EU indices mixed | TA focus on Imperial Brands

INDICES

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 rose 1.18%, Germany's DAX added 0.47%, France's CAC 40 jumped 1.70%, and the U.K.'s FTSE 100 was up 1.66%.

EUROPE ADVANCE/DECLINE

76% of STOXX 600 constituents traded higher yesterday.

86% of the shares trade above their 20D MA vs 86% Friday (above the 20D moving average).

85% of the shares trade above their 200D MA vs 82% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.76pt to 22.38, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Insurance, Autos, Banks, Travel & Leisure

3mths relative low: Chemicals, Healthcare

Europe Best 3 sectors

insurance, banks, automobiles & parts

Europe worst 3 sectors

media, personal & household goods, telecommunications

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.55% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

EC 14:00: ECB Guindos speech

UK 15:00: BoE Gov Bailey speech

GE 16:45: Bundesbank Balz speech

EC 17:00: ECB President Lagarde speech

UK 18:00: BoE Ramsden speech

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1860 and GBP/USD climbed to 1.3223. USD/JPY slipped to 104.47.

Spot gold edged up to $1,891 an ounce.

#UK - IRELAND#

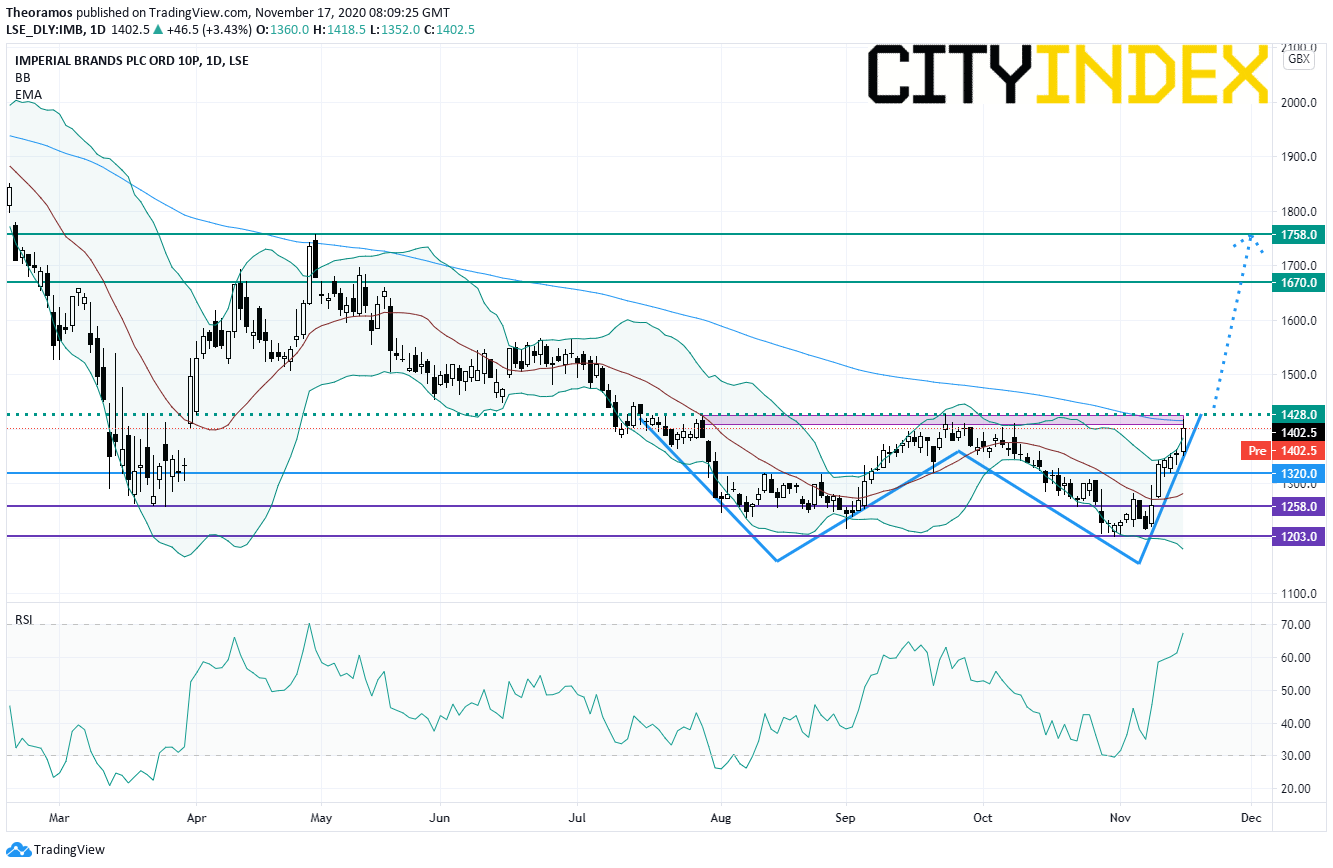

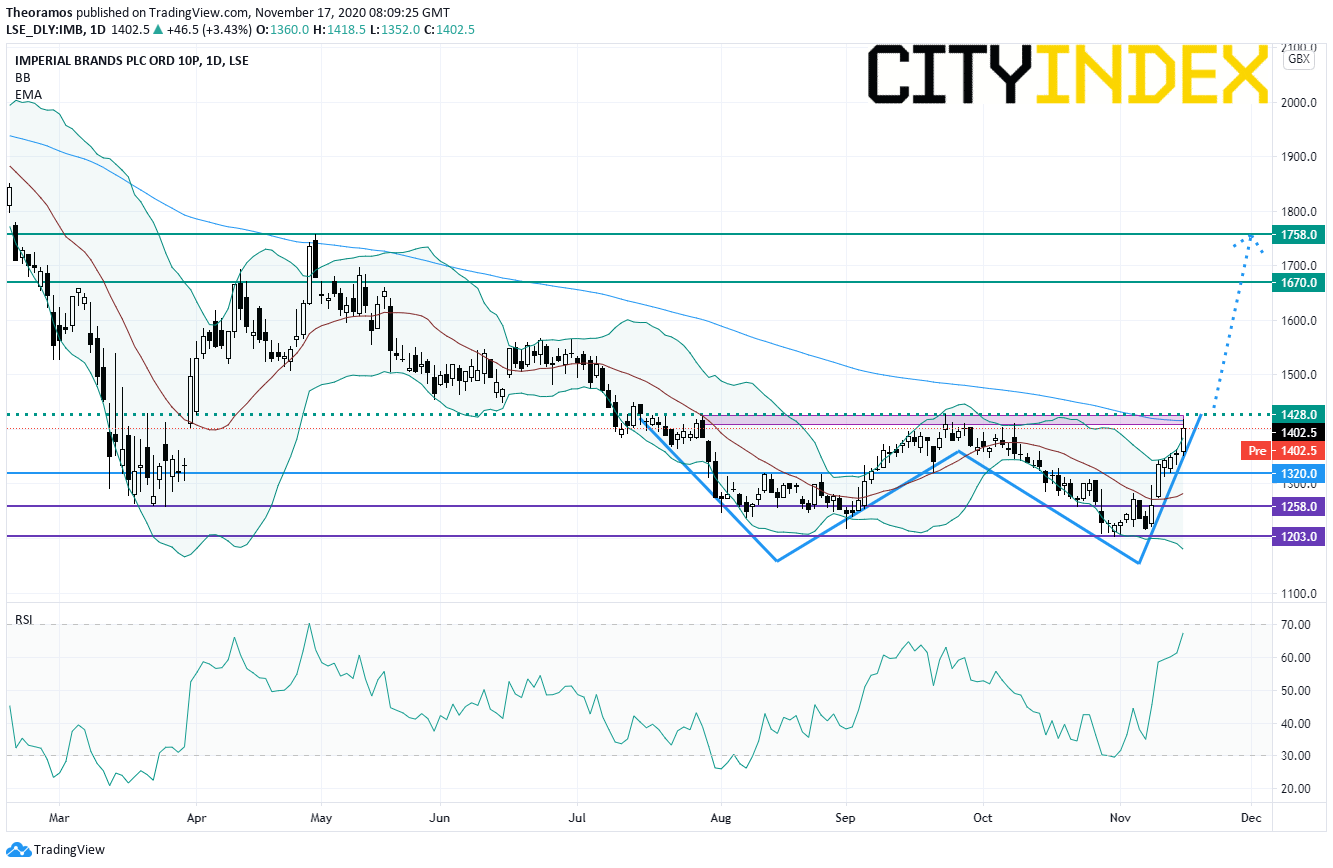

Imperial Brands, a tobacco manufacturer, announced that full-year adjusted EPS dropped 6.6% on year to 254.4p and adjusted operating profit fell 5.7% to 3.53 billion pounds on net revenue of 7.99 billion pounds, down 0.1% (+0.8% at constant currency). The company proposed an annual dividend of 137.7p per share, down from 206.6p per share in the prior year. Regarding the outlook, the company said: "We currently expect to deliver low to mid-single digit growth in organic adjusted operating profit at constant currency, (...) A higher tax rate will have a c. 2% impact on earnings with constant currency earnings per share expected to be slightly ahead of the prior year."

From a technical point of view, the stock is trading within an hypothetical double bottom pattern in place since July 2020. A break above the key level at 1428p would validate the pattern, question the 150-period exponential moving average and call for a new upleg towards 1670p and 1758p.

Source: TradingView, GAIN Capital

Experian, a consumer credit reporting company, reported 1H results: "Performance in the period was resilient, revenue was stable at US$2,487m (2019: US$2,495m) notwithstanding the effects of the COVID-19 pandemic. Operating profit for the six months ended 30 September 2020 was down marginally to US$546m (2019: US$556m). (...) Basic EPS reduced to 36.7 US cents (2019: 39.0 US cents). (...) We have announced a first interim dividend of 14.5 US cents per share, unchanged year-on-year."

BHP Group, a giant metals group, was downgraded to "hold" from "buy" at Societe Generale.

National Grid, an electricity and gas utility company, was downgraded to "neutral" from "buy" at UBS.

#SPAIN#

BBVA and Sabadell, the two Spanish banks, have confirmed they are in discussions regarding a potential merger.

#FINLAND#

Sampo, a Finnish financial company, was downgraded to "hold" from "buy" at Deutsche Bank.

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 rose 1.18%, Germany's DAX added 0.47%, France's CAC 40 jumped 1.70%, and the U.K.'s FTSE 100 was up 1.66%.

EUROPE ADVANCE/DECLINE

76% of STOXX 600 constituents traded higher yesterday.

86% of the shares trade above their 20D MA vs 86% Friday (above the 20D moving average).

85% of the shares trade above their 200D MA vs 82% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.76pt to 22.38, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Insurance, Autos, Banks, Travel & Leisure

3mths relative low: Chemicals, Healthcare

Europe Best 3 sectors

insurance, banks, automobiles & parts

Europe worst 3 sectors

media, personal & household goods, telecommunications

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.55% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

EC 14:00: ECB Guindos speech

UK 15:00: BoE Gov Bailey speech

GE 16:45: Bundesbank Balz speech

EC 17:00: ECB President Lagarde speech

UK 18:00: BoE Ramsden speech

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1860 and GBP/USD climbed to 1.3223. USD/JPY slipped to 104.47.

Spot gold edged up to $1,891 an ounce.

#UK - IRELAND#

Imperial Brands, a tobacco manufacturer, announced that full-year adjusted EPS dropped 6.6% on year to 254.4p and adjusted operating profit fell 5.7% to 3.53 billion pounds on net revenue of 7.99 billion pounds, down 0.1% (+0.8% at constant currency). The company proposed an annual dividend of 137.7p per share, down from 206.6p per share in the prior year. Regarding the outlook, the company said: "We currently expect to deliver low to mid-single digit growth in organic adjusted operating profit at constant currency, (...) A higher tax rate will have a c. 2% impact on earnings with constant currency earnings per share expected to be slightly ahead of the prior year."

From a technical point of view, the stock is trading within an hypothetical double bottom pattern in place since July 2020. A break above the key level at 1428p would validate the pattern, question the 150-period exponential moving average and call for a new upleg towards 1670p and 1758p.

Source: TradingView, GAIN Capital

Experian, a consumer credit reporting company, reported 1H results: "Performance in the period was resilient, revenue was stable at US$2,487m (2019: US$2,495m) notwithstanding the effects of the COVID-19 pandemic. Operating profit for the six months ended 30 September 2020 was down marginally to US$546m (2019: US$556m). (...) Basic EPS reduced to 36.7 US cents (2019: 39.0 US cents). (...) We have announced a first interim dividend of 14.5 US cents per share, unchanged year-on-year."

BHP Group, a giant metals group, was downgraded to "hold" from "buy" at Societe Generale.

National Grid, an electricity and gas utility company, was downgraded to "neutral" from "buy" at UBS.

#SPAIN#

BBVA and Sabadell, the two Spanish banks, have confirmed they are in discussions regarding a potential merger.

#FINLAND#

Sampo, a Finnish financial company, was downgraded to "hold" from "buy" at Deutsche Bank.