US Futures under pressure - Watch TSLA, ETSY, PCG, BA, AZN

The S&P 500 Futures are facing a consolidation after they were closed yesterday in observance of Labor Day.

The National Federation of Independent Business has posted its Small Business Optimism Index for August at 100.2 (vs 99.0 expected). Later today, The Federal Reserve will report July consumer credit (+12.9 billion dollars expected).

European indices are under pressure. The European Commission has reported final readings of 2Q GDP at -11.8% (vs -12.1% on quarter expected). The German Federal Statistical Office has posted July trade balance at 19.2 billion euros surplus (vs 16 billion euros surplus expected). France's INSEE has released July trade balance at 6.99 billion euros deficit, vs 4.8 billion euros deficit expected.

Asian indices all closed in the green. This morning, government data showed that Japan's final readings of 2Q annualized GDP was confirmed at -28.1% on quarter (-28.5% expected), while household spending declined 7.6% on year in July (-3.7% expected).

WTI Crude Oil futures remain on the downside. Russia's compliance with the OPEC+ oil output deal was close to 100% in August, reported Tass citing Energy Minister Alexander Novak. Societe Generale projected that Oil demands would continue to rise to normal level as economies recover. The Bank projected that Brent oil would reach $50 at the end of 2021.

Gold declined 6.73$ (-0.35%) to 1926.91, following U.S. dollar rebound.

GBP/USD fell 57pips to 1.3109 the day's range was 1.3109 - 1.3173 compared to 1.3141 - 1.3280 the previous session after British Prime Minister Boris Johnson said he planned to overturn Northern Irish border deal. He added that the country is ready to walk away if no agreement is struck by October 15.

U.S. Equity Snapshot

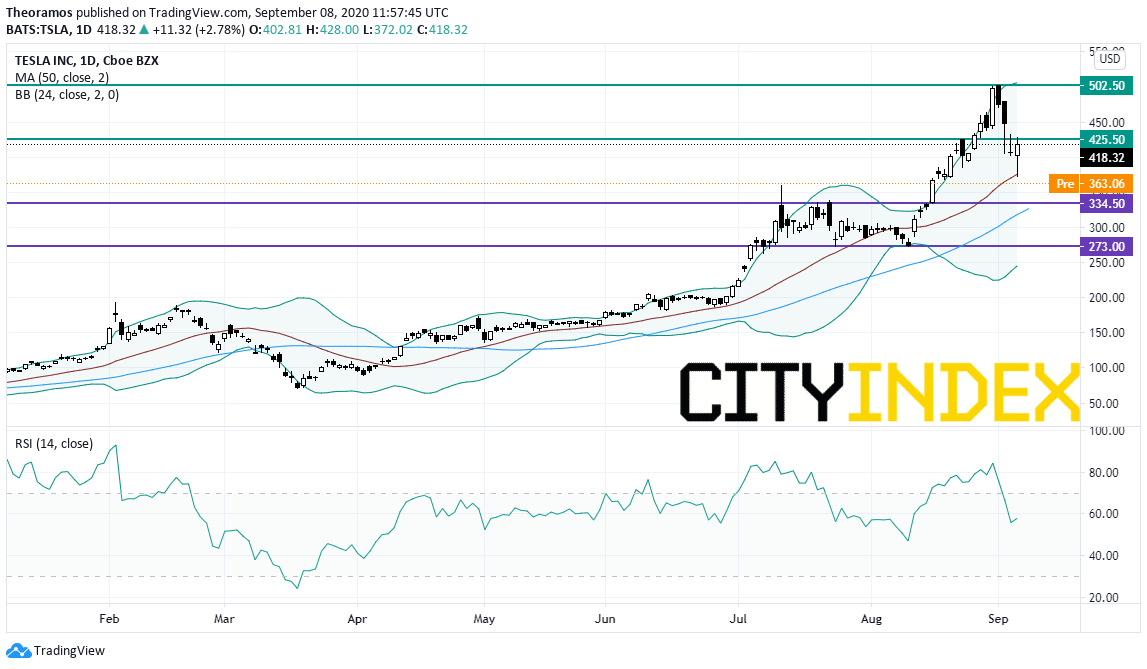

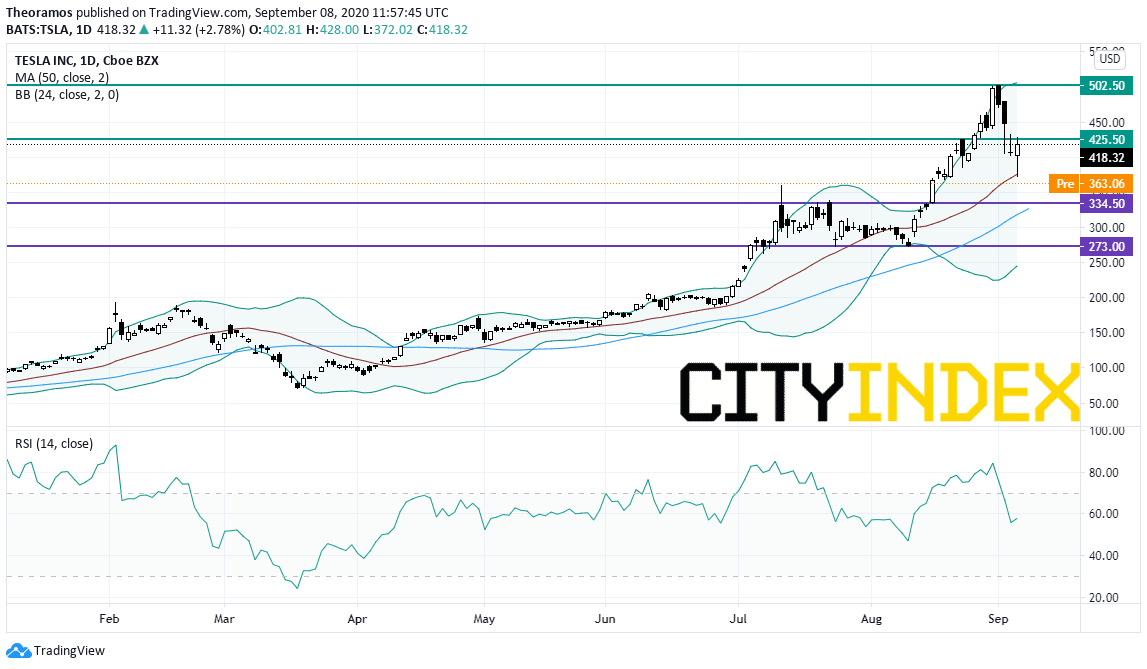

Tesla (TSLA), the electric-vehicle maker, stock dropped more than 10% Tuesday before the opening as investors were disappointed the stock not being chosen for inclusion at the latest S&P 500 reshuffle. In addition, the Co confirmed the completion of a previously announced $5 billion share sale.

Source: GAIN Capital, TradingView

PG&E (PCG), an energy company, said the public safety power shutoff starting Monday, due to a potential strong and dry offshore wind event, could impact approximately 172,000 customers in portions of 22 counties.

Boeing (BA), the commercial airplane company, is losing ground before the opening as the The Federal Aviation Administration said it was investigating manufacturing flaws involving some Boeing 787 Dreamliners but said it was too early to say if new inspections would be needed.

AstraZeneca (AZN), BioNTech SE (BNTX), GlaxoSmithKline plc (GSK), Johnson & Johnson (JNJ), Merck (MRK), Moderna, Inc. (MRNA), Novavax, Inc. (NVAX), Pfizer Inc. (PFE), and Sanofi (SNY) announced their CEOs signed a pledge "outlining a united commitment to uphold the integrity of the scientific process as they work towards potential global regulatory filings and approvals of the first COVID-19 vaccines". The Cos expect "this pledge will help ensure public confidence in the rigorous scientific and regulatory process by which COVID-19 vaccines are evaluated and may ultimately be approved."

The National Federation of Independent Business has posted its Small Business Optimism Index for August at 100.2 (vs 99.0 expected). Later today, The Federal Reserve will report July consumer credit (+12.9 billion dollars expected).

European indices are under pressure. The European Commission has reported final readings of 2Q GDP at -11.8% (vs -12.1% on quarter expected). The German Federal Statistical Office has posted July trade balance at 19.2 billion euros surplus (vs 16 billion euros surplus expected). France's INSEE has released July trade balance at 6.99 billion euros deficit, vs 4.8 billion euros deficit expected.

Asian indices all closed in the green. This morning, government data showed that Japan's final readings of 2Q annualized GDP was confirmed at -28.1% on quarter (-28.5% expected), while household spending declined 7.6% on year in July (-3.7% expected).

WTI Crude Oil futures remain on the downside. Russia's compliance with the OPEC+ oil output deal was close to 100% in August, reported Tass citing Energy Minister Alexander Novak. Societe Generale projected that Oil demands would continue to rise to normal level as economies recover. The Bank projected that Brent oil would reach $50 at the end of 2021.

Gold declined 6.73$ (-0.35%) to 1926.91, following U.S. dollar rebound.

GBP/USD fell 57pips to 1.3109 the day's range was 1.3109 - 1.3173 compared to 1.3141 - 1.3280 the previous session after British Prime Minister Boris Johnson said he planned to overturn Northern Irish border deal. He added that the country is ready to walk away if no agreement is struck by October 15.

U.S. Equity Snapshot

Tesla (TSLA), the electric-vehicle maker, stock dropped more than 10% Tuesday before the opening as investors were disappointed the stock not being chosen for inclusion at the latest S&P 500 reshuffle. In addition, the Co confirmed the completion of a previously announced $5 billion share sale.

Source: GAIN Capital, TradingView

Etsy (ETSY), a retailer of handmade goods, vintage items, and crafted goods, Teradyne (TER), an equipment manufacturer and Catalent (CTLT), a drug manufacturing company will be joining the S&P 500 index, effective Sept. 21.

PG&E (PCG), an energy company, said the public safety power shutoff starting Monday, due to a potential strong and dry offshore wind event, could impact approximately 172,000 customers in portions of 22 counties.

Boeing (BA), the commercial airplane company, is losing ground before the opening as the The Federal Aviation Administration said it was investigating manufacturing flaws involving some Boeing 787 Dreamliners but said it was too early to say if new inspections would be needed.

AstraZeneca (AZN), BioNTech SE (BNTX), GlaxoSmithKline plc (GSK), Johnson & Johnson (JNJ), Merck (MRK), Moderna, Inc. (MRNA), Novavax, Inc. (NVAX), Pfizer Inc. (PFE), and Sanofi (SNY) announced their CEOs signed a pledge "outlining a united commitment to uphold the integrity of the scientific process as they work towards potential global regulatory filings and approvals of the first COVID-19 vaccines". The Cos expect "this pledge will help ensure public confidence in the rigorous scientific and regulatory process by which COVID-19 vaccines are evaluated and may ultimately be approved."

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM