US Futures: tentative rebound, Watch JPM, FAST, NFLX

The S&P 500 Futures try to recover as they turned sharply lower in the final trading hour yesterday. Investors were discouraged by California's action to roll back its reopening plans due to an uptick in coronavirus cases.

Later today, the U.S. Labor Department will release June CPI (+0.6% on year expected).

European indices are on the downside. The U.K. Office for National Statistics has reported May GDP at +1.8% (vs +5.0% on month expected), industrial production at +6.0% on month (as expected), manufacturing production at +8.4% (vs +8.0% on month expected) and trade balance at 4.3 billion pounds (vs 800 million pounds deficit expected). ZEW survey results of July were released for Germany at -80.9 for current situation vs -65.0 expected, investment confidence was published at 59.3 vs 60 expected. The German Federal Statistical Office has posted final readings of June CPI at +0.6% (vs +0.9% on year expected). The European Commission has reported May industrial production at +12.4% (vs +15.0% on month expected).

Asian indices all ended in the red. This morning, official data showed that China's June exports grew 4.3% on year in yuan terms (+3.5% expected) and imports rose 6.2% (-4.7% expected).

WTI Crude Oil futures remain on the downside after reports that major oil-producing countries may ease output curbs in view of improving demand.

Gold declined 2.58 dollars (-0.14%) to 1800.18 dollars.

U.K GDP disappointed at +1.8% on month in May, vs +5.5% expected. U.K. is on track for largest decline in annual GDP for 300 years.

GBP/USD fell 35pips to 1.252 the day's range was 1.2507 - 1.2563 compared to 1.2551 - 1.2666 the previous session.

U.S. Equity Snapshot

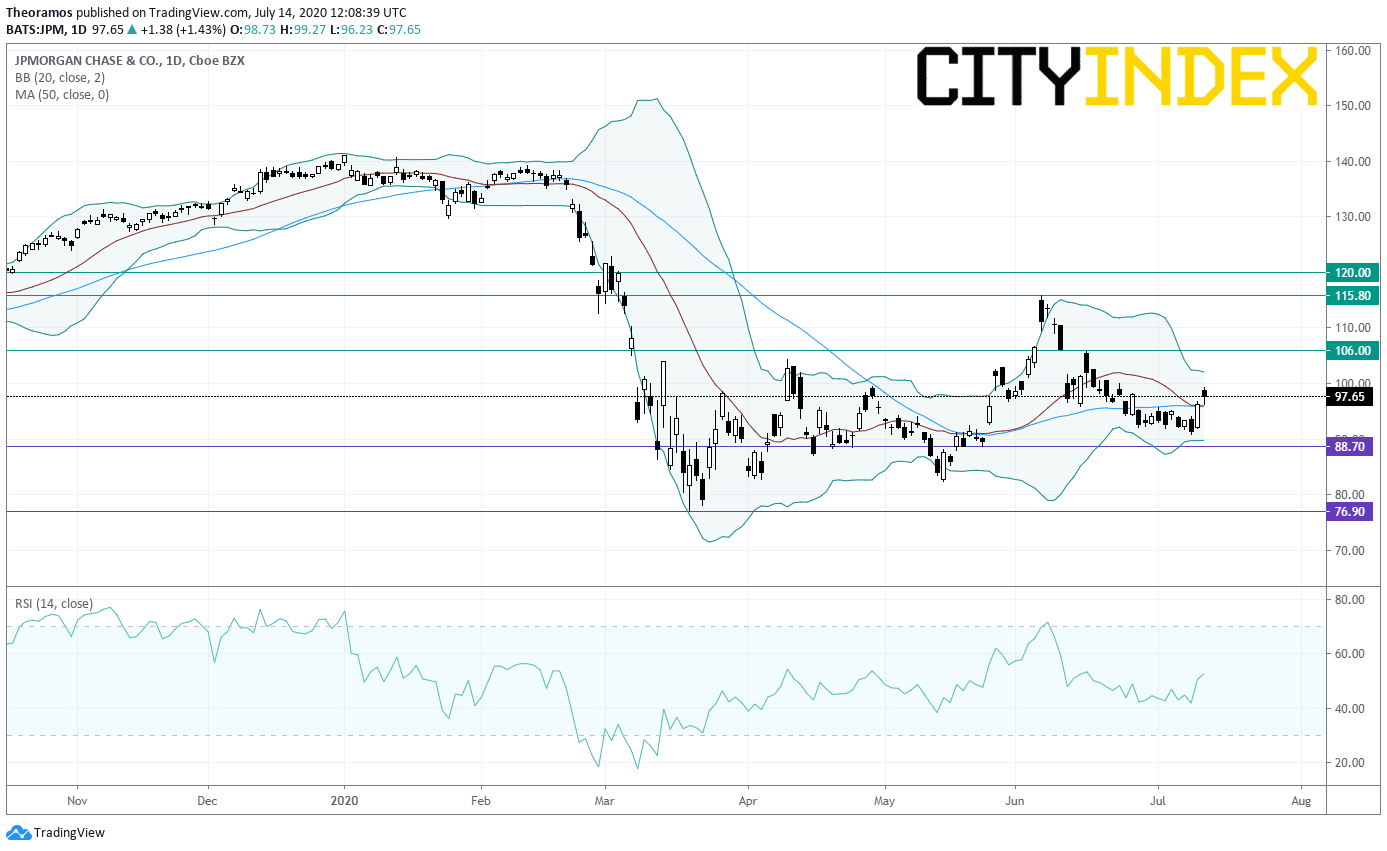

JPMorgan (JPM), the largest financial services and retail bank in the U.S, reported second quarter adjusted revenue up 14% from a year earlier to 33.82 billion dollars, above estimates. EPS for the second quarter is down to 1.38 dollar from 2.82 dollars a year earlier.

Later today, the U.S. Labor Department will release June CPI (+0.6% on year expected).

European indices are on the downside. The U.K. Office for National Statistics has reported May GDP at +1.8% (vs +5.0% on month expected), industrial production at +6.0% on month (as expected), manufacturing production at +8.4% (vs +8.0% on month expected) and trade balance at 4.3 billion pounds (vs 800 million pounds deficit expected). ZEW survey results of July were released for Germany at -80.9 for current situation vs -65.0 expected, investment confidence was published at 59.3 vs 60 expected. The German Federal Statistical Office has posted final readings of June CPI at +0.6% (vs +0.9% on year expected). The European Commission has reported May industrial production at +12.4% (vs +15.0% on month expected).

Asian indices all ended in the red. This morning, official data showed that China's June exports grew 4.3% on year in yuan terms (+3.5% expected) and imports rose 6.2% (-4.7% expected).

WTI Crude Oil futures remain on the downside after reports that major oil-producing countries may ease output curbs in view of improving demand.

Gold declined 2.58 dollars (-0.14%) to 1800.18 dollars.

U.K GDP disappointed at +1.8% on month in May, vs +5.5% expected. U.K. is on track for largest decline in annual GDP for 300 years.

GBP/USD fell 35pips to 1.252 the day's range was 1.2507 - 1.2563 compared to 1.2551 - 1.2666 the previous session.

U.S. Equity Snapshot

JPMorgan (JPM), the largest financial services and retail bank in the U.S, reported second quarter adjusted revenue up 14% from a year earlier to 33.82 billion dollars, above estimates. EPS for the second quarter is down to 1.38 dollar from 2.82 dollars a year earlier.

Source: TradingView, Gain Capital

Fastenal (FAST), a construction supplies distributor, disclosed second quarter net sales up 10% from a year earlier to 1.51 billion dollars, above estimates. EPS for the second quarter is up to 0.42 dollar from 0.36 dollar a year earlier.

Netflix (NFLX), the video streaming service, was downgraded from Buy to Neutral at UBS.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM