US Futures slightly up before Powell speech, watch LVS, PNC, BLK, KKR, UBER, RCL

Later today, April Producer Price Index (-0.5% on month expected) will be reported. All eyes will be on Federal Reserve Chairman Jerome Powell’s speech on economic issues.

European indices are on the downside. The European Commission has posted March industrial production at 11.3% (vs -12.5% on month expected). The U.K. Office for National Statistics has reported 1Q GDP at -2% (vs -2.6% on quarter expected), March industrial production at -4.2% (vs -5.6% on month expected), manufacturing production -4.6% (vs -6.0% on month expected) and trade balance at 6.7 billion pounds deficit (vs 2.5 billion pounds deficit expected).

Asian indices closed slightly in the red. The Reserve Bank of New Zealand said it has decided to expand the Large Scale Asset Purchase program potential to 60 billion New Zealand dollars from a previous limit of 33 billion New Zealand dollars, while keeping its benchmark rate unchanged at 0.25%. The central bank added: "The Monetary Policy Committee is prepared to use additional monetary policy tools if and when needed."

WTI Crude Oil Futures are under pressure. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 7.6 million barrels for week ended May 8. The U.S. Energy Information Administration (EIA) lowered its 2020 domestic oil production forecast to an average 11.7 million barrels per day, down 500,000 barrels a day from 2019. Later today, EIA will release crude oil inventories data for last week.

Gold stays firm while the US dollar is consolidating before Jerome Powell speech.

Gold slightly increased 3.4 dollars (+0.2%) to 1706.1 dollars. EUR/USD rose 16pips to 1.0864 while GBP/USD gained 37pips to 1.2297.

US Equity Snapshot

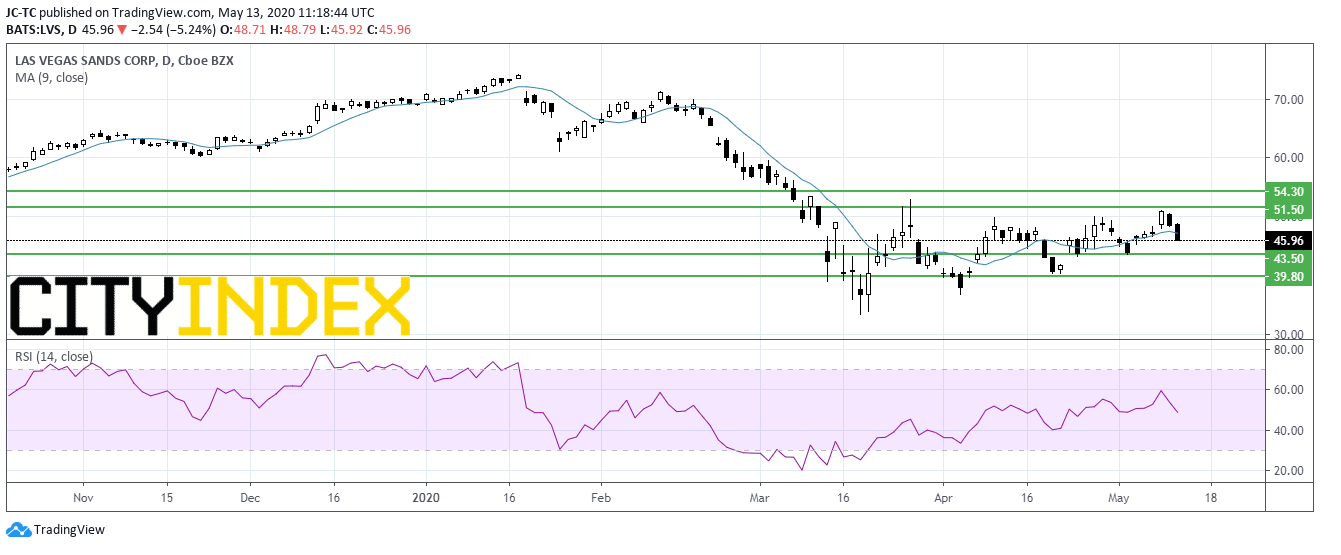

Las Vegas Sands (LVS), the global operator of casino resorts, announced the company will discontinue its pursuit of Integrated Resort (IR) development in Japan. Chairman and CEO Sheldon G. Adelson said he "remains bullish on company's growth prospects".

PNC Financial Services Group (PNC), the bank holding company, may sell its stake in asset management firm BlackRock (BLK) at $420 dollars per share to raise 14 billion dollars, reported Bloomberg.

KKR (KKR): Commonwealth Bank of Australia (CBA) has entered into an agreement to sell a 55% interest in Australian wealth management company Colonial First State (CFS) to the investment firm for 1.7 billion dollars.

Uber Technologies (UBER), the technology platform, "proposes to offer 750 million dollars principal amount of Senior Notes due 2025. Uber intends to use the net proceeds from this offering primarily for working capital and other general corporate purposes, which may include potential acquisitions and strategic transactions."

Royal Caribbean Cruises (RCL), a global cruise vacation company, "has commenced a private offering of senior secured notes to be issued by the company in separate series of notes due 2023 and 2025, for an aggregate principal amount of 3.3 billion dollars."