U.S Futures mixed - Watch BA, F, STLX

The American Futures are little changed after they ended in negative territory yesterday. The persistently high claims for U.S. jobless benefits caused some concerns.

Later today, the U.S. Commerce Department will release 2Q current account balance (160 billion dollars deficit expected). The Conference Board will post its Leading Index for August (+1.3% on month expected). The University of Michigan will publish its Consumer Sentiment Index for September (75.0 expected).

European indices are facing a consolidation. The German Federal Statistical Office has posted August PPI at +0.0% on month, as expected. The U.K. Office for National Statistics has reported August retail sales at +0.8% (vs +0.7% on month expected). The July Eurozone Trade balance was released at 16.6 billion euros surplus, vs 20.7 billion euros surplus in June.

Asian indices closed in the green except the Australian ASX. Japan's national CPI grew 0.2% on year in August (as expected).

WTI Crude Oil futures remain on the upside after the Organization of the Petroleum Exporting Countries (OPEC) and its allies stressed commitment to their agreed output cut. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold advanced 5.3$ to 1955.82, as dollar remains under pressure.

U.S. dollar remains on the downside as high jobless levels is worrying investors.

U.S. Equity Snapshot

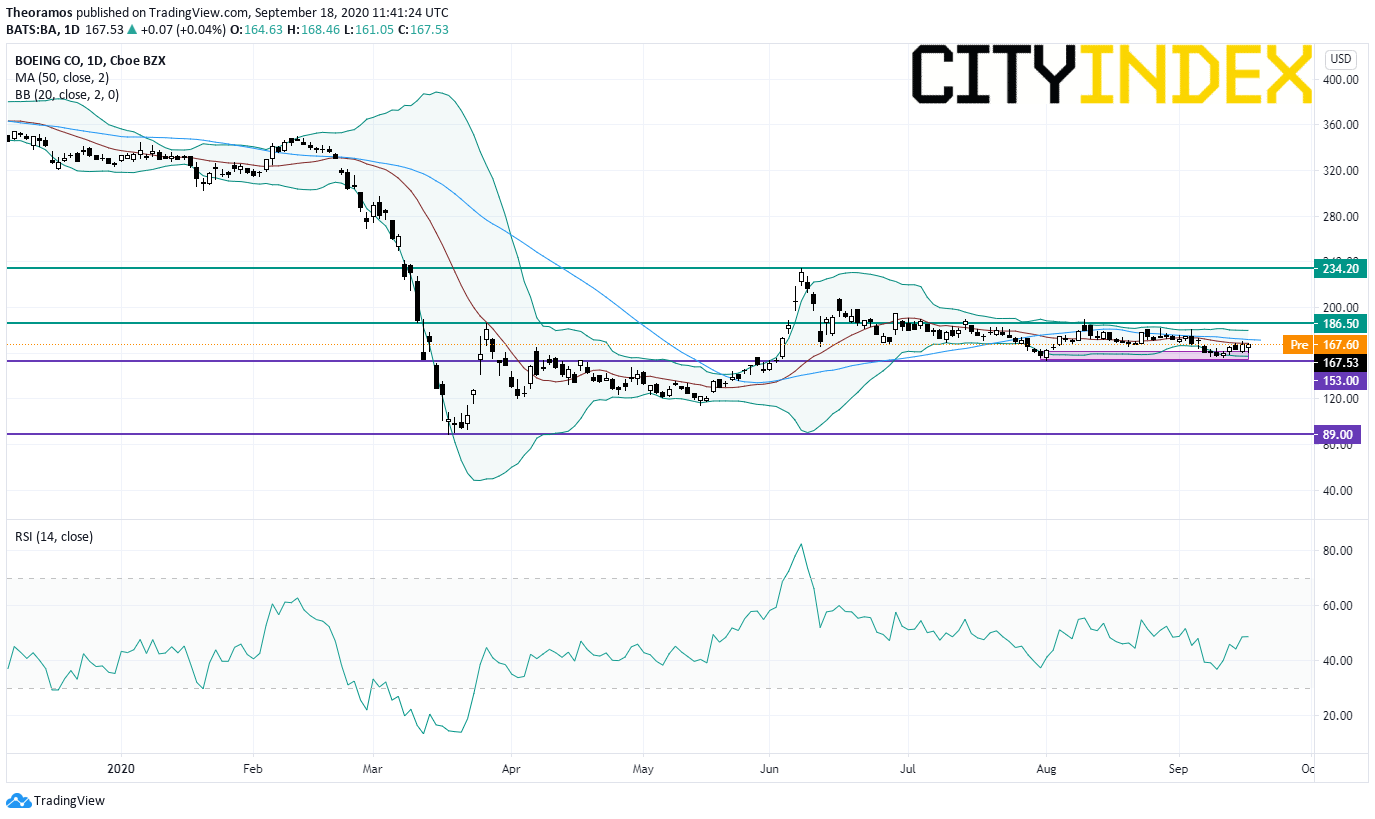

Boeing (BA): The National Transportation Safety Board said proposed safety upgrades for Boeing's 737 MAX are "positive progress".

Source: GAIN Capital, TradingView

Ford Motor (F), the automaker, will invest $700 million to expand its plant in Michigan. With this expansion, the group will begin production of its electric pickup, the F-150, by mid-2022.

Steel Dynamics (STLD) shares jump in premarket trading after the iron producer raised its third quarter forecast. The Co expects its adjusted EPS in a range of 0.46 to 0.50 dollar compared to a previous estimate of 0.30 to 0.54 dollar.

Later today, the U.S. Commerce Department will release 2Q current account balance (160 billion dollars deficit expected). The Conference Board will post its Leading Index for August (+1.3% on month expected). The University of Michigan will publish its Consumer Sentiment Index for September (75.0 expected).

European indices are facing a consolidation. The German Federal Statistical Office has posted August PPI at +0.0% on month, as expected. The U.K. Office for National Statistics has reported August retail sales at +0.8% (vs +0.7% on month expected). The July Eurozone Trade balance was released at 16.6 billion euros surplus, vs 20.7 billion euros surplus in June.

Asian indices closed in the green except the Australian ASX. Japan's national CPI grew 0.2% on year in August (as expected).

WTI Crude Oil futures remain on the upside after the Organization of the Petroleum Exporting Countries (OPEC) and its allies stressed commitment to their agreed output cut. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold advanced 5.3$ to 1955.82, as dollar remains under pressure.

U.S. dollar remains on the downside as high jobless levels is worrying investors.

U.S. Equity Snapshot

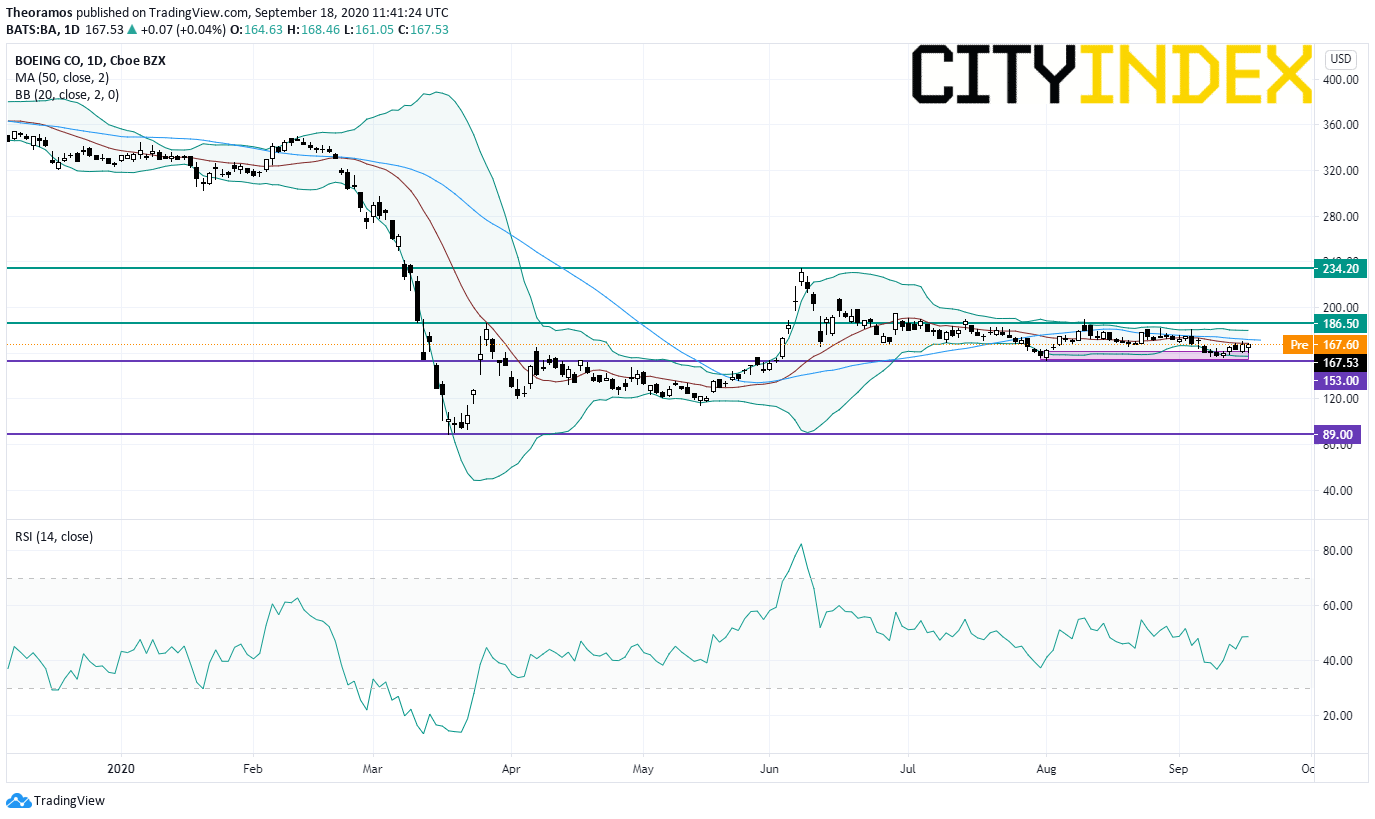

Boeing (BA): The National Transportation Safety Board said proposed safety upgrades for Boeing's 737 MAX are "positive progress".

Source: GAIN Capital, TradingView

Ford Motor (F), the automaker, will invest $700 million to expand its plant in Michigan. With this expansion, the group will begin production of its electric pickup, the F-150, by mid-2022.

Steel Dynamics (STLD) shares jump in premarket trading after the iron producer raised its third quarter forecast. The Co expects its adjusted EPS in a range of 0.46 to 0.50 dollar compared to a previous estimate of 0.30 to 0.54 dollar.

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM