U.S Futures jump - Watch PFE, MCD, BRK-A, AAPL, BIIB

No major economic data are expected in North America today.

European indices are on a strongly bullish mood after Pfizer's announcement. The German Federal Statistical Office has posted September trade balance at 20.8 billion euros (vs 16 billion euros surplus expected). Europe Sentix Investor Confidence for November was released at -10, vs -15 expected and -8.3 in October. Bank of France Industrial Sentiment for October was published at 97, vs 90 expected.

Asian indices closed on a strong up move. In Japan, November Tankan Index was released at -13, above -28 expected.

WTI Crude Oil is posting a rebound. The total number of rotary rigs in the U.S. rose to 300 as of November 6 from 296 in the prior week.

US indices closed mixed on Friday with the Nasdaq (+0.04%) closing up, while the Dow Jones (-0.24%) and S&P 500 (-0.03%) closed down. Semiconductors & Semiconductor Equipment (+1.38%), Telecommunication Services (+0.88%) and Food & Staples Retailing (+0.79%) sectors were the best performers on the day, while Energy (-2.14%), Banks (-1.78%) and Consumer Durables & Apparel (-1.38%) sectors were the worst performers.

Approximately 75% of stocks in the S&P 500 Index were trading above their 200-day moving average and 68% were trading above their 20-day moving average. The VIX Index dropped 2.73pts (-9.9%) to 24.85, while Gold rose $2.99 (+0.15%) to $1952.65, and WTI Crude Oil fell $1.38 (-3.56%) to $37.41 at the close.

On the US economic data front, Change in Nonfarm Payrolls fell to 638K on month in October (580K expected), from a revised 672K in September. The Unemployment Rate dropped to 6.9% on month in October (7.6% expected), from 7.9% in September. Finally, Wholesale Inventories rose 0.4% on month in the September final reading (-0.1% expected), from -0.1% in the September preliminary reading.

Gold loses ground while the U.S dollar edges higher on Biden's win, rallying equity markets.

Gold fell 33.7 dollars (-1.73%) to 1917.65 dollars.

The dollar index rose 0.13pt to 92.354

U.S. Equity Snapshot

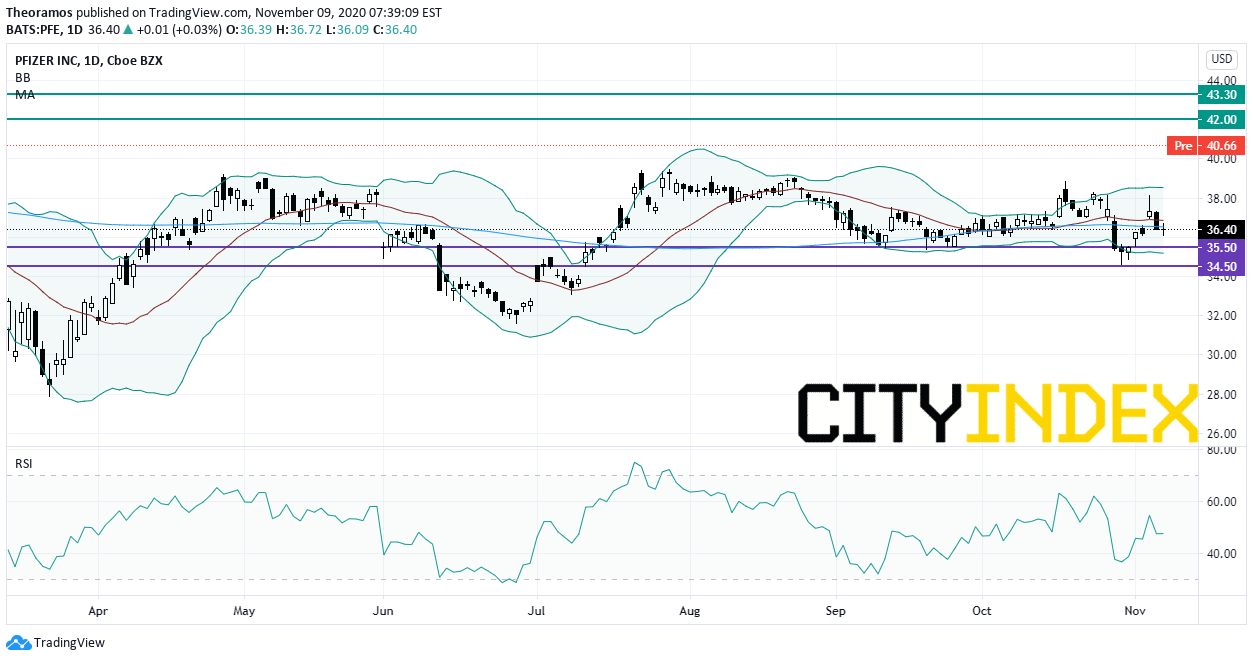

Pfizer (PFE) and BioNtech said their "vaccine candidate was found to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection in the first interim efficacy analysis."

Source: TradingView, GAIN Capital

McDonald's (MCD), the global fast-food restaurant chain, jumps premarket as third quarter earnings beat estimates.

Apple (AAPL), a tech giant, suspended iPhone maker Pegatron following labour abuses in China. Separately, Apple is considering acquiring American podcast network Wondery for 300-400 million dollars, reported Bloomberg.

Berkshire Hathaway (BRK-A), an investment company, announced third quarter net income jumped 82% on year to 30.14 billion dollars while operating income dropped 30% to 5.48 billion dollars.

Biogen (BIIB), a pharmaceutical company, might dive after a FDA advisory panel voted against the company's Alzheimer's experimental treatment.

Peloton Interactive (PTON)'s, the interactive fitness platform, price target was raised to 160 dollars from 120 dollars at Bernstein.