US Futures flat, watch WMT, HD, DIS, KSS, BIDU, WST, CCL

Later today, U.S. official data on Housing Starts for April (a decline to an annualized rate of 927,000 units expected) will be released.

European indices are on the downside. The U.K. Office for National Statistics has reported jobless rate for the three months to March at 3.9% (vs 4.3% expected). ZEW survey results of May have been released for Germany (current situation at -93.5 vs -87.6; Investors’ confidence at 51.0 vs 28.2 in April).

Asian indices all closed on strong gains.

WTI Crude Oil Futures remain on the upside. Later today, API would release the change of U.S. oil stockpile data for May 15.

Gold consolidated to 1732.38, as Moderna's data slightly lifted investors' risk appetite.

On the forex front, the EUR/USD rose 45pips to 1.0958 after France and Germany proposed a 500 billion euro recovery fund.

Commodity-linked currencies were broadly higher against the greenback, buoyed by surging oil prices and U.S. stocks. AUD/USD rose 26pips to 0.655 while the USD/CAD fell 23pips to 1.3914.

US Equity Snapshot

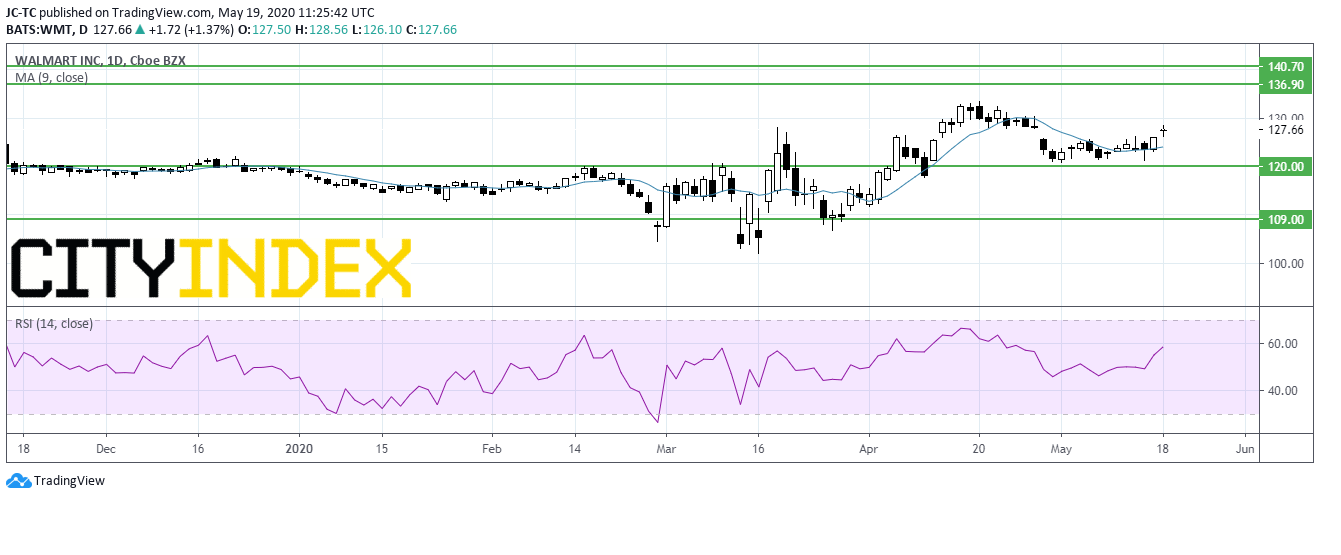

Wal-Mart (WMT), the retailer, unveiled first quarter adjusted EPS up to 1.18 dollar, beating estimates, from 1.13 dollar a year earlier. US comparable sales grew 10.0%, above forecasts. The company withdraws full year financial guidance.

Home Depot (HD), the home improvement specialty retailer, is expected to lose ground after posting first quarter EPS down to 2.08 dollars a share, less than estimated, from 2.27 dollars a share a year earlier. Sales rose 7.1% to 28.26 billion dollars, beating forecasts. Same-store sales were up 6.4%, above consensus. The company suspends full year views.

Walt Disney (DIS): Kevin Mayer, company's Chairman, Direct-to-Consumer division, will become the new CEO of social media platform TikTok.

Kohl's (KSS), the department store chain, announced first quarter loss per share of 3.50 dollars a share, worse than expected, vs a 0.38 dollar EPS a year earlier. Net sales fell 43.5% to 2.43 billion dollars, but beat estimates. The company is suspending its quarterly dividend and share repurchase program.

Baidu (BIDU), the Chinese technology company, surged after hours reporting better than expected first quarter sales down 7% to 3.18 billion dollars.

West Pharmaceutical Services (WST), an injectable pharmaceutical packaging and delivery systems manufacturer, will replace Helmerich & Payne (HP) in the S&P 500 Index effective prior to the open of trading on May 22.

Carnival's (CCL), a cruise operator, credit rating was downgraded to "Ba1", a junk rating, from "Baa3" at Moody's, outlook "Negative". The rating agency said: "The downgrades reflect the risks Carnival faces as its operations continue to be suspended and Moody's expectation of a slow recovery resulting in financial metrics that are not indicative of an investment grade rating for the foreseeable future.

Source : TradingVIEW, Gain Capital