U.S Futures under pressure - Watch ORCL, DUK, MLHR

The S&P 500 Futures remain under pressure after they scrapped earlier gains to close mixed yesterday. As expected, the Federal Reserve decided to keep its key interest rate unchanged at 0.00%-0.25%. The central bank said it would keep interest rates near zero at least through 2023.

Later today, the U.S. Commerce Department will report August housing starts (1.48 million units expected) and building permits (1.52 million units expected). The Labor Department will release initial jobless claims in the week ending September 12 (0.85 million expected). The Philadelphia Federal Reserve will report its Business Outlook Index for September (15.0 expected).

European indices are under pressure. The European Commission has posted final readings of August CPI at -0.4% on month, as expected. The Bank of England hold its interest rate unchanged at 0.10%, as expected. The BoE said: "The Committee does not intend to tighten monetary policy until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the two per cent inflation target sustainably."

Asian indices closed in the red. Official data showed that the Australian economy added 111,000 jobs in August (-35,000 jobs expected), while jobless rate dropped to 6.8% (7.7% expected) from 7.5% in July.

WTI Crude Oil futures are turning down even if U.S. Energy Information Administration reported an unexpected reduction of 4.4 million barrels in crude-oil stockpiles (+1.3 million barrels expected). Moreover, over 27% of Gulf of Mexico oil production was shut down due to Hurricane Sally.

Gold fell 14.85$ (-0.76%) to 1944.42, below a ST declining trend line.

U.S. Equity Snapshot

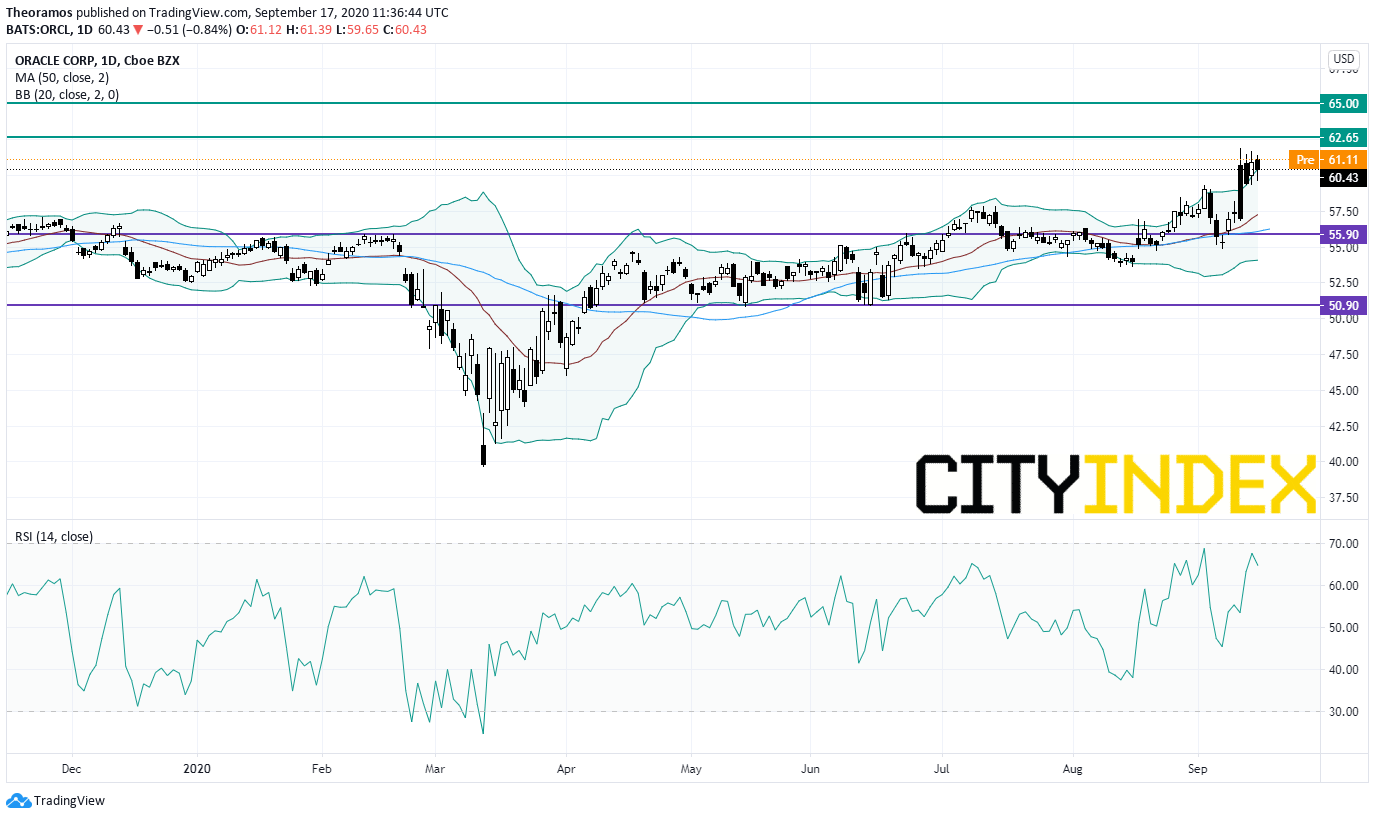

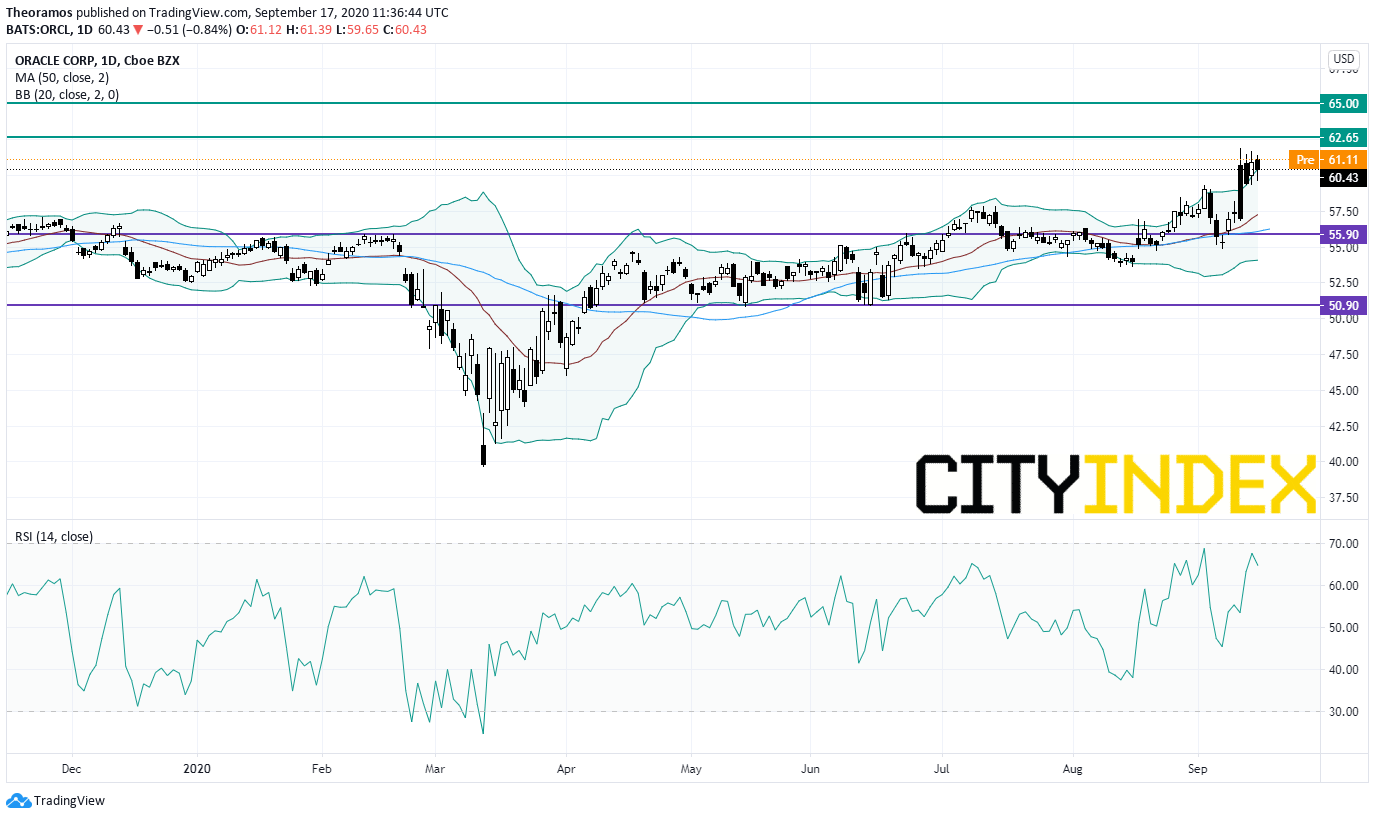

Oracle (ORCL): the Trump administration had not made a decision on the agreement between TikTok and Oracle, which should allow the popular application to remain active in the United States, said Donald Trump, assuring that he does not want any security flaws.

Source: GAIN Capital, TradingView

Herman Miller's (MLHR) shares jump in premarket trading after the provider of furnishings and related technologies and services company reported first quarter adjusted EPS of 1.24 dollar, significantly exceeding the forecast, up from 0.84 dollar a year ago on revenue of 626.8 million dollars, down 6.6% year on year.

Later today, the U.S. Commerce Department will report August housing starts (1.48 million units expected) and building permits (1.52 million units expected). The Labor Department will release initial jobless claims in the week ending September 12 (0.85 million expected). The Philadelphia Federal Reserve will report its Business Outlook Index for September (15.0 expected).

European indices are under pressure. The European Commission has posted final readings of August CPI at -0.4% on month, as expected. The Bank of England hold its interest rate unchanged at 0.10%, as expected. The BoE said: "The Committee does not intend to tighten monetary policy until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the two per cent inflation target sustainably."

Asian indices closed in the red. Official data showed that the Australian economy added 111,000 jobs in August (-35,000 jobs expected), while jobless rate dropped to 6.8% (7.7% expected) from 7.5% in July.

WTI Crude Oil futures are turning down even if U.S. Energy Information Administration reported an unexpected reduction of 4.4 million barrels in crude-oil stockpiles (+1.3 million barrels expected). Moreover, over 27% of Gulf of Mexico oil production was shut down due to Hurricane Sally.

Gold fell 14.85$ (-0.76%) to 1944.42, below a ST declining trend line.

GBP/USD dropped 55pips to 1.2912 as the BoE hold its interest rates unchanged.

U.S. Equity Snapshot

Oracle (ORCL): the Trump administration had not made a decision on the agreement between TikTok and Oracle, which should allow the popular application to remain active in the United States, said Donald Trump, assuring that he does not want any security flaws.

Source: GAIN Capital, TradingView

Duke Energy (DUK), the electric power company, said it has reached an agreement with solar installers, environmental groups and renewable energy advocates in South Carolina which could "create long-term stability for the residential solar industry in the state."

Herman Miller's (MLHR) shares jump in premarket trading after the provider of furnishings and related technologies and services company reported first quarter adjusted EPS of 1.24 dollar, significantly exceeding the forecast, up from 0.84 dollar a year ago on revenue of 626.8 million dollars, down 6.6% year on year.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM