EU indices slightly down | TA focus on Intesa Sanpaolo

INDICES

Yesterday, European stocks were mixed at close. The Stoxx Europe 600 declined 0.24%, Germany's DAX was little changed, France's CAC 40 gained 0.21%, while the U.K.'s FTSE 100 dropped 0.87%.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded lower or unchanged yesterday.

83% of the shares trade above their 20D MA vs 86% Monday (above the 20D moving average).

85% of the shares trade above their 200D MA vs 85% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.13pt to 22.25, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Insurance, Autos, Banks

3mths relative low: Chemicals, Healthcare

Europe Best 3 sectors

insurance, automobiles & parts, energy

Europe worst 3 sectors

health care, travel & leisure, food & beverage

INTEREST RATE

The 10yr Bund yield was unchanged to -0.55% (above its 20D MA). The 2yr-10yr yield spread rose 2bps to -16bps (above its 20D MA).

ECONOMIC DATA

UK 08:00: Oct Retail Price Idx YoY, exp.: 1.1%

UK 08:00: Oct Retail Price Idx MoM, exp.: 0.3%

UK 08:00: Oct PPI Core Output MoM, exp.: 0.2%

UK 08:00: Oct PPI Core Output YoY, exp.: 0.3%

UK 08:00: Oct PPI Output MoM, exp.: -0.1%

UK 08:00: Oct PPI Input YoY, exp.: -3.7%

UK 08:00: Oct PPI Input MoM, exp.: 1.1%

UK 08:00: Oct PPI Output YoY, exp.: -0.9%

UK 08:00: Oct Inflation Rate MoM, exp.: 0.4%

UK 08:00: Oct Core Inflation Rate YoY, exp.: 1.3%

UK 08:00: Oct Inflation Rate YoY, exp.: 0.5%

UK 08:00: Oct Core Inflation Rate MoM, exp.: 0.6%

EC 09:00: ECB Non-Monetary Policy Meeting

GE 09:30: Bundesbank Balz speech

EC 11:00: Oct Inflation Rate MoM final, exp.: 0.1%

EC 11:00: Oct Core Inflation Rate YoY final, exp.: 0.2%

EC 11:00: Oct Inflation Rate YoY final, exp.: -0.3%

UK 11:30: BoE Haldane speech

GE 11:40: 10-Year Bund auction, exp.: -0.51%

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1858 while GBP/USD held gains at 1.3251. USD/JPY remained subdued at 104.15. This morning, official data showed that Japan's exports fell 0.2% on year in October (-4.5% expected) and imports dropped 13.3% (-8.8% expected).

Spot gold extended its decline to $1,876 an ounce.

#UK - IRELAND#

SSE, an energy company, announced that 1H adjusted EPS dropped 34% on year to 11.9p and adjusted operating profit (from continuing operations) slid 15% to 418 million pounds. The company added: "SSE has today announced an interim dividend of 24.4p per share with an intention to recommend a full-year dividend of 80p per share plus RPI inflation. (...) Adjusted earnings per share for 2020/21 is currently forecast to be in the range of 75p to 85p including a gain on disposal of a stake in Dogger Bank offshore wind farm."

British Land, a property group, reported that 1H underlying EPS declined 34.8% on year to 10.5p and underlying profit dropped 29.6% to 107 million pounds. The company proposed an interim dividend of 8.40p per share, down from 15.97p per share in the prior-year period.

RSA Insurance Group, a general insurance company, said Intact Financial has agreed to offer 685p per share in cash to buy the company, which represent a premium of approximately 51% to the closing price of 460 pence per RSA Share on November 4.

Croda International, a speciality chemicals company, said it has agreed to acquire fragrances and flavours company Iberchem for a total consideration of 820 million euros on a debt-free, cash-free basis.

Compass Group, a contract food service company, was downgraded to "neutral" from "buy" at Goldman Sachs.

#GERMANY#

Deutsche Boerse, a stock exchange operator, said it has agreed to acquire a majority share of approximately 80% in proxy advisory firm Institutional Shareholder Services, valuing it at 2.275 billion dollars for 100% of the business (cash and debt free).

#FRANCE#

Air France-KLM, an aircraft manufacturer, is seeking to raise 6 billion euros to strengthen its balance sheet, including contributions from the French and Dutch governments, according to French newspaper Le Monde.

#ITALY#

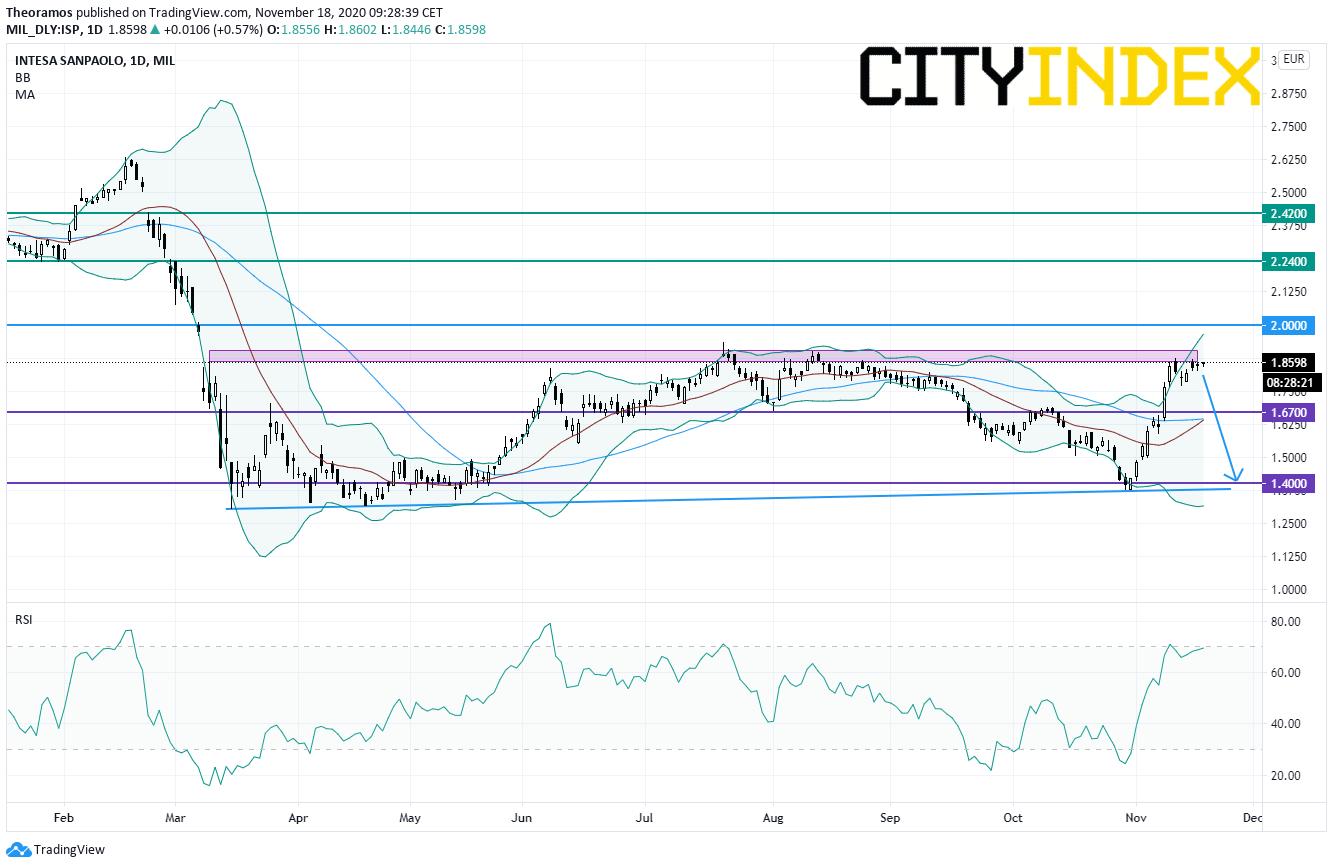

Intesa Sanpaolo, an Italian banking group, was upgraded to "buy" from "neutral" at Goldman Sachs.

Yesterday, European stocks were mixed at close. The Stoxx Europe 600 declined 0.24%, Germany's DAX was little changed, France's CAC 40 gained 0.21%, while the U.K.'s FTSE 100 dropped 0.87%.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded lower or unchanged yesterday.

83% of the shares trade above their 20D MA vs 86% Monday (above the 20D moving average).

85% of the shares trade above their 200D MA vs 85% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.13pt to 22.25, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Insurance, Autos, Banks

3mths relative low: Chemicals, Healthcare

Europe Best 3 sectors

insurance, automobiles & parts, energy

Europe worst 3 sectors

health care, travel & leisure, food & beverage

INTEREST RATE

The 10yr Bund yield was unchanged to -0.55% (above its 20D MA). The 2yr-10yr yield spread rose 2bps to -16bps (above its 20D MA).

ECONOMIC DATA

UK 08:00: Oct Retail Price Idx YoY, exp.: 1.1%

UK 08:00: Oct Retail Price Idx MoM, exp.: 0.3%

UK 08:00: Oct PPI Core Output MoM, exp.: 0.2%

UK 08:00: Oct PPI Core Output YoY, exp.: 0.3%

UK 08:00: Oct PPI Output MoM, exp.: -0.1%

UK 08:00: Oct PPI Input YoY, exp.: -3.7%

UK 08:00: Oct PPI Input MoM, exp.: 1.1%

UK 08:00: Oct PPI Output YoY, exp.: -0.9%

UK 08:00: Oct Inflation Rate MoM, exp.: 0.4%

UK 08:00: Oct Core Inflation Rate YoY, exp.: 1.3%

UK 08:00: Oct Inflation Rate YoY, exp.: 0.5%

UK 08:00: Oct Core Inflation Rate MoM, exp.: 0.6%

EC 09:00: ECB Non-Monetary Policy Meeting

GE 09:30: Bundesbank Balz speech

EC 11:00: Oct Inflation Rate MoM final, exp.: 0.1%

EC 11:00: Oct Core Inflation Rate YoY final, exp.: 0.2%

EC 11:00: Oct Inflation Rate YoY final, exp.: -0.3%

UK 11:30: BoE Haldane speech

GE 11:40: 10-Year Bund auction, exp.: -0.51%

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1858 while GBP/USD held gains at 1.3251. USD/JPY remained subdued at 104.15. This morning, official data showed that Japan's exports fell 0.2% on year in October (-4.5% expected) and imports dropped 13.3% (-8.8% expected).

Spot gold extended its decline to $1,876 an ounce.

#UK - IRELAND#

SSE, an energy company, announced that 1H adjusted EPS dropped 34% on year to 11.9p and adjusted operating profit (from continuing operations) slid 15% to 418 million pounds. The company added: "SSE has today announced an interim dividend of 24.4p per share with an intention to recommend a full-year dividend of 80p per share plus RPI inflation. (...) Adjusted earnings per share for 2020/21 is currently forecast to be in the range of 75p to 85p including a gain on disposal of a stake in Dogger Bank offshore wind farm."

British Land, a property group, reported that 1H underlying EPS declined 34.8% on year to 10.5p and underlying profit dropped 29.6% to 107 million pounds. The company proposed an interim dividend of 8.40p per share, down from 15.97p per share in the prior-year period.

RSA Insurance Group, a general insurance company, said Intact Financial has agreed to offer 685p per share in cash to buy the company, which represent a premium of approximately 51% to the closing price of 460 pence per RSA Share on November 4.

Croda International, a speciality chemicals company, said it has agreed to acquire fragrances and flavours company Iberchem for a total consideration of 820 million euros on a debt-free, cash-free basis.

Compass Group, a contract food service company, was downgraded to "neutral" from "buy" at Goldman Sachs.

#GERMANY#

Deutsche Boerse, a stock exchange operator, said it has agreed to acquire a majority share of approximately 80% in proxy advisory firm Institutional Shareholder Services, valuing it at 2.275 billion dollars for 100% of the business (cash and debt free).

#FRANCE#

Air France-KLM, an aircraft manufacturer, is seeking to raise 6 billion euros to strengthen its balance sheet, including contributions from the French and Dutch governments, according to French newspaper Le Monde.

#ITALY#

Intesa Sanpaolo, an Italian banking group, was upgraded to "buy" from "neutral" at Goldman Sachs.

From a technical point of view, the stock is facing a key horizontal resistance around 1.9E. As long as the level at 2E is not crossed, look towards 1.67E and 1.4E in extension. Alternatively, a break above 2E would call for a new up leg with 2.24E as first target.

#DENMARK#

Maersk, a Danish integrated shipping company, posted 3Q underlying profit (from continuing operations) jumped to 1.04 billion dollars from 0.45 billion dollars in the prior-year quarter and EBITDA rose 38.7% on year to 2.30 billion dollars on revenue of 9.92 billion dollars, down 1.4%. The company has raised its full-year adjusted EBITDA guidance to 8.0 - 8.5 billion dollars from 7.5 - 8.0 billion dollars previously, and has decided to initiate a new 10 billion Danish krone share buy-back programme.

Source: TradingView, GAIN Capital

#SWITZERLAND#

UBS, a Swiss banking group, was downgraded to "neutral" from "buy" at Goldman Sachs.

#DENMARK#

Maersk, a Danish integrated shipping company, posted 3Q underlying profit (from continuing operations) jumped to 1.04 billion dollars from 0.45 billion dollars in the prior-year quarter and EBITDA rose 38.7% on year to 2.30 billion dollars on revenue of 9.92 billion dollars, down 1.4%. The company has raised its full-year adjusted EBITDA guidance to 8.0 - 8.5 billion dollars from 7.5 - 8.0 billion dollars previously, and has decided to initiate a new 10 billion Danish krone share buy-back programme.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM