US Futures slightly down, watch CVX, CCL, AXP

The S&P 500 Futures are facing a consolidation after they closed mixed yesterday, as worries over a second-wave coronavirus pandemic persisted. Authorities of Chinese capital city Beijing order the lockdown of residential communities following surging infections. In the U.S., the number of coronavirus cases in Arizona, Florida and Texas reached new highs. Meanwhile, a clinical trial in Britain showed that dexamethasone, an inexpensive and common drug, can help save critically-ill COVID-19 patients.

Later today, initial jobless claims for the week ended June 13 are expected at 1.29 million. The Philadelphia Federal Reserve will post its Business Outlook Index for June (-22.9 expected). The Conference Board will release its Leading Index for May (+2.4% on month expected).

European indices are mixed. The Bank of England has announced it monetary policy decision and kept its benchmark rate on hold at 0.10%, asset purchase target was raised to 745 billion pounds from 645 billion pounds.

Asian indices closed in the red except the Chinese CSI. This morning, official data showed that Australia's economy shed 227,700 jobs in May (-78,800 jobs expected), while jobless rate rose to 7.1% (6.9% expected) from 6.2% in April,

WTI Crude Oil Futures continue to retreat after the U.S. Energy Information Administration reported crude-oil stockpiles added 1.2 million barrels last week to another record level.

Gold eases but remains firm above 1700 dollars while the US dollar gains ground on fears of a new COVID-19 wave.

Gold fell 4.99 dollars (-0.29%) to 1721.96 dollars.

EUR/USD fell 3pips to 1.1241 while GBP/USD declined 46pips to 1.2509. GBP lost some ground following the BOE announcement.

Later today, initial jobless claims for the week ended June 13 are expected at 1.29 million. The Philadelphia Federal Reserve will post its Business Outlook Index for June (-22.9 expected). The Conference Board will release its Leading Index for May (+2.4% on month expected).

European indices are mixed. The Bank of England has announced it monetary policy decision and kept its benchmark rate on hold at 0.10%, asset purchase target was raised to 745 billion pounds from 645 billion pounds.

Asian indices closed in the red except the Chinese CSI. This morning, official data showed that Australia's economy shed 227,700 jobs in May (-78,800 jobs expected), while jobless rate rose to 7.1% (6.9% expected) from 6.2% in April,

WTI Crude Oil Futures continue to retreat after the U.S. Energy Information Administration reported crude-oil stockpiles added 1.2 million barrels last week to another record level.

Gold eases but remains firm above 1700 dollars while the US dollar gains ground on fears of a new COVID-19 wave.

Gold fell 4.99 dollars (-0.29%) to 1721.96 dollars.

EUR/USD fell 3pips to 1.1241 while GBP/USD declined 46pips to 1.2509. GBP lost some ground following the BOE announcement.

US Equity Snapshot

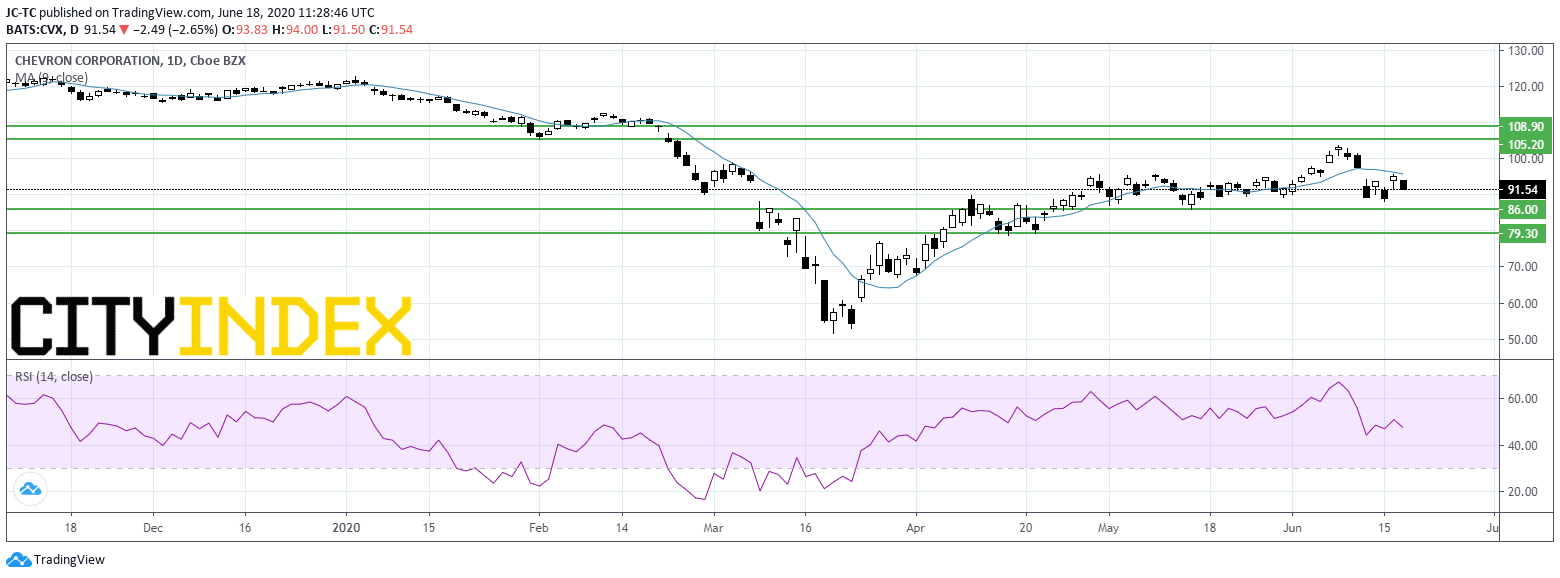

Chevron (CVX), the energy company, decided to start the process of selling its stake in the North West Shelf project in Australia, a liquefied natural gas venture.

Carnival (CCL), the cruise company, is losing ground before hours after reporting second quarter adjusted LPS of 3.30 dollars, worse than expected, vs an EPS of 0.66 dollar a year earlier. Sales plunged 86% to 700 million dollars, missing estimates.

American Express (AXP), a globally integrated payments company, was downgraded to "hold" from "buy" at DZ Bank.

Source : TradingVIEW, Gain Capital

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM