EU indices slightly up | TA focus on Alcon

INDICES

Yesterday, European stocks remained very firm. The Stoxx Europe 600 rose 0.90%, Germany's DAX climbed 0.51%, France's CAC 40 jumped 1.55%, and the U.K.'s FTSE 100 gained 1.79%.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded higher yesterday.

78% of the shares trade above their 20D MA vs 81% Monday (above the 20D moving average).

79% of the shares trade above their 200D MA vs 76% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.22pt to 25.08, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Insurance, Autos, Banks, Construction

3mths relative low: Technology, Healthcare

Europe Best 3 sectors

banks, energy, insurance

Europe worst 3 sectors

technology, travel & leisure, health care

INTEREST RATE

The 10yr Bund yield rose 11bps to -0.51% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -23bps (below its 20D MA).

ECONOMIC DATA

FR : Armistice Day

GE 11:40: 30-Year Bund auction, exp.: -0.16%

EC 14:00: ECB President Lagarde speech

EC 14:30: ECB Guindos speech

EC 15:45: ECB Guindos speech

EC 17:00: ECB Lane speech

MORNING TRADING

In Asian trading hours, EUR/USD climbed to 1.1830 while GBP/USD held gains at 1.3272. USD/JPY eased to 105.12. NZD/USD advanced to 0.6895. This morning, the Reserve Bank of New Zealand kept its benchmark rate unchanged at 0.25% as expected. RBNZ said additional stimulus would be provided through a Funding for Lending Programme (FLP), commencing in December, and "monetary policy will need to remain stimulatory for a long time".

Spot gold rose to $1,880 an ounce.

#UK - IRELAND#

BAE Systems, an aerospace company, released a trading statement: "The Group's full year guidance for 2020 sales and cashflow remains unchanged from the 2020 interim results. Underlying earnings per share are now expected to be slightly higher than previously guided with good operational performance and an expected lower tax rate offsetting the negative foreign exchange impact."

Flutter Entertainment, a sports-betting and gaming company, reported that 3Q revenue rose 27% on year (+30% at constant currency) to 1.325 billion pounds. The company has raised its full-year EBITDA (ex-US) guidance to 1.275 - 1.350 billion pounds from 1.175 - 1.325 billion pounds previously.

IAG, an airline group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

Continental, an automotive parts manufacturer, said it now expects full-year revenue of about 37.5 billion euros. The company is expected to report 3Q results later today.

#BENELUX#

ABN Amro, a Dutch bank, announced that 3Q net profit dropped 46% on year to 301 million euros, as impairment charges jumped 141% to 270 million euros, but down from 703 million euros in 2Q. Operating income increased 5% on year to 2.21 billion euros.

#ITALY#

Telecom Italia, a telecommunications company, reported that 3Q net income jumped 66.1% on year to 500 million euros while EBITDA dropped 18.4% to 1.72 billion euros on revenue of 3.90 billion euros, down 12.0% (-5.0% organic growth).

#SWITZERLAND#

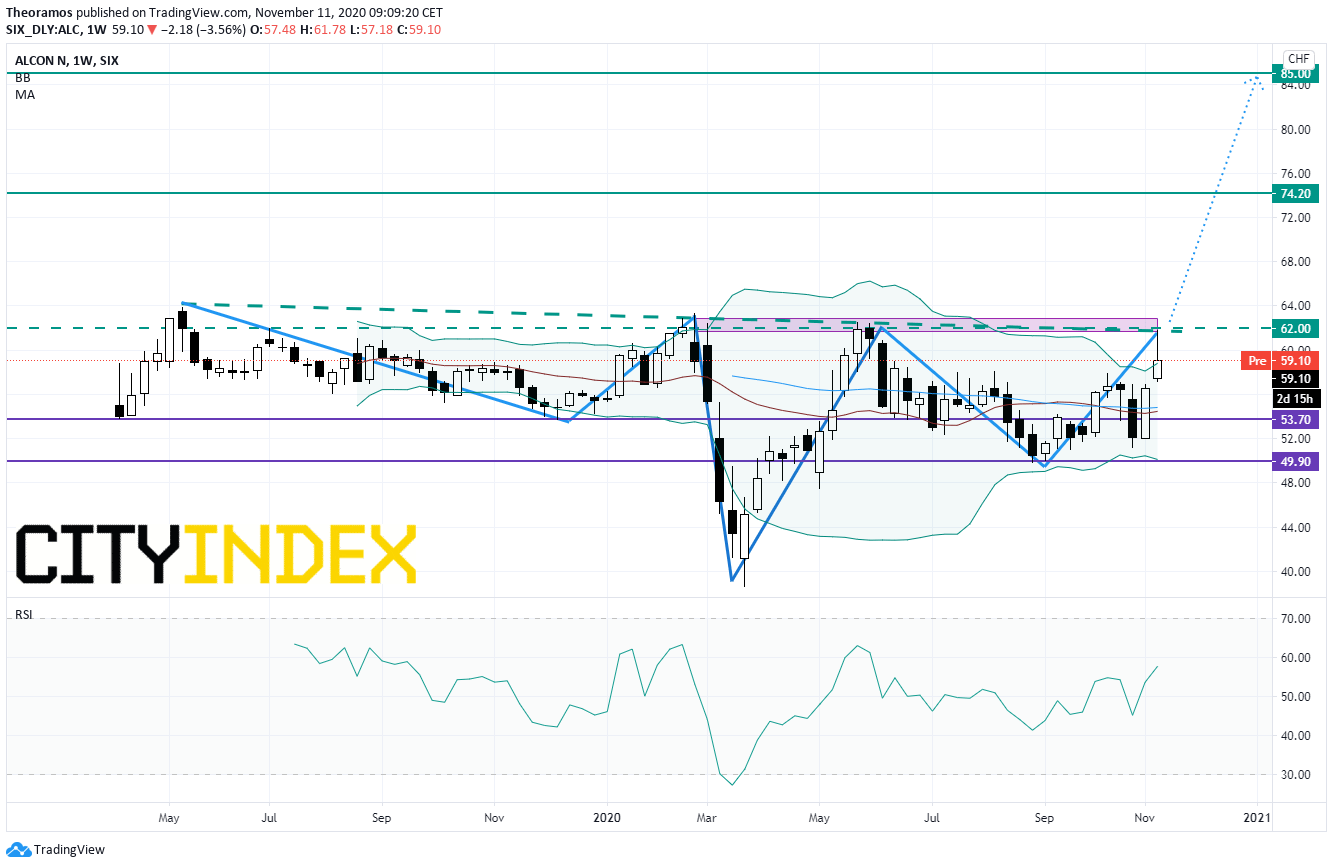

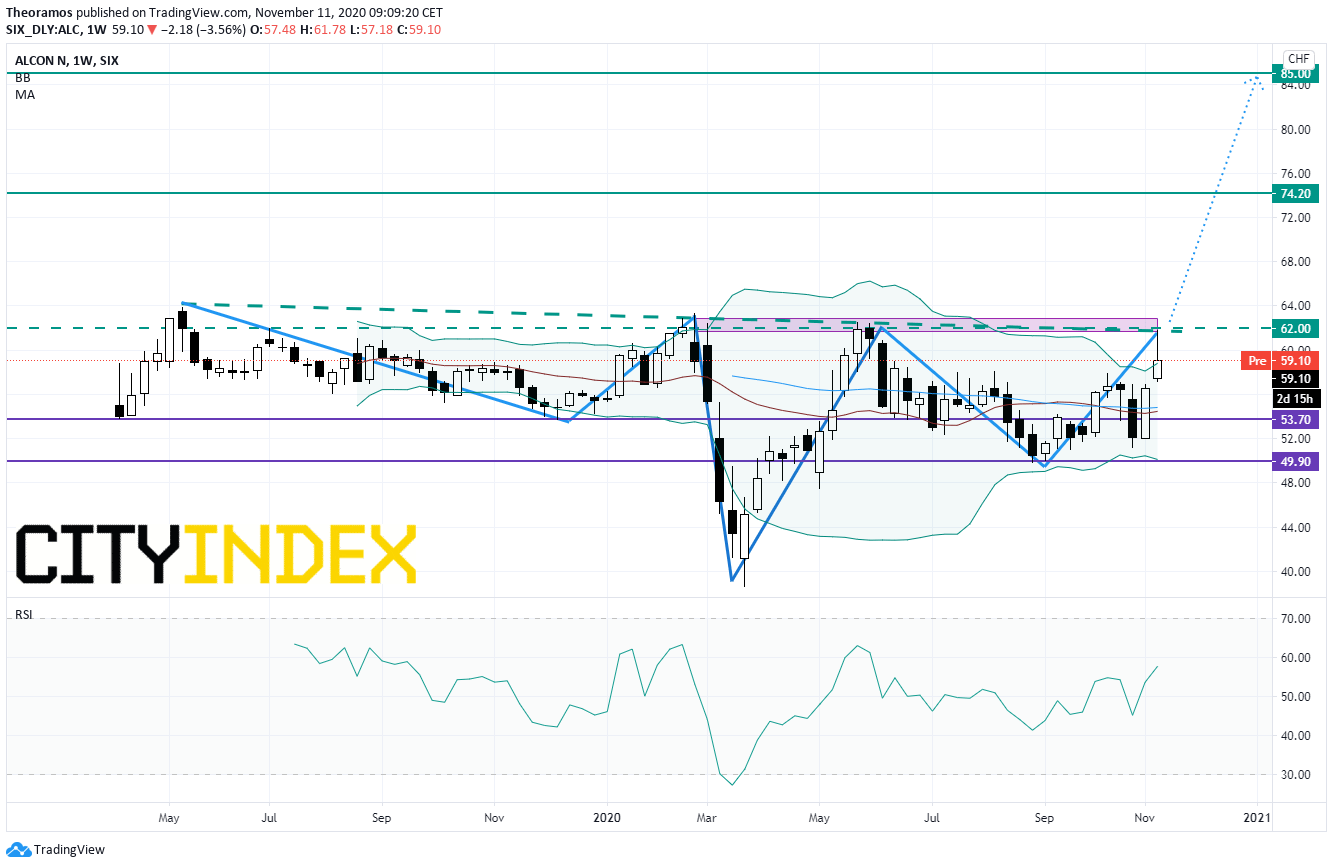

Alcon, a medical company, announced that 3Q core EPS slid 15.2% on year to 0.39 dollar on net sales of 1.82 billion dollars, down 1.2%.

From a technical point of view, an hypothetical inverse head and shoulders pattern is in formation since May 2019. A break above the pattern's neckline at 62CHF would validate the H&S and call for a new up leg towards 69CHF and 74.2CHF in extension.

EX-DIVIDEND

Hennes & Mauritz: SEK4.85

Yesterday, European stocks remained very firm. The Stoxx Europe 600 rose 0.90%, Germany's DAX climbed 0.51%, France's CAC 40 jumped 1.55%, and the U.K.'s FTSE 100 gained 1.79%.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded higher yesterday.

78% of the shares trade above their 20D MA vs 81% Monday (above the 20D moving average).

79% of the shares trade above their 200D MA vs 76% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.22pt to 25.08, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Insurance, Autos, Banks, Construction

3mths relative low: Technology, Healthcare

Europe Best 3 sectors

banks, energy, insurance

Europe worst 3 sectors

technology, travel & leisure, health care

INTEREST RATE

The 10yr Bund yield rose 11bps to -0.51% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -23bps (below its 20D MA).

ECONOMIC DATA

FR : Armistice Day

GE 11:40: 30-Year Bund auction, exp.: -0.16%

EC 14:00: ECB President Lagarde speech

EC 14:30: ECB Guindos speech

EC 15:45: ECB Guindos speech

EC 17:00: ECB Lane speech

MORNING TRADING

In Asian trading hours, EUR/USD climbed to 1.1830 while GBP/USD held gains at 1.3272. USD/JPY eased to 105.12. NZD/USD advanced to 0.6895. This morning, the Reserve Bank of New Zealand kept its benchmark rate unchanged at 0.25% as expected. RBNZ said additional stimulus would be provided through a Funding for Lending Programme (FLP), commencing in December, and "monetary policy will need to remain stimulatory for a long time".

Spot gold rose to $1,880 an ounce.

#UK - IRELAND#

BAE Systems, an aerospace company, released a trading statement: "The Group's full year guidance for 2020 sales and cashflow remains unchanged from the 2020 interim results. Underlying earnings per share are now expected to be slightly higher than previously guided with good operational performance and an expected lower tax rate offsetting the negative foreign exchange impact."

Flutter Entertainment, a sports-betting and gaming company, reported that 3Q revenue rose 27% on year (+30% at constant currency) to 1.325 billion pounds. The company has raised its full-year EBITDA (ex-US) guidance to 1.275 - 1.350 billion pounds from 1.175 - 1.325 billion pounds previously.

IAG, an airline group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

Continental, an automotive parts manufacturer, said it now expects full-year revenue of about 37.5 billion euros. The company is expected to report 3Q results later today.

#BENELUX#

ABN Amro, a Dutch bank, announced that 3Q net profit dropped 46% on year to 301 million euros, as impairment charges jumped 141% to 270 million euros, but down from 703 million euros in 2Q. Operating income increased 5% on year to 2.21 billion euros.

#ITALY#

Telecom Italia, a telecommunications company, reported that 3Q net income jumped 66.1% on year to 500 million euros while EBITDA dropped 18.4% to 1.72 billion euros on revenue of 3.90 billion euros, down 12.0% (-5.0% organic growth).

#SWITZERLAND#

Alcon, a medical company, announced that 3Q core EPS slid 15.2% on year to 0.39 dollar on net sales of 1.82 billion dollars, down 1.2%.

From a technical point of view, an hypothetical inverse head and shoulders pattern is in formation since May 2019. A break above the pattern's neckline at 62CHF would validate the H&S and call for a new up leg towards 69CHF and 74.2CHF in extension.

Source: TradingView, GAIN Capital

EX-DIVIDEND

Hennes & Mauritz: SEK4.85

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM