US Futures consolidating, watch PNC, BLK, TSLA, DUK, IFF

Later today, April U.S. Consumer Price Index (-0.8% on month expected), government monthly budget balance (deficit of 737.0 billion dollars expected), and the National Federation of Independent Business's Small Business Optimism Index (84.0 expected) will be reported.

European indices are facing a consolidation. On the economic front, the Banque de France's industrial business climate index came out at 48 in April, compared with 52 in March (revised from 51) and 40 anticipated by economists. The institution indicated that economic activity in France fell by 27% in April, a slight improvement on the decline observed in March.

Asian indices closed on the downside. China's CPI grew 3.3% on year in April (+3.7% expected, +4.3% in March), while PPI was down 3.1% (-2.5% expected, -1.5% in March), according to the government. Also, China's government will impose a partial ban on meat imported from Australia.

WTI Crude Oil Futures are on the upside. Saudi Arabia says it will pump 7.492M b/d crude oil in June, reaching the lowest level in 18 years. Later today, API would release the change of U.S. oil stockpile data for May 8.

Gold rose 5.9 dollars (+0.35%) to 1703.83 dollars, firm above 1700 dollars, as investors fear a second wave of COVID-19 infections.

The US dollar is slightly consolidating after hitting a two-week peak. EUR/USD rose 36pips to 1.0843 while GBP/USD gained 23pips to 1.2358.

US Equity Snapshot

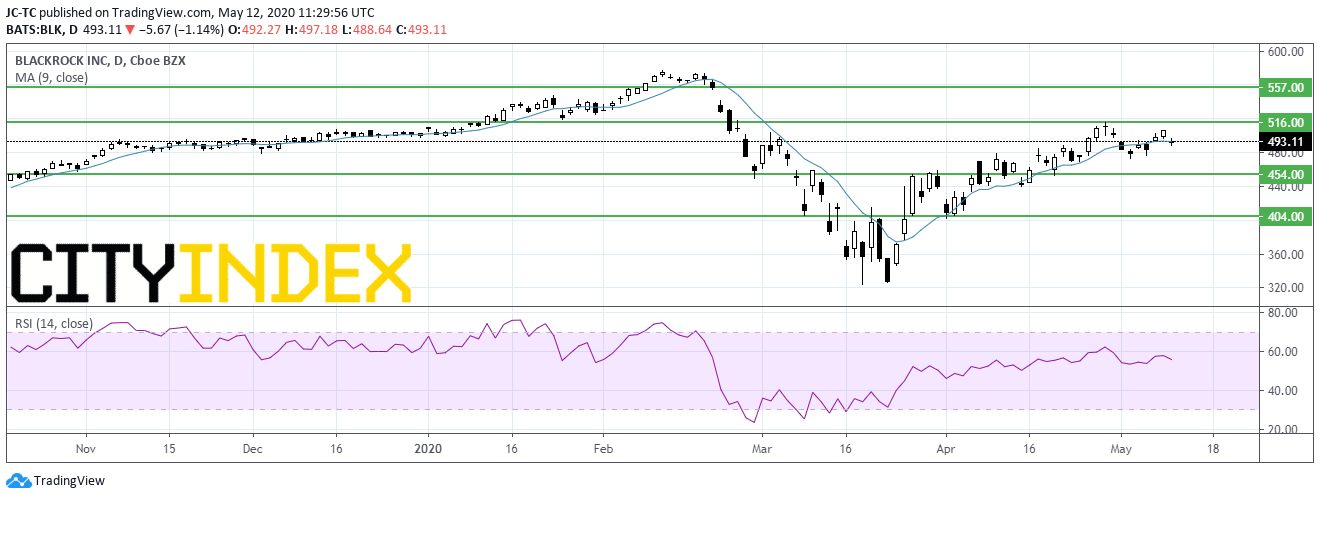

PNC Financial Services Group (PNC) announced its intent to sell its investment in BlackRock (BLK) through a registered offering and related buyback by BlackRock. PNC currently holds 34.8 million common and Series B preferred shares of BlackRock, representing 22.4% ownership. Blackrock intends to repurchase 1.1 billion dollars of common stock directly from PNC.

Tesla (TSLA) CEO Elon Musk announced a resumption of production at its California plant, which is in defiance of local authorities. He said: "If anyone is arrested, I ask that it only be me."

Duke Energy (DUK), the energy company, reported first quarter adjusted EPS down to 1.14 dollar from 1.24 dollar a year earlier, on operating sales down to 3.5% to 5.95 billion dollars. The company maintained its full-year adjusted EPS forecast.

International Flavors & Fragrances (IFF), a maker of food flavors & fragrances, jumped after hours after disclosing first quarter EPS up to 1.62 dollar from 1.57 dollar a year ago on sales up to 1.4 billion dollars from 1.3 billion dollars a year earlier. Those figures beat estimates.

Source : TradingVIEW, Gain Capital