EU indices under pressure | TA focus on Antofagasta

INDICES

Yesterday, European stocks rebounded. The Stoxx Europe 600 Index rose 0.65%. Germany's DAX 30 increased 0.74%, France's CAC 40 gained 0.79%, and the U.K.'s FTSE 100 added 0.58%

EUROPE ADVANCE/DECLINE

70% of STOXX 600 constituents traded higher yesterday.

64% of the shares trade above their 20D MA vs 55% Tuesday (above the 20D moving average).

52% of the shares trade above their 200D MA vs 51% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.28pt to 21.99, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Construction

3mths relative low: none

Europe Best 3 sectors

banks, telecommunications, construction & materials

Europe worst 3 sectors

real estate, utilities, retail

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.46% (above its 20D MA). The 2yr-10yr yield spread fell 0bp to -20bps (below its 20D MA).

ECONOMIC DATA

UK : UK-EU Brexit Talks

GE 07:00: Jul PPI YoY, exp.: -1.8%

GE 07:00: Jul PPI MoM, exp.: 0%

EC 10:00: Jun Construction Output YoY, exp.: -11.9%

UK 11:00: Aug CBI Industrial Trends Orders, exp.: -46

EC 12:30: ECB Monetary Policy Meeting Accounts

UK 00:01: Aug Gfk Consumer Confidence, exp.: -27

MORNING TRADING

In Asian trading hours, the U.S. dollar strengthened further, as EUR/USD fell to 1.1839 and GBP/USD slid to 1.3093. USD/JPY held gains at 106.11.

Spot gold bounced to $1,941 an ounce.

#UK - IRELAND#

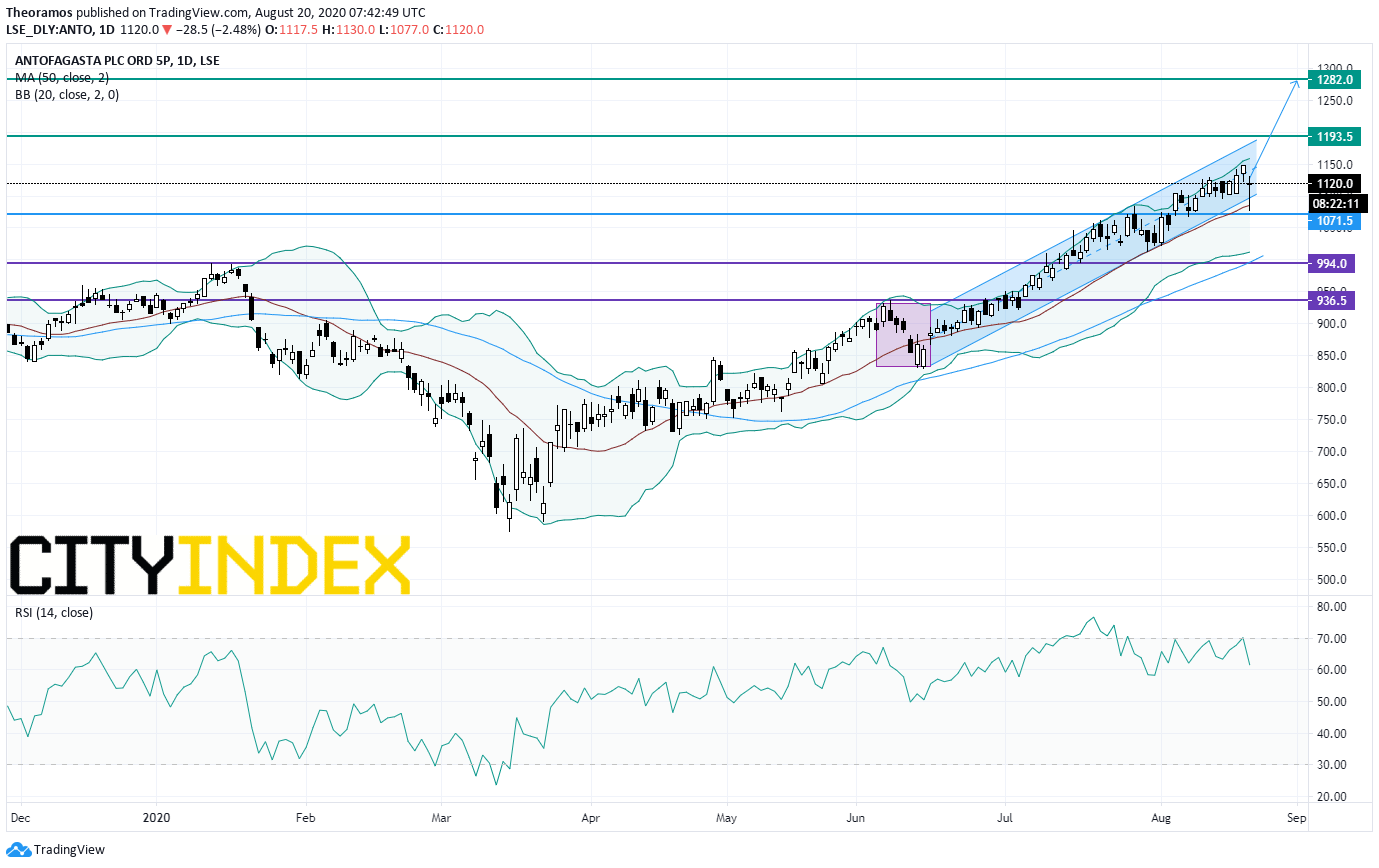

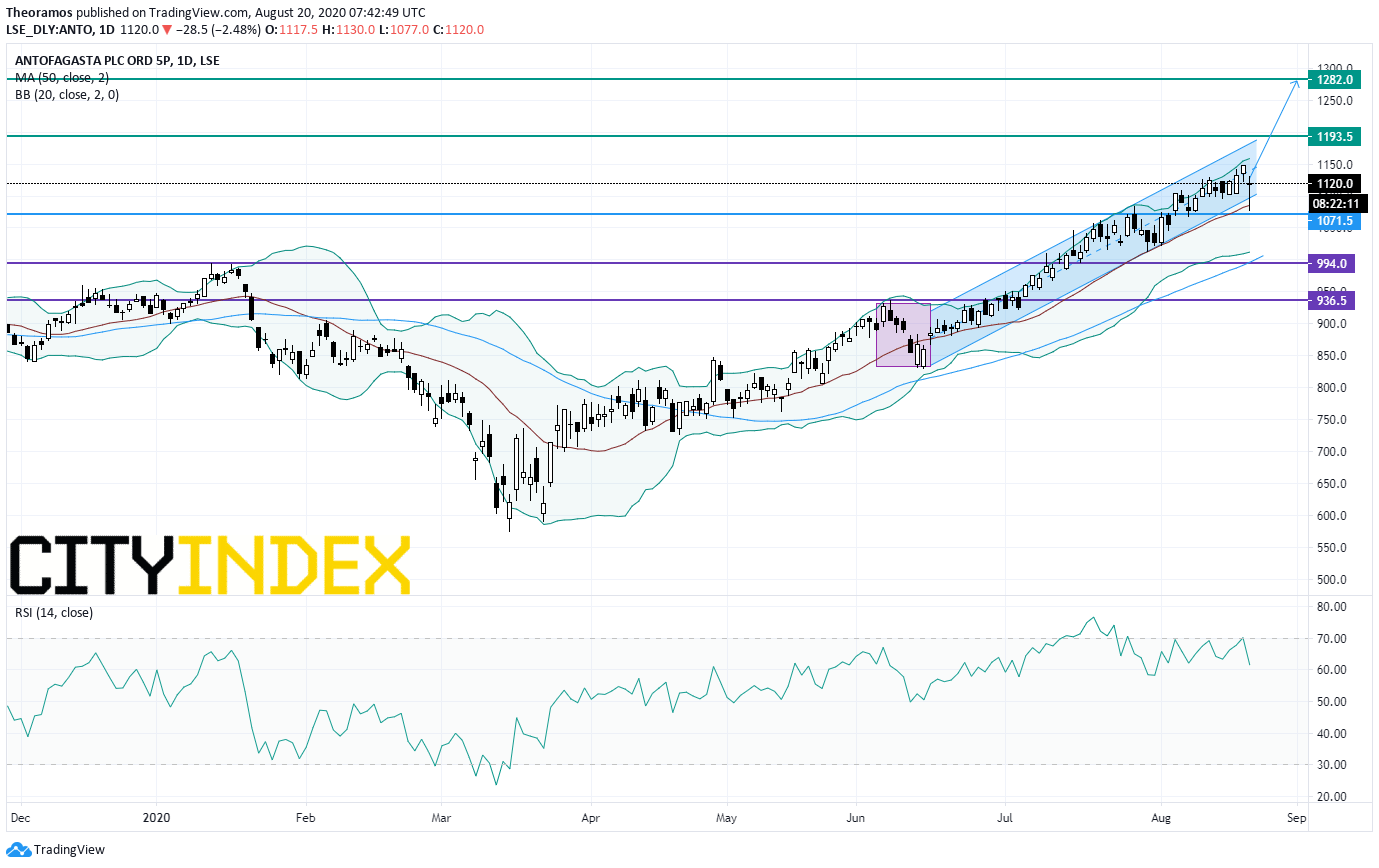

Antofagasta, one of the world's largest copper producer, posted 1H results: "Revenue for the first half of 2020 was $2,139 million, 15.3% lower than the same period in 2019 mainly as a result of lower realised copper prices and sales volumes, partially offset by the increase in the realised gold price. (...) EBITDA was $1,013 million, $293 million lower. (...) Earnings per share including exceptional items fell from 30.7 cents per share to 13.7 cents per share. (...) Exceptional after-tax loss of approximately $61 million with an impact on attributable net earnings of $40 million as a result of the impairment of an indirect 40% interest in the Hornitos coal fired power station prior to its final disposal in 2021. (...) The Board has declared an interim ordinary interim dividend of 6.2 cents per share."

the share is trading within an ascending channel drawn since June. Moreover, the 20-DMA plays its support role. Above 1071.5p look for 1193.5p and 1282p in extension.

Source: GAIN Capital, TradingView

Frasers Group, a retail group, announced full-year results: "Group revenue increased by 6.9% to £3,957.4m in the year. (...) Group underlying EBITDA for the year was up 5.0% to £302.1m (FY19: £287.8m). (...) Group underlying profit before tax decreased 18.1% to £117.4m (FY19: £143.3m), largely due to the effects of Covid-19 including the closure of retail stores and associated provisioning and depreciation and amortisation charges. Underlying basic EPS for the year decreased by 2.3% to 17.2p (FY19: 17.6p). (...) The Board has decided not to pay a dividend in relation to FY20."

John Laing Group, an infrastructure investment group, published 1H results: "During the first half, NAV reduced from £1,658 million at 31 December 2019 to £1,525 million at 30 June 2020. And NAV per share reduced from 337 pence to 309 pence, a reduction of 6% before dividends paid (equivalent to a decline of 10% on a constant currency basis). (...) We are declaring an interim dividend of 1.88 pence per share, representing a year-on-year increase of 2.2%."

SSE, an energy company, was upgraded to "buy" from "hold" at HSBC.

#BENELUX#

Adyen, a Dutch payment company, announced that 1H net income fell 15.3% on year to 78 million euros while EBITDA grew 11.9% to 141 million euros on net revenue of 280 million euros, up 26.6%.

#SCANDINAVIA#

EQT, a Swedish investment group, reported that 1H adjusted net income dropped 41.7% on year to 60 million euros and adjusted EBITDA slid 39.8% to 80 million euros on adjusted total revenue of 261 million euros, down 7.4%.

EX-DIVIDEND

Anglo American (AAL): $0.28, Imperial Brands:20.85p, London Stock Exchange:23.3p, Prudential (PRU): $0.0537, Reckitt Benckiser:73p

Yesterday, European stocks rebounded. The Stoxx Europe 600 Index rose 0.65%. Germany's DAX 30 increased 0.74%, France's CAC 40 gained 0.79%, and the U.K.'s FTSE 100 added 0.58%

EUROPE ADVANCE/DECLINE

70% of STOXX 600 constituents traded higher yesterday.

64% of the shares trade above their 20D MA vs 55% Tuesday (above the 20D moving average).

52% of the shares trade above their 200D MA vs 51% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.28pt to 21.99, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Construction

3mths relative low: none

Europe Best 3 sectors

banks, telecommunications, construction & materials

Europe worst 3 sectors

real estate, utilities, retail

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.46% (above its 20D MA). The 2yr-10yr yield spread fell 0bp to -20bps (below its 20D MA).

ECONOMIC DATA

UK : UK-EU Brexit Talks

GE 07:00: Jul PPI YoY, exp.: -1.8%

GE 07:00: Jul PPI MoM, exp.: 0%

EC 10:00: Jun Construction Output YoY, exp.: -11.9%

UK 11:00: Aug CBI Industrial Trends Orders, exp.: -46

EC 12:30: ECB Monetary Policy Meeting Accounts

UK 00:01: Aug Gfk Consumer Confidence, exp.: -27

MORNING TRADING

In Asian trading hours, the U.S. dollar strengthened further, as EUR/USD fell to 1.1839 and GBP/USD slid to 1.3093. USD/JPY held gains at 106.11.

Spot gold bounced to $1,941 an ounce.

#UK - IRELAND#

Antofagasta, one of the world's largest copper producer, posted 1H results: "Revenue for the first half of 2020 was $2,139 million, 15.3% lower than the same period in 2019 mainly as a result of lower realised copper prices and sales volumes, partially offset by the increase in the realised gold price. (...) EBITDA was $1,013 million, $293 million lower. (...) Earnings per share including exceptional items fell from 30.7 cents per share to 13.7 cents per share. (...) Exceptional after-tax loss of approximately $61 million with an impact on attributable net earnings of $40 million as a result of the impairment of an indirect 40% interest in the Hornitos coal fired power station prior to its final disposal in 2021. (...) The Board has declared an interim ordinary interim dividend of 6.2 cents per share."

the share is trading within an ascending channel drawn since June. Moreover, the 20-DMA plays its support role. Above 1071.5p look for 1193.5p and 1282p in extension.

Source: GAIN Capital, TradingView

Frasers Group, a retail group, announced full-year results: "Group revenue increased by 6.9% to £3,957.4m in the year. (...) Group underlying EBITDA for the year was up 5.0% to £302.1m (FY19: £287.8m). (...) Group underlying profit before tax decreased 18.1% to £117.4m (FY19: £143.3m), largely due to the effects of Covid-19 including the closure of retail stores and associated provisioning and depreciation and amortisation charges. Underlying basic EPS for the year decreased by 2.3% to 17.2p (FY19: 17.6p). (...) The Board has decided not to pay a dividend in relation to FY20."

John Laing Group, an infrastructure investment group, published 1H results: "During the first half, NAV reduced from £1,658 million at 31 December 2019 to £1,525 million at 30 June 2020. And NAV per share reduced from 337 pence to 309 pence, a reduction of 6% before dividends paid (equivalent to a decline of 10% on a constant currency basis). (...) We are declaring an interim dividend of 1.88 pence per share, representing a year-on-year increase of 2.2%."

SSE, an energy company, was upgraded to "buy" from "hold" at HSBC.

#BENELUX#

Adyen, a Dutch payment company, announced that 1H net income fell 15.3% on year to 78 million euros while EBITDA grew 11.9% to 141 million euros on net revenue of 280 million euros, up 26.6%.

#SCANDINAVIA#

EQT, a Swedish investment group, reported that 1H adjusted net income dropped 41.7% on year to 60 million euros and adjusted EBITDA slid 39.8% to 80 million euros on adjusted total revenue of 261 million euros, down 7.4%.

EX-DIVIDEND

Anglo American (AAL): $0.28, Imperial Brands:20.85p, London Stock Exchange:23.3p, Prudential (PRU): $0.0537, Reckitt Benckiser:73p

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM