US Futures red, watch SHOP, MMM, AXP, INTC

Due later today is the Empire Manufacturing Index for June (a rise to -30.0 expected).

European indices are under pressure. The European Commission has reported April trade balance at 1.2 billion euros surplus (vs 25.5 billion euros surplus in March).

Asian indices all closed in the red. This morning, official data showed that China's industrial production grew 4.4% on year in May (vs +5.0% expected) while retail sales fell 2.8% (vs -2.3% expected).

WTI Crude Oil Futures are on the downside. The number of U.S. oil rigs fell to 199 as of June 12 from 206 a week ago, while oil rigs in Canada remained at 7, according to Baker Hughes.

Gold is consolidating after the safe-haven asset posted its best week since April. Gold fell 20.62 dollars (-1.19%) to 1710.14 dollars.

Risk currencies weaken

on fears of a second wave of coronavirus. EUR/USD declined 9pips to 1.1247 while GBP/USD fell 23pips to 1.2517.

US Equity Snapshot

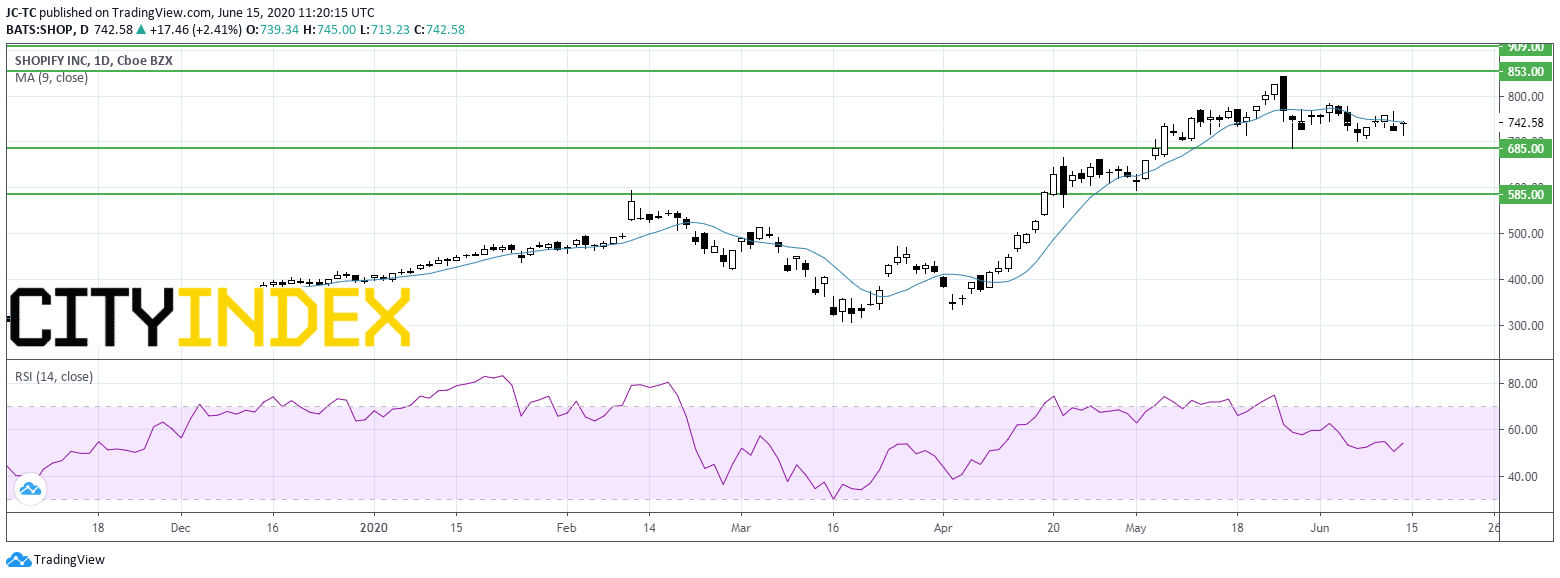

Shopify (SHOP) is gaining ground before hours after a Walmart (MWT) executive said that the retailer partners with the e-commerce giant to expand its marketplace site. Separately, Shopify was upgraded to "overweight" from" neutral" by Piper Sandler.

3M (MMM), a diversified multinational conglomerate, posted May sales down 20% to 2.2 billion dollars.

American Express (AXP), a financial services corporation, has obtained a network clearing license to start bank card clearing services in China, according to the China's central bank.

Intel (INTC), a global provider of advertising services, was upgraded to "overweight" from "sector weight" at KeyBanc.

Source : TradingVIEW, Gain Capital