US Futures sliding - Watch GME, ZS, TIF

The S&P 500 Futures are back in the red after they rebounded yesterday, following a three-day decline.

Later today, the U.S. Labor Department will report July PPI (-0.3% on year expected) and initial jobless claims in the week ending September 5 (0.85 million expected). July Wholesales inventories are expected at -0.1% on month.

European indices are under pressure in mid-day trading. France's INSEE has posted July industrial production at +3.8% (vs +5.0% on month expected). The European Central Bank has kept its interest rates unchanged. ECB’s President Lagarde press conference is to follow.

Asian indices closed in the green. This morning, official data showed that Japan's core machine orders grew 6.3% on month in July (+2.0% expected).

WTI Crude Oil futures are posting a rebound. The American Petroleum Institute (API) reported that U.S. crude-oil inventories increased 2.97 million barrels in the week ending September 4. The U.S. Energy Information Administration (EIA) lowered 2021 world oil demand to 93.07M b/d from 93.14M b/d in the previous estimation, while global oil supply would decrease to 99.34M b/d from 99.37M b/d, according to its monthly Short Term Energy Outlook. Later today, EIA will release official crude oil inventories data for the same week.

Gold gained 0.94$ (+0.05%) to 1947.78 and remains within a tight range.

EUR/USD rose 31pips to 1.1834 as the ECB maintains its rates unchanged.

U.S. Equity Snapshot

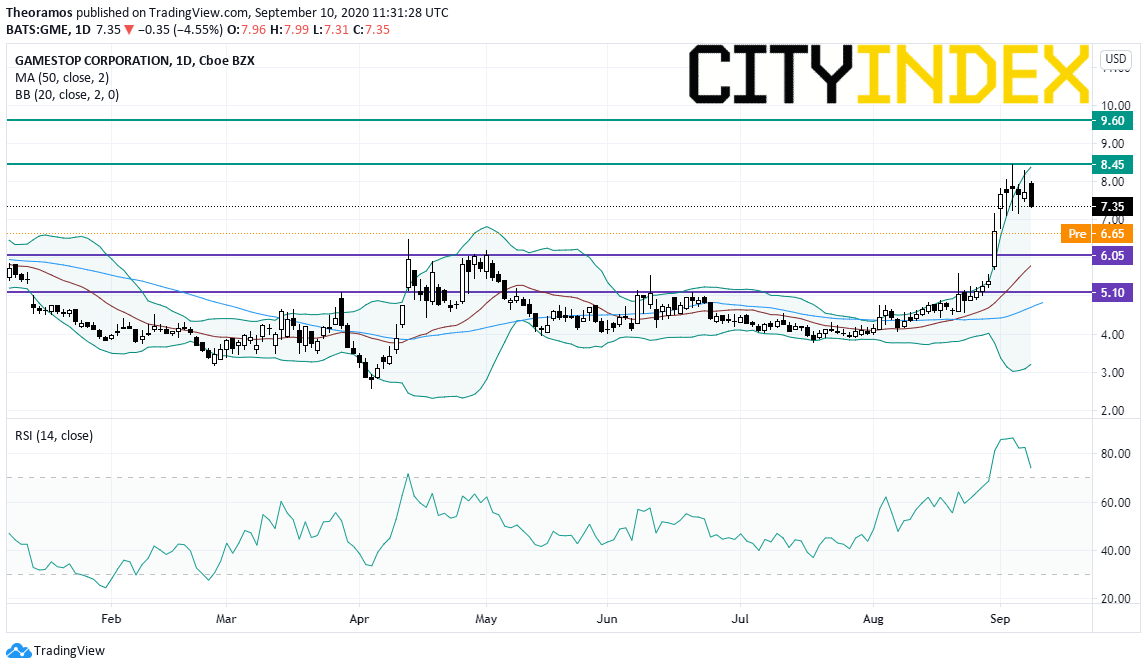

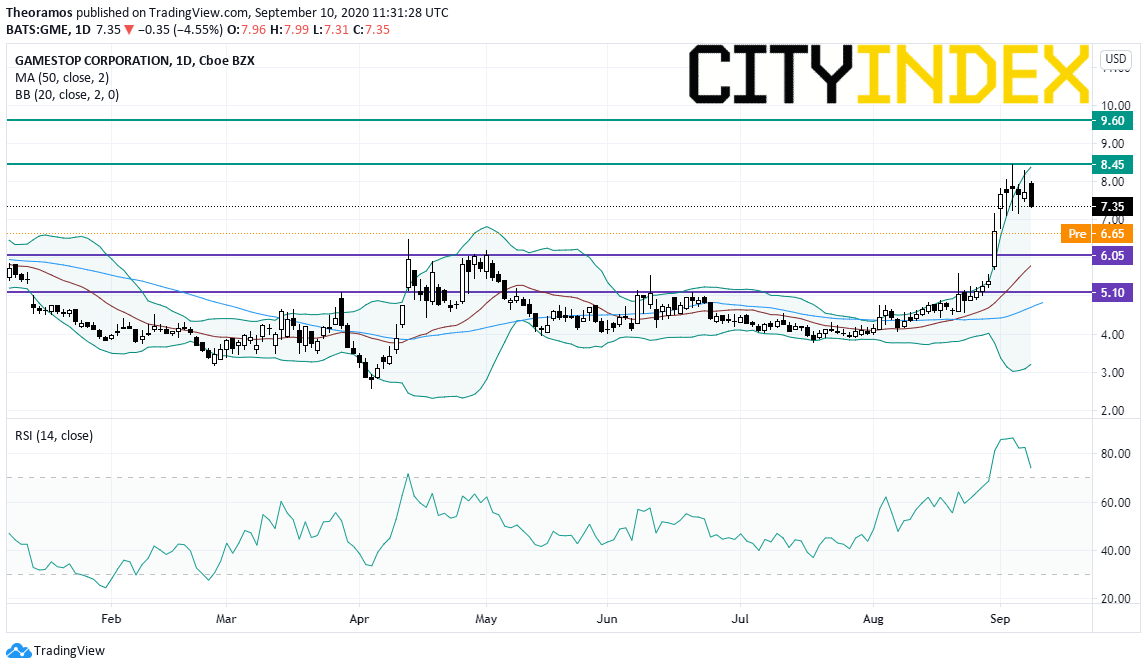

GameStop (GME), the videogame retailer, reported a wider-than-expected loss per share of 1.71 dollar in the second quarter. Sales fell nearly 27% and missed estimates.

Source: GAIN Capital, TradingView

Zscaler (ZS), a security software firm, reported fourth quarter adjusted EPS of 0.05 dollar, beating the estimate, down from 0.07 dollar a year ago on revenue of 125.9 million dollars, also above the forecast, up from 86.1 million dollars in the previous year.

Tiffany & Co's (TIF): LVMH stated that it was no longer in a position to complete the $16 billion purchase of the luxury jewelry retailer, which has filed a lawsuit in the United States against the French group in order to force it to complete the acquisition.

Later today, the U.S. Labor Department will report July PPI (-0.3% on year expected) and initial jobless claims in the week ending September 5 (0.85 million expected). July Wholesales inventories are expected at -0.1% on month.

European indices are under pressure in mid-day trading. France's INSEE has posted July industrial production at +3.8% (vs +5.0% on month expected). The European Central Bank has kept its interest rates unchanged. ECB’s President Lagarde press conference is to follow.

Asian indices closed in the green. This morning, official data showed that Japan's core machine orders grew 6.3% on month in July (+2.0% expected).

WTI Crude Oil futures are posting a rebound. The American Petroleum Institute (API) reported that U.S. crude-oil inventories increased 2.97 million barrels in the week ending September 4. The U.S. Energy Information Administration (EIA) lowered 2021 world oil demand to 93.07M b/d from 93.14M b/d in the previous estimation, while global oil supply would decrease to 99.34M b/d from 99.37M b/d, according to its monthly Short Term Energy Outlook. Later today, EIA will release official crude oil inventories data for the same week.

Gold gained 0.94$ (+0.05%) to 1947.78 and remains within a tight range.

EUR/USD rose 31pips to 1.1834 as the ECB maintains its rates unchanged.

U.S. Equity Snapshot

GameStop (GME), the videogame retailer, reported a wider-than-expected loss per share of 1.71 dollar in the second quarter. Sales fell nearly 27% and missed estimates.

Source: GAIN Capital, TradingView

Zscaler (ZS), a security software firm, reported fourth quarter adjusted EPS of 0.05 dollar, beating the estimate, down from 0.07 dollar a year ago on revenue of 125.9 million dollars, also above the forecast, up from 86.1 million dollars in the previous year.

Tiffany & Co's (TIF): LVMH stated that it was no longer in a position to complete the $16 billion purchase of the luxury jewelry retailer, which has filed a lawsuit in the United States against the French group in order to force it to complete the acquisition.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM