US Futures mixed, watch WBA, CSCO, MSFT, BBBY

Today, the U.S. Labor Department will release initial jobless claims in the week ended July 4 and the Commerce Department will report final readings of May wholesale inventories.

Asian indices ended into positive territory with the China Mainland CSI 300 adding 1.40% recording an 8-day rally. The index is now up 18.17% year to date while in comparison the Nasdaq 100 is up 22.14%. Also, Hong Kong HSI gained 0.31%, Australian ASX 200 added 0.59% and the Japanese Nikkei rose 0.40%. On the economic data front, China's Consumer Price Index grew 2.5% on year in June (as expected) while Producer Price Index dropped 3.0% (-3.2% expected). Also, Japan's core machine orders grew 1.7% on month in May while a -5.0% decline was expected.

WTI Crude Oil futures are little changed. The Energy Information Administration reported a build of 5.7M barrels in crude-oil stockpiles last week, in contrast to expectations of a reduction of 3.1M barrels. Meanwhile, U.S. crude oil production was unchanged at 11.0M b/d. Standard Chartered Bank projected oil demand in 2021 would be only at 2017 level as coronavirus pandemic would destroy four years of growth.US Equity Snapshot

Gold prices are trading around 1,810 dollars at their higher level since September 2011 on coronavirus fears while the US dollar remains weak on rallying equities.

Gold fell 0.47 dollar (-0.03%) to 1808.42 dollars.

The EUR/USD fell 7pips to 1.1323 and GBP/USD rose 32pips to 1.2642.

US EQUITY SNAPSHOT

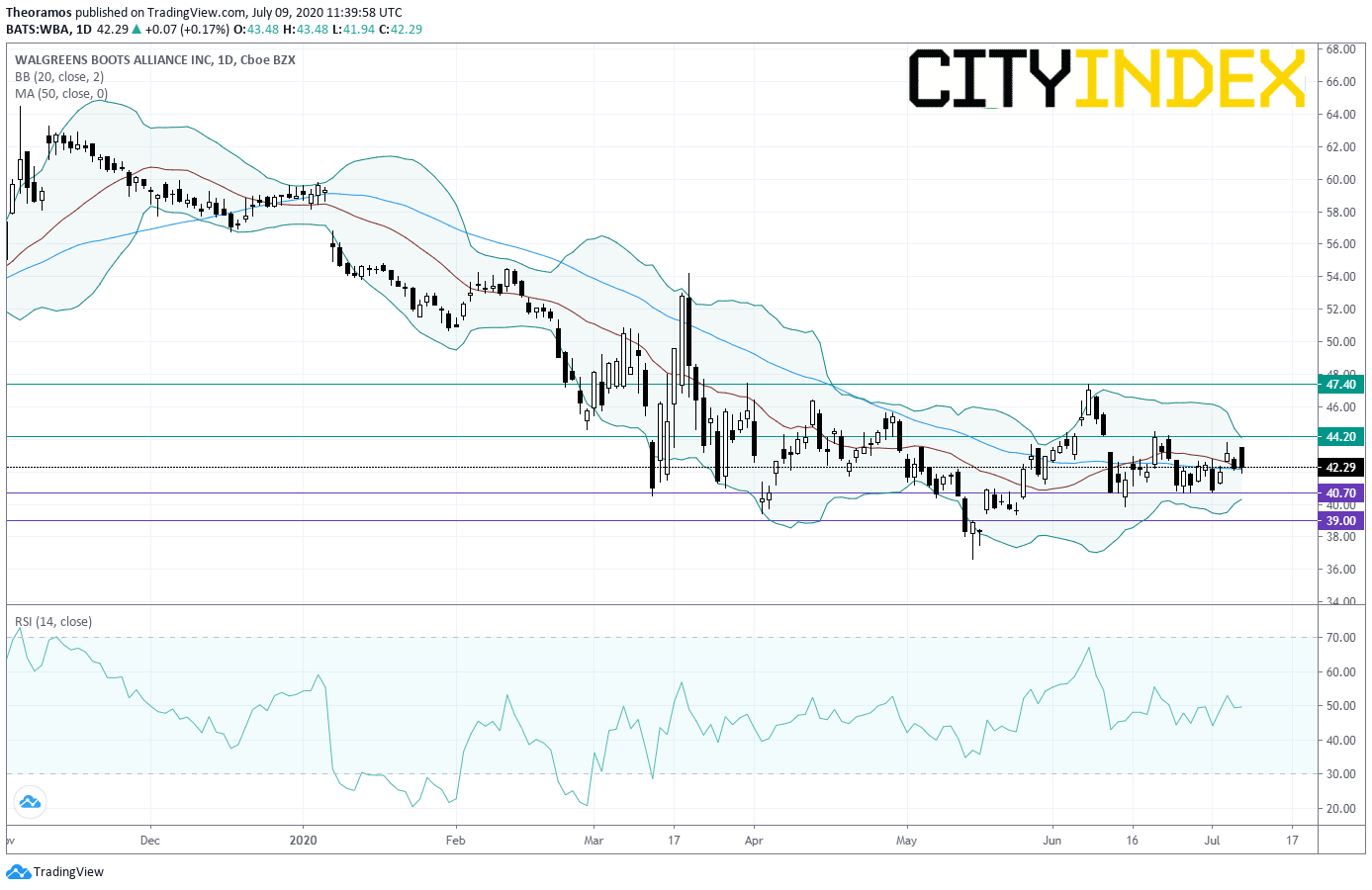

Walgreens Boots Alliance (WBA), a global leader in retail and wholesale pharmacy, reported third quarter adjusted EPS down to 0.83 dollar, below estimates, from 1.47 dollar a year earlier. The company expects full year adjusted EPS of 4.65-4.75 dollars, missing the current consensus. Walgreens announced 4,000 jobs cuts and suspends its share buyback plan.

Source: TradingVIEW, Gain Capital

Cisco Systems(CSCO), a leading global supplier of network hardware and software, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Microsoft's (MSFT), the software development company, price target was raised to 260 dollars from 220 dollars at Wedbush.

Bed Bath & Beyond (BBBY), the home furnishing retail chain, disclosed first quarter adjusted LPS of 1.96 dollar, missing estimates, down from an EPS of 0.12 dollar a year ago, on net sales of 1.3 billion dollars, also below consensus, down from 2.6 billion dollars in the previous year. The company expects to close about 200 stores over the next two years.

Costco Wholesale (COST), an operator of a chain of warehouse stores, posted June net sales up 11.1% to 16.18 billion dollars.

Regeneron (REGN), the pharma, was upgraded to "buy" from "hold" at SunTrust.