U.S Futures rising - Watch PFE, BNTX, AAPL, BA, TSLA, NIO

The S&P 500 Futures are rebounding after they took a breather yesterday after a recent strong run.

Later today, the U.S. Commerce Department will release October housing starts (1.46 million units expected) and building permits (1.57 million units expected).

European indices are slightly on the upside. The European Commission has posted final readings of October CPI at +0.2% on month, vs +0.1% in September. The U.K. Office for National Statistics has reported October CPI at +0.7% (vs +0.5% on year expected) and PPI at +0.0%, vs +0.1% expected.

Asian indices closed on the upside except the Japanese Nikkei. This morning, official data showed that Japan's exports fell 0.2% on year in October (-4.5% expected) and imports dropped 13.3% (-8.8% expected).

WTI Crude Oil remains on the upside. OPEC+ has not decided to delay the plan for January output increase after the OPEC meeting. The American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 4.17M barrels in the week ending November 13. Later today, the International Energy Agency (EIA) will release official crude oil inventories data for the same week.

Gold lose some ground while the U.S dollar consolidates on Covid-19 vaccine optimism.

Gold fell 10.81 dollars (-0.57%) to 1869.57 dollars.

The dollar index declined 0.09pt to 92.33.

U.S. Equity Snapshot

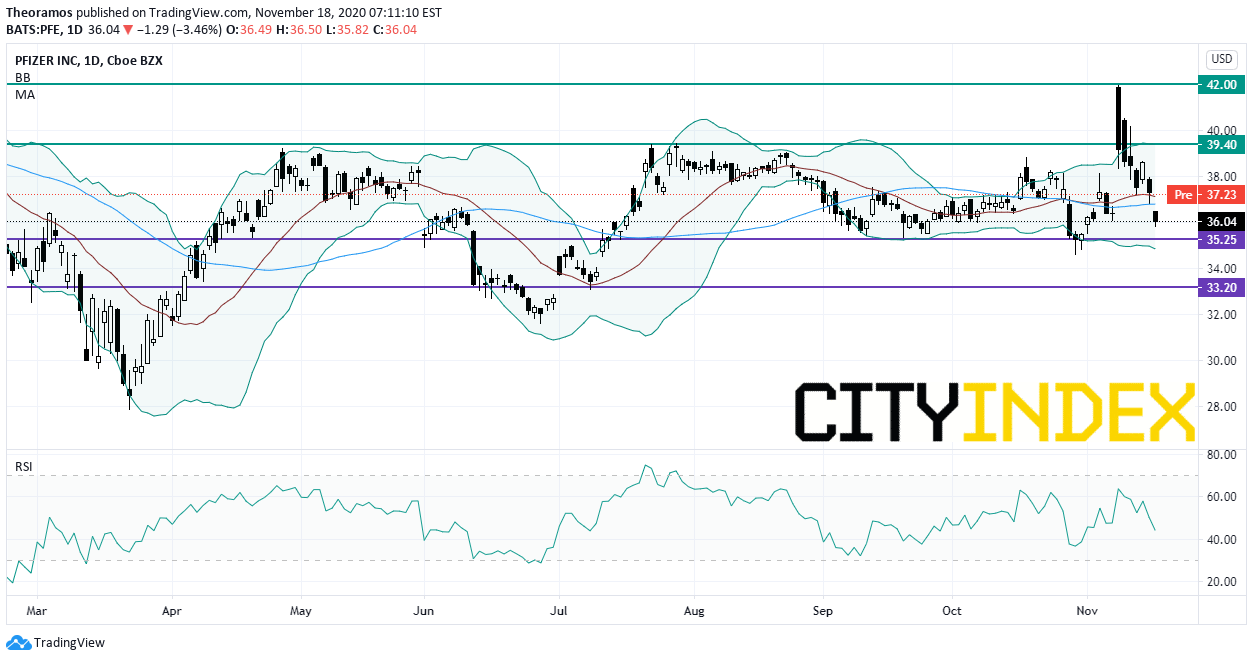

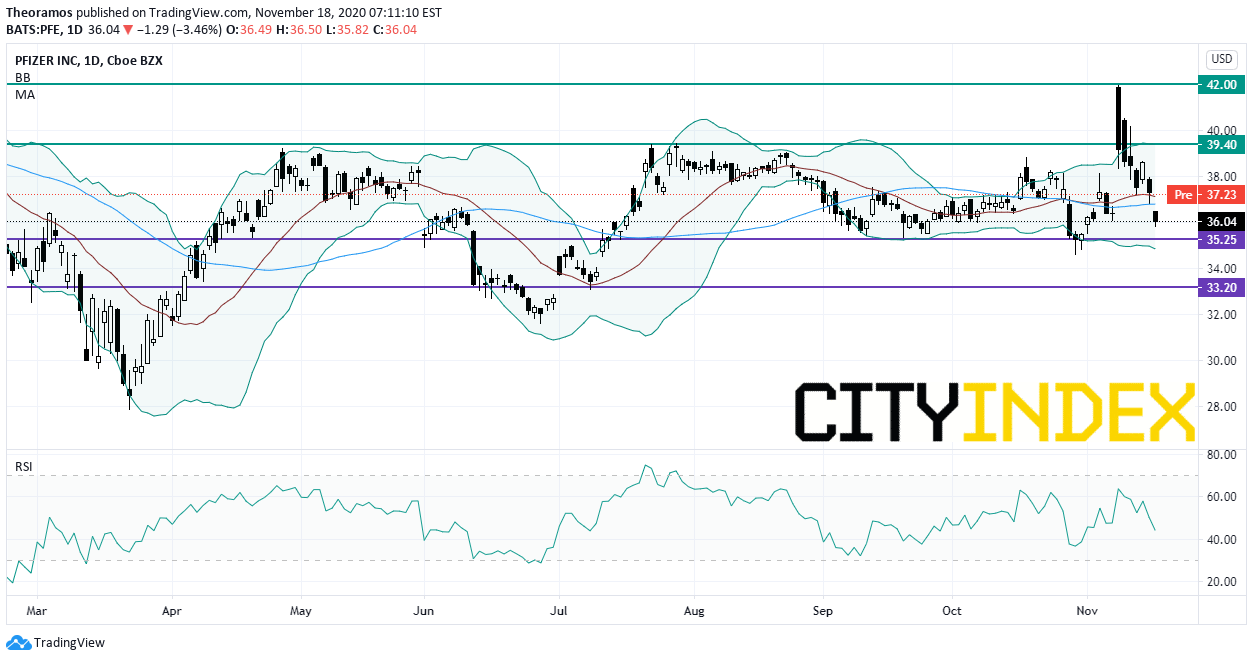

Pfizer (PFE) and BioNTech (BNTX) said data demonstrated that their COVID-19 vaccine was 95% effective. "Companies plan to submit within days to the FDA for Emergency Use Authorization."

Source: TradingView, GAIN Capital

Apple (AAPL), the tech giant, announced a reduction of fees charged to small businesses earning up to 1 million dollars per year, to 15% from 30% previously.

Boeing (BA), the aircraft maker, is surging before hours after winning the US FAA approval to resume 737 MAX flight. Separately, the stock was upgraded to "outperform" from "neutral" at Baird.

Tesla (TSLA), the electric-vehicle maker, was upgraded to "overweight" from "equalweight" at Morgan Stanley with a price target raised to 540 dollars from 360 dollars.

Nio (NIO), the Chinese electric-vehicle maker, is expected to gain ground after posting third quarter earnings that beat estimates and forecasting fourth quarter sales above expectations.

Lowe's (LOW), the second-largest home improvement retailer in the US, is diving premarket as third quarter adjusted EPS missed estimates. The company plans to buy back 4 billion dollars of stocks in the current quarter.

Target (TGT), a leading general merchandise discount retailer, posted third quarter adjusted EPS and comparable sales that beat expectations. The company expects to resume shares buyback in 2021.

PG&E Corp (PCG), a natural gas and electric service provider, announced "the appointment of Patricia K. Poppe as CEO and member of its Board of Directors. Ms. Poppe currently serves as President and CEO of CMS Energy. She will take over from Interim PG&E CEO William Smith on January 4, 2021."

Honeywell (HON), a diversified technology company, was downgraded to "hold" from "buy" at Jefferies.

Later today, the U.S. Commerce Department will release October housing starts (1.46 million units expected) and building permits (1.57 million units expected).

European indices are slightly on the upside. The European Commission has posted final readings of October CPI at +0.2% on month, vs +0.1% in September. The U.K. Office for National Statistics has reported October CPI at +0.7% (vs +0.5% on year expected) and PPI at +0.0%, vs +0.1% expected.

Asian indices closed on the upside except the Japanese Nikkei. This morning, official data showed that Japan's exports fell 0.2% on year in October (-4.5% expected) and imports dropped 13.3% (-8.8% expected).

WTI Crude Oil remains on the upside. OPEC+ has not decided to delay the plan for January output increase after the OPEC meeting. The American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 4.17M barrels in the week ending November 13. Later today, the International Energy Agency (EIA) will release official crude oil inventories data for the same week.

U.S indices closed down on Tuesday, pressured by Utilities (-2.01%), Food & Staples Retailing (-1.49%) and Health Care Equipment & Services (-1.42%) sectors.

Approximately 90% of stocks in the S&P 500 Index were trading above their 200-day moving average and 88% were trading above their 20-day moving average. The VIX Index rose 0.3pt (+1.34%) to 22.75 and WTI Crude Oil gained $0.11 (+0.27%) to $41.45 at the close.

On the US economic data front, Retail Sales Advance rose 0.3% on month in October (+0.5% expected), compared to a revised +1.6% in September. Finally, Industrial Production increased 1.1% on month in October (+1.0% expected), compared to a revised -0.4% in September.Gold lose some ground while the U.S dollar consolidates on Covid-19 vaccine optimism.

Gold fell 10.81 dollars (-0.57%) to 1869.57 dollars.

The dollar index declined 0.09pt to 92.33.

U.S. Equity Snapshot

Pfizer (PFE) and BioNTech (BNTX) said data demonstrated that their COVID-19 vaccine was 95% effective. "Companies plan to submit within days to the FDA for Emergency Use Authorization."

Source: TradingView, GAIN Capital

Apple (AAPL), the tech giant, announced a reduction of fees charged to small businesses earning up to 1 million dollars per year, to 15% from 30% previously.

Boeing (BA), the aircraft maker, is surging before hours after winning the US FAA approval to resume 737 MAX flight. Separately, the stock was upgraded to "outperform" from "neutral" at Baird.

Tesla (TSLA), the electric-vehicle maker, was upgraded to "overweight" from "equalweight" at Morgan Stanley with a price target raised to 540 dollars from 360 dollars.

Nio (NIO), the Chinese electric-vehicle maker, is expected to gain ground after posting third quarter earnings that beat estimates and forecasting fourth quarter sales above expectations.

Lowe's (LOW), the second-largest home improvement retailer in the US, is diving premarket as third quarter adjusted EPS missed estimates. The company plans to buy back 4 billion dollars of stocks in the current quarter.

Target (TGT), a leading general merchandise discount retailer, posted third quarter adjusted EPS and comparable sales that beat expectations. The company expects to resume shares buyback in 2021.

PG&E Corp (PCG), a natural gas and electric service provider, announced "the appointment of Patricia K. Poppe as CEO and member of its Board of Directors. Ms. Poppe currently serves as President and CEO of CMS Energy. She will take over from Interim PG&E CEO William Smith on January 4, 2021."

Honeywell (HON), a diversified technology company, was downgraded to "hold" from "buy" at Jefferies.

Latest market news

Yesterday 08:33 AM