US Futures flat ahead of Fed, watch AAPL, AMZN, UAL, GME

The S&P 500 Futures are flat after Nasdaq 100 marked another record close yesterday.

Later today, U.S. Consumer Price Index (flat in May expected) will be reported. The Federal Reserve is expected to keep its key interest rates unchanged.

European indices are down. France's INSEE has posted April industrial production at -20.1% (vs -20.0% on month expected). OECD sees Global GDP At -6% in 2020 and at -7.6% if there is a second Covid-19 wave with a +2.8% rebound in 2021.

Asian indices closed in the green except the Chinese CSI. This morning, official data showed that Japan's core machine orders dropped 12.0% on month in April (-7.0% expected). China's CPI rose 2.4% on year in May (+2.7% expected) while PPI dropped 3.7% (-3.3% expected).

WTI Crude Oil Futures remain under pressure even if the U.S. Energy Information Administration raised its 2020 oil price forecasts while lowering its projection for U.S. oil production.

Gold gains ground as equities rally fades. Gold rose 6.3 dollars (+0.37%) to 1721.63 dollars.

The US dollar continues to consolidate before the Fed monetary policy decision. The EUR/USD rose 41pips to 1.1381 while GBP/USD gained 56pips to 1.2784.

Later today, U.S. Consumer Price Index (flat in May expected) will be reported. The Federal Reserve is expected to keep its key interest rates unchanged.

European indices are down. France's INSEE has posted April industrial production at -20.1% (vs -20.0% on month expected). OECD sees Global GDP At -6% in 2020 and at -7.6% if there is a second Covid-19 wave with a +2.8% rebound in 2021.

Asian indices closed in the green except the Chinese CSI. This morning, official data showed that Japan's core machine orders dropped 12.0% on month in April (-7.0% expected). China's CPI rose 2.4% on year in May (+2.7% expected) while PPI dropped 3.7% (-3.3% expected).

WTI Crude Oil Futures remain under pressure even if the U.S. Energy Information Administration raised its 2020 oil price forecasts while lowering its projection for U.S. oil production.

Gold gains ground as equities rally fades. Gold rose 6.3 dollars (+0.37%) to 1721.63 dollars.

The US dollar continues to consolidate before the Fed monetary policy decision. The EUR/USD rose 41pips to 1.1381 while GBP/USD gained 56pips to 1.2784.

US Equity Snapshot

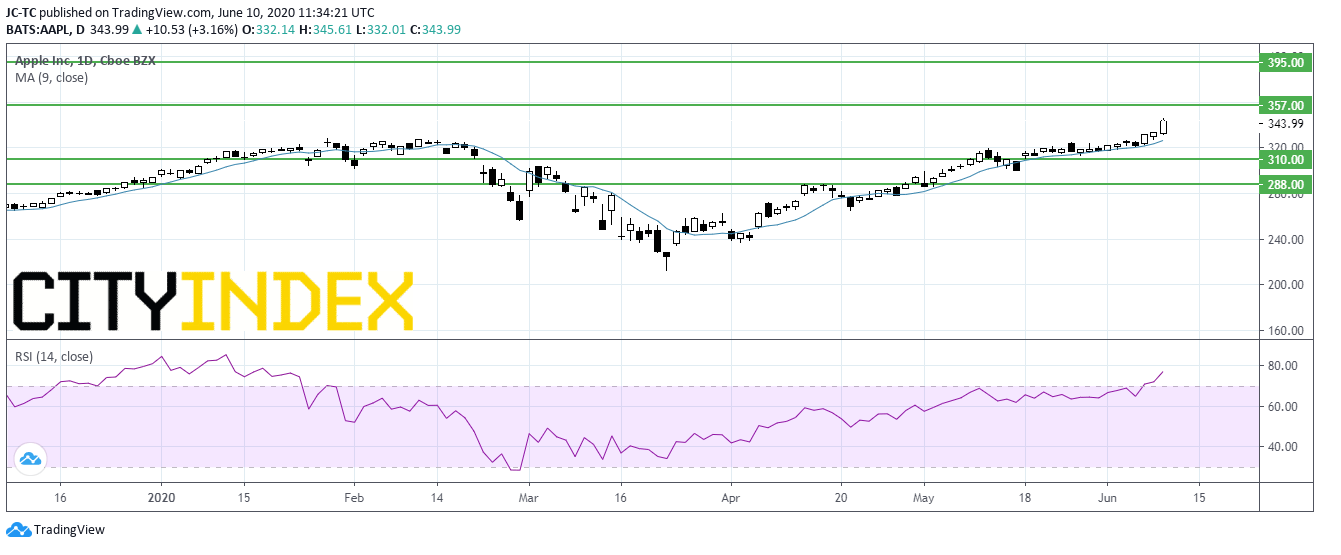

Apple (AAPL +3.16% to 343.99 dollars), the consumer electronics company, spiked to an all-time high yesterday after Bloomberg reported that the Co plans to start using its own processors instead of Intel's in its Mac computers.

Amazon.com ( AMZN +3.04% to 2600.86 dollars) reached a new all-time high yesterday.

United Airlines (UAL) was downgraded to "neutral" from "overweight" at Morgan Stanley.

eBay (EBAY), the global electronic commerce platform, was upgraded to "hold" from "underperform" at Jefferies.

Gamestop (GME), the videogame retailer, lost ground after hours after reporting worse than expected quarterly earnings and sales.

Source : TradingVIEW, Gain Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM