The S&P 500 Futures continue to rebound after they closed slightly higher on Friday despite data showing sharp economic contraction. On Sunday, Fed Chairman Powell says GDP could shrink more than 30%, but he doesn’t see another Depression.

Later today, the National Association of Home Builders will release Housing Market Index for May (34 expected).

European indices are posting a rebound. Bank of England Chief Economist Andy Haldane said BOE is looking at monetary policy options, including negative interest rates and purchasing riskier financial assets. In the meantime, European Union chief negotiator Michel Barnier said, after the latest round of E.U. and U.K. trade talks, "no progress had been made on the most difficult issues" and he was "still determined but not optimistic."

Asian indices closed in the green except the Chinese CSI. This morning, government data showed that Japan's first quarter annualized GDP declined 3.4% on quarter (-4.5% expected).

WTI Crude Oil Futures remain on the upside. OPEC+ production cut this month could reach 9.7 million barrels per day, nearly 10% of global supplies, according to Bloomberg.

Gold hit its highest level since October 2012 on weak economic data while the US dollar is consolidating as investors assess the effects of gradual reopening economies.

Gold rose 21.25$ (+1.22%) to 1764.92 dollars. The EUR/USD fell 6pips to 1.0814.

USD/CAD dropped 50pips to 1.4059 in boucing oil prices.

Later today, the National Association of Home Builders will release Housing Market Index for May (34 expected).

European indices are posting a rebound. Bank of England Chief Economist Andy Haldane said BOE is looking at monetary policy options, including negative interest rates and purchasing riskier financial assets. In the meantime, European Union chief negotiator Michel Barnier said, after the latest round of E.U. and U.K. trade talks, "no progress had been made on the most difficult issues" and he was "still determined but not optimistic."

Asian indices closed in the green except the Chinese CSI. This morning, government data showed that Japan's first quarter annualized GDP declined 3.4% on quarter (-4.5% expected).

WTI Crude Oil Futures remain on the upside. OPEC+ production cut this month could reach 9.7 million barrels per day, nearly 10% of global supplies, according to Bloomberg.

Gold hit its highest level since October 2012 on weak economic data while the US dollar is consolidating as investors assess the effects of gradual reopening economies.

Gold rose 21.25$ (+1.22%) to 1764.92 dollars. The EUR/USD fell 6pips to 1.0814.

USD/CAD dropped 50pips to 1.4059 in boucing oil prices.

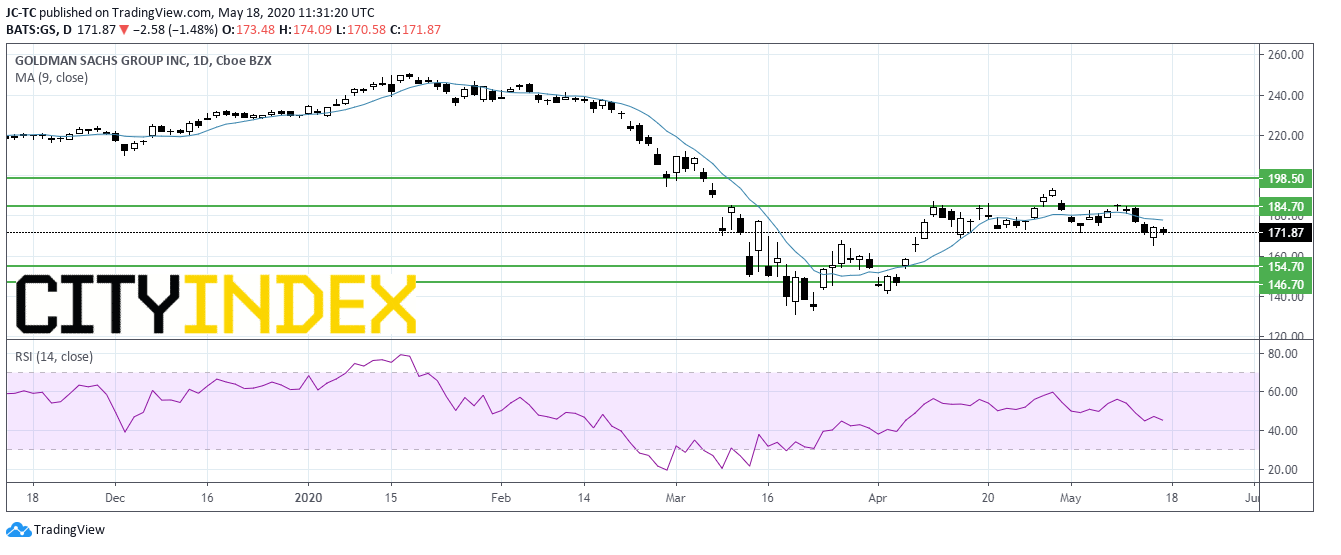

US Equity Snapshot

Goldman Sachs (GS): Warren Buffett's Berkshire Hathaway Inc reported in a securities filing that it had sold over 10 million shares in the banking group, trimming its stake to 1.9 million shares or less than 0.6%.

Alphabet's (GOOGL) Google, a tech giant, could face antitrust suits by the U.S. Justice Department after nearly a year of investigation, reported the Wall Street Journal.

Apple (AAPL), a multinational technology company, has reopened about 100 stores worldwide, according to Bloomberg.

Source : TradingVIEW, Gain Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM