US Futures rebounding ahead of jobless claims data, watch PYPL, BMY, DXCM, DPZ

Later today, the U.S. Labor Department will report Initial Jobless Claims for the week ended May 2 (3.000 million expected).

European indices are on the upside. The German Federal Statistical Office has reported March industrial production at -9.2% (vs -7.4% on month expected). France's INSEE has posted March industrial production at -16.2% (vs -12.4% on month expected) and manufacturing production at -18.2% (vs -16.0% expected). March Trade balance was released at 3.3 billion euros deficit vs 4 billion euros deficit expected. The Bank of England has maintained its interest rates at 0.10%, as expected.

Asian indices have closed in the red. This morning, government data showed that China's exports grew 3.5% on year in April (-11.0% expected), while imports dropped 14.2% (-10.0% expected). Also, China's Caixin Services PMI rose to 44.4 in April (50.1 expected) from 43.0 in March.

WTI Crude Oil Futures are slightly bullish. The U.S. Energy Information Administration reported a build of 4.6 million barrels in crude-oil stockpiles for week ended May 1, less than an addition of 7.4 million barrels expected. Besides, U.S. oil production dropped 11.9M b/d from 12.1M b/d in the prior-period.

Gold rose 8.59 dollars (+0.51%) to 1694.3, still firm on economic fears.

On the forex front, GBP/USD gained 12pips to 1.2362, gaining some ground following the BoE decision.

The US dollar remains strong against other major currencies, as weak economic growth is supporting the greenback. EUR/USD fell 4pips to 1.0791 while USD/JPY rose 44pips to 106.56.

US Equity Snapshot

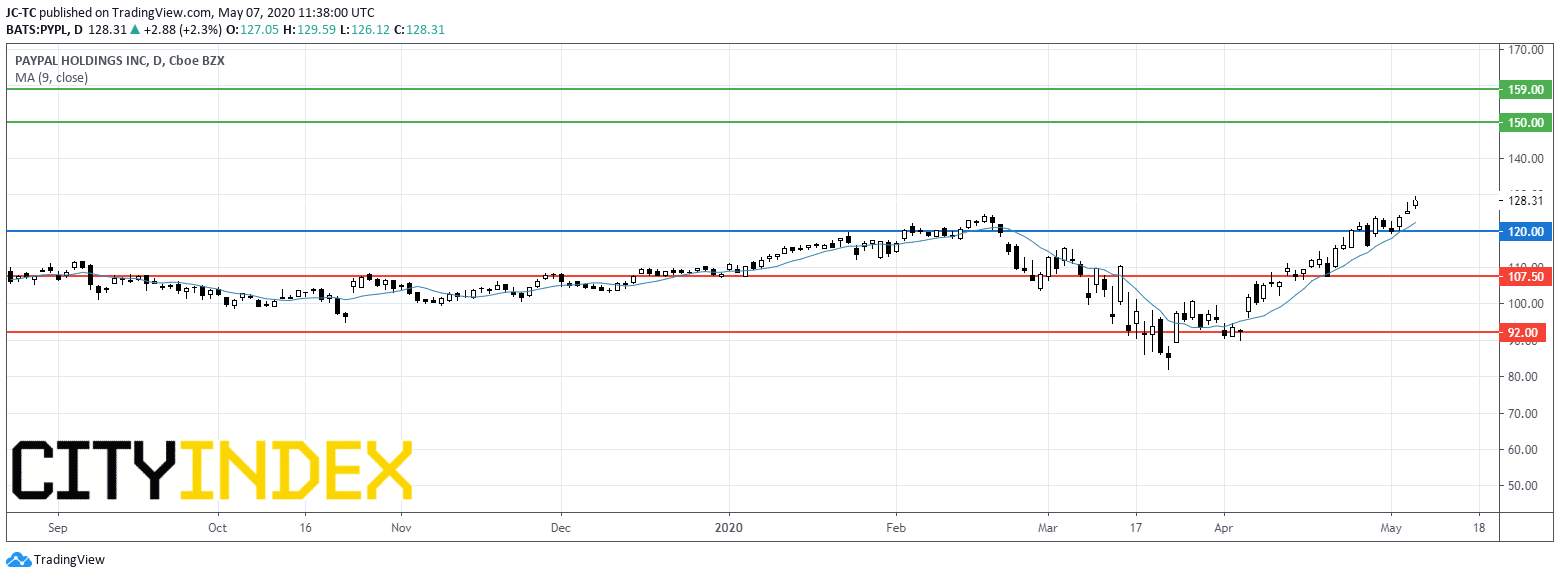

PayPal (PYPL), the online payment firm, surged after hours after saying it saw a strong improvement regarding its numbers in April. Separately, the company announced first quarter EPS down to 0.66 dollar, missing estimates, from 0.78 dollar a year ago, on sales up to 4.6 billion dollars, just below forecasts, from 4.1 billion dollars a year earlier.

Bristol-Myers Squibb (BMY), the biopharma company, posted first quarter adjusted EPS up to 1.72 dollar from 1.10 dollar a year earlier, exceeding forecasts, and confirmed full year adjusted EPS guidance.

MetLife (MET), the global insurance firm, released first quarter adjusted EPS up to 1.58 dollar, beating estimates, from 1.48 dollar a year ago.

DexCom (DXCM), the continuous glucose monitoring systems manufacturer, and Domino's Pizza (DPZ), a pizza delivery company, will replace Allergan (AGN) and Capri (CPRI) in the S&P 500 Index effective prior to the opening on May 12, according to the S&P Dow Jones Indices.

UnitedHealth Group (UNH), the private health insurance provider, "will provide more than 1.5 billion dollars in initial assistance, including customer premium rebates, to its customers".

Fox (FOXA), the entertainment company, posted third quarter adjusted EPS up to 0.93 dollar, above estimates, from 0.76 dollar a year earlier. Sales increased 25% to 3.44 billion dollars.

Lyft (LYFT), the ridesharing company, soared in extended trading after unveiling first quarter sales up 23% to 955.7 million dollars, above estimates.

Peloton Interactive (PTON), the interactive fitness platform, is expected to jump after posting better than expected quarterly sales up 66% to 525 million dollars.