EU indices slightly up | TA focus on LVMH

INDICES

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 Index advanced 1.8%, Germany's DAX 30 jumped 2.1%, France's CAC 40 and U.K.'s FTSE 100 were up 1.4%.

EUROPE ADVANCE/DECLINE

83% of STOXX 600 constituents traded higher yesterday.

57% of the shares trade above their 20D MA vs 37% Tuesday (below the 20D moving average).

56% of the shares trade above their 200D MA vs 53% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.56pts to 25.89, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals

3mths relative low: none

Europe Best 3 sectors

telecommunications, insurance, technology

Europe worst 3 sectors

travel & leisure, retail, automobiles & parts

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.5% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -23bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: Jul Industrial Production MoM, exp.: 12.7%

EC 12:45: ECB Interest Rate Decision, exp.: 0%

EC 12:45: Marginal Lending Rate, exp.: 0.25%

EC 12:45: Deposit Facility Rate, exp.: -0.5%

EC 13:30: ECB Press Conference

EC 18:00: ECB President Lagarde speech

MORNING TRADING

In Asian trading hours, EUR/USD rebounded to 1.1820 while GBP/USD retreated to 1.2990. USD/JPY held above the 106.00 level. This morning, official data showed that Japan's core machine orders grew 6.3% on month in July (+2.0% expected).

Spot gold slipped to $1,946 an ounce.

#UK - IRELAND#

British Land, a property group, announced that CFO Simon Carter will succeed Chris Grigg as CEO effective on November 18.

National Grid, an electricity and gas utility company, announced the appointment of Paula Rosput Reynolds, currently Non-executive Director at General Electric and will the company on January 1, to succeed Sir Peter Gershon as Chairman.

AstraZeneca, a pharmaceutical group, reported that its Fasenra met both co-primary endpoints in a phase 3 trial for patients with chronic rhinosinusitis with nasal polyps.

Dunelm Group, a home furnishings retailer, released full-year results: "Total revenue for the 52 weeks to 27 June 2020 fell by 3.9% to £1,057.9m (FY19: £1,100.4m). (...) Operating profit for the period was £116.0m (FY19: £126.9m). (...) PBT in the period was £109.1m (FY19: £125.9m), a reduction of £16.8m year-on-year. (...) The Board is not recommending a final dividend for FY20, to retain maximum liquidity ahead of winter peak trading."

Rio Tinto, a giant miner, was upgraded to "buy" from "neutral" at Citigroup.

#FRANCE#

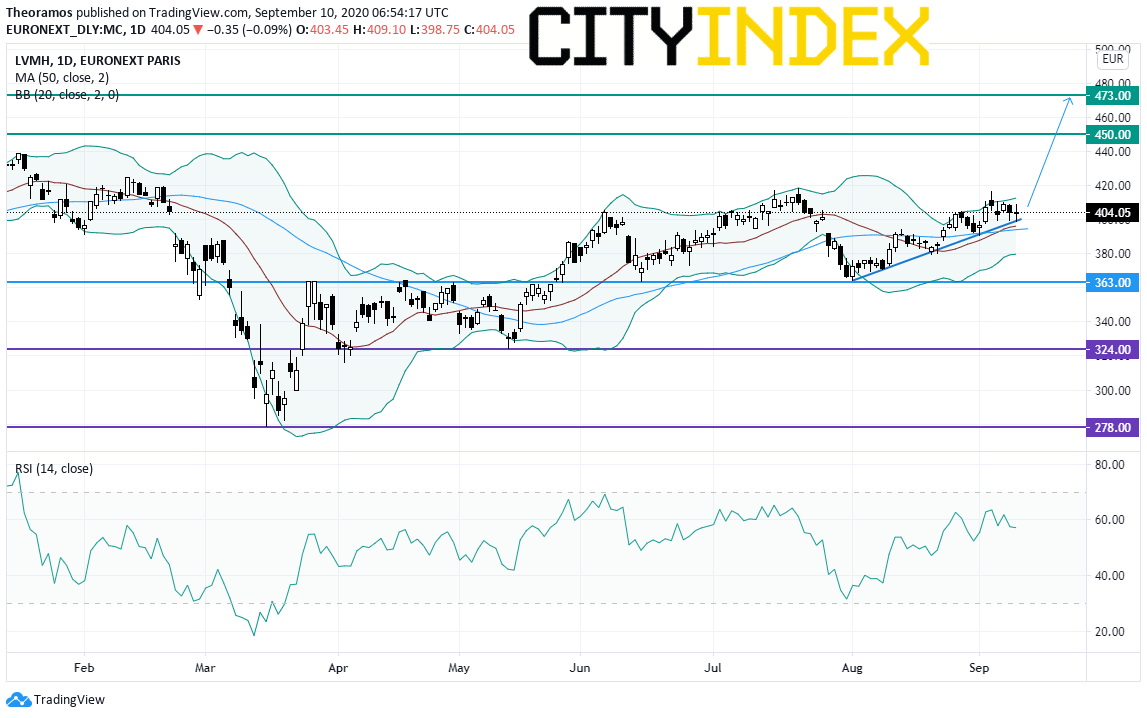

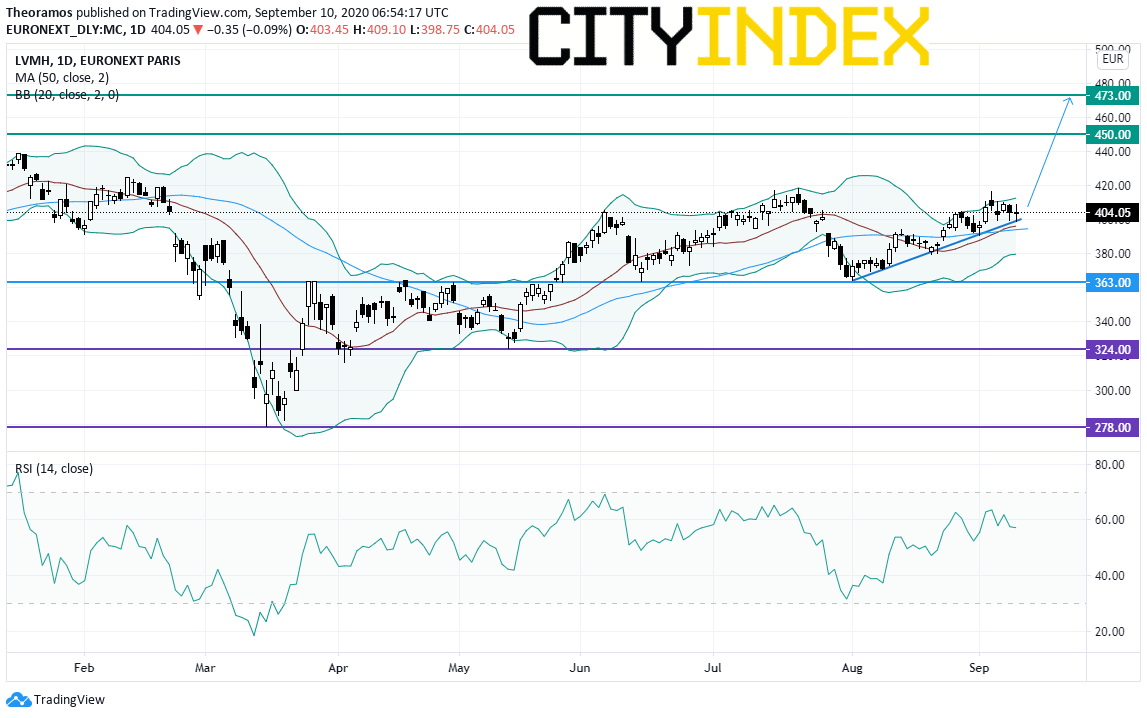

LVMH's, a luxury goods producer, Chairman Bernard Arnault is seeking for help from the French government to cancel the deal to acquire Tiffany & Co, reported Bloomberg citing people familiar with the matter.

From a daily point of view, the stock is supported by a rising trendline drawn since August. Above the overlap threshold (resistance twice in May & June before becoming a support twice as well in June & August) at 363E targets are set at 450E and 473E in extension.

Source: GAIN Capital, TradingView

#SPAIN#

Iberdrola, a Spanish electric utility company, is considering acquiring energy group PPL Corp's unit in the U.K., which could be valued at 12 billion pounds, reported Bloomberg citing people familiar with the matter.

#ITALY#

UniCredit, an Italian bank, was downgraded to "hold" from "buy" at HSBC.

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 Index advanced 1.8%, Germany's DAX 30 jumped 2.1%, France's CAC 40 and U.K.'s FTSE 100 were up 1.4%.

EUROPE ADVANCE/DECLINE

83% of STOXX 600 constituents traded higher yesterday.

57% of the shares trade above their 20D MA vs 37% Tuesday (below the 20D moving average).

56% of the shares trade above their 200D MA vs 53% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.56pts to 25.89, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals

3mths relative low: none

Europe Best 3 sectors

telecommunications, insurance, technology

Europe worst 3 sectors

travel & leisure, retail, automobiles & parts

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.5% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -23bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: Jul Industrial Production MoM, exp.: 12.7%

EC 12:45: ECB Interest Rate Decision, exp.: 0%

EC 12:45: Marginal Lending Rate, exp.: 0.25%

EC 12:45: Deposit Facility Rate, exp.: -0.5%

EC 13:30: ECB Press Conference

EC 18:00: ECB President Lagarde speech

MORNING TRADING

In Asian trading hours, EUR/USD rebounded to 1.1820 while GBP/USD retreated to 1.2990. USD/JPY held above the 106.00 level. This morning, official data showed that Japan's core machine orders grew 6.3% on month in July (+2.0% expected).

Spot gold slipped to $1,946 an ounce.

#UK - IRELAND#

British Land, a property group, announced that CFO Simon Carter will succeed Chris Grigg as CEO effective on November 18.

National Grid, an electricity and gas utility company, announced the appointment of Paula Rosput Reynolds, currently Non-executive Director at General Electric and will the company on January 1, to succeed Sir Peter Gershon as Chairman.

AstraZeneca, a pharmaceutical group, reported that its Fasenra met both co-primary endpoints in a phase 3 trial for patients with chronic rhinosinusitis with nasal polyps.

Dunelm Group, a home furnishings retailer, released full-year results: "Total revenue for the 52 weeks to 27 June 2020 fell by 3.9% to £1,057.9m (FY19: £1,100.4m). (...) Operating profit for the period was £116.0m (FY19: £126.9m). (...) PBT in the period was £109.1m (FY19: £125.9m), a reduction of £16.8m year-on-year. (...) The Board is not recommending a final dividend for FY20, to retain maximum liquidity ahead of winter peak trading."

Rio Tinto, a giant miner, was upgraded to "buy" from "neutral" at Citigroup.

#FRANCE#

LVMH's, a luxury goods producer, Chairman Bernard Arnault is seeking for help from the French government to cancel the deal to acquire Tiffany & Co, reported Bloomberg citing people familiar with the matter.

From a daily point of view, the stock is supported by a rising trendline drawn since August. Above the overlap threshold (resistance twice in May & June before becoming a support twice as well in June & August) at 363E targets are set at 450E and 473E in extension.

Source: GAIN Capital, TradingView

#SPAIN#

Iberdrola, a Spanish electric utility company, is considering acquiring energy group PPL Corp's unit in the U.K., which could be valued at 12 billion pounds, reported Bloomberg citing people familiar with the matter.

#ITALY#

UniCredit, an Italian bank, was downgraded to "hold" from "buy" at HSBC.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM