EU indices mixed this morning | TA focus on Daimler

INDICES

Yesterday, European stocks were mixed. The Stoxx Europe 600 Index was up 0.15%, France's CAC 40 advanced 0.35%, while Germany's DAX 30 eased 0.07% and the U.K.'s FTSE 100 declined 0.10%.

EUROPE ADVANCE/DECLINE

52% of STOXX 600 constituents traded higher yesterday.

55% of the shares trade above their 20D MA vs 53% Friday (below the 20D moving average).

57% of the shares trade above their 200D MA vs 55% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.16pt to 22.57, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Pers. & House. Goods

3mths relative low: Utilities, Energy

Europe Best 3 sectors

travel & leisure, technology, banks

Europe worst 3 sectors

energy, utilities, insurance

INTEREST RATE

The 10yr Bund yield fell 5bps to -0.48% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Jun Employment chg, exp.: -220K

UK 07:00: Jul Average Earnings excl. Bonus, exp.: -0.2%

UK 07:00: Jul Average Earnings incl. Bonus, exp.: -1.2%

UK 07:00: Jul Unemployment Rate, exp.: 3.9%

UK 07:00: Aug Claimant Count chg, exp.: 94.4K

FR 07:45: Aug Inflation Rate YoY final, exp.: 0.8%

FR 07:45: Aug Inflation Rate MoM final, exp.: 0.4%

FR 07:45: Aug Harmonised Inflation Rate YoY final, exp.: 0.9%

FR 07:45: Aug Harmonised Inflation Rate MoM final, exp.: 0.4%

FR 09:00: IEA Oil Market Report

EC 10:00: Q2 Labour Cost Idx YoY, exp.: 3.4%

EC 10:00: Q2 Wage Growth YoY, exp.: 3.4%

EC 10:00: Sep ZEW Economic Sentiment Idx, exp.: 64

GE 10:00: Sep ZEW Current Conditions, exp.: -81.3

GE 10:00: Sep ZEW Economic Sentiment Idx, exp.: 71.5

MORNING TRADING

In Asian trading hours, EUR/USD rose further to 1.1881 while GBP/USD was little changed at 1.2843. USD/JPY remained subdued at 105.64. AUD/USD climbed to 0.7309, lifted by better-than-expected Chinese data. This morning, official data showed that China's industrial production rose 5.6% on year in August (+5.1% expected) and retail sales grew 0.5% (flat expected).

Spot gold advanced to $1,965 an ounce.

#UK - IRELAND#

Ocado, a British online supermarket, posted a 3Q trading statement: "Retail Revenue grew 52% as channel shift to online grocery in UK continues. (...) Retail sales grew faster compared to Q2 as demand remained high versus a seasonally softer quarter in Q3 2019. (...) While uncertainties remain over the scale, and duration, of the ongoing impact of social distancing restrictions in the UK, the strong trading performance of Ocado Retail in the first three quarters of the year, combined with the impact of operational leverage in the retail business, suggest, given current trends, a full year EBITDA result for Ocado Group of at least £40m."

AstraZeneca's, a pharmaceutical giant, coronavirus vaccine trial in the U.S. remains on hold as regulators are still examining the serious side effect on the British patient, according to Reuters.

FirstGroup, a transport group, released a trading update for the period from April 1 to August 31: "The Group is now expecting to deliver a small adjusted operating profit for the seasonally weaker first half of the financial year, ahead of our expectations earlier this summer."

Rio Tinto, a giant miner, was upgraded to "overweight" from "neutral" at JPMorgan.

BHP Group, a multinational mining group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

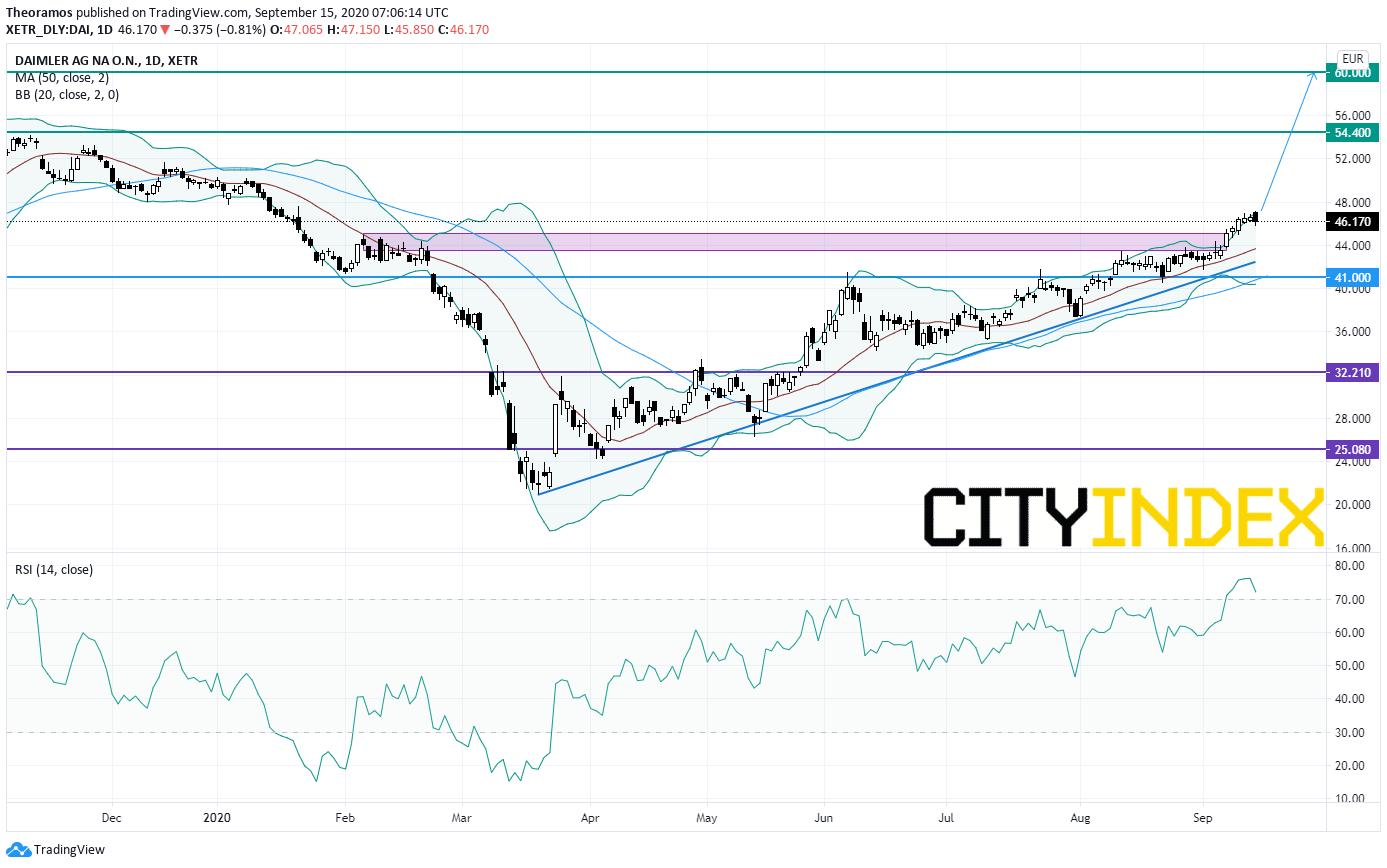

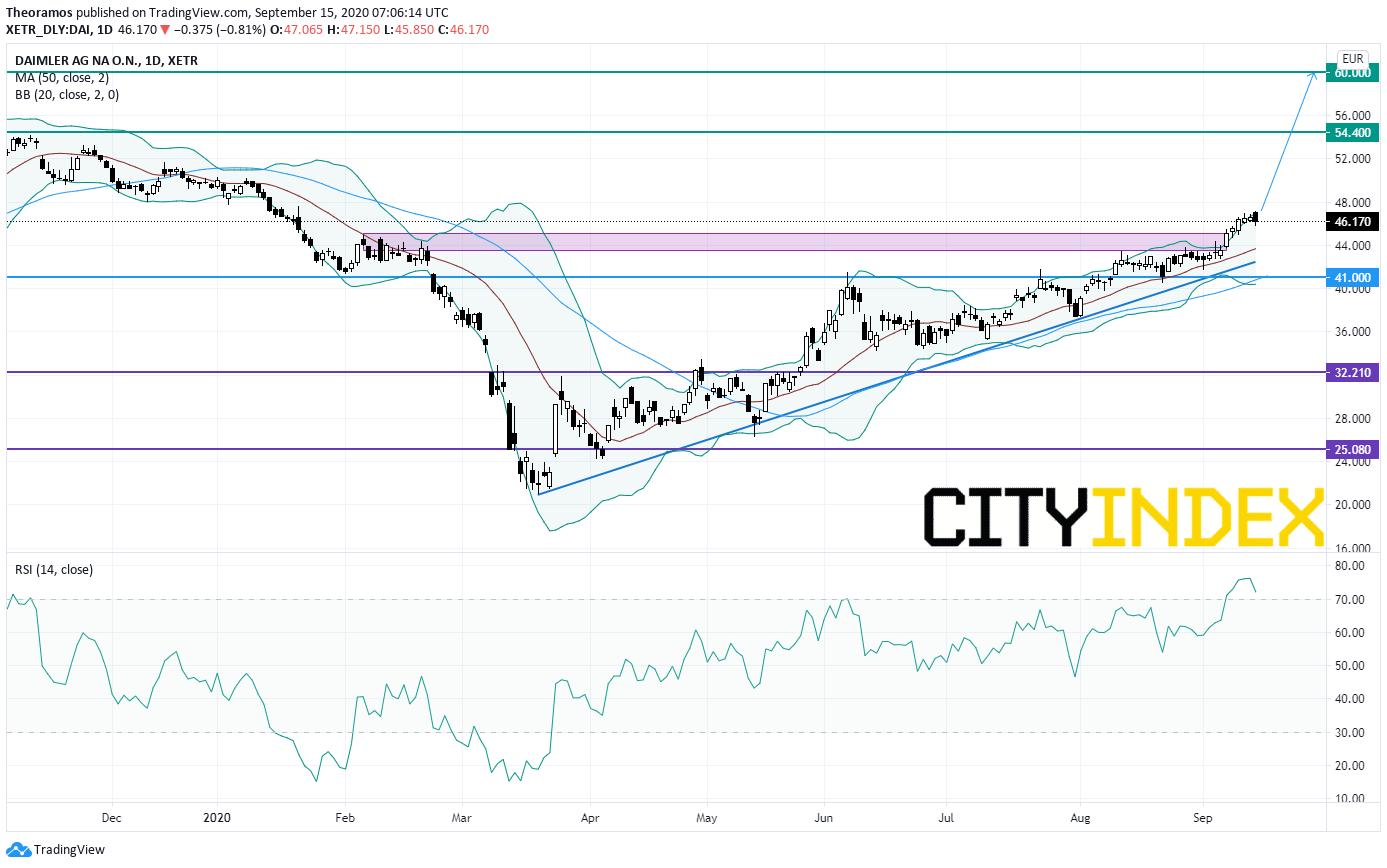

Daimler, a vehicle manufacturer, and the U.S. regulators have reached a 1.5 billion dollars settlement, resolving alleged violations of the Clean Air Act and California law associated with emissions cheating in Mercedes-Benz diesel vehicles, according to the U.S. Department of Justice.

From a daily point of view, the share remains supported by a rising trend line drawn since March. The share has broken above the resistance area between 43.5E (previous top of August) and 45E (horizontal resistance of February), releasing a new upside potential. above the overlap threshold at 41E look for the horizontal resistance of November 2019 at 54.4E and 60E in extension.

Source: GAIN Capital, TradingView

#FRANCE#

Bureau Veritas, an inspection and certification company, was upgraded to "buy" from "hold" at HSBC.

#SPAIN#

Ferrovial, an infrastructure group, announced that it has agreed to sell its 49% stake in Portugal's Norte Litoral highway and its 48% stake in the Via do Infante highway to a fund managed by DIF Capital Partners a total consideration of 171 million euros.

#ITALY#

Leonardo, an aerospace and defence, was upgraded to "buy" from "hold" at Societe Generale.

#SWITZERLAND#

SGS, a testing and certification services provider, was upgraded to "hold" from "reduce" at HSBC.

#SWEDEN#

Hennes & Mauritz, a clothing-retail company, announced that 3Q net sales declined 19% on year (-16% in local currencies) to 50.87 billion Swedish krona. The company said the group's recovery is "better than expected" and "preliminary results show profit before tax of approximately SEK 2 billion".

Yesterday, European stocks were mixed. The Stoxx Europe 600 Index was up 0.15%, France's CAC 40 advanced 0.35%, while Germany's DAX 30 eased 0.07% and the U.K.'s FTSE 100 declined 0.10%.

EUROPE ADVANCE/DECLINE

52% of STOXX 600 constituents traded higher yesterday.

55% of the shares trade above their 20D MA vs 53% Friday (below the 20D moving average).

57% of the shares trade above their 200D MA vs 55% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.16pt to 22.57, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Pers. & House. Goods

3mths relative low: Utilities, Energy

Europe Best 3 sectors

travel & leisure, technology, banks

Europe worst 3 sectors

energy, utilities, insurance

INTEREST RATE

The 10yr Bund yield fell 5bps to -0.48% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Jun Employment chg, exp.: -220K

UK 07:00: Jul Average Earnings excl. Bonus, exp.: -0.2%

UK 07:00: Jul Average Earnings incl. Bonus, exp.: -1.2%

UK 07:00: Jul Unemployment Rate, exp.: 3.9%

UK 07:00: Aug Claimant Count chg, exp.: 94.4K

FR 07:45: Aug Inflation Rate YoY final, exp.: 0.8%

FR 07:45: Aug Inflation Rate MoM final, exp.: 0.4%

FR 07:45: Aug Harmonised Inflation Rate YoY final, exp.: 0.9%

FR 07:45: Aug Harmonised Inflation Rate MoM final, exp.: 0.4%

FR 09:00: IEA Oil Market Report

EC 10:00: Q2 Labour Cost Idx YoY, exp.: 3.4%

EC 10:00: Q2 Wage Growth YoY, exp.: 3.4%

EC 10:00: Sep ZEW Economic Sentiment Idx, exp.: 64

GE 10:00: Sep ZEW Current Conditions, exp.: -81.3

GE 10:00: Sep ZEW Economic Sentiment Idx, exp.: 71.5

MORNING TRADING

In Asian trading hours, EUR/USD rose further to 1.1881 while GBP/USD was little changed at 1.2843. USD/JPY remained subdued at 105.64. AUD/USD climbed to 0.7309, lifted by better-than-expected Chinese data. This morning, official data showed that China's industrial production rose 5.6% on year in August (+5.1% expected) and retail sales grew 0.5% (flat expected).

Spot gold advanced to $1,965 an ounce.

#UK - IRELAND#

Ocado, a British online supermarket, posted a 3Q trading statement: "Retail Revenue grew 52% as channel shift to online grocery in UK continues. (...) Retail sales grew faster compared to Q2 as demand remained high versus a seasonally softer quarter in Q3 2019. (...) While uncertainties remain over the scale, and duration, of the ongoing impact of social distancing restrictions in the UK, the strong trading performance of Ocado Retail in the first three quarters of the year, combined with the impact of operational leverage in the retail business, suggest, given current trends, a full year EBITDA result for Ocado Group of at least £40m."

AstraZeneca's, a pharmaceutical giant, coronavirus vaccine trial in the U.S. remains on hold as regulators are still examining the serious side effect on the British patient, according to Reuters.

FirstGroup, a transport group, released a trading update for the period from April 1 to August 31: "The Group is now expecting to deliver a small adjusted operating profit for the seasonally weaker first half of the financial year, ahead of our expectations earlier this summer."

Rio Tinto, a giant miner, was upgraded to "overweight" from "neutral" at JPMorgan.

BHP Group, a multinational mining group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

Daimler, a vehicle manufacturer, and the U.S. regulators have reached a 1.5 billion dollars settlement, resolving alleged violations of the Clean Air Act and California law associated with emissions cheating in Mercedes-Benz diesel vehicles, according to the U.S. Department of Justice.

From a daily point of view, the share remains supported by a rising trend line drawn since March. The share has broken above the resistance area between 43.5E (previous top of August) and 45E (horizontal resistance of February), releasing a new upside potential. above the overlap threshold at 41E look for the horizontal resistance of November 2019 at 54.4E and 60E in extension.

Source: GAIN Capital, TradingView

#FRANCE#

Bureau Veritas, an inspection and certification company, was upgraded to "buy" from "hold" at HSBC.

#SPAIN#

Ferrovial, an infrastructure group, announced that it has agreed to sell its 49% stake in Portugal's Norte Litoral highway and its 48% stake in the Via do Infante highway to a fund managed by DIF Capital Partners a total consideration of 171 million euros.

#ITALY#

Leonardo, an aerospace and defence, was upgraded to "buy" from "hold" at Societe Generale.

#SWITZERLAND#

SGS, a testing and certification services provider, was upgraded to "hold" from "reduce" at HSBC.

#SWEDEN#

Hennes & Mauritz, a clothing-retail company, announced that 3Q net sales declined 19% on year (-16% in local currencies) to 50.87 billion Swedish krona. The company said the group's recovery is "better than expected" and "preliminary results show profit before tax of approximately SEK 2 billion".