U.S Futures mixed - Watch AMZN, BA, BYND, LLY, LOW

The S&P 500 Futures are facing a consolidation after they ended on a big up move yesterday, boosted by the fact that a Covid-19 vaccine being developed by Pfizer and BioNTech was found to be over 90% effective.

Later today, the Labor Department will release JOLTS job openings for September (6.5 million expected). The National Federation of Independent Business will post its Small Business Optimism Index for October (104.4 expected).

European indices are mixed. ZEW survey results of November were released for Germany (current situation at -64.3 vs -63.5 expected, expectations at 39.0 vs 44.3 expected). France's INSEE has reported 3Q ILO jobless rate at 9% (vs 7.5% expected) and September industrial production at +1.4% (vs +0.7% on month expected). The U.K. Office for National Statistics has posted jobless rate for the three months to September at 4.8%, as expected.

Asian indices ended in the green except the Chinese CSI. This morning, official data showed that China's CPI grew 0.5% on year in October (+0.8% expected) while PPI dropped 2.1% (-1.9% expected). Also, Chines vaccine trial in Brazil was halted after a serious adverse event.

WTI Crude Oil remains bullish after a strong up move yesterday. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for November 6.

US indices closed mixed on Monday with the Dow Jones (+2.95%) and S&P 500 (+1.17%) closing up, while the Nasdaq (-1.53%) closed down. Energy (+14.22%), Banks (+13.2%) and Insurance (+5.63%) sectors were the best performers on the day, while Retailing (-3.3%), Household & Personal Products (-3.1%) and Semiconductors & Semiconductor Equipment (-1.83%) sectors were the worst performers.

Gold climbs while the U.S dollar consolidates as central banks are expected to keep an accommodative tone.

Gold rose 15.38 dollars (+0.83%) to 1878.42 dollars.

The dollar index is little changed at 92.816.

U.S. Equity Snapshot

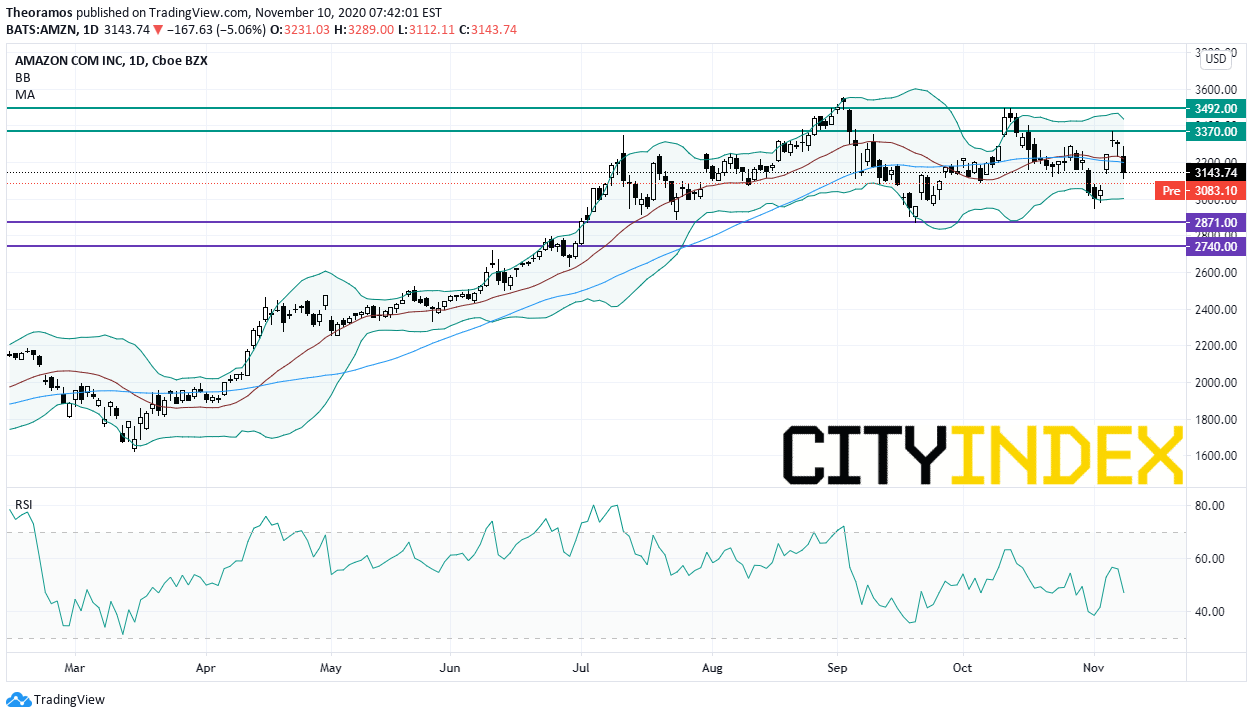

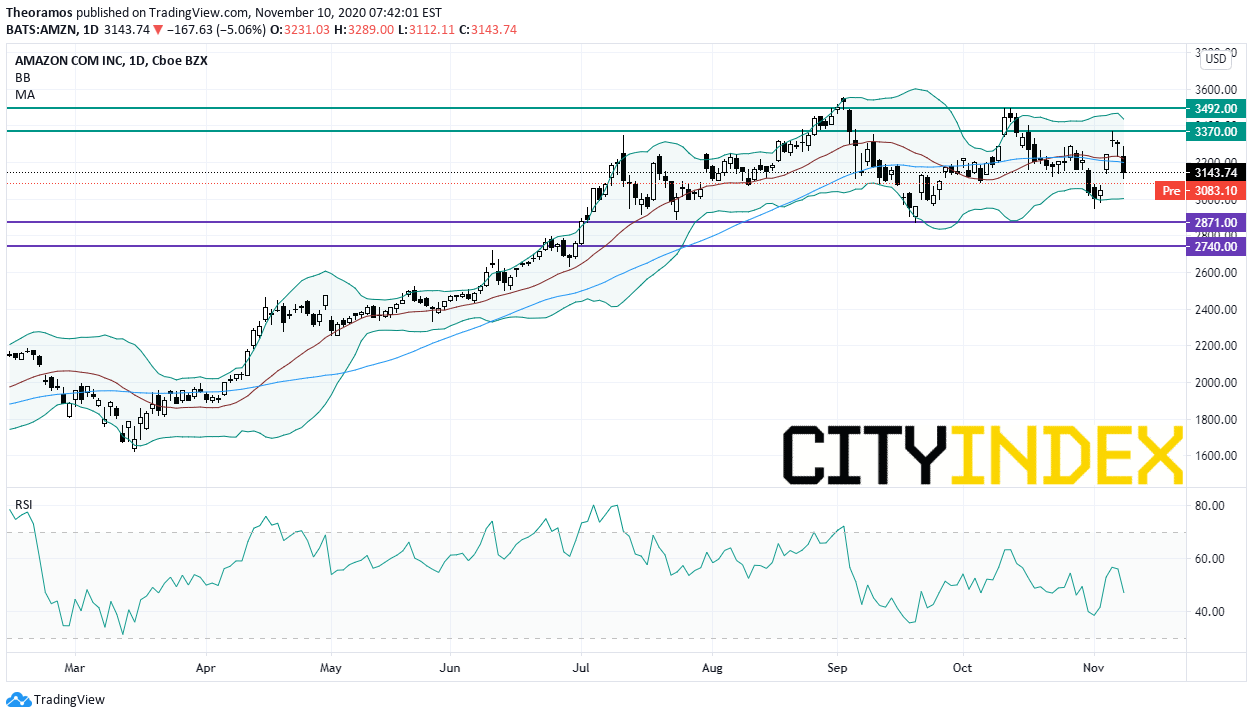

Amazon.com (AMZN), the e-commerce giant, faces new European Union charges over the company's sales practice.

Source: TradingView, GAIN Capital

Eli Lilly (LLY), a developer and producer of pharmaceuticals, popped post market as its "neutralizing antibody bamlanivimab (LY-CoV555) received FDA emergency use authorization for the treatment of recently diagnosed COVID-19 "

Lowe's (LOW), home improvement retailer, denied a Bloomberg report saying that the company might be in talks to buy industrial distributor HD Supply (HDS).

Adobe (ADBE), a developer of software products, "has entered into a definitive agreement to acquire Workfront, the leading work management platform for marketers, for 1.5 billion dollars."

Novavax (NVAX), the drugmaker, slipped after hours as quarterly earnings missed estimates.

Nikola (NKLA), the hydrogen-electric vehicles maker, gained ground after hours after posting a lower than expected third quarter adjusted LPS.

Take-Two Interactive Software (TTWO), a leading global video game publisher, agreed to buy UK game maker Codemasters Group for about 956 million dollars.

Simon Property (SPG), the largest retail center real estate investment firm in the U.S., reported third quarter EPS of 0.48 dollar, significantly missing estimates, down from 1.74 dollar a year ago.

Occidental Petroleum (OXY), an energy exploration and production company, disclosed third quarter adjusted LPS of 0.84 dollar, more than expected, vs an EPS of 0.11 dollar a year ago, on revenue of 3.0 billion dollars, below forecasts, down from 4.5 billion dollars a year earlier.

Norwegian Cruise Line (NCLH), the third largest cruise company in the world, unveiled third quarter adjusted LPS of 2.35 dollars, missing the consensus, vs an EPS of 2.23 dollars a year ago on revenue of 6.5 million dollars, lower than projected, down from 1.9 billion dollars a year earlier.

Later today, the Labor Department will release JOLTS job openings for September (6.5 million expected). The National Federation of Independent Business will post its Small Business Optimism Index for October (104.4 expected).

European indices are mixed. ZEW survey results of November were released for Germany (current situation at -64.3 vs -63.5 expected, expectations at 39.0 vs 44.3 expected). France's INSEE has reported 3Q ILO jobless rate at 9% (vs 7.5% expected) and September industrial production at +1.4% (vs +0.7% on month expected). The U.K. Office for National Statistics has posted jobless rate for the three months to September at 4.8%, as expected.

Asian indices ended in the green except the Chinese CSI. This morning, official data showed that China's CPI grew 0.5% on year in October (+0.8% expected) while PPI dropped 2.1% (-1.9% expected). Also, Chines vaccine trial in Brazil was halted after a serious adverse event.

WTI Crude Oil remains bullish after a strong up move yesterday. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for November 6.

US indices closed mixed on Monday with the Dow Jones (+2.95%) and S&P 500 (+1.17%) closing up, while the Nasdaq (-1.53%) closed down. Energy (+14.22%), Banks (+13.2%) and Insurance (+5.63%) sectors were the best performers on the day, while Retailing (-3.3%), Household & Personal Products (-3.1%) and Semiconductors & Semiconductor Equipment (-1.83%) sectors were the worst performers.

Approximately 72% of stocks in the S&P 500 Index were trading above their 200-day moving average and 62% were trading above their 20-day moving average. The VIX Index rose 0.89pt (+3.58%) to 25.75 and WTI Crude Oil jumped $2.82 (+7.59%) to $39.96 at the close.

On the US economic data front, no major economic data was released. In other news, over the weekend Democratic Presidential nominee Joe Biden declared victory in the 2020 Presidential election.Gold climbs while the U.S dollar consolidates as central banks are expected to keep an accommodative tone.

Gold rose 15.38 dollars (+0.83%) to 1878.42 dollars.

The dollar index is little changed at 92.816.

U.S. Equity Snapshot

Amazon.com (AMZN), the e-commerce giant, faces new European Union charges over the company's sales practice.

Source: TradingView, GAIN Capital

Boeing (BA), the aircraft maker, is gaining ground premarket after Reuters reported that the FAA may lift 737 MAX grounding order as early as next week.

Beyond Meat (BYND), a producer of plant-based meat substitutes, tumbled in extended trading after announcing third quarter adjusted LPS of 0.28 dollar, below forecasts, vs an EPS 0.07 dollar a year earlier on net revenue of 94.4 million dollars, worse than expected, up from 92.0 million dollars a year ago.Eli Lilly (LLY), a developer and producer of pharmaceuticals, popped post market as its "neutralizing antibody bamlanivimab (LY-CoV555) received FDA emergency use authorization for the treatment of recently diagnosed COVID-19 "

Lowe's (LOW), home improvement retailer, denied a Bloomberg report saying that the company might be in talks to buy industrial distributor HD Supply (HDS).

Adobe (ADBE), a developer of software products, "has entered into a definitive agreement to acquire Workfront, the leading work management platform for marketers, for 1.5 billion dollars."

Novavax (NVAX), the drugmaker, slipped after hours as quarterly earnings missed estimates.

Nikola (NKLA), the hydrogen-electric vehicles maker, gained ground after hours after posting a lower than expected third quarter adjusted LPS.

Take-Two Interactive Software (TTWO), a leading global video game publisher, agreed to buy UK game maker Codemasters Group for about 956 million dollars.

Simon Property (SPG), the largest retail center real estate investment firm in the U.S., reported third quarter EPS of 0.48 dollar, significantly missing estimates, down from 1.74 dollar a year ago.

Occidental Petroleum (OXY), an energy exploration and production company, disclosed third quarter adjusted LPS of 0.84 dollar, more than expected, vs an EPS of 0.11 dollar a year ago, on revenue of 3.0 billion dollars, below forecasts, down from 4.5 billion dollars a year earlier.

Norwegian Cruise Line (NCLH), the third largest cruise company in the world, unveiled third quarter adjusted LPS of 2.35 dollars, missing the consensus, vs an EPS of 2.23 dollars a year ago on revenue of 6.5 million dollars, lower than projected, down from 1.9 billion dollars a year earlier.

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM