European shares go into reverse after initial drop as the European Union leaders were yet to agree on the size of a stimulus package, where oppositions led by Dutch Prime Minister Mark Rutte demanded a substantially less figure. European Central Bank has reported the eurozone's May current account at 8.0 billion euros surplus (vs 14.4 billion euros surplus in April). German June PPI was released at 0.0%, vs 0.2% expected.

Asian indices closed mixed even if the Chinese CSI jumped by 3.11%. This morning, government data showed that Japan's exports declined 26.2% on year in June (-24.7% expected) and imports slid 14.4% (-17.6% expected).

WTI Crude Oil futures are under pressure. The total number of U.S. rigs fell to 253 as of July 17 from 258 a week ago, while oil rigs in Canada increased to 32 from 26, according to Baker Hughes.

Gold is consolidating above 1800 dollars, remaining firm on COVID-19 fears.

Gold rose 0.17 dollars (+0.01%) to 1810.6 dollars.

The euro is gaining ground, climbing to a four-month high, on hopes of progress regarding debt talks.

EUR/USD rose 20pips to 1.1448 while the GBP/USD gained 29pips to 1.2597

U.S. Equity Snapshot

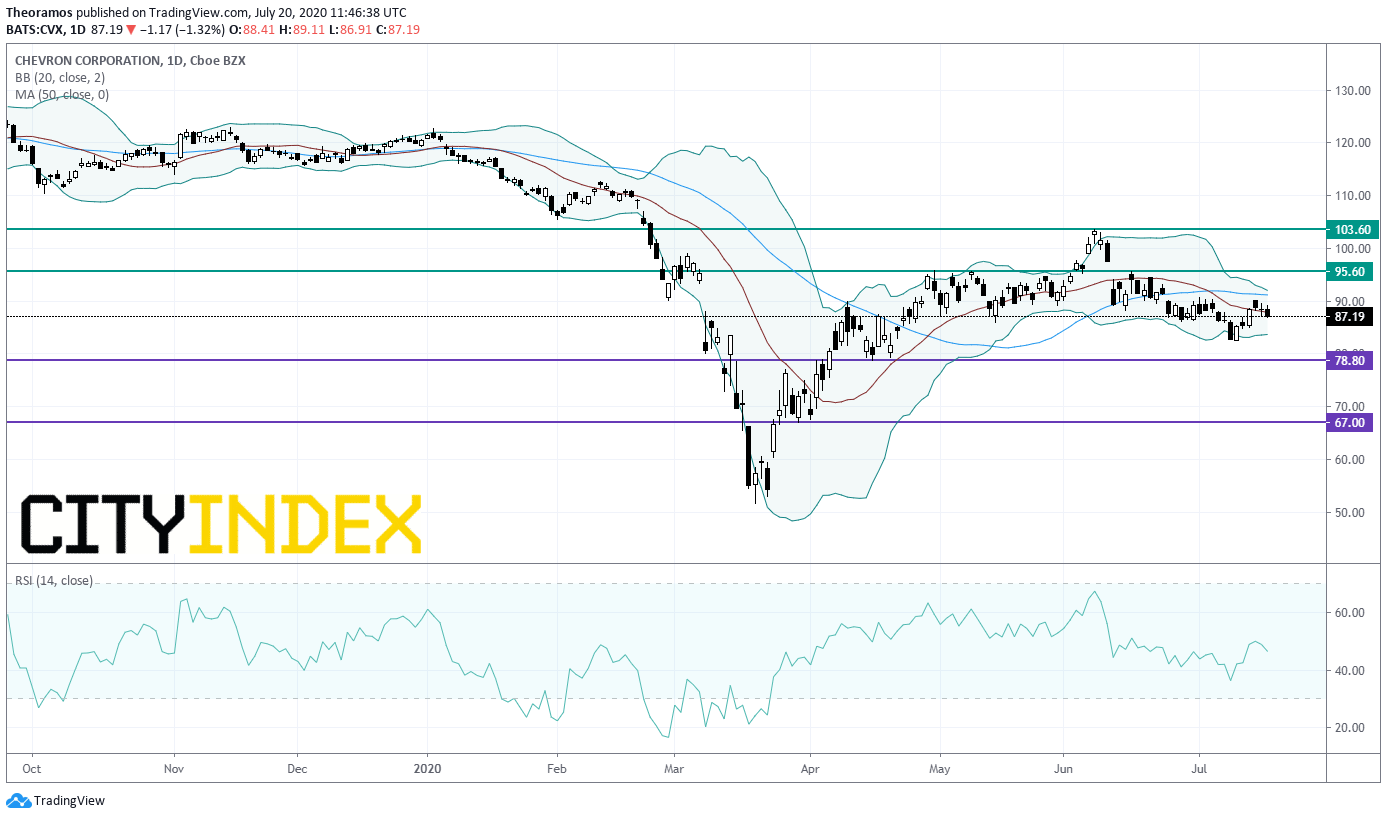

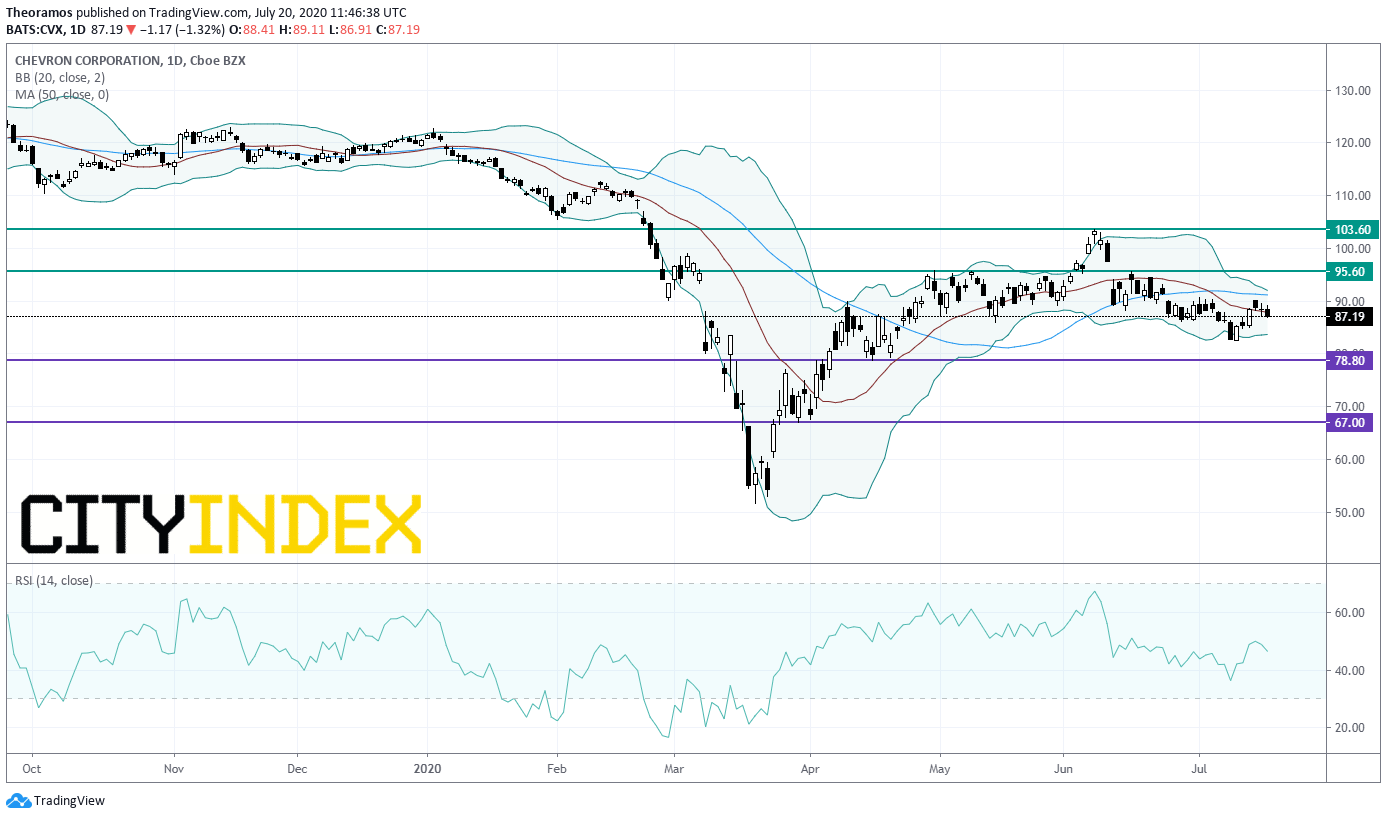

Chevron (CVX), the oil giant, "has entered into a definitive agreement with Noble Energy (NBL) to acquire all of the outstanding shares of Noble Energy in an all-stock transaction valued at 5 billion dollars, or 10.38 dollars per share."

Amazon.com's (AMZN) price target was raised to 3,800 dollars from 3,100 dollars at Jefferies.

eBay (EBAY), the global electronic commerce platform, would be close to sell its Classified-Ads unit to Adevinta for about 9 billion dollars, according to Bloomberg.

Starbucks (SBUX), the global specialty coffee chain, was rated "overweight" in a new coverage at Wells Fargo.

Moderna (MRNA), the biotech, was downgraded to "neutral" from "overweight" at JPMorgan.

Celanese (CE), a global chemical and specialty materials company, "announced it has reached a definitive agreement to sell its 45% equity investment in the Polyplastics joint venture to Daicel Corporation for 1.575 billion dollars. Following the completion of the transaction, Daicel will own 100 percent of Polyplastics."

US Futures mixed - Watch CVX, HAL, AMZN, EBAY, SBUX, MRNA, CE

The S&P 500 Futures are still consolidating after they closed mixed on Friday as the coronavirus pandemic keeps exploding across the world. The number of confirmed virus deaths has exceeded 600,000 globally, and topped 140,000 in the U.S.

European shares go into reverse after initial drop as the European Union leaders were yet to agree on the size of a stimulus package, where oppositions led by Dutch Prime Minister Mark Rutte demanded a substantially less figure. European Central Bank has reported the eurozone's May current account at 8.0 billion euros surplus (vs 14.4 billion euros surplus in April). German June PPI was released at 0.0%, vs 0.2% expected.

Asian indices closed mixed even if the Chinese CSI jumped by 3.11%. This morning, government data showed that Japan's exports declined 26.2% on year in June (-24.7% expected) and imports slid 14.4% (-17.6% expected).

WTI Crude Oil futures are under pressure. The total number of U.S. rigs fell to 253 as of July 17 from 258 a week ago, while oil rigs in Canada increased to 32 from 26, according to Baker Hughes.

Gold is consolidating above 1800 dollars, remaining firm on COVID-19 fears.

Gold rose 0.17 dollars (+0.01%) to 1810.6 dollars.

The euro is gaining ground, climbing to a four-month high, on hopes of progress regarding debt talks.

EUR/USD rose 20pips to 1.1448 while the GBP/USD gained 29pips to 1.2597

U.S. Equity Snapshot

Chevron (CVX), the oil giant, "has entered into a definitive agreement with Noble Energy (NBL) to acquire all of the outstanding shares of Noble Energy in an all-stock transaction valued at 5 billion dollars, or 10.38 dollars per share."

Source: TradingView, Gain Capital

Halliburton (HAL), the oil and gas services company, reported second quarter EPS of 0.05 dollar, above estimates, down from 0.31 dollar a year earlier. Sales decreased 46% to 3.2 billion dollars, missing forecasts.Amazon.com's (AMZN) price target was raised to 3,800 dollars from 3,100 dollars at Jefferies.

eBay (EBAY), the global electronic commerce platform, would be close to sell its Classified-Ads unit to Adevinta for about 9 billion dollars, according to Bloomberg.

Starbucks (SBUX), the global specialty coffee chain, was rated "overweight" in a new coverage at Wells Fargo.

Moderna (MRNA), the biotech, was downgraded to "neutral" from "overweight" at JPMorgan.

Celanese (CE), a global chemical and specialty materials company, "announced it has reached a definitive agreement to sell its 45% equity investment in the Polyplastics joint venture to Daicel Corporation for 1.575 billion dollars. Following the completion of the transaction, Daicel will own 100 percent of Polyplastics."

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM