US Futures consolidating, watch JD, AMAT, NLOCK, ABT

The S&P 500 Futures are consolidating after they closed in positive territory yesterday after two sessions of losses.

The US department of commerce announced plans to restrict Huawei’s ability to use U.S. technology and software to design and manufacture its semiconductors abroad.

Later today, investors will focus on retail sales (-12.0% on month in April expected), the Empire Manufacturing Index (-60.0 for May expected), industrial production (-12.0% on month in April expected), and the University of Michigan's Consumer Sentiment Index (68.0 for May expected).

European indices are rebounding. The European Commission has reported 1Q GDP at -3.8% (vs +0.1% the previous quarter). The German Federal Statistical Office has posted 1Q GDP at -2.2% (as expected). France's INSEE has released final readings of April CPI at +0.3% (vs +0.4% on year expected).

Asian indices are on the upside. This morning, official data showed that China's industrial production rose 3.9% on year in April (+1.5% expected) while retail sales dropped 7.5% (-6.0% expected).

WTI Crude Oil Futures remain on the upside. OPEC+ oil exports dropped by 4.85m b/d for the first 14 days of May compared to full-month April data, according to Petro-Logistics. The IEA boosted the estimation of global oil demand by 3.2M b/d to 79.3M b/d in 2Q, down 20% on year at the same period in 2019.

Gold gains ground on increasing US-China tensions while the US dollar is consolidating before economic data.

Gold rose 4.24 dollars (+0.25%) to 1734.54 dollars. The EUR/USD gained 7pips to 1.0812 while GBP/USD fell 30pips to 1.22.

US Equity Snapshot

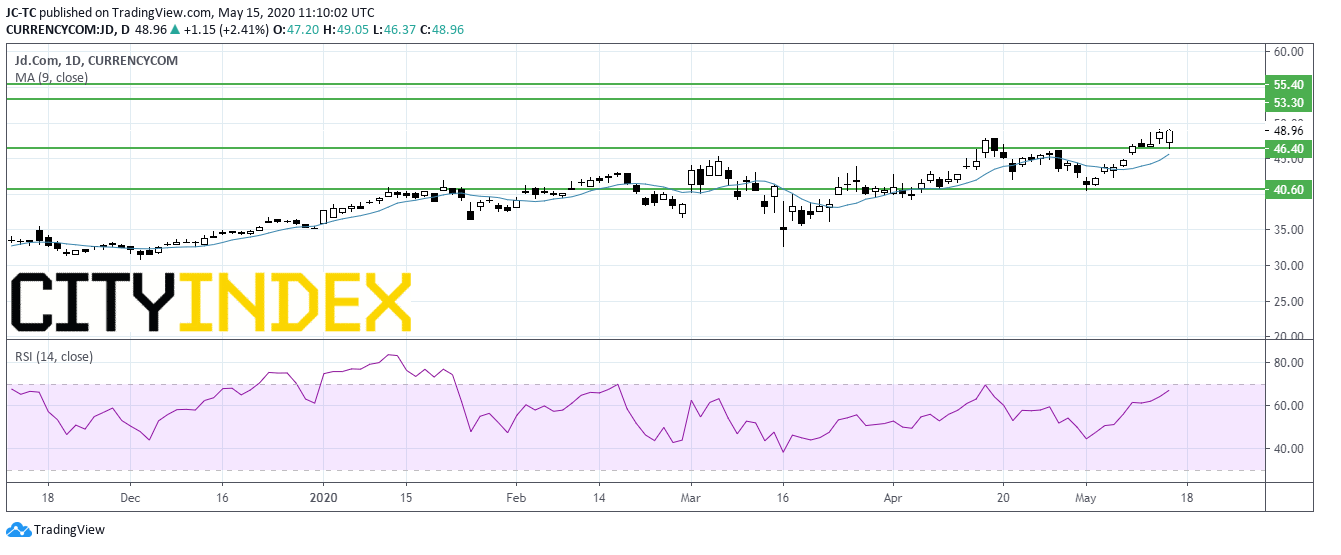

JD.Com (JD), the Chinese e-commerce company, is expected to rise after reporting first quarter profit and sales that beat estimates.

Applied Materials (AMAT), the global leader in materials engineering solutions for the semiconductor industry, posted second quarter adjusted EPS of 0.89 dollar, up from 0.70 dollar a year ago, on sales of 4.0 billion dollars, up from 3.5 billion dollars in the previous year. Those figures were shy of consensus.

NortonLifeLock (NLOK), a global leader in consumer Cyber Safety, announced fourth quarter adjusted EPS of 0.26 dollar, beating estimates, down from 0.39 dollar a year ago, on revenue of 614 million dollars, above forecasts, down from 1.2 billion dollars last year.

Abbott Laboratories' (ABT), a medical devices and health care company, ID NOW point-of-care test to diagnose Covid-19 may produce false negative results, according to the U.S. Food and Drug Administration cited by Bloomberg.

The US department of commerce announced plans to restrict Huawei’s ability to use U.S. technology and software to design and manufacture its semiconductors abroad.

Later today, investors will focus on retail sales (-12.0% on month in April expected), the Empire Manufacturing Index (-60.0 for May expected), industrial production (-12.0% on month in April expected), and the University of Michigan's Consumer Sentiment Index (68.0 for May expected).

European indices are rebounding. The European Commission has reported 1Q GDP at -3.8% (vs +0.1% the previous quarter). The German Federal Statistical Office has posted 1Q GDP at -2.2% (as expected). France's INSEE has released final readings of April CPI at +0.3% (vs +0.4% on year expected).

Asian indices are on the upside. This morning, official data showed that China's industrial production rose 3.9% on year in April (+1.5% expected) while retail sales dropped 7.5% (-6.0% expected).

WTI Crude Oil Futures remain on the upside. OPEC+ oil exports dropped by 4.85m b/d for the first 14 days of May compared to full-month April data, according to Petro-Logistics. The IEA boosted the estimation of global oil demand by 3.2M b/d to 79.3M b/d in 2Q, down 20% on year at the same period in 2019.

Gold gains ground on increasing US-China tensions while the US dollar is consolidating before economic data.

Gold rose 4.24 dollars (+0.25%) to 1734.54 dollars. The EUR/USD gained 7pips to 1.0812 while GBP/USD fell 30pips to 1.22.

US Equity Snapshot

JD.Com (JD), the Chinese e-commerce company, is expected to rise after reporting first quarter profit and sales that beat estimates.

Applied Materials (AMAT), the global leader in materials engineering solutions for the semiconductor industry, posted second quarter adjusted EPS of 0.89 dollar, up from 0.70 dollar a year ago, on sales of 4.0 billion dollars, up from 3.5 billion dollars in the previous year. Those figures were shy of consensus.

NortonLifeLock (NLOK), a global leader in consumer Cyber Safety, announced fourth quarter adjusted EPS of 0.26 dollar, beating estimates, down from 0.39 dollar a year ago, on revenue of 614 million dollars, above forecasts, down from 1.2 billion dollars last year.

Abbott Laboratories' (ABT), a medical devices and health care company, ID NOW point-of-care test to diagnose Covid-19 may produce false negative results, according to the U.S. Food and Drug Administration cited by Bloomberg.

Source : TradingVIEW, Gain Capital

Latest market news

Today 08:15 AM