EU indices mixed | TA focus on Aveva

INDICES

Friday, European stocks - except for the Ibex 35 - remained buyed. The Stoxx Europe 600 Index rose 0.55%, France's CAC 40 rose 0.71% and the U.K.'s FTSE 100 added 0.65%, while Germany's DAX 30 was little changed.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded higher Friday.

73% of the shares trade above their 20D MA vs 68% Thursday (above the 20D moving average).

63% of the shares trade above their 200D MA vs 61% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.74pt to 22.24, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Travel & Leisure, Industrial

3mths relative low: none

Europe Best 3 sectors

travel & leisure, technology, basic resources

Europe worst 3 sectors

automobiles & parts, banks, construction & materials

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.52% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -19bps (above its 20D MA).

ECONOMIC DATA

FR 14:00: 12-Mth BTF auction, exp.: -0.61%

FR 14:00: 3-Mth BTF auction, exp.: -0.64%

FR 14:00: 6-Mth BTF auction, exp.: -0.61%

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1817 and GBP/USD retreated to 1.3027. USD/JPY slipped further to 105.56. This morning, official data showed that Japan's core machine orders grew 0.2% on month in August (-0.4% expected) and PPI fell 0.8% on year in September (-0.5% expected).

Spot gold fell to $1,926 an ounce.

#UK - IRELAND#

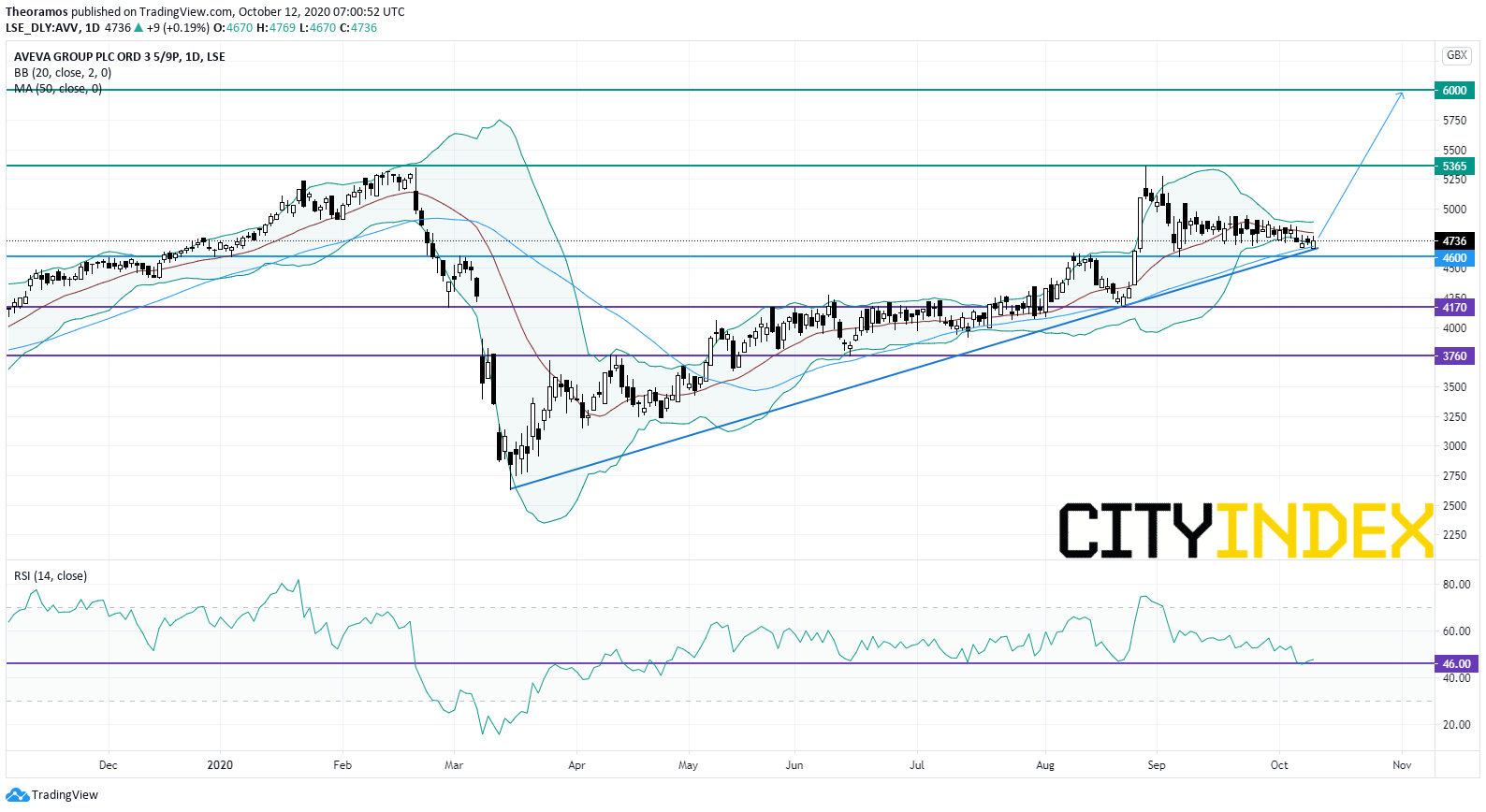

Aveva, an IT company, posted a 1H trading update: "The Group expects to report revenue of approximately £333 million for the first half of FY 2021. This is broadly in-line with the Group's plan for the shape of the year, (...) Adjusting for the previously disclosed early renewal of a significant Global Account contract, which caused a £20 million pull forward of revenue into September 2019, the organic constant currency revenue decline was 7%. Without this adjustment, the decline was 12%. (...) the Board expects to see solid revenue growth in the second half and remains confident in the full year outlook."

Source: GAIN Capital, TradingView

Spectris, a supplier of precision instrumentation and controls, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

#GERMANY#

Daimler, an automobile group, was upgraded to "buy" from "sell" at Goldman Sachs.

#FRANCE#

Veolia, a resource management group, said it is appealing the decision by a court in Paris, which ordered the suspension of the operation of the company's purchase of a stake in Suez from Engie , until it has informed and consulted workers' groups.

Eiffage, a civil engineering construction group, was upgraded to "buy" from "hold" at Societe Generale.

#BENELUX#

KPN, a Dutch landline and mobile telecommunications company, may be offered a takeover deal from European private equity firm EQT, reported Bloomberg citing people familiar with the matter.

Altice Europe, a telecommunications group, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

#SWEDEN#

EQT, a private equity firm, is considering acquiring Dutch landline and mobile telecommunications company KPN, which has a market value of about 9.4 billion euros, reported Bloomberg citing people familiar with the matter.

Friday, European stocks - except for the Ibex 35 - remained buyed. The Stoxx Europe 600 Index rose 0.55%, France's CAC 40 rose 0.71% and the U.K.'s FTSE 100 added 0.65%, while Germany's DAX 30 was little changed.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded higher Friday.

73% of the shares trade above their 20D MA vs 68% Thursday (above the 20D moving average).

63% of the shares trade above their 200D MA vs 61% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.74pt to 22.24, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Travel & Leisure, Industrial

3mths relative low: none

Europe Best 3 sectors

travel & leisure, technology, basic resources

Europe worst 3 sectors

automobiles & parts, banks, construction & materials

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.52% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -19bps (above its 20D MA).

ECONOMIC DATA

FR 14:00: 12-Mth BTF auction, exp.: -0.61%

FR 14:00: 3-Mth BTF auction, exp.: -0.64%

FR 14:00: 6-Mth BTF auction, exp.: -0.61%

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1817 and GBP/USD retreated to 1.3027. USD/JPY slipped further to 105.56. This morning, official data showed that Japan's core machine orders grew 0.2% on month in August (-0.4% expected) and PPI fell 0.8% on year in September (-0.5% expected).

Spot gold fell to $1,926 an ounce.

#UK - IRELAND#

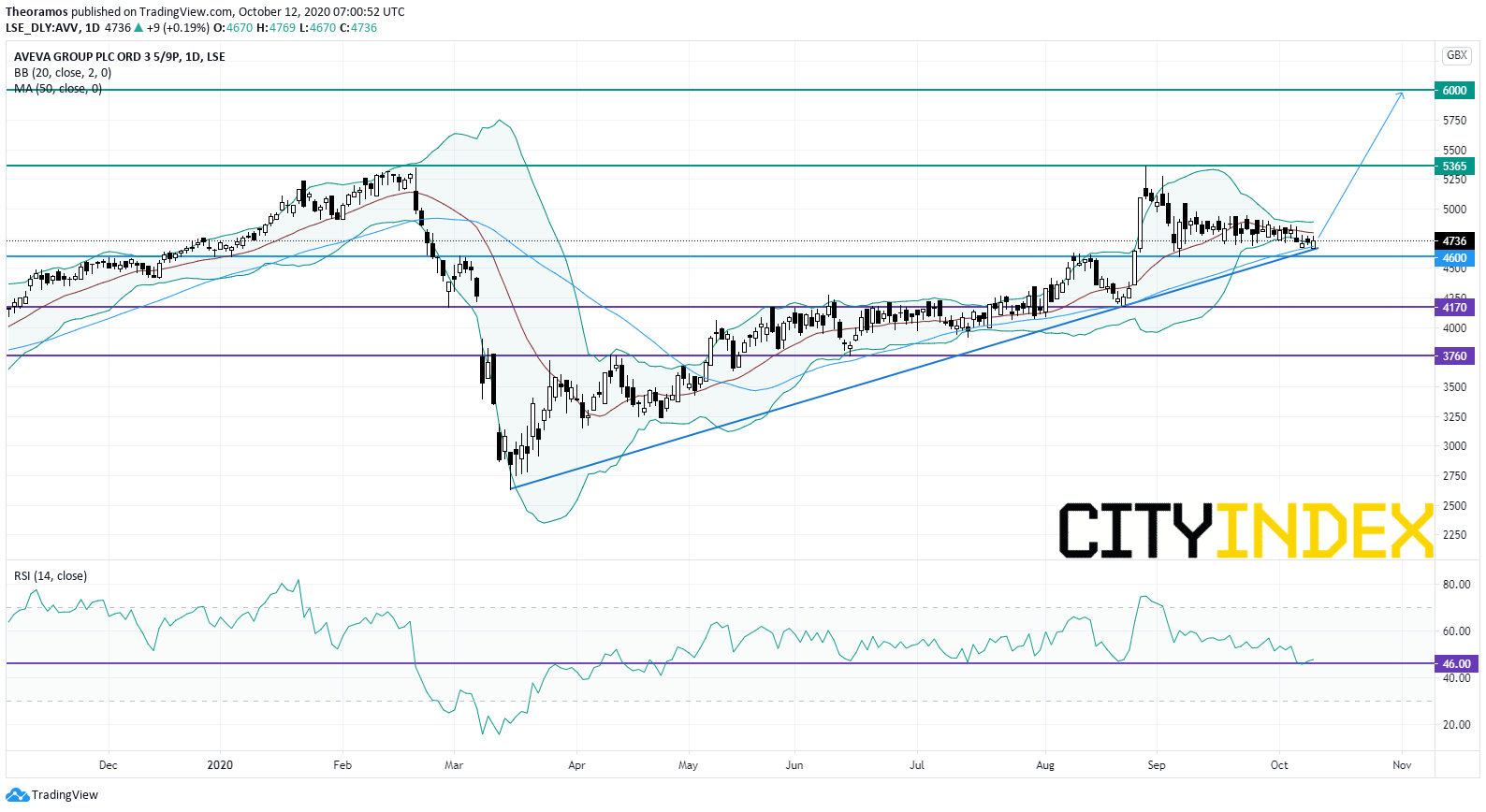

Aveva, an IT company, posted a 1H trading update: "The Group expects to report revenue of approximately £333 million for the first half of FY 2021. This is broadly in-line with the Group's plan for the shape of the year, (...) Adjusting for the previously disclosed early renewal of a significant Global Account contract, which caused a £20 million pull forward of revenue into September 2019, the organic constant currency revenue decline was 7%. Without this adjustment, the decline was 12%. (...) the Board expects to see solid revenue growth in the second half and remains confident in the full year outlook."

From a daily point of view, the stock is excepting to bounce back on a potential rising trend line. Moreover, prices are supported by a key support on the RSI at 46%, while the 50 DMA plays a support role. Above 4600p, targets are set at the previous all-time high at 5365p and 6000p in extension.

Source: GAIN Capital, TradingView

#GERMANY#

Daimler, an automobile group, was upgraded to "buy" from "sell" at Goldman Sachs.

#FRANCE#

Veolia, a resource management group, said it is appealing the decision by a court in Paris, which ordered the suspension of the operation of the company's purchase of a stake in Suez from Engie , until it has informed and consulted workers' groups.

Eiffage, a civil engineering construction group, was upgraded to "buy" from "hold" at Societe Generale.

#BENELUX#

KPN, a Dutch landline and mobile telecommunications company, may be offered a takeover deal from European private equity firm EQT, reported Bloomberg citing people familiar with the matter.

Altice Europe, a telecommunications group, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

#SWEDEN#

EQT, a private equity firm, is considering acquiring Dutch landline and mobile telecommunications company KPN, which has a market value of about 9.4 billion euros, reported Bloomberg citing people familiar with the matter.

Latest market news

Today 01:15 PM

Today 07:49 AM

Today 04:24 AM