EU indices slightly up | TA focus on AstraZeneca

INDICES

Yesterday, European stocks were broadly lower. The Stoxx Europe 600 fell 0.75%, Germany's DAX lost 0.88%, France's CAC 40 dropped 0.67%, and the U.K.'s FTSE 100 was down 0.80%.

EUROPE ADVANCE/DECLINE

72% of STOXX 600 constituents traded lower or unchanged yesterday.

82% of the shares trade above their 20D MA vs 84% Wednesday (above the 20D moving average).

83% of the shares trade above their 200D MA vs 85% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.07pt to 21.97, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Autos

3mths relative low: none

Europe Best 3 sectors

retail, energy, basic resources

Europe worst 3 sectors

banks, automobiles & parts, insurance

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.55% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -16bps (above its 20D MA).

ECONOMIC DATA

UK 01:01: Nov GfK Consumer Confidence, exp.: -31

GE 08:00: Oct PPI YoY, exp.: -1%

GE 08:00: Oct PPI MoM, exp.: 0.4%

UK 08:00: Oct Public Sector Net Borrowing, exp.: £-36.1B

UK 08:00: Oct Retail Sales ex Fuel MoM, exp.: 1.6%

UK 08:00: Oct Retail Sales ex Fuel YoY, exp.: 6.4%

UK 08:00: Oct Retail Sales YoY, exp.: 4.7%

UK 08:00: Oct Retail Sales MoM, exp.: 1.5%

GE 14:00: Bundesbank Weidmann speech

EC 16:00: Nov Consumer Confidence Flash, exp.: -15.5

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1875 and GBP/USD was broadly flat at 1.3265. USD/JPY edged up to 103.82. AUD/USD remained subdued at 0.7289. This morning, official data showed that Australia's preliminary retail sales grew 1.6% on month in October (-1.1% in September).

Spot gold slipped to $1,864 an ounce.

#UK - IRELAND#

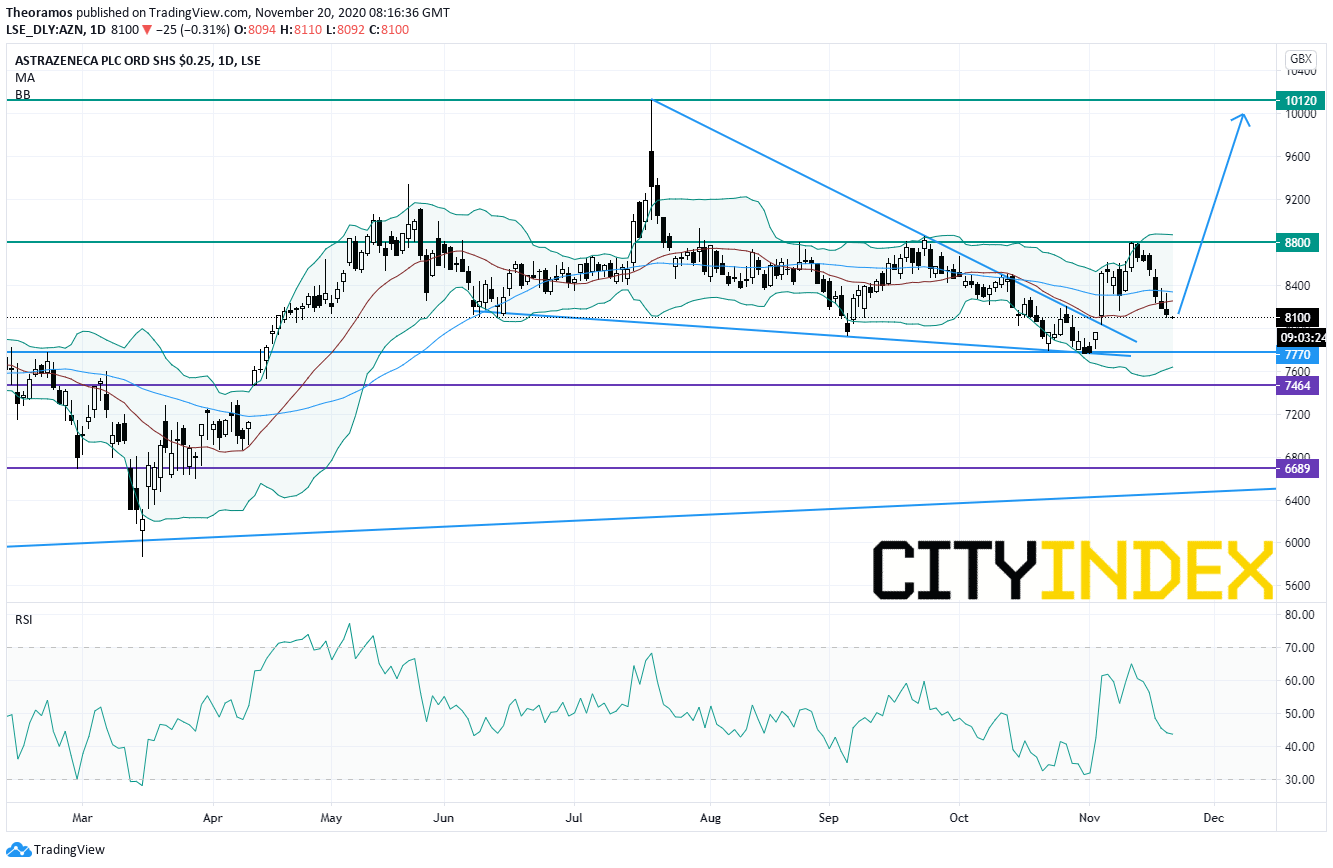

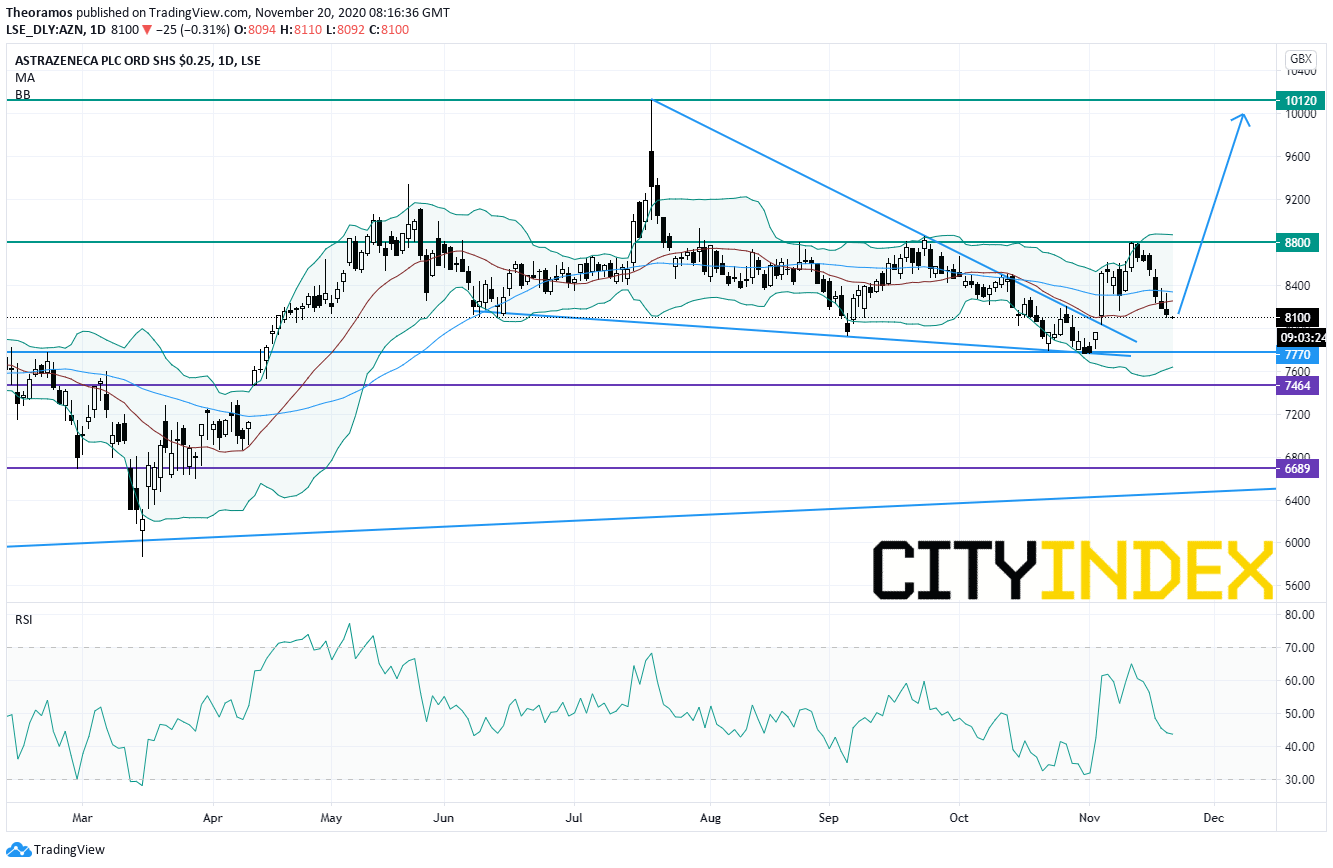

AstraZeneca, a pharmaceutical group, said its "Imfinzi (durvalumab) has been approved in the US for an additional dosing option, a 1,500mg fixed dose every four weeks, in the approved indications of unresectable Stage III non-small cell lung cancer (NSCLC) after chemoradiation therapy (CRT) and previously treated advanced bladder cancer".

From a technical point of view, the stock has escaped from a falling wedge in place since June 2020. Despite the recent pullback, as long as 7770p is support look for 8800p and the previous all-time high at 10120p. Alternatively, a break below 7770p should be limited by a rising long term trend line.

Talanx, a financial services company, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

BNP Paribas, a banking group, may sell its Italian payments unit Axepta for 200 million euros, reported Bloomberg citing people familiar with the matter.

#BENELUX#

Altice Europe, a telecommunications corporation, announced that 3Q adjusted EBITDA grew 5.1% on year to 1.48 billion euros on revenue of 3.77 billion euros, up 3.2% (+4.1% at constant currency).

#SWITZERLAND#

ABB, an automation technology company, was downgraded to "sell" from "hold" at Deutsche Bank.

Swatch Group, a manufacturer of watches and jewellery, was downgraded to "hold" from "buy" at HSBC.

Yesterday, European stocks were broadly lower. The Stoxx Europe 600 fell 0.75%, Germany's DAX lost 0.88%, France's CAC 40 dropped 0.67%, and the U.K.'s FTSE 100 was down 0.80%.

EUROPE ADVANCE/DECLINE

72% of STOXX 600 constituents traded lower or unchanged yesterday.

82% of the shares trade above their 20D MA vs 84% Wednesday (above the 20D moving average).

83% of the shares trade above their 200D MA vs 85% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.07pt to 21.97, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Autos

3mths relative low: none

Europe Best 3 sectors

retail, energy, basic resources

Europe worst 3 sectors

banks, automobiles & parts, insurance

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.55% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -16bps (above its 20D MA).

ECONOMIC DATA

UK 01:01: Nov GfK Consumer Confidence, exp.: -31

GE 08:00: Oct PPI YoY, exp.: -1%

GE 08:00: Oct PPI MoM, exp.: 0.4%

UK 08:00: Oct Public Sector Net Borrowing, exp.: £-36.1B

UK 08:00: Oct Retail Sales ex Fuel MoM, exp.: 1.6%

UK 08:00: Oct Retail Sales ex Fuel YoY, exp.: 6.4%

UK 08:00: Oct Retail Sales YoY, exp.: 4.7%

UK 08:00: Oct Retail Sales MoM, exp.: 1.5%

GE 14:00: Bundesbank Weidmann speech

EC 16:00: Nov Consumer Confidence Flash, exp.: -15.5

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1875 and GBP/USD was broadly flat at 1.3265. USD/JPY edged up to 103.82. AUD/USD remained subdued at 0.7289. This morning, official data showed that Australia's preliminary retail sales grew 1.6% on month in October (-1.1% in September).

Spot gold slipped to $1,864 an ounce.

#UK - IRELAND#

AstraZeneca, a pharmaceutical group, said its "Imfinzi (durvalumab) has been approved in the US for an additional dosing option, a 1,500mg fixed dose every four weeks, in the approved indications of unresectable Stage III non-small cell lung cancer (NSCLC) after chemoradiation therapy (CRT) and previously treated advanced bladder cancer".

From a technical point of view, the stock has escaped from a falling wedge in place since June 2020. Despite the recent pullback, as long as 7770p is support look for 8800p and the previous all-time high at 10120p. Alternatively, a break below 7770p should be limited by a rising long term trend line.

Source: TradingView, GAIN Capital

Talanx, a financial services company, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

BNP Paribas, a banking group, may sell its Italian payments unit Axepta for 200 million euros, reported Bloomberg citing people familiar with the matter.

#BENELUX#

Altice Europe, a telecommunications corporation, announced that 3Q adjusted EBITDA grew 5.1% on year to 1.48 billion euros on revenue of 3.77 billion euros, up 3.2% (+4.1% at constant currency).

#SWITZERLAND#

ABB, an automation technology company, was downgraded to "sell" from "hold" at Deutsche Bank.

Swatch Group, a manufacturer of watches and jewellery, was downgraded to "hold" from "buy" at HSBC.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM