EU indices slightly down | TA focus on Kingspan

EUROPE ADVANCE/DECLINE

68% of STOXX 600 constituents traded higher yesterday.

79% of the shares trade above their 20D MA vs 73% Friday (above the 20D moving average).

64% of the shares trade above their 200D MA vs 63% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.02pt to 22.25, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Industrial

3mths relative low: none

Europe Best 3 sectors

utilities, technology, automobiles & parts

Europe worst 3 sectors

travel & leisure, energy, banks

INTEREST RATE

The 10yr Bund yield was unchanged to -0.53% (below its 20D MA). The 2yr-10yr yield spread rose 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Sep Inflation Rate MoM final, exp.: -0.1%

GE 07:00: Sep Harmonised Inflation Rate YoY final, exp.: -0.1%

GE 07:00: Sep Harmonised Inflation Rate MoM final, exp.: -0.2%

GE 07:00: Sep Inflation Rate YoY final, exp.: 0%

UK 07:00: Aug Average Earnings excl. Bonus, exp.: 0.2%

UK 07:00: Aug Average Earnings incl. Bonus, exp.: -1%

UK 07:00: Aug Unemployment Rate, exp.: 4.1%

UK 07:00: Sep Claimant Count chg, exp.: 73.7K

UK 07:00: Jul Employment chg, exp.: -12K

UK 07:00: Q2 Labour Productivity QoQ final, exp.: -1.3%

EC 10:00: Oct ZEW Economic Sentiment Idx, exp.: 73.9

GE 10:00: Bundesbank Wuermeling speech

GE 10:00: Bundesbank Buch speech

GE 10:00: Oct ZEW Current Conditions, exp.: -66.2

GE 10:00: Oct ZEW Economic Sentiment Idx, exp.: 77.4

GE 13:00: Bundesbank Wuermeling speech

MORNING TRADING

In Asian trading hours, EUR/USD dropped to 1.1794 and GBP/USD eased to 1.3041. USD/JPY slid to 105.37.

Spot gold extended its decline to $1,913 an ounce.

#UK - IRELAND#

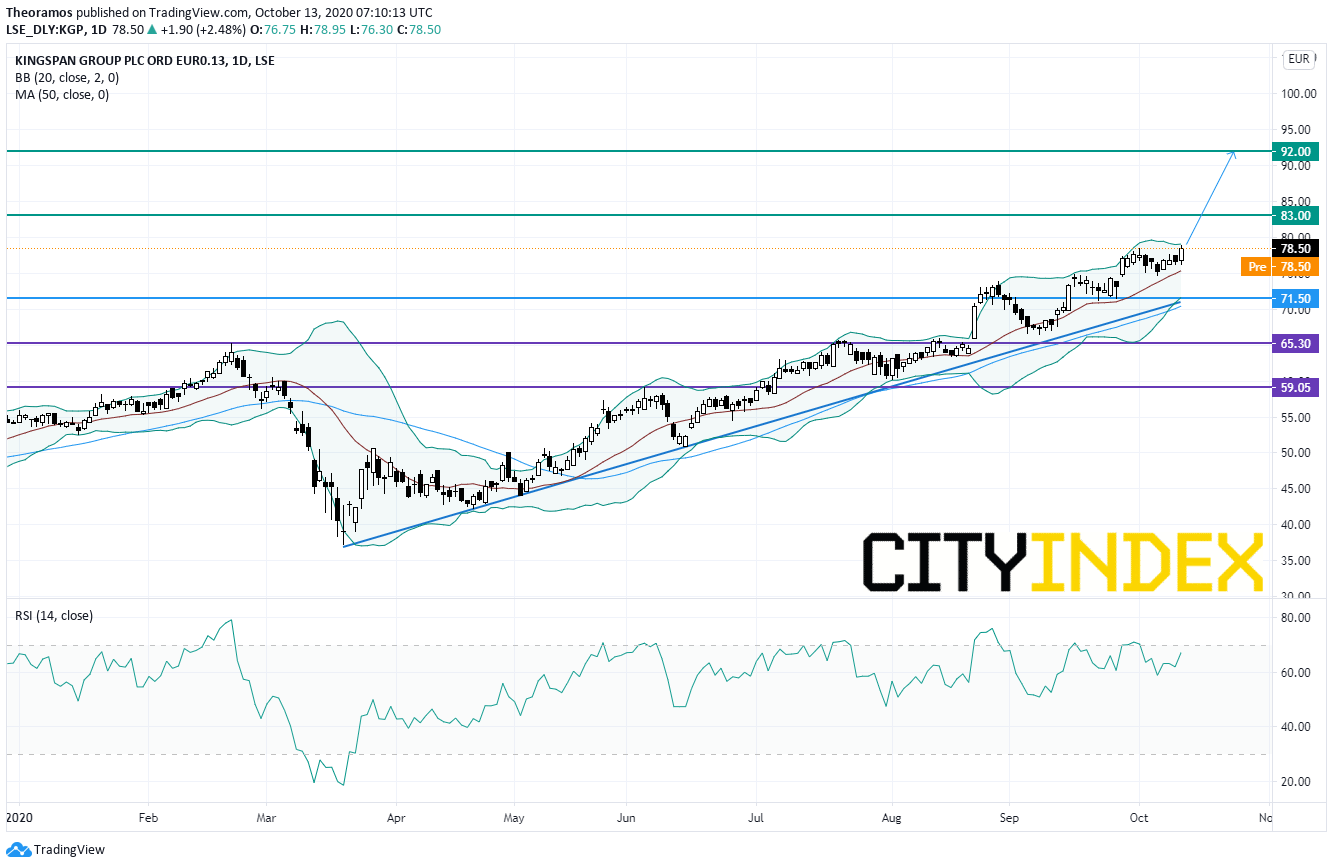

Kingspan, a building materials company, was upgraded to "buy" from "hold" at Societe Generale.

From a daily point of view, the stock remains on the upside, supported by a rising trend line drawn since March. Above the horizontal support at 71.5p, look for 83p and 92p in extension.

Source: GAIN Capital, TradingView

#GERMANY#

Evotec, a drug discovery and development company, said Mubadala Investment Company and Novo Holdings will subscribe a total of 11,478,315 new shares of the company for 250 million euros (21.7802 euros per share).

#FRANCE#

Sanofi, a pharmaceutical group, reported that a phase 3 trial of its Dupixent met the primary and all key secondary endpoints in children aged 6 to 11 years with uncontrolled moderate-to-severe asthma.

BNP Paribas', a banking group, "A+" credit rating outlook was revised to "Negative" from "Watch Negative" by Fitch. The rating agency said: "The Negative Outlook on BNPP's Long-Term IDR reflects downside risks to our baseline scenario, as pressure on the ratings would increase substantially if the downturn is deeper or more prolonged than we currently expect."

Vinci, a concessions and construction company, is expected to report 3Q traffic figures for its airports.

#BENELUX#

Unibail-Rodamco-Westfield, a commercial real estate company, announced that it has agreed to sell the SHiFT office building in Paris to a consortium of French institutional investors for 620 million euros.

#SWITZERLAND#

Adecco, a recruitment services provider, was upgraded to "overweight" from "neutral" at JPMorgan.

#DENMARK#

Rockwool International, a Danish manufacturer of mineral wool products, was upgraded to "hold" from "sell" at Societe Generale.