US Futures slightly up - Watch AMZN, TSLA, NVAX, BRK/B

The S&P 500 Futures remain slightly on the upside. Still, no progress was made on political negotiations over the new coronavirus relief package.

Due later today is the U.S. Empire State Manufacturing Survey (a decline to 14.5 in August is expected).

European indices are searching for a trend as Covid-19 cases are on the upside.

Asian indices closed in dispersed order. The Hong Kong HSI and the Chinese CSI closed on the upside while the Japanese Nikkei and the Australian ASX closed lower. This morning, Japan's second quarter annualized GDP shrank 27.8% on quarter (-26.9% expected), the largest decline on records, according to the government.

WTI Crude Oil futures are rebounding. The total number of rigs in the U.S. fell to 244 as of August 14 from 247 a week ago, while rigs in Canada increased to 54 from 47, according to Baker Hughes. U.S. Crude Oil rigs fell from 176 to 172, the lowest since July 2005.

Gold gains some ground after prices had their biggest weekly decline since March on risk appetite comeback.

Gold rose 9.23 dollars (+0.47%) to 1954.35.

The US dollar consolidates before the release of Fed minutes this week.

The dollar index fell 0.11pt to 92.983.

U.S. Equity Snapshot

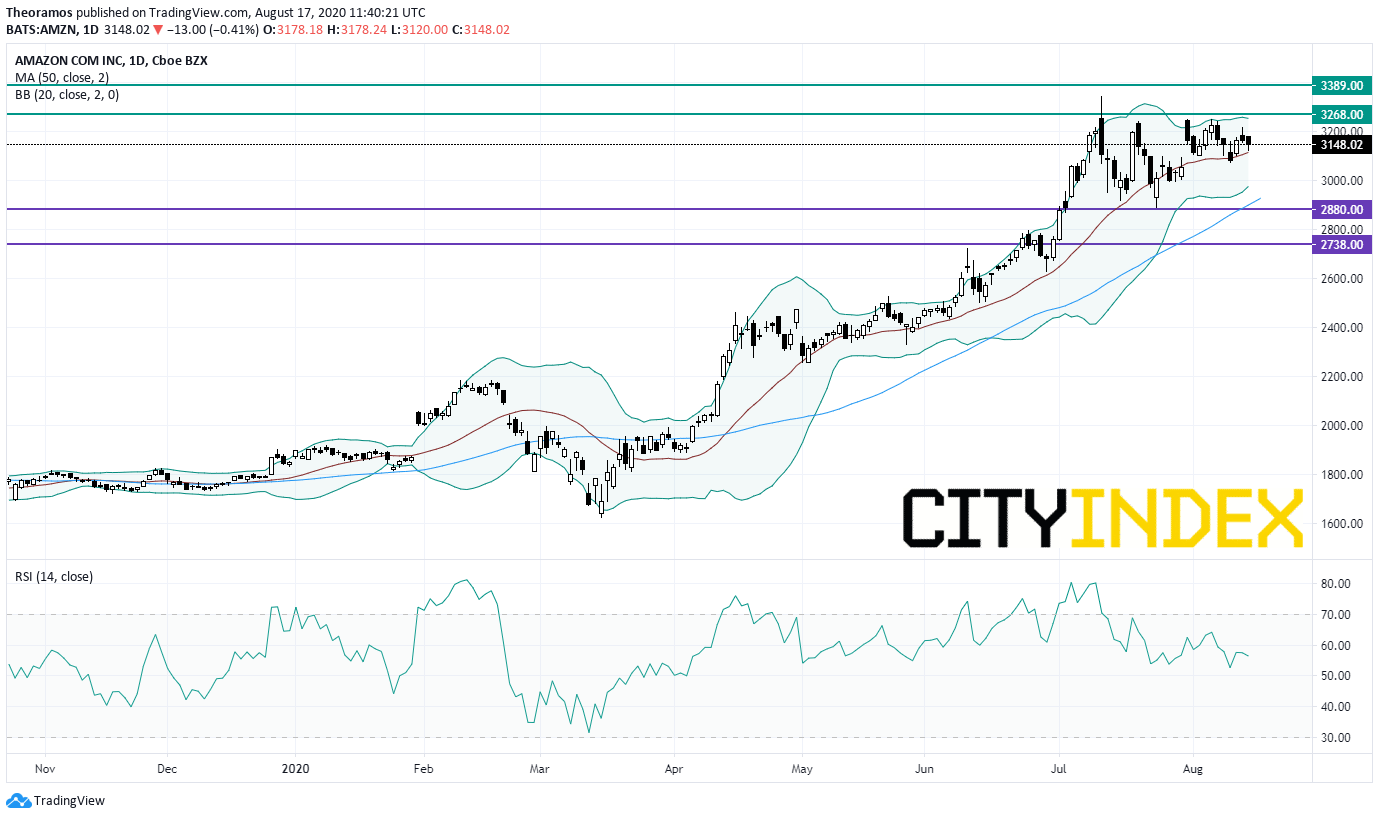

Amazon (AMZN), the e-commerce giant, is currently being probed by the German Federal Cartel Office over potential abuse of dominance during the COVID-19 pandemic, according to CNBC.

Source: TradingView, GAIN Capital

Tesla (TSLA): the electric-vehicle maker's car registrations in China fell to 11,623 units in July from 15,529 units in June, according to Reuters.

Novavax (NVAX), the biotech, "announced the beginning of a Phase 2b clinical trial in South Africa to evaluate the efficacy of NVX-CoV2373, Novavax’ COVID-19 vaccine candidate."

Berkshire Hathaway (BRK/B): according to financial filings, the Warren Buffet holding reduced its stakes in JPMorgan (JPM), Wells Fargo (WFC) and PNC Financial (PFC) during the second quarter, and exited Goldman Sachs (GS) stake, also during the second quarter.

Due later today is the U.S. Empire State Manufacturing Survey (a decline to 14.5 in August is expected).

European indices are searching for a trend as Covid-19 cases are on the upside.

Asian indices closed in dispersed order. The Hong Kong HSI and the Chinese CSI closed on the upside while the Japanese Nikkei and the Australian ASX closed lower. This morning, Japan's second quarter annualized GDP shrank 27.8% on quarter (-26.9% expected), the largest decline on records, according to the government.

WTI Crude Oil futures are rebounding. The total number of rigs in the U.S. fell to 244 as of August 14 from 247 a week ago, while rigs in Canada increased to 54 from 47, according to Baker Hughes. U.S. Crude Oil rigs fell from 176 to 172, the lowest since July 2005.

Gold gains some ground after prices had their biggest weekly decline since March on risk appetite comeback.

Gold rose 9.23 dollars (+0.47%) to 1954.35.

The US dollar consolidates before the release of Fed minutes this week.

The dollar index fell 0.11pt to 92.983.

U.S. Equity Snapshot

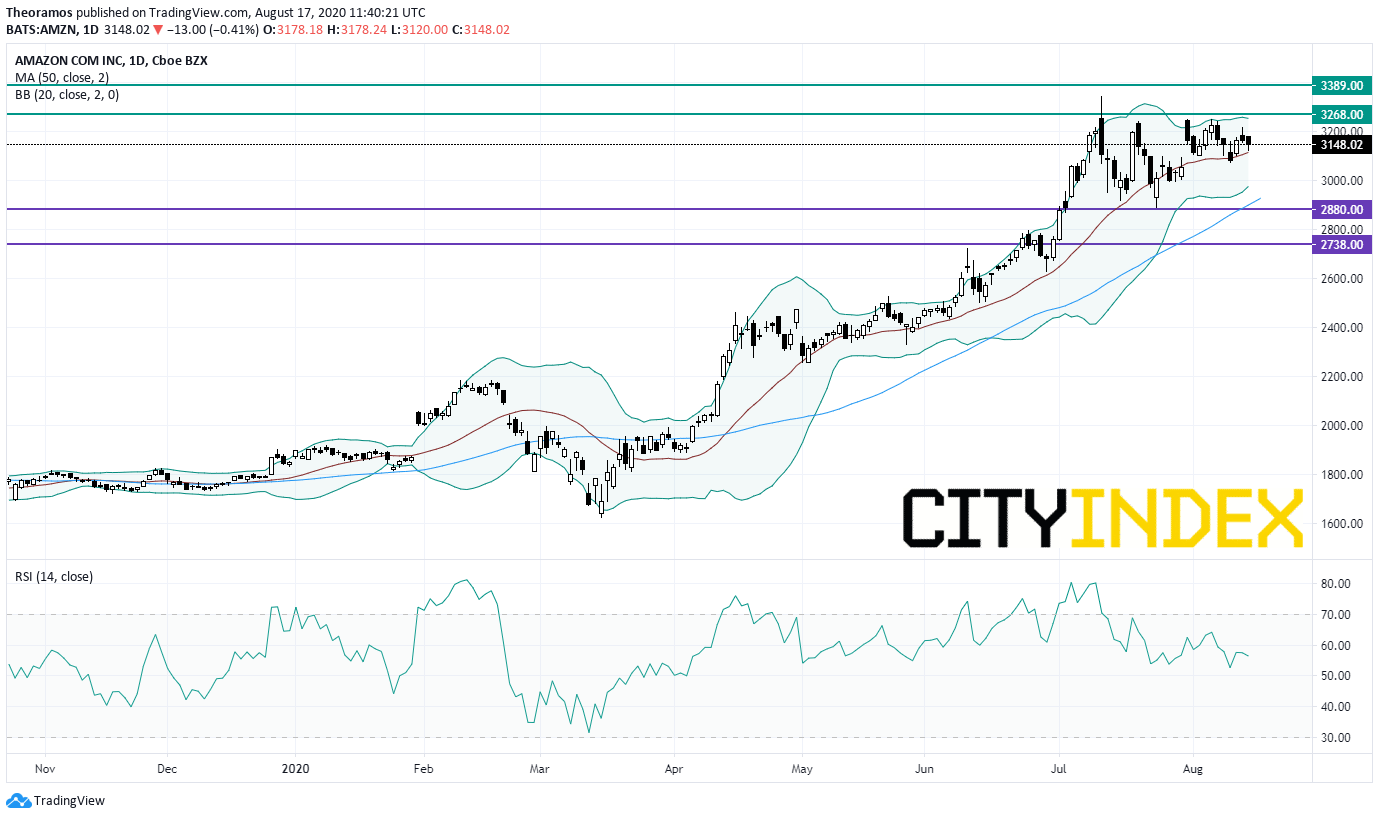

Amazon (AMZN), the e-commerce giant, is currently being probed by the German Federal Cartel Office over potential abuse of dominance during the COVID-19 pandemic, according to CNBC.

Source: TradingView, GAIN Capital

Tesla (TSLA): the electric-vehicle maker's car registrations in China fell to 11,623 units in July from 15,529 units in June, according to Reuters.

Novavax (NVAX), the biotech, "announced the beginning of a Phase 2b clinical trial in South Africa to evaluate the efficacy of NVX-CoV2373, Novavax’ COVID-19 vaccine candidate."

Berkshire Hathaway (BRK/B): according to financial filings, the Warren Buffet holding reduced its stakes in JPMorgan (JPM), Wells Fargo (WFC) and PNC Financial (PFC) during the second quarter, and exited Goldman Sachs (GS) stake, also during the second quarter.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM