U.S Futures still up - Watch IBM, C, REGN, LLY

The S&P 500 Futures remain on the upside after they rebounded nearly 2% yesterday. U.S President Donald Trump reversed an earlier stance and said he could sign partial fiscal stimulus bills from Congress. This helped to boost market sentiment.

Later today, the U.S. Labor Department will release initial jobless claims in the week ending October 3 (0.82 million expected).

European indices remain bullish. The German Federal Statistical Office has posted August trade balance at 12.8 billion euros surplus (vs 16 billion euros surplus expected). The Bank of France has released Industry Sentiment Indicator for September at 101 (vs 105 expected).

Asian indices closed in the green except the Hong Kong HSI.

WTI Crude Oil futures continue to rebound. Gulf of Mexico operators have shut down 80% of oil production ahead of Hurricane Delta.

Gold steadies as the U.S dollar consolidates on U.S stimulus hopes.

Gold rose 4.09 dollars (+0.22%) to 1891.51 dollars while the dollar index was almost flat at 93.678.

U.S. Equity Snapshot

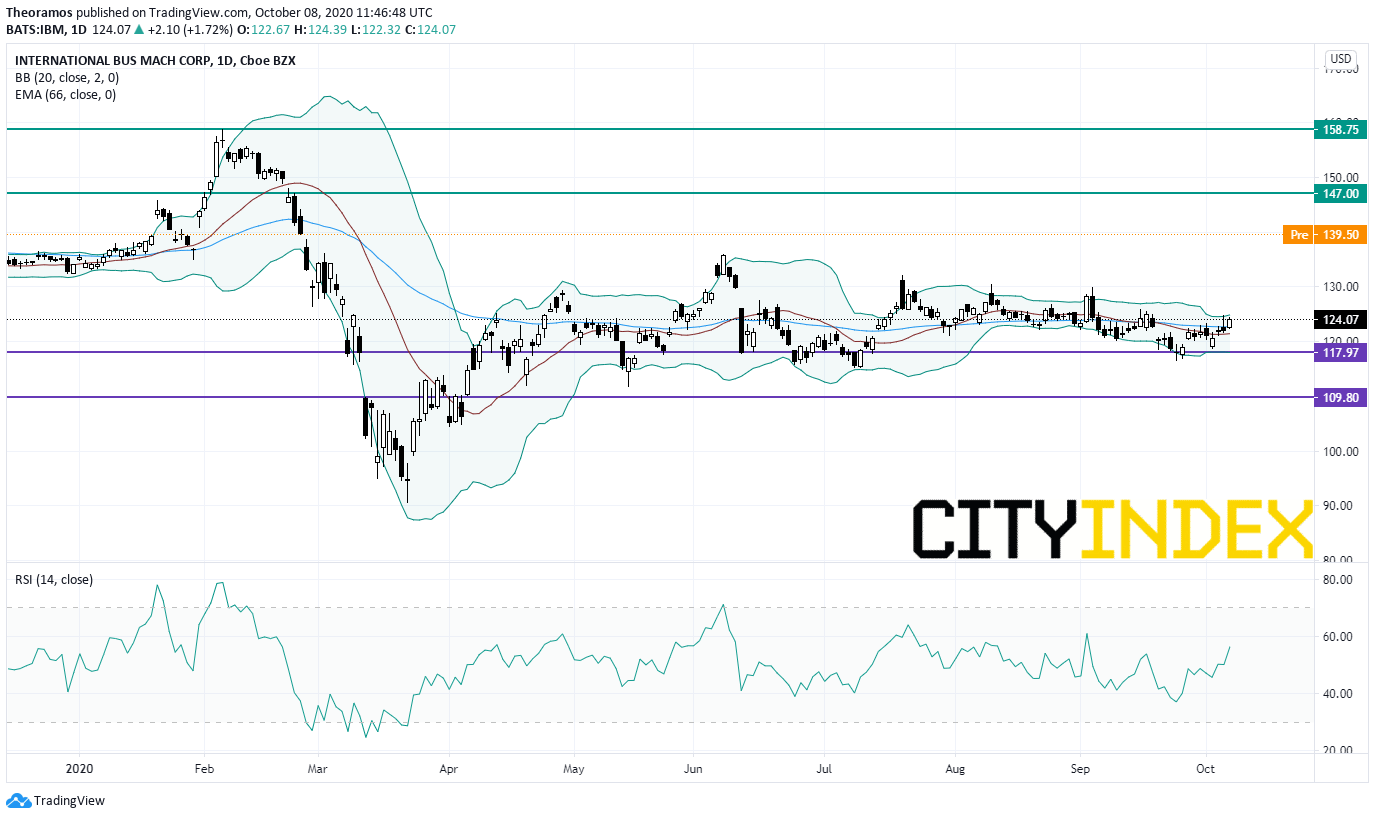

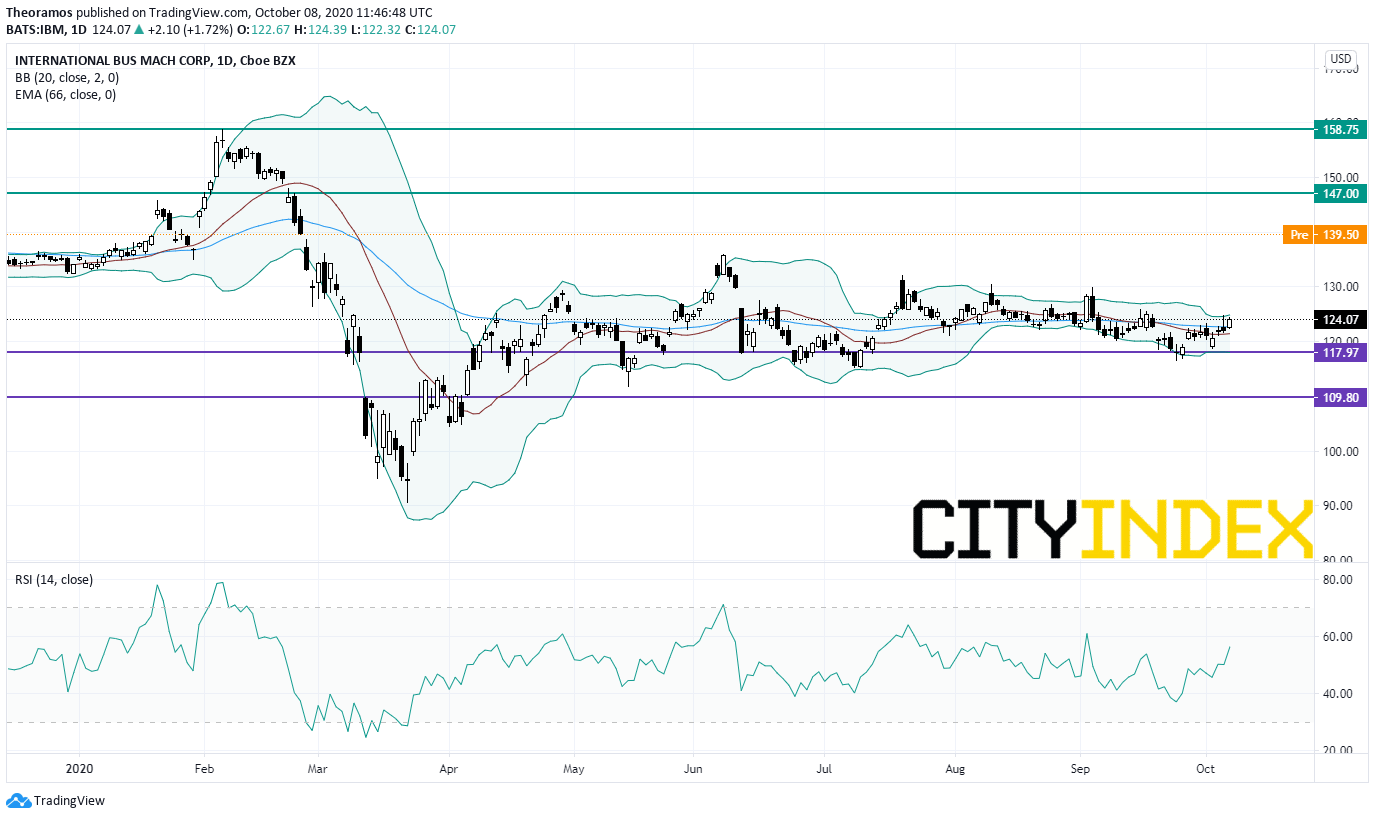

IBM (IBM), an IT company, is surging before hours after saying it "will separate its Managed Infrastructure Services unit of its Global Technology Services division into a new public company." Separately, the company expects third quarter sales and adjusted EPS in-line with current consensus.

Source: TradingView, GAIN Capital

Tesla (TSLA), the electric-vehicle maker, was upgraded to "buy" from "neutral" at New Street.

Roku (ROKU)'s, the video streaming platform, target price was raised to 255 dollars from 190 dollars at Needham.

DTE Energy (DTE), an energy company, is considering selling or spinning off its natural gas pipelines and other non-utility operations, reported Bloomberg citing people familiar with the matter.

Later today, the U.S. Labor Department will release initial jobless claims in the week ending October 3 (0.82 million expected).

European indices remain bullish. The German Federal Statistical Office has posted August trade balance at 12.8 billion euros surplus (vs 16 billion euros surplus expected). The Bank of France has released Industry Sentiment Indicator for September at 101 (vs 105 expected).

Asian indices closed in the green except the Hong Kong HSI.

WTI Crude Oil futures continue to rebound. Gulf of Mexico operators have shut down 80% of oil production ahead of Hurricane Delta.

Gold steadies as the U.S dollar consolidates on U.S stimulus hopes.

Gold rose 4.09 dollars (+0.22%) to 1891.51 dollars while the dollar index was almost flat at 93.678.

U.S. Equity Snapshot

IBM (IBM), an IT company, is surging before hours after saying it "will separate its Managed Infrastructure Services unit of its Global Technology Services division into a new public company." Separately, the company expects third quarter sales and adjusted EPS in-line with current consensus.

Source: TradingView, GAIN Capital

Citigroup (C), a banking group, was fined 400 million dollars by the Office of the U.S. Comptroller of the Currency, related to deficiencies in risk controls. The regulator said the order requires the bank to seek its non-objection before making significant new acquisitions and could implement additional business restrictions or require changes in senior management if the bank does not make sufficient progress in complying with the order. Separately, the stock was downgraded to "neutral" from "overweight" at JPMorgan

Regeneron (REGN) and Eli Lilly (LLY), the biotechs, are gaining ground before hours as the Cos asked the FDA to authorize their treatment against COVID-19 for emergency use after Donald Trump mentioned then in a video.Tesla (TSLA), the electric-vehicle maker, was upgraded to "buy" from "neutral" at New Street.

Roku (ROKU)'s, the video streaming platform, target price was raised to 255 dollars from 190 dollars at Needham.

DTE Energy (DTE), an energy company, is considering selling or spinning off its natural gas pipelines and other non-utility operations, reported Bloomberg citing people familiar with the matter.

Latest market news

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM