U.S Futures sliding - Watch TSLA, WMT, HD, TMUS, BRK/B, COST

The S&P 500 Futures are sliding after they maintained their upward momentum yesterday. Investors' risk appetite was enlarged by Moderna's announcement of positive trial results of its COVID-19 vaccine.

Later today, the U.S. Commerce Department will report October retail sales (+0.5% on month expected) and September business inventories (+0.6% on month expected). The Federal Reserve will release October industrial production (+1.0% on month expected). The National Association of Home Builders will post Housing Market Index for November (85 expected).

European indices are searching for a trend. German Foreign Minister has declared he was "certain we will find a solution to EU Recovery Fund" after Poland and Hungary blocked the adoption of the 2021-2027 budget and recovery fund yesterday.

Asian indices closed slightly on the upside except the Chinese CSI which ended in the red.

WTI Crude Oil remains bullish. The U.S. Energy Information Administration (EIA) projected that the U.S. shale oil output would fall by 140K b/d to 7.51M b/d in December. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for November 13.

US indices closed up on Monday, lifted by Energy (+6.5%), Automobiles & Components (+3.01%) and Banks (+2.95%) sectors.

Approximately 87% of stocks in the S&P 500 Index were trading above their 200-day moving average and 86% were trading above their 20-day moving average. The VIX Index declined 0.57pt (-2.47%) to 22.53, while Gold rose $0.53 (+0.03%) to $1889.73, and WTI Crude Oil jumped $1.27 (+3.16%) to $41.4 at the close.

On the US economic data front, Empire Manufacturing unexpectedly dropped to 6.3 on month in November (13.5 expected), from 10.5 in October.

The U.S dollar dips on concerns regarding new coronavirus restrictions in some U.S states and worries about White House transition.

The dollar index fell 0.29pt to 92.352.

U.S. Equity Snapshot

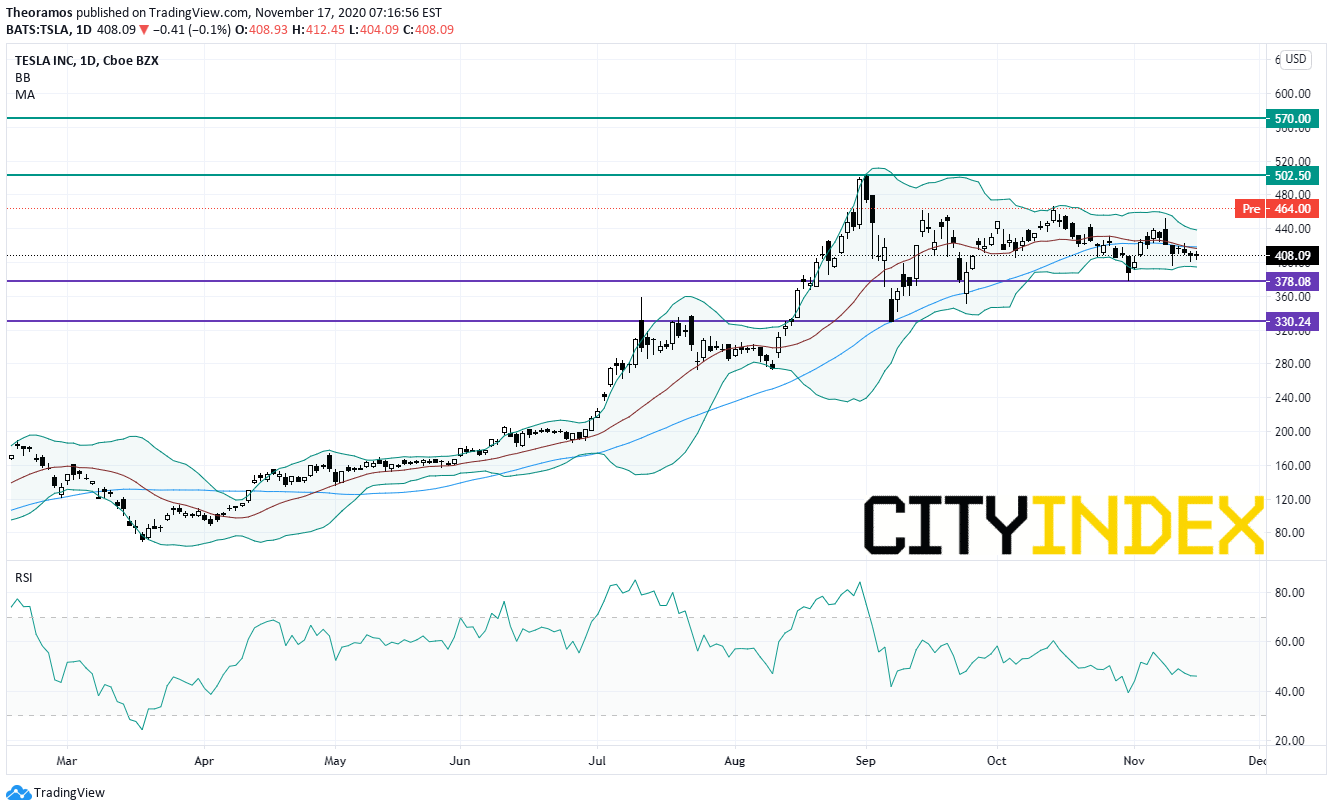

Tesla (TSLA), the electric-vehicle maker, is expected to surge as the company will join the S&P 500 Index before the open of trading December 21, announced S&P Dow Jones Indices.

Source: TradingView, GAIN Capital

Walmart (WMT), the retailer, climbs in extended trading as third quarter adjusted EPS and sales topped estimates.

Home Depot (HD), the home improvement specialty retailer, is losing ground premarket after announcing a 1 billion dollars compensation investment for its frontline workers. Separately, the company posted third quarter comparable sales up 24.1%, beating estimates. EPS was up to 3.18 dollars vs 2.53 dollars a year earlier.

T-Mobile US (TMUS), a wireless network operator, gained ground post market as Berkshire Hathaway (BRK/B), a holding company with a vast range of subsidiaries, disclosed a stake in the company.

Costco Wholesale (COST), an operator of a chain of warehouse stores, popped after hours after announcing a special cash dividend of 10 dollars per share.

Later today, the U.S. Commerce Department will report October retail sales (+0.5% on month expected) and September business inventories (+0.6% on month expected). The Federal Reserve will release October industrial production (+1.0% on month expected). The National Association of Home Builders will post Housing Market Index for November (85 expected).

European indices are searching for a trend. German Foreign Minister has declared he was "certain we will find a solution to EU Recovery Fund" after Poland and Hungary blocked the adoption of the 2021-2027 budget and recovery fund yesterday.

Asian indices closed slightly on the upside except the Chinese CSI which ended in the red.

WTI Crude Oil remains bullish. The U.S. Energy Information Administration (EIA) projected that the U.S. shale oil output would fall by 140K b/d to 7.51M b/d in December. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for November 13.

US indices closed up on Monday, lifted by Energy (+6.5%), Automobiles & Components (+3.01%) and Banks (+2.95%) sectors.

Approximately 87% of stocks in the S&P 500 Index were trading above their 200-day moving average and 86% were trading above their 20-day moving average. The VIX Index declined 0.57pt (-2.47%) to 22.53, while Gold rose $0.53 (+0.03%) to $1889.73, and WTI Crude Oil jumped $1.27 (+3.16%) to $41.4 at the close.

On the US economic data front, Empire Manufacturing unexpectedly dropped to 6.3 on month in November (13.5 expected), from 10.5 in October.

The U.S dollar dips on concerns regarding new coronavirus restrictions in some U.S states and worries about White House transition.

The dollar index fell 0.29pt to 92.352.

U.S. Equity Snapshot

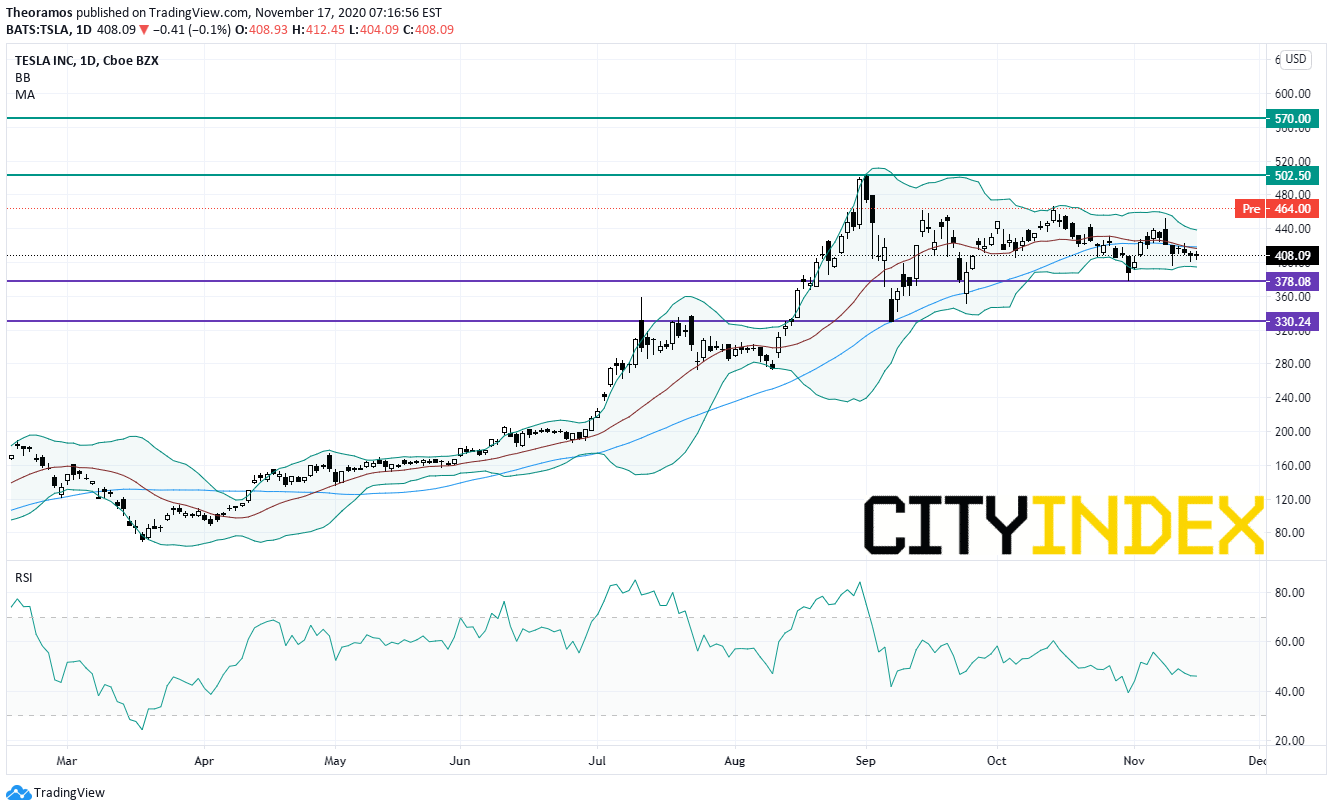

Tesla (TSLA), the electric-vehicle maker, is expected to surge as the company will join the S&P 500 Index before the open of trading December 21, announced S&P Dow Jones Indices.

Source: TradingView, GAIN Capital

Walmart (WMT), the retailer, climbs in extended trading as third quarter adjusted EPS and sales topped estimates.

Home Depot (HD), the home improvement specialty retailer, is losing ground premarket after announcing a 1 billion dollars compensation investment for its frontline workers. Separately, the company posted third quarter comparable sales up 24.1%, beating estimates. EPS was up to 3.18 dollars vs 2.53 dollars a year earlier.

T-Mobile US (TMUS), a wireless network operator, gained ground post market as Berkshire Hathaway (BRK/B), a holding company with a vast range of subsidiaries, disclosed a stake in the company.

Costco Wholesale (COST), an operator of a chain of warehouse stores, popped after hours after announcing a special cash dividend of 10 dollars per share.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM