US Futures remain firm, watch AAPL, NVDA, QCOM

Due later today are May Retail Sales (+8.0% on month expected), Industrial Production (+3.0% on month expected) and capacity utilization (66.9% expected). The National Association of Home Builders will release Housing Market Index for June (45 expected). Last but not least, the U.S. Federal Reserve Chairman Jerome Powell will deliver semi-annual policy report to the Senate.

European indices are posting a rebound. ZEW survey results of June were released for Germany at -83.1 for Current situation, vs -84 expected. Economic Sentiment was released at 63.4, vs 60.0 expected. The German Federal Statistical Office has posted final readings of May CPI at +0.6% on year, as expected. The U.K. Office for National Statistics has reported jobless rate for the three months to April at 3.9% (vs 4.7% expected).

Asian indices posted strong gains today. This morning, the Bank of Japan kept its benchmark rate unchanged at -0.10% as expected, while expanding its special lending program to 110 trillion yen from 75 trillion yen.

WTI Crude Oil Futures are searching for a trend. Later today, API would release the change of U.S. oil stockpile data for June 12.

Gold remains firm while the US dollar eases on Fed's decision to buy corporate bonds.

Gold rose 6.61 dollars (+0.38%) to 1731.77 dollars. The dollar index fell 0.02pt to 96.688.

US Equity Snapshot

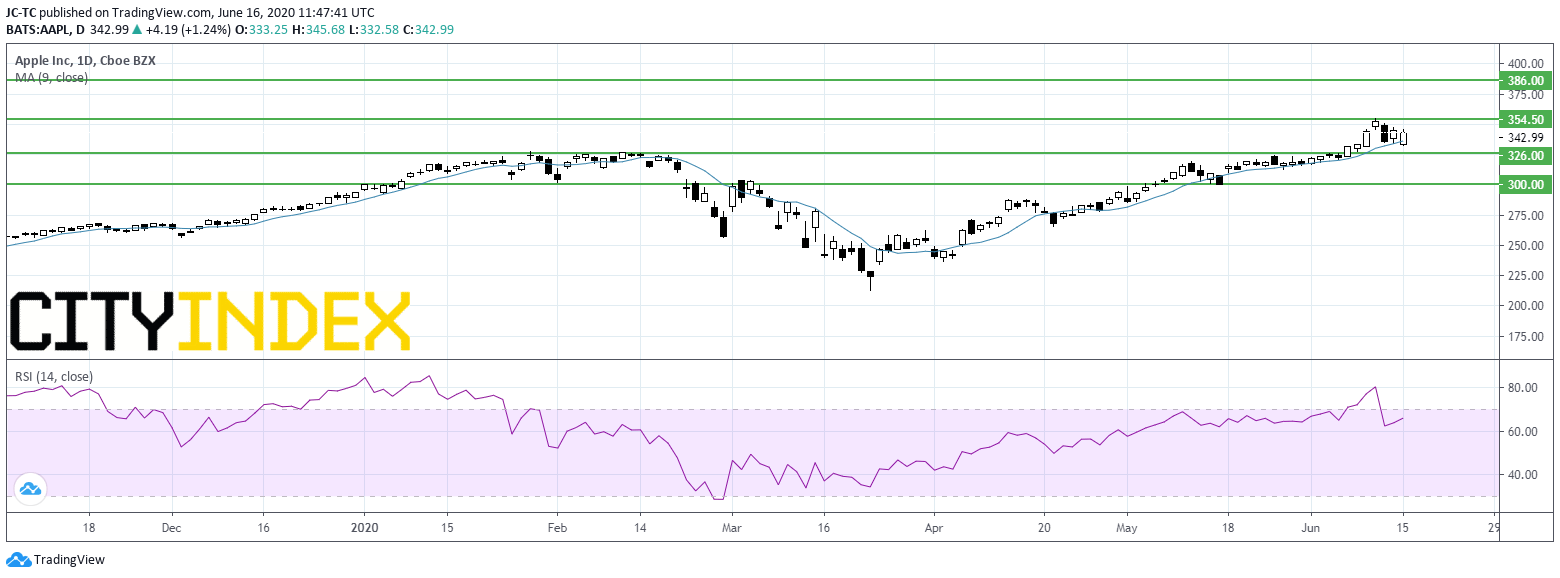

Apple (AAPL), the tech giant, is facing two antitrust probes launched by the European Commission regarding the App store rules and Apple Pay.

Nvidia (NVDA), a leading designer of graphics processors, was downgraded to "equal-weight" from "overweight" at Morgan Stanley.

QUALCOMM (QCOM), a maker of digital wireless communications equipment, was upgraded to "overweight" from "equal-weight" by Morgan Stanley.

Tiffany (TIF), the jeweler, received the approval of South Korea regarding a potential merger with LVMH. Tiffany expects to close the merger in the middle of 2020.

T-Mobile US (TMUS): Softbank confirmed it is still exploring a potential sale of T-Mobile shares.

Lennar (LEN), the homebuilder, reported second quarter EPS up to 1.65 dollar a share from 1.30 dollar a year earlier, on sales down 5.29 billion dollars from 5.56 billion dollars a year ago. Those figures beat estimates. The company said that business rebounded "significantly" in May.

Source : TradingVIEW, Gain Capital