U.S Futures on the upside - Watch AAPL, TWTR, PEP

The S&P 500 Futures remain on the upside after they posted further gains on Friday. U.S President Donald Trump said in an interview that he wants to see a larger stimulus package than the one offered by either Democrats or Republicans.

No major economic data are expected in North America today.

European indices are on the upside. In Germany, September Wholesale Prices were released at +0.0%, vs -0.4% on month in August.

Asian indices closed in the green except the Japanese Nikkei. Japan's core machine orders grew 0.2% on month in August (-0.4% expected) and PPI fell 0.8% on year in September (-0.5% expected).

WTI Crude Oil futures are under pressure. The total number of rotary rigs in the U.S. rose to 269 as of October 9 from 266 in the prior week, and rigs in Canada increased to 80 from 75, according to Baker Hughes.

The dollar index rose 0.15pt to 93.204.

U.S. Equity Snapshot

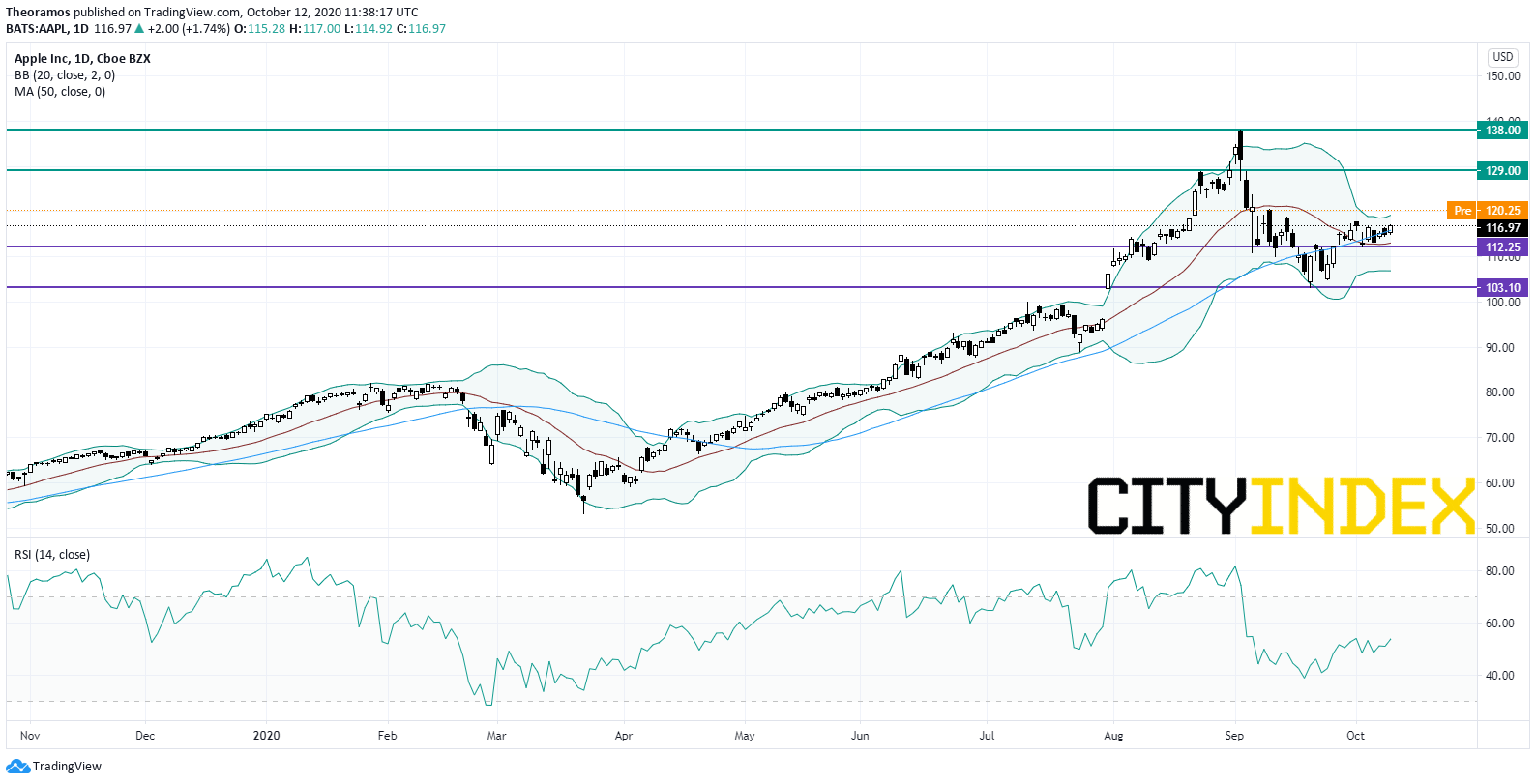

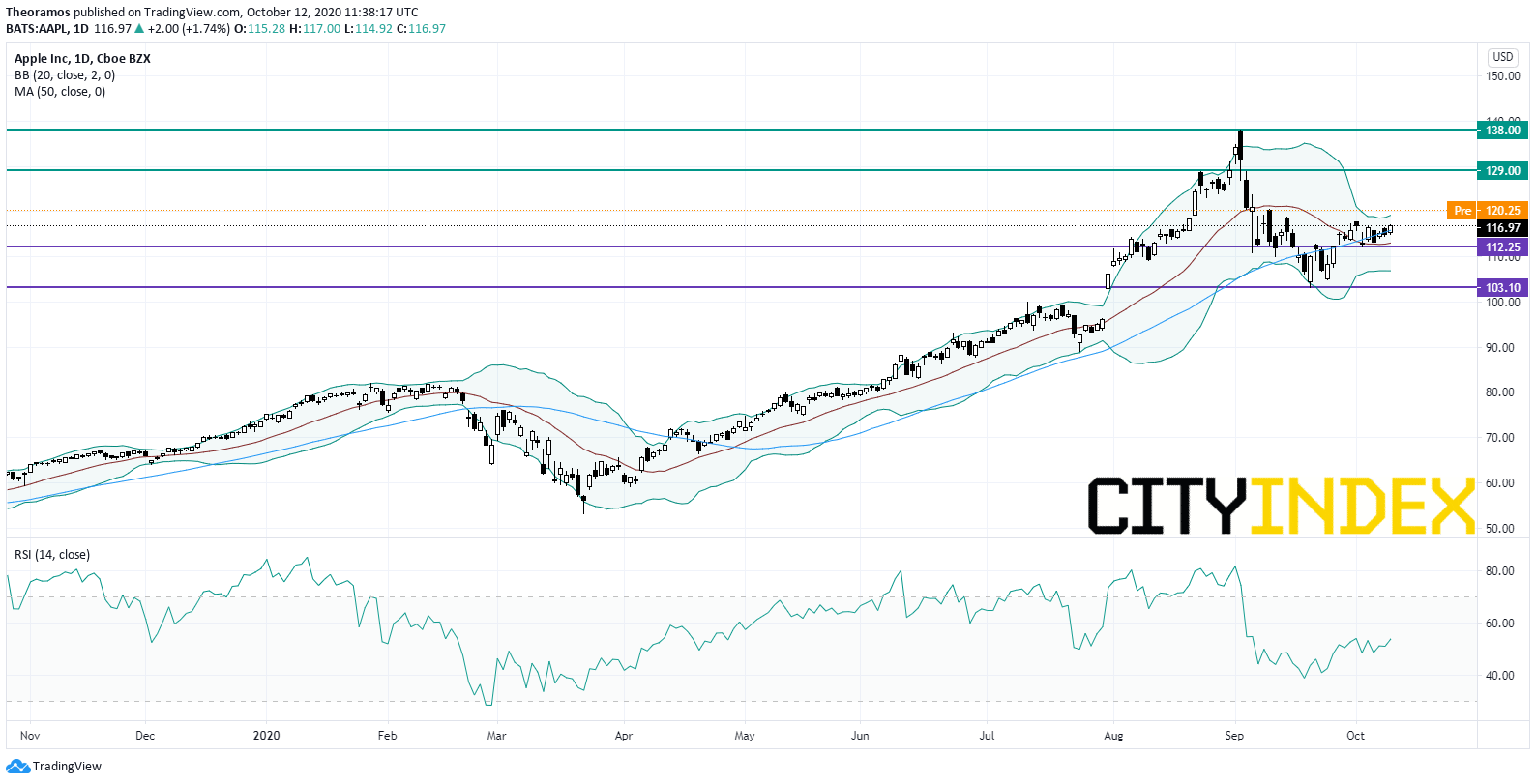

Apple (AAPL)'s price target was raised to 132 dollars from 111 dollars at RBC Capital.

Source: TradingView, GAIN Capital

Twitter (TWTR), the social network, was upgraded to "buy" from "hold" at Deutsche Bank.

Pepsico (PEP), the international beverage and food company, was upgraded to "buy" from "neutral" at Citi.

United Airlines (UAL) was downgraded to "equal-weight" from "overweight" at Barclays.

No major economic data are expected in North America today.

European indices are on the upside. In Germany, September Wholesale Prices were released at +0.0%, vs -0.4% on month in August.

Asian indices closed in the green except the Japanese Nikkei. Japan's core machine orders grew 0.2% on month in August (-0.4% expected) and PPI fell 0.8% on year in September (-0.5% expected).

WTI Crude Oil futures are under pressure. The total number of rotary rigs in the U.S. rose to 269 as of October 9 from 266 in the prior week, and rigs in Canada increased to 80 from 75, according to Baker Hughes.

Gold and U.S dollar are consolidating, amid bets on U.S fiscal stimulus.

Gold fell 8.64 dollars (-0.45%) to 1921.76 dollars.The dollar index rose 0.15pt to 93.204.

U.S. Equity Snapshot

Apple (AAPL)'s price target was raised to 132 dollars from 111 dollars at RBC Capital.

Source: TradingView, GAIN Capital

Twitter (TWTR), the social network, was upgraded to "buy" from "hold" at Deutsche Bank.

Pepsico (PEP), the international beverage and food company, was upgraded to "buy" from "neutral" at Citi.

United Airlines (UAL) was downgraded to "equal-weight" from "overweight" at Barclays.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM