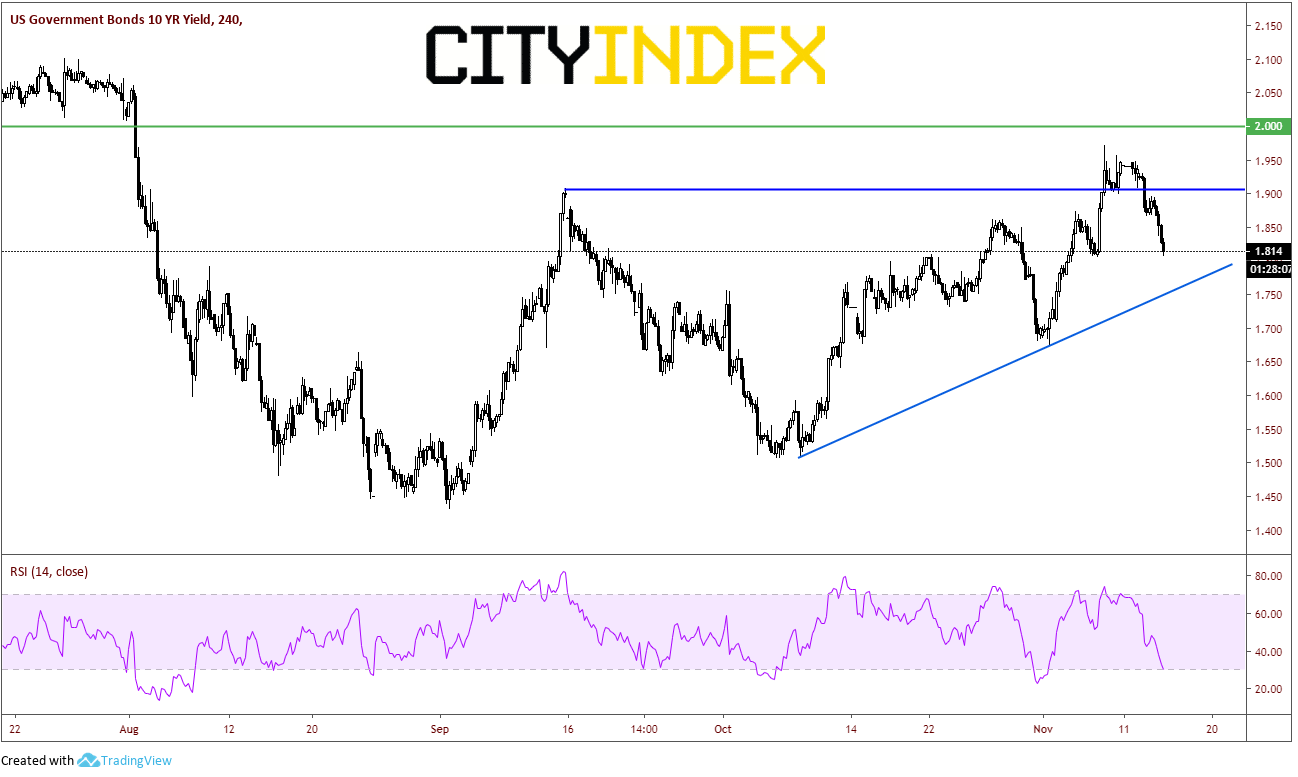

10-Year Yields Can’t Take Out 2% as Markets Stall

Earlier in the week with yields sitting at 1.94%, we pondered whether or not 10-Yields could push above 2%. Currently that answer is no, as price has broken back through support at 1.91% and is currently pushing lower at 1.814%. Below here, support comes in at the rising trendline from October 8th near 1.75%. Resistance is above at previous support of 1.91%, and then the ever looming 2.00%.

Source: Tradingview, City Index

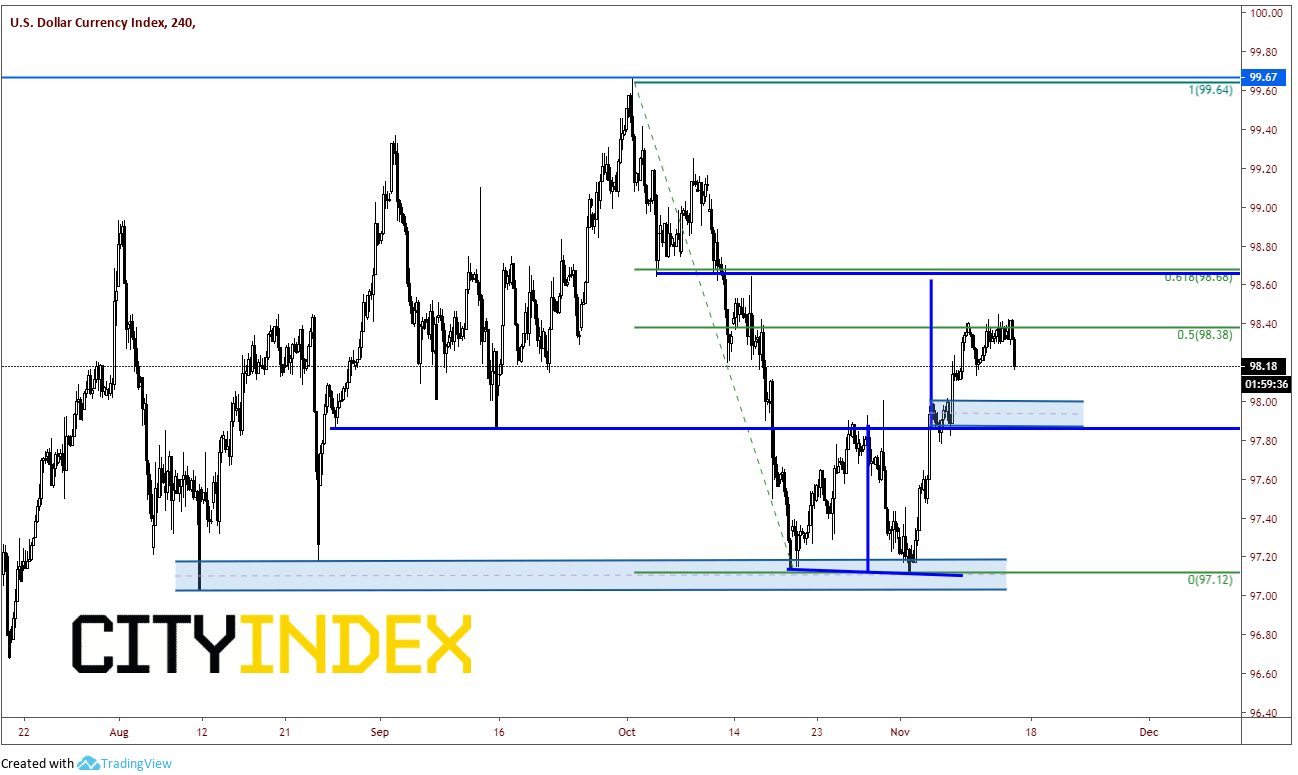

Falling yields, means a falling US Dollar, or DXY. On a 240-minute timeframe, price failed to take out the 50% retracement level from the highs on October 1st to the lows on November 1st. Therefore, it has been unable to complete the target for the double bottom near 98.60. Strong support comes into play below between 98.85 (the breakout of the double bottom) and 98.00 (horizontal support). Resistance comes in at the recent highs of 98.45. Above that is horizontal resistance and the 61.8% Fibonacci retracement level from the previously mentioned timeframe just above 98.60.

Source: Tradingview, City Index

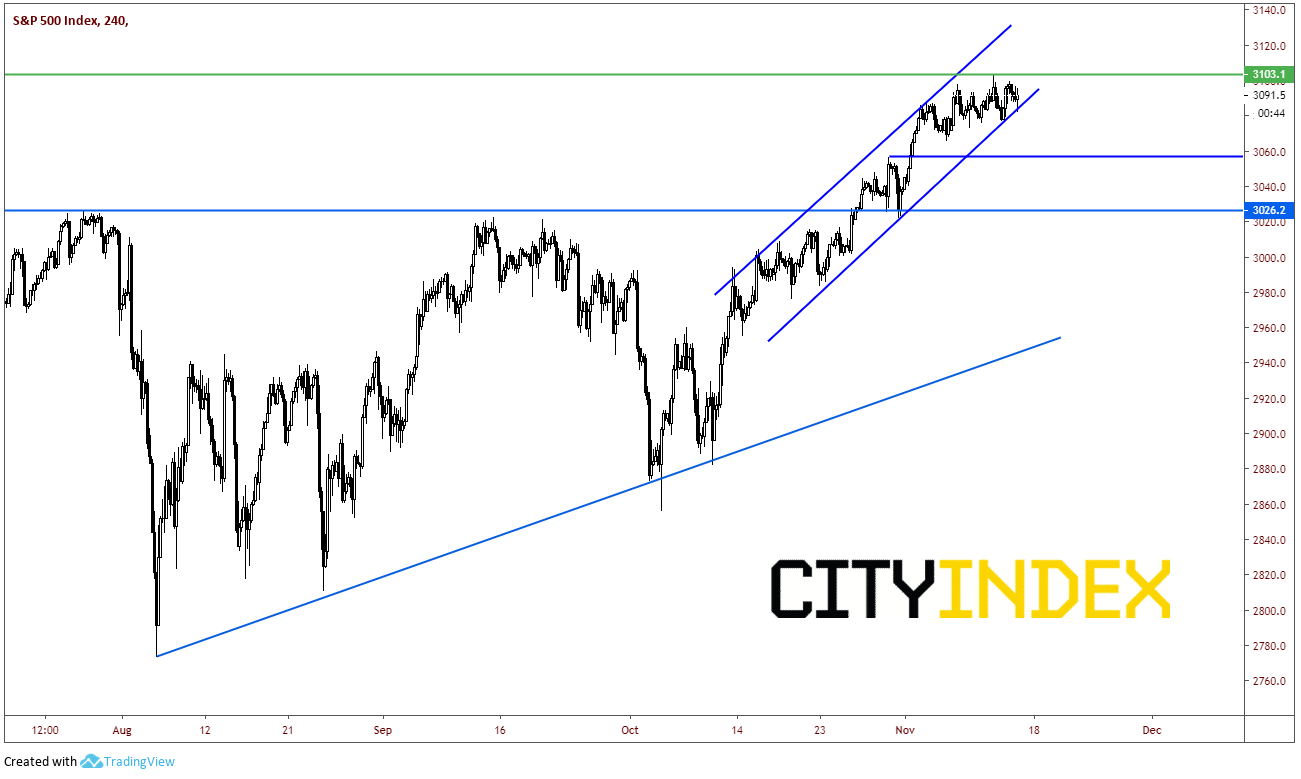

Could falling yields and a falling US Dollar be a sign that there is downside ahead in stock indices as well? Traditionally, this is the correlation. S&P 500 has been in an uptrend since forever, but more recently, the beginning of October and appears to be stalling today just below 3103. If price breaks the lower upward sloping trendline of the channel near 3080, there is minor horizontal support is at 3059 and strong horizontal support is at 3026. Resistance is back at the all-time highs of 3103.

Source: Tradingview, City Index

Unfortunately, this week has been pretty slow in terms of volatility. As the markets waits for the next catalyst to push them in either direction, be weary of more sideways action over the next few days.