EU indices slightly up | TA on Iberdrola

INDICES

Yesterday, European stocks lacked upward momentum. The Stoxx Europe 600 Index slipped 0.35%, Germany's DAX 30 dropped 0.92%, France's CAC 40 lost 0.27%, while the U.K.'s FTSE 100 was little changed.

EUROPE ADVANCE/DECLINE

52% of STOXX 600 constituents traded lower or unchanged yesterday.

61% of the shares trade above their 20D MA vs 60% Monday (above the 20D moving average).

61% of the shares trade above their 200D MA vs 60% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.01pt to 27.63, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Autos, Media, Industrial

3mths relative low: none

Europe Best 3 sectors

banks, travel & leisure, retail

Europe worst 3 sectors

technology, chemicals, health care

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.63% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -18bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Sep Core Inflation Rate MoM, exp.: -0.6%

UK 07:00: Sep PPI Core Output YoY, exp.: 0%

UK 07:00: Sep PPI Core Output MoM, exp.: 0.1%

UK 07:00: Sep PPI Output MoM, exp.: 0%

UK 07:00: Sep PPI Input MoM, exp.: -0.4%

UK 07:00: Sep PPI Input YoY, exp.: -5.8%

UK 07:00: Sep PPI Output YoY, exp.: -0.9%

UK 07:00: Sep Inflation Rate MoM, exp.: -0.4%

UK 07:00: Sep Core Inflation Rate YoY, exp.: 0.9%

UK 07:00: Sep Inflation Rate YoY, exp.: 0.2%

UK 07:00: Sep Retail Price Idx MoM, exp.: -0.3%

UK 07:00: Sep Retail Price Idx YoY, exp.: 0.5%

UK 07:00: Sep Public Sector Net Borrowing, exp.: £-35.9B

EC 08:30: ECB President Lagarde speech

EC 08:45: ECB Lane speech

EC 11:00: ECB Guindos speech

UK 13:10: BoE Ramsden speech

EC 14:55: ECB Lane speech

GE 15:00: Bundesbank Balz speech

EC 17:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD advanced further to 1.1841 and GBP/USD climbed to 1.2972. USD/JPY fell to 105.37.

Spot gold rose to $1,919 an ounce.

#UK - IRELAND#

Avast, a cybersecurity provider, posted a 3Q trading update: "For the third quarter, Adjusted Revenue of $226.0m was up by 8.6% on an organic basis, and 2.6% at actual rates. (...) As a result of the strong demand in the second quarter, revenue growth is expected to continue to outpace billings growth in the second half of the year. The Group reaffirms its FY 2020 outlook for Adjusted Revenue to be at the upper end of mid-single digit growth."

Fresnillo, a precious metals mining company, released a 3Q production report: "Quarterly attributable silver production of 13.3 moz (including Silverstream), down 2.3% vs. 2Q20. (...) Quarterly attributable gold production of 172.7 koz, down 6.3% vs. 2Q20. (...) 2020 silver production guidance remains in the range of 51 to 56 moz (including Silverstream) while gold production is now expected to be in a range of 745 to 775 koz (previously 785 to 815 koz)."

Segro, a real estate investment trust, announced the acquisition of Electra Park, an urban warehouse estate in London, for 133 million pounds.

#SPAIN#

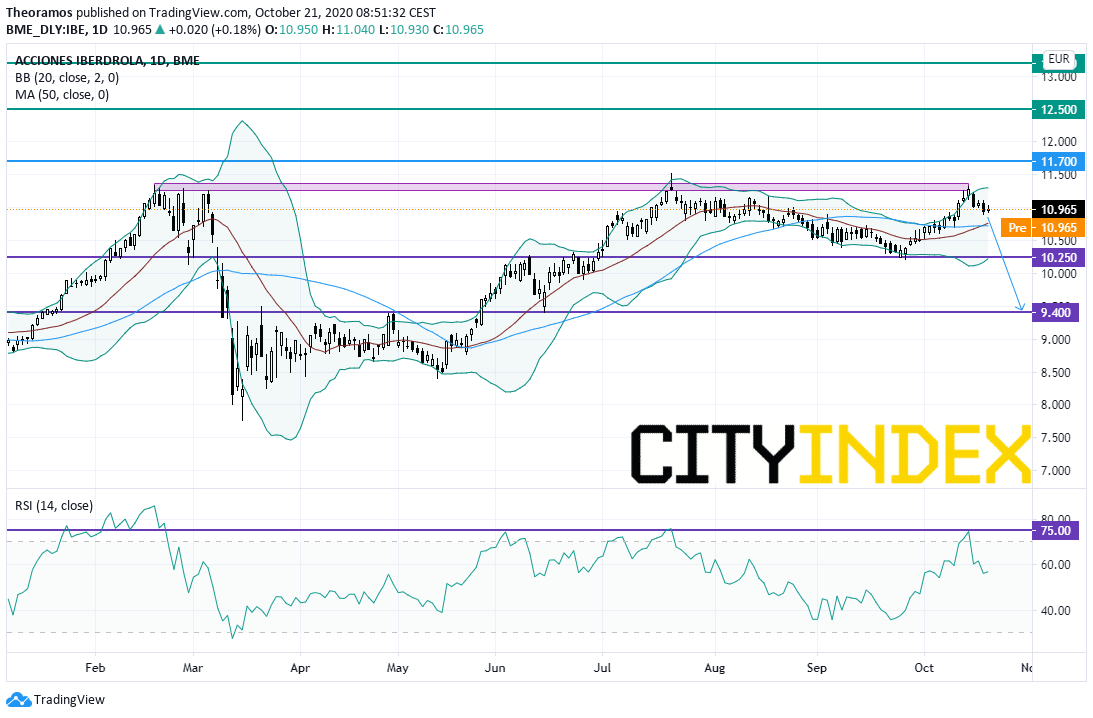

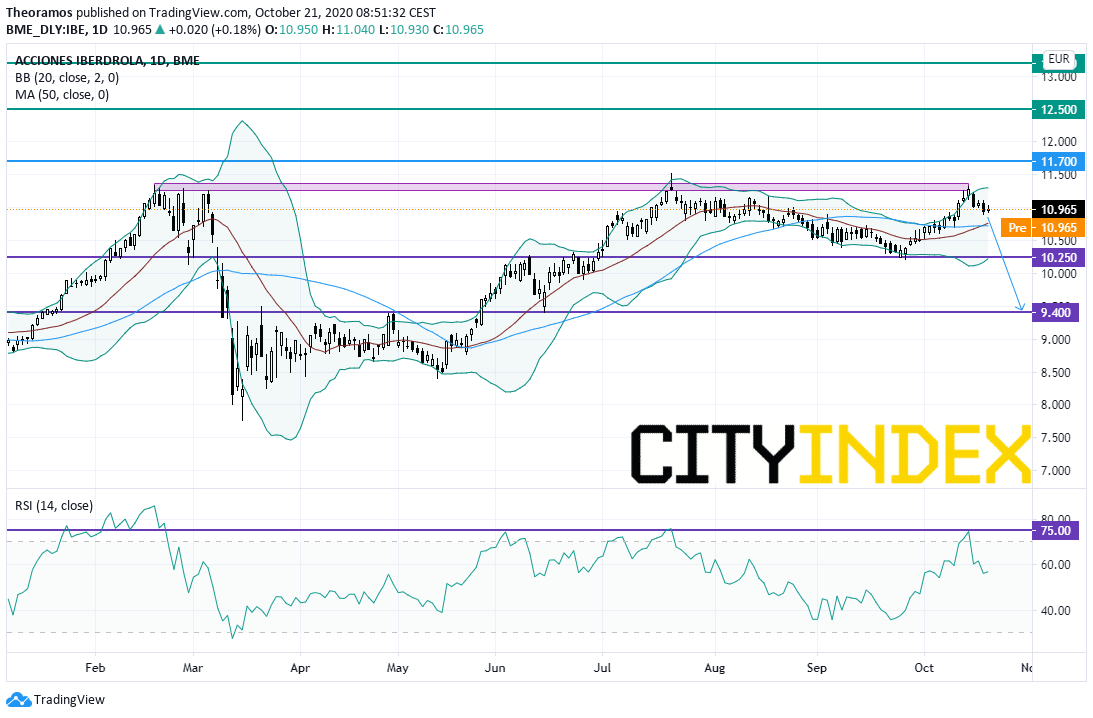

Iberdrola, a Spanish electric utility company, is expected to report 3Q results. Meanwhile, the company's U.S. power utility, Avangrid, said it has agreed to acquire PNM Resources for 50.3 dollars per share, representing an aggregate consideration of approximately 4.32 billion dollars.

From a daily point of view, the stock has struck against the key resistance area (and previous all-time high) around 11.5E in place since 2005. Moreover, the RSI is capped since June by the resistance at 75%. Below the key level at 11.7, look for the horizontal September's support at 10.25E and the June's support at 9.4E in extension.

Source: TradingView, GAIN Capital

#SCANDINAVIA#

Ericsson, a Swedish networking and telecommunications company, announced that it swung to a 3Q net profit of 5.6 billion Swedish krona from a net loss of 6.9 billion Swedish krona in the prior-year period and adjusted operating income rose 38% on year to 9.0 billion Swedish krona. Net sales grew 1% (+7% adjusted for comparable units and currency) to 57.5 billion Swedish krona.

Telenor, a Norwegian telecommunications group, posted 3Q net income of 4.53 billion Norwegian krone, compared with a net loss of 0.68 billion Norwegian krone in the prior-year period and EBITDA increased 11.0% on year to 14.57 billion Norwegian krone. Revenue rose 5.6% to 30.01 billion Norwegian krone.

Svenska Handelsbanken, a banking group, reported that 3Q net income fell 7% on year to 3.32 billion Swedish krona on net interest income of 7.89 billion Swedish krona, down 2%.

Yesterday, European stocks lacked upward momentum. The Stoxx Europe 600 Index slipped 0.35%, Germany's DAX 30 dropped 0.92%, France's CAC 40 lost 0.27%, while the U.K.'s FTSE 100 was little changed.

EUROPE ADVANCE/DECLINE

52% of STOXX 600 constituents traded lower or unchanged yesterday.

61% of the shares trade above their 20D MA vs 60% Monday (above the 20D moving average).

61% of the shares trade above their 200D MA vs 60% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.01pt to 27.63, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Autos, Media, Industrial

3mths relative low: none

Europe Best 3 sectors

banks, travel & leisure, retail

Europe worst 3 sectors

technology, chemicals, health care

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.63% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -18bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Sep Core Inflation Rate MoM, exp.: -0.6%

UK 07:00: Sep PPI Core Output YoY, exp.: 0%

UK 07:00: Sep PPI Core Output MoM, exp.: 0.1%

UK 07:00: Sep PPI Output MoM, exp.: 0%

UK 07:00: Sep PPI Input MoM, exp.: -0.4%

UK 07:00: Sep PPI Input YoY, exp.: -5.8%

UK 07:00: Sep PPI Output YoY, exp.: -0.9%

UK 07:00: Sep Inflation Rate MoM, exp.: -0.4%

UK 07:00: Sep Core Inflation Rate YoY, exp.: 0.9%

UK 07:00: Sep Inflation Rate YoY, exp.: 0.2%

UK 07:00: Sep Retail Price Idx MoM, exp.: -0.3%

UK 07:00: Sep Retail Price Idx YoY, exp.: 0.5%

UK 07:00: Sep Public Sector Net Borrowing, exp.: £-35.9B

EC 08:30: ECB President Lagarde speech

EC 08:45: ECB Lane speech

EC 11:00: ECB Guindos speech

UK 13:10: BoE Ramsden speech

EC 14:55: ECB Lane speech

GE 15:00: Bundesbank Balz speech

EC 17:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD advanced further to 1.1841 and GBP/USD climbed to 1.2972. USD/JPY fell to 105.37.

Spot gold rose to $1,919 an ounce.

#UK - IRELAND#

Avast, a cybersecurity provider, posted a 3Q trading update: "For the third quarter, Adjusted Revenue of $226.0m was up by 8.6% on an organic basis, and 2.6% at actual rates. (...) As a result of the strong demand in the second quarter, revenue growth is expected to continue to outpace billings growth in the second half of the year. The Group reaffirms its FY 2020 outlook for Adjusted Revenue to be at the upper end of mid-single digit growth."

Fresnillo, a precious metals mining company, released a 3Q production report: "Quarterly attributable silver production of 13.3 moz (including Silverstream), down 2.3% vs. 2Q20. (...) Quarterly attributable gold production of 172.7 koz, down 6.3% vs. 2Q20. (...) 2020 silver production guidance remains in the range of 51 to 56 moz (including Silverstream) while gold production is now expected to be in a range of 745 to 775 koz (previously 785 to 815 koz)."

Segro, a real estate investment trust, announced the acquisition of Electra Park, an urban warehouse estate in London, for 133 million pounds.

#SPAIN#

Iberdrola, a Spanish electric utility company, is expected to report 3Q results. Meanwhile, the company's U.S. power utility, Avangrid, said it has agreed to acquire PNM Resources for 50.3 dollars per share, representing an aggregate consideration of approximately 4.32 billion dollars.

From a daily point of view, the stock has struck against the key resistance area (and previous all-time high) around 11.5E in place since 2005. Moreover, the RSI is capped since June by the resistance at 75%. Below the key level at 11.7, look for the horizontal September's support at 10.25E and the June's support at 9.4E in extension.

Source: TradingView, GAIN Capital

#SCANDINAVIA#

Ericsson, a Swedish networking and telecommunications company, announced that it swung to a 3Q net profit of 5.6 billion Swedish krona from a net loss of 6.9 billion Swedish krona in the prior-year period and adjusted operating income rose 38% on year to 9.0 billion Swedish krona. Net sales grew 1% (+7% adjusted for comparable units and currency) to 57.5 billion Swedish krona.

Telenor, a Norwegian telecommunications group, posted 3Q net income of 4.53 billion Norwegian krone, compared with a net loss of 0.68 billion Norwegian krone in the prior-year period and EBITDA increased 11.0% on year to 14.57 billion Norwegian krone. Revenue rose 5.6% to 30.01 billion Norwegian krone.

Svenska Handelsbanken, a banking group, reported that 3Q net income fell 7% on year to 3.32 billion Swedish krona on net interest income of 7.89 billion Swedish krona, down 2%.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM