINE

96% of STOXX 600 constituents traded lower or unchanged yesterday.

26% of the shares trade above their 20D MA vs 52% Friday (above the 20D moving average).

51% of the shares trade above their 200D MA vs 58% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 7.23pts to 29.88, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail

3mths relative low: Insurance, Banks, Energy

Europe Best 3 sectors

utilities, health care, food & beverage

Europe worst 3 sectors

banks, travel & leisure, automobiles & parts

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.49% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -20bps (above its 20D MA).

ECONOMIC DATA

GE 10:40: 2-Year Schatz auction, exp.: -0.69%

UK 11:00: Sep CBI Industrial Trends Orders, exp.: -44

EC 15:00: Sep Consumer Confidence Flash, exp.: -14.7

MORNING TRADING

In Asian trading hours, EUR/USD remained subdued at 1.1761 and GBP/USD slipped further to 1.2813. USD/JPY retreated to 104.53.

Spot gold dropped to $1,909 an ounce.

#UK - IRELAND#

Whitbread, a hotel and restaurant group, posted a 1H trading update: "H1 total sales were significantly down year-on-year reflecting the closure of the vast majority of our hotels and restaurants for a large part of the period. (...) With market demand expected to remain at lower levels in the short to medium-term, we have now taken the very difficult decision to announce our intention to enter into consultation on proposals that could result in up to 6,000 redundancies for our hotel and restaurant colleagues (representing 18% of our total workforce). We expect a significant proportion of these redundancies to be achieved voluntarily."

Beazley, a specialist insurance company, said it has raised its cost estimate of Covid-19 claims for its first party business to 340 million dollars net of reinsurance from 170 million dollars previously, "with almost of all of the increase caused by further event cancellation losses".

Hikma Pharmaceuticals, a pharmaceutical company, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#GERMANY#

TUI, a travel and tourism company, released a full-year trading update: "We have initiated the main projects of our global realignment programme to address group-wide costs. The programme targets to permanently reduce our annual overhead cost base by 30% across the entire Group and potentially impacts 8,000 roles. We are targeting permanent annual saving of more than E300m, with the first benefits expected to be delivered from FY20 and full benefits to be delivered by FY23."

From a daily point of view, the stock have validated a break below the lower end of a symmetrical continuation triangle drawn since August. Furthermore, the support line drawn since March has been broken down. Moreover, the RSI has struck against the resistance at 59% with a recent increasing seller volumes. Below 4E, look for the horizontal resistance at 2.4E and 1.4E in extension.

Source: GAIN Capital, TradingView

#FRANCE#

Suez, a utility company, said it plans ordinary dividends of 0.65 euro per share payable in 2021, increasing to 0.70 euro per share in 2022, and a potential addition of at least 1 billion euros extraordinary distribution in 2021. It added that it now sees recurring EPS at between 0.75 euro and 0.80 euro in 2021 and 0.90 euro and 1.0 euro in 2022. Meanwhile, the company reported that it has entered into exclusive negotiations for the sale of its Recycling and Recovery operations in Sweden for an enterprise value of 3.7 billion Swedish krona.

LVMH, a luxury goods conglomerate, said: "LVMH is fully confident that it will be able to defeat Tiffany's accusations and convince the Court that the conditions necessary for the acquisition of Tiffany are no longer met. In this regard, in the coming months, LVMH will demonstrate to the American justice system that the mismanagement of Tiffany during the COVID-19 crisis constitutes a Material Adverse Effect."

Safran, an aerospace-component and defense company, was upgraded to "overweight" from "equalweight" at Barclays.

#DENMARK#

Maersk, a Danish integrated shipping company, was upgraded to "overweight" from "neutral" at JPMorgan.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM