U.S Futures rising - Watch AMD, XLNX, NXPI, WMT

The S&P 500 Futures remain on the upside even if market optimism is capped by a tug-of-war between the U.S. government and Congress on negotiations over a new fiscal stimulus package.

Later today, the U.S. Commerce Department will post final readings of August wholesale inventories (+0.5% on month expected).

European indices are facing a consolidation. France's INSEE has reported August industrial production at +1.3% (vs +1.7% on month expected). The U.K. Office for National Statistics has released August GDP at +2.1% (vs +4.6% on month expected), industrial production at +0.3% (vs +2.5% on month expected) and trade balance at 1.3 billion pounds surplus (vs break even expected).

Asian indices were under pressure. Japan's household spending dropped 6.9% on year in August (-6.7% expected). China's Caixin Services PMI rose to 54.8 in September (54.3 expected) from 54.0 in August.

WTI Crude Oil futures are turning down. OPEC said "worst is over for the global oil market" and predicted that the worldwide oil demand would return to the pre-crisis level in 2022. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold keeps bouncing as the U.S dollar retreats on U.S stimulus hopes.

Gold jumped 22.16 dollars (+1.17%) to 1915.98 dollars.

The dollar index fell 0.28pt to 93.323.

U.S. Equity Snapshot

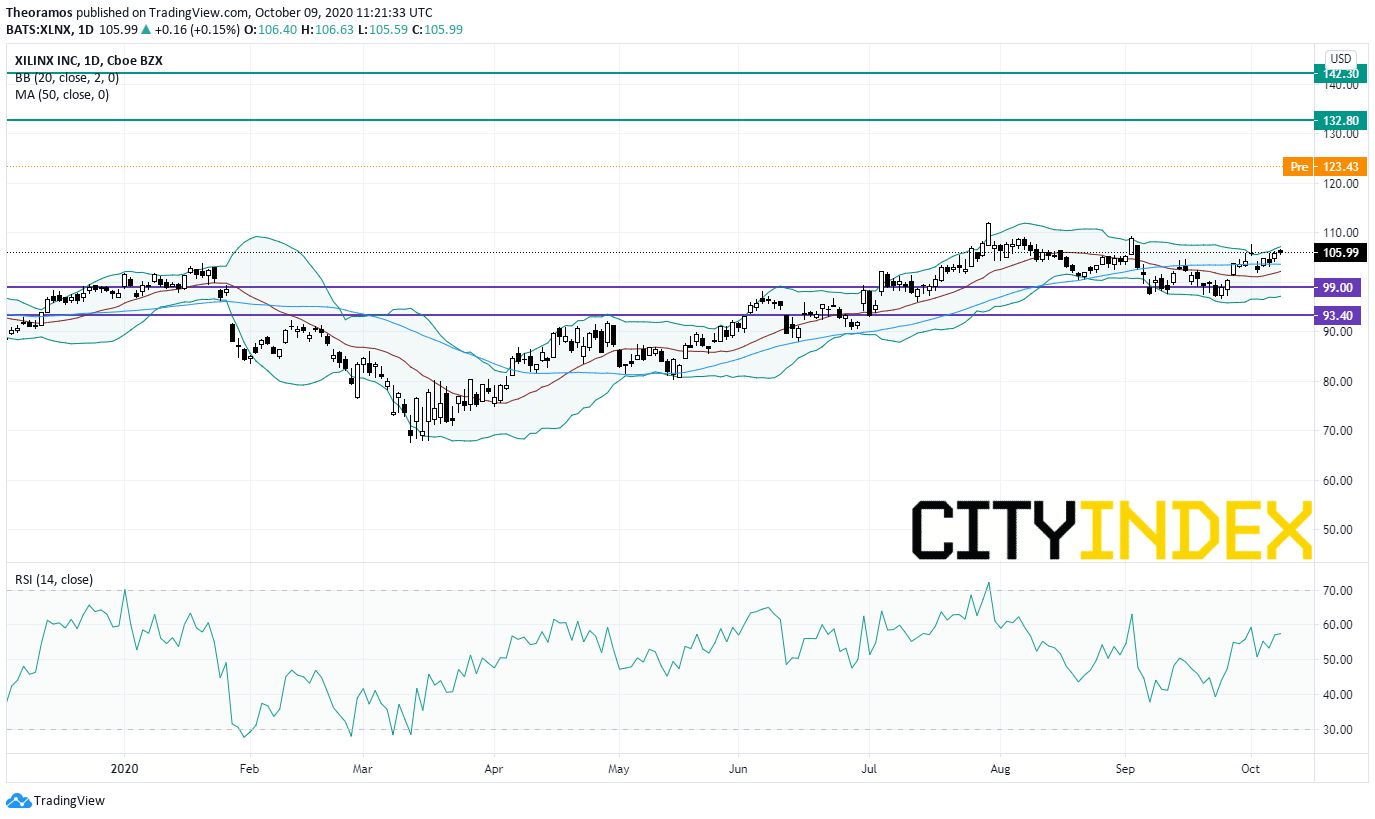

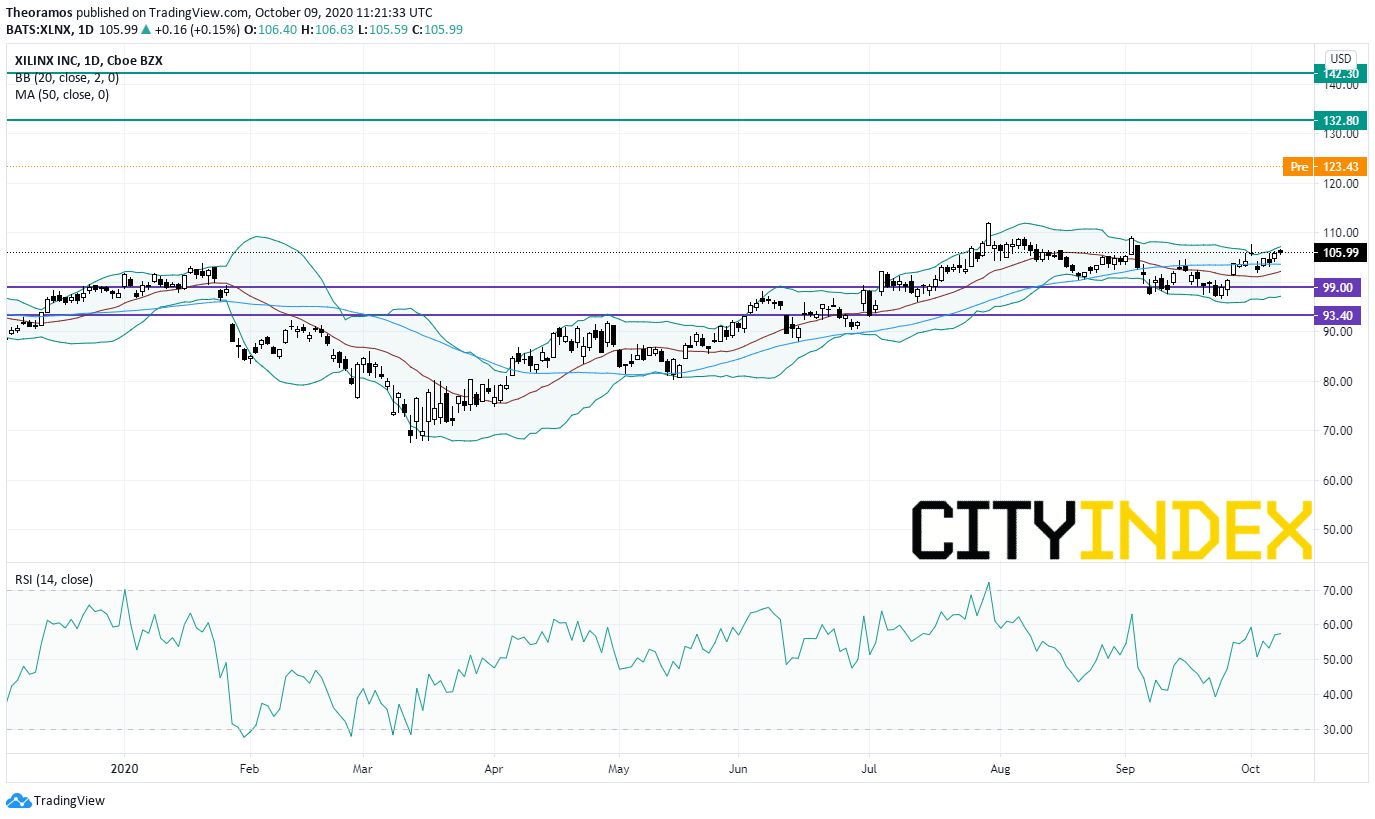

Advanced Micro Devices (AMD), a semiconductor company, is near a deal to acquire chip maker Xilinx (XLNX) for more than 30 billion dollars, reported the Wall Street Journal.

Source: TradingView, GAIN Capital

Later today, the U.S. Commerce Department will post final readings of August wholesale inventories (+0.5% on month expected).

European indices are facing a consolidation. France's INSEE has reported August industrial production at +1.3% (vs +1.7% on month expected). The U.K. Office for National Statistics has released August GDP at +2.1% (vs +4.6% on month expected), industrial production at +0.3% (vs +2.5% on month expected) and trade balance at 1.3 billion pounds surplus (vs break even expected).

Asian indices were under pressure. Japan's household spending dropped 6.9% on year in August (-6.7% expected). China's Caixin Services PMI rose to 54.8 in September (54.3 expected) from 54.0 in August.

WTI Crude Oil futures are turning down. OPEC said "worst is over for the global oil market" and predicted that the worldwide oil demand would return to the pre-crisis level in 2022. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold keeps bouncing as the U.S dollar retreats on U.S stimulus hopes.

Gold jumped 22.16 dollars (+1.17%) to 1915.98 dollars.

The dollar index fell 0.28pt to 93.323.

U.S. Equity Snapshot

Advanced Micro Devices (AMD), a semiconductor company, is near a deal to acquire chip maker Xilinx (XLNX) for more than 30 billion dollars, reported the Wall Street Journal.

Source: TradingView, GAIN Capital

NXP Semiconductors (NXPI), the tech company, soared after hours after issuing third quarter sales guidance that beat estimates.

Walmart (WMT): "Walmart Canada is seeking to immediately hire 10,000 new associates as the business grows and offers customers the very best shopping experience."Latest market news

Today 08:15 AM