US Futures still green before jobs data, watch UBER, F, TSLA, BKNG, DBX

The S&P 500 Futures remain bullish, lifted by reports which suggested that U.S. Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He will communicate on trade deal progress next week.

Later today, the official U.S. Jobs Report for April will be released, and it is widely expected that the economy cut a record 21.653 million Nonfarm Payrolls with the jobless rate surging to 16.0%. The Commerce Department will post final readings of March wholesale inventories (-1.0% on month expected).

European indices are on the upside. The German Federal Statistical Office has reported March trade balance at 17.4 billion euros surplus (vs 18.8 billion euros surplus expected).

Asian indices closed in the green. This morning, government data showed that Japan's household spending dropped 6.0% on year in March (-6.5% estimated).

WTI Crude Oil Futures are rebounding. Saudi Arabia's state oil giant Aramco raised its June crude-oil contract prices.

Gold gained 3.81 dollars (+0.22%) to 1719.87 dollars, close from a two-week high on rising prospects regarding further rate cuts by the Fed.

The US dollar is consolidating on firmer equity markets, EUR/USD rose 8pips to 1.0842 while GBP/USD gained 18pips to 1.238.

US Equity Snapshot

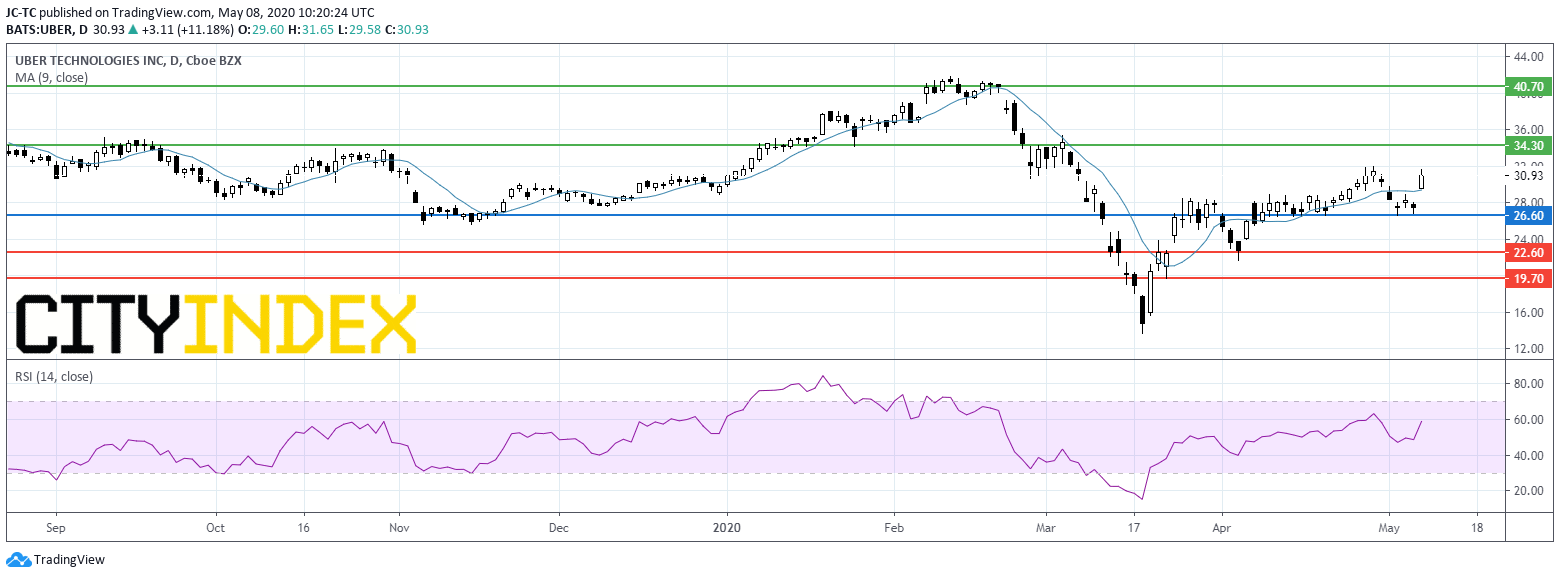

Uber Technologies (UBER), the ride-hailing company, jumped in extended trading after management team said rides business started to recover in the past three weeks. Separately, the company reported first quarter LPS down to 1.70 dollar from 2.23 dollars a year ago, on adjusted sales up to 18% of 3.26 billion dollars, above expectations. The company also posted Uber Eats bookings up 52% to of 4.68 billion dollars, above consensus.

Ford (F), the vehicle manufacturer, announced a phased restart for its operations and vehicle production in North America beginning May 18.

Tesla (TSLA), the electric-vehicle maker, might restart production at its Fremont, California, plant as soon as today, according to Bloomberg.

Booking (BKNG), the travel metasearch engine operator, announced first quarter adjusted EPS down to 3.77 dollars per share, below estimates, from 11.17 dollars a year ago, on sales down 19% to 2.29 billion dollars, above consensus. The company said room nights booked in April slumped 85%.

Dropbox (DBX), the smart workspace, unveiled first quarter net income of 39.3 million dollars, or 0.09 dollar a share, its first quarterly profit, vs a loss of 7.7 million dollars a year earlier. Sales climbed 18% to 455 million dollars, topping estimates.

Live Nation Entertainment (LYV), the largest live entertainment promoter and ticket vendor in the world, reported first quarter LPS of 0.94 dollar, a bit more than expected, vs an LPS of 0.27 dollar a year ago, on sales down to 1.4 billion dollars, in line with the consensus, from 1.7 billion dollars last year.

Fiserv (FISV), the provider of payment processing to the financial industry, announced first quarter adjusted EPS up to 0.99 dollar, as expected, from 0.84 dollar a year ago, on sales up to 3.8 billion dollars, beating forecasts, from 1.5 billion dollars a year earlier.

Later today, the official U.S. Jobs Report for April will be released, and it is widely expected that the economy cut a record 21.653 million Nonfarm Payrolls with the jobless rate surging to 16.0%. The Commerce Department will post final readings of March wholesale inventories (-1.0% on month expected).

European indices are on the upside. The German Federal Statistical Office has reported March trade balance at 17.4 billion euros surplus (vs 18.8 billion euros surplus expected).

Asian indices closed in the green. This morning, government data showed that Japan's household spending dropped 6.0% on year in March (-6.5% estimated).

WTI Crude Oil Futures are rebounding. Saudi Arabia's state oil giant Aramco raised its June crude-oil contract prices.

Gold gained 3.81 dollars (+0.22%) to 1719.87 dollars, close from a two-week high on rising prospects regarding further rate cuts by the Fed.

The US dollar is consolidating on firmer equity markets, EUR/USD rose 8pips to 1.0842 while GBP/USD gained 18pips to 1.238.

US Equity Snapshot

Uber Technologies (UBER), the ride-hailing company, jumped in extended trading after management team said rides business started to recover in the past three weeks. Separately, the company reported first quarter LPS down to 1.70 dollar from 2.23 dollars a year ago, on adjusted sales up to 18% of 3.26 billion dollars, above expectations. The company also posted Uber Eats bookings up 52% to of 4.68 billion dollars, above consensus.

Ford (F), the vehicle manufacturer, announced a phased restart for its operations and vehicle production in North America beginning May 18.

Tesla (TSLA), the electric-vehicle maker, might restart production at its Fremont, California, plant as soon as today, according to Bloomberg.

Booking (BKNG), the travel metasearch engine operator, announced first quarter adjusted EPS down to 3.77 dollars per share, below estimates, from 11.17 dollars a year ago, on sales down 19% to 2.29 billion dollars, above consensus. The company said room nights booked in April slumped 85%.

Dropbox (DBX), the smart workspace, unveiled first quarter net income of 39.3 million dollars, or 0.09 dollar a share, its first quarterly profit, vs a loss of 7.7 million dollars a year earlier. Sales climbed 18% to 455 million dollars, topping estimates.

Live Nation Entertainment (LYV), the largest live entertainment promoter and ticket vendor in the world, reported first quarter LPS of 0.94 dollar, a bit more than expected, vs an LPS of 0.27 dollar a year ago, on sales down to 1.4 billion dollars, in line with the consensus, from 1.7 billion dollars last year.

Fiserv (FISV), the provider of payment processing to the financial industry, announced first quarter adjusted EPS up to 0.99 dollar, as expected, from 0.84 dollar a year ago, on sales up to 3.8 billion dollars, beating forecasts, from 1.5 billion dollars a year earlier.

Source : TradingVIEW, Gain Capital

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM