US Futures rising - Watch OXY, UBER, LYFT, SPG

The S&P 500 Futures are on the upside after they closed mixed again on Monday as tech stocks lagged behind.

Later today, the U.S. Labor Department will release (-0.7% on year expected).

European indices are bullish. ZEW survey results of August were released for Germany (current situation at -81.3 vs -69.5, expectations at 71.5 vs 55.8 expected). The U.K. Office for National Statistics has reported ILO jobless rate for the three months to June at 3.9%, vs 4.2% expected.

Asian indices closed on the upside except the Chinese CSI which closed lower.

WTI Crude Oil futures are posting further advance. Later today, API would release the change of U.S. oil stockpile data for August 7.

Gold fell below 2000 dollars on rising equities and a stronger US dollar.

Gold declined 50.15 dollars (-2.47%) to 1977.2.

The dollar index consolidates, losing 0.3pt to 93.281.

U.S. Equity Snapshot

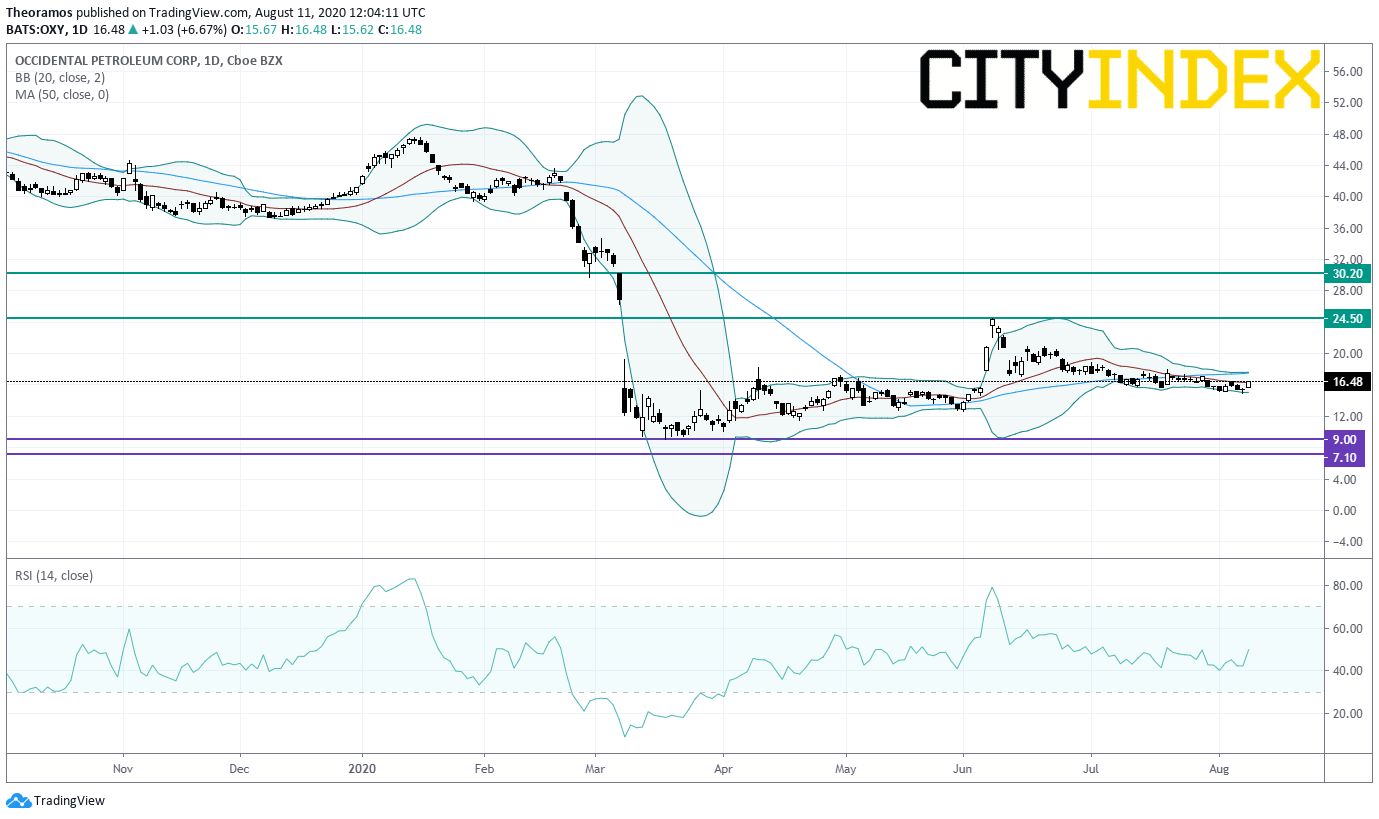

Occidental Petroleum (OXY), an energy exploration and production company, announced a second quarter adjusted LPS of 1.76 dollar, wider than expected. The company booked an impairment charge of 6.6 billion dollars.

Later today, the U.S. Labor Department will release (-0.7% on year expected).

European indices are bullish. ZEW survey results of August were released for Germany (current situation at -81.3 vs -69.5, expectations at 71.5 vs 55.8 expected). The U.K. Office for National Statistics has reported ILO jobless rate for the three months to June at 3.9%, vs 4.2% expected.

Asian indices closed on the upside except the Chinese CSI which closed lower.

WTI Crude Oil futures are posting further advance. Later today, API would release the change of U.S. oil stockpile data for August 7.

Gold fell below 2000 dollars on rising equities and a stronger US dollar.

Gold declined 50.15 dollars (-2.47%) to 1977.2.

The dollar index consolidates, losing 0.3pt to 93.281.

U.S. Equity Snapshot

Occidental Petroleum (OXY), an energy exploration and production company, announced a second quarter adjusted LPS of 1.76 dollar, wider than expected. The company booked an impairment charge of 6.6 billion dollars.

Source: TradingView, Gain Capital

Uber (UBER) and Lyft (LYFT), the ride-hailing companies, dipped in extended trading after a Californian judge ruled against them regarding their driver status.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM