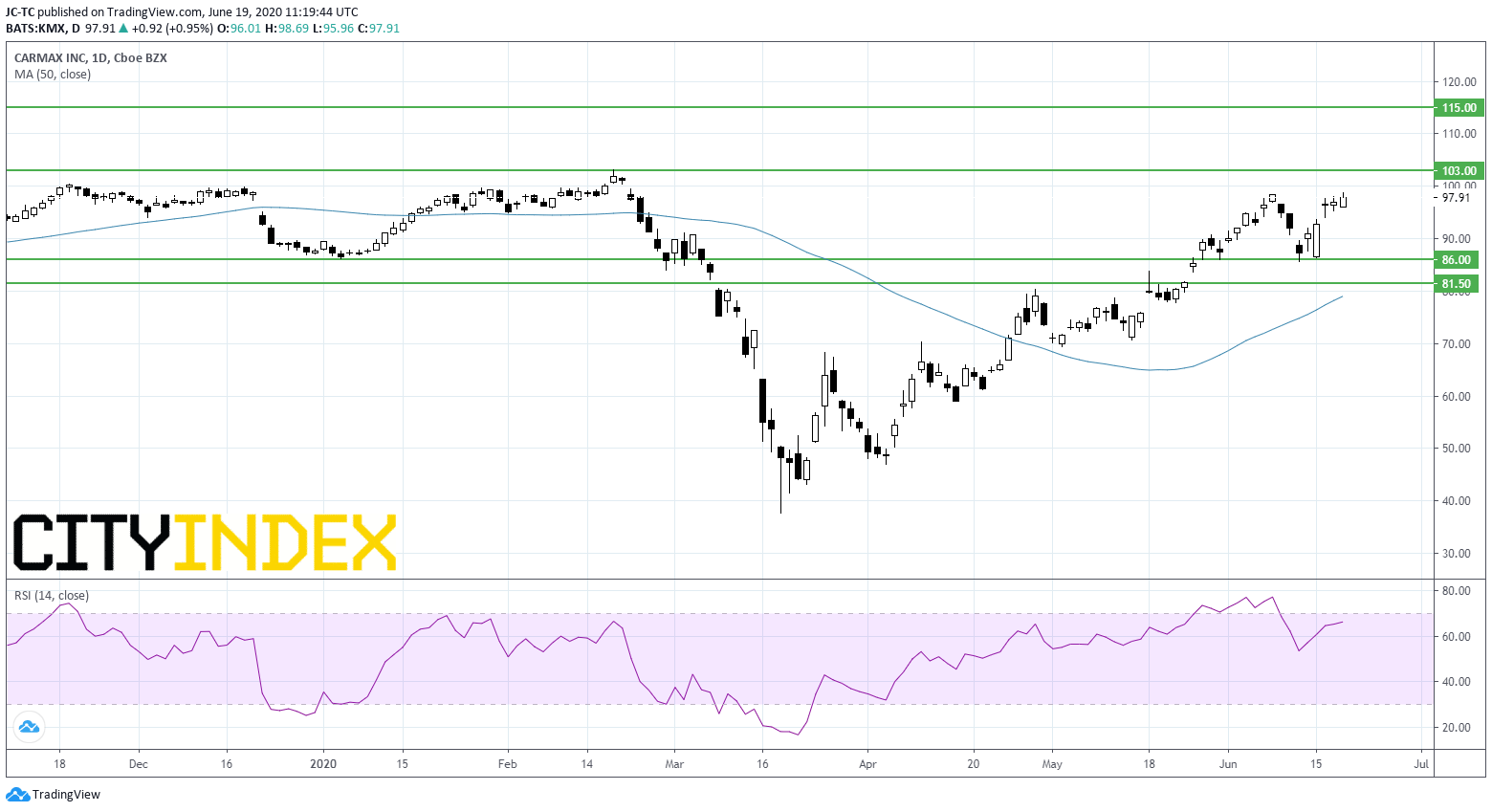

US Futures green, watch KMX, ULTA

The S&P 500 Futures are on the upside after they closed mixed again yesterday, as investors tried to digest data on rising coronavirus cases and initial jobless claims.

Later today, the U.S. Commerce Department will release 1Q current account balance (102.9 billion dollars deficit expected).

European indices are on the upside as European leaders are negotiating over their 750 billion euros relief package. The German Federal Statistical Office has reported May PPI at -2.2% on year (vs -2.0% expected). The U.K. Office for National Statistics has posted May retail sales at 12.0% (vs 6.3% expected and -18.0% the previous month) and public sector net borrowing excluding banking groups at -54.5 billion pounds (vs -47.3 billion pounds expected).

Asian indices closed in the green. This morning, official data showed that Japan's national CPI grew 0.1% on year in May (+0.2% expected).

WTI Crude Oil Futures are rebounding. Russian Energy Minister Alexander Novak said global oil inventories would fell to a 5-year average level in late 2020 or mid-2021.

Gold remains firm on fears of a second COVID-19 wave. Gold rose 7.77 dollars (+0.45%) to 1730.69 dollars.

The US dollar is set for weekly gain on rising geopolitical tension. The EUR/USD fell 2pip to 1.1203 while GBP/USD declined 50pips to 1.2374.

Later today, the U.S. Commerce Department will release 1Q current account balance (102.9 billion dollars deficit expected).

European indices are on the upside as European leaders are negotiating over their 750 billion euros relief package. The German Federal Statistical Office has reported May PPI at -2.2% on year (vs -2.0% expected). The U.K. Office for National Statistics has posted May retail sales at 12.0% (vs 6.3% expected and -18.0% the previous month) and public sector net borrowing excluding banking groups at -54.5 billion pounds (vs -47.3 billion pounds expected).

Asian indices closed in the green. This morning, official data showed that Japan's national CPI grew 0.1% on year in May (+0.2% expected).

WTI Crude Oil Futures are rebounding. Russian Energy Minister Alexander Novak said global oil inventories would fell to a 5-year average level in late 2020 or mid-2021.

Gold remains firm on fears of a second COVID-19 wave. Gold rose 7.77 dollars (+0.45%) to 1730.69 dollars.

The US dollar is set for weekly gain on rising geopolitical tension. The EUR/USD fell 2pip to 1.1203 while GBP/USD declined 50pips to 1.2374.

US Equity Snapshot

CarMax (KMX), a car and light truck retail chain, posted first quarter used vehicle unit comparable store sales down 41.8%. Total sales were down 40% to 3.23 billion dollars, beating estimates. EPS was 0.03 dollar vs 1.59 dollar a year earlier.

Ulta Beauty (ULTA), an operator of a chain of beauty retailers, was upgraded to "overweight" from "equal-weight" at Barclays.

Source : TradingVIEW, Gain Capital