U.S Futures gaining ground - Watch LEVI, TSLA, UAL

The S&P 500 Futures are posting a rebound after they ended in negative territory yesterday. U.S President Donald Trump announced he was halting negotiations with lawmakers on an economic stimulus bill, adding: "Immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business." Thereafter, the market erased earlier gains and took a nosedive about an hour before the close.

Later today, the U.S. Federal Reserve will release its latest FOMC meeting minutes.

European indices are consolidating. The German Federal Statistical Office has posted August industrial production at -0.2% (vs +1.5% on month expected).

Asian indices closed on the upside except the Japanese Nikkei which ended slightly in the red.

WTI Crude Oil futures are facing a consolidation. The U.S. Energy Information Administration (EIA) slightly raised 2021 crude oil production forecast to 11.09M b/d from 11.08M b/d, while 2021 crude oil forecast prices is lowered to $44.72 from $45.07 in the previous projection.

U.S. Equity Snapshot

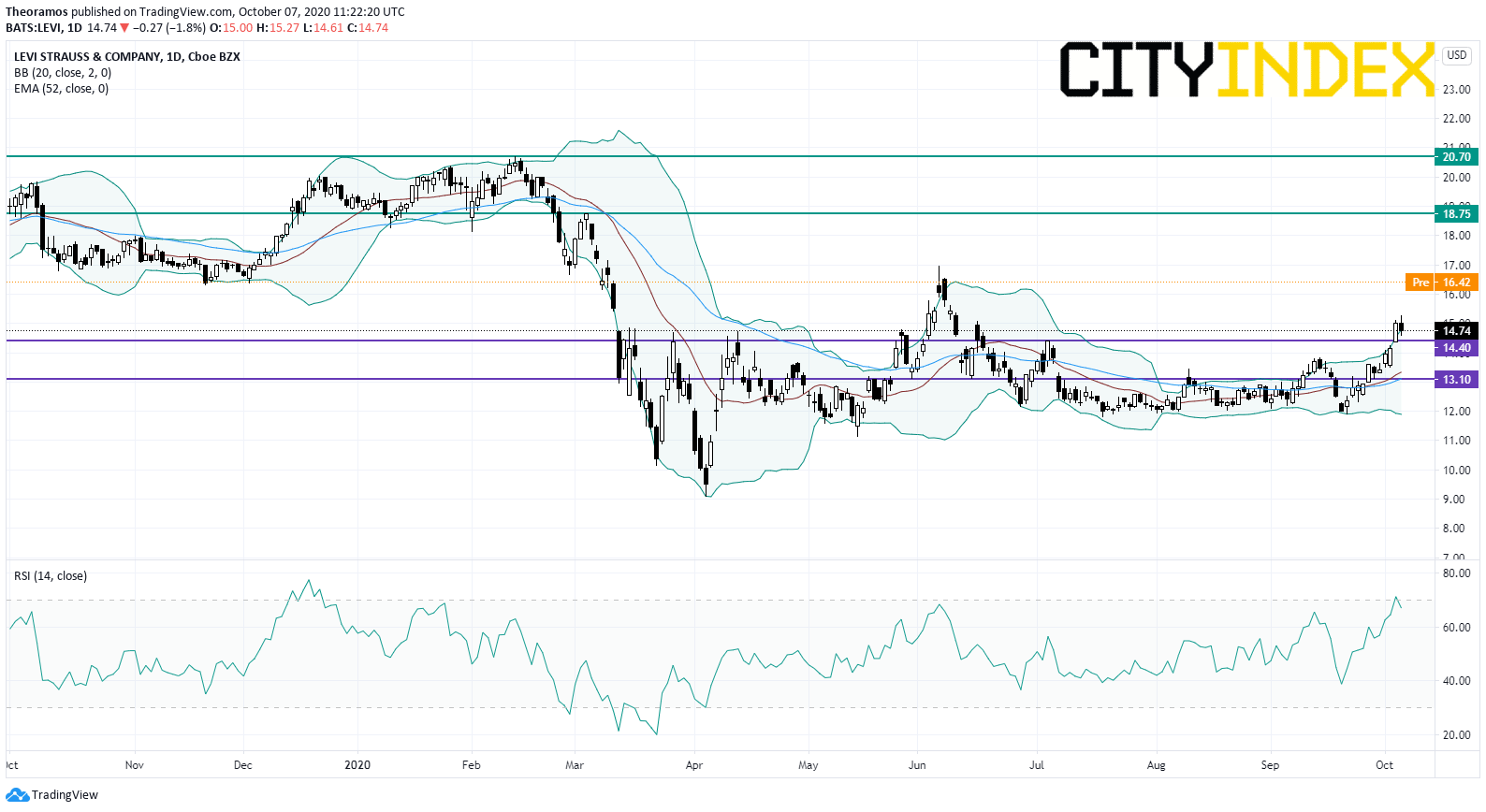

Levi Strauss (LEVI), a designer and seller of a variety of clothing products, reported third quarter adjusted EPS of 0.08 dollar, beating estimates, down from 0.31 dollar a year earlier, on net sales of 1.1 billion dollars, better than expected, down from 1.4 billion dollars a year earlier.

Source: TradingView, GAIN Capital

Tesla (TSLA), the electric-vehicle maker, is in talks with mining company BHP on a nickel-supply deal, according to Bloomberg.

United Airlines (UAL) was upgraded to "overweight" from "neutral" at JPMorgan.

Gap (GPS), an apparel retailer, was upgraded to "overweight" from "underweight" at Barclays.

Foot Locker (FL), a global athletic footwear and apparel retailer, was upgraded to "overweight" from "equal-weight" at Barclays.

Later today, the U.S. Federal Reserve will release its latest FOMC meeting minutes.

European indices are consolidating. The German Federal Statistical Office has posted August industrial production at -0.2% (vs +1.5% on month expected).

Asian indices closed on the upside except the Japanese Nikkei which ended slightly in the red.

WTI Crude Oil futures are facing a consolidation. The U.S. Energy Information Administration (EIA) slightly raised 2021 crude oil production forecast to 11.09M b/d from 11.08M b/d, while 2021 crude oil forecast prices is lowered to $44.72 from $45.07 in the previous projection.

Gold slightly rebounds after hitting a one-week low as U.S dollar remains firms on U.S stimulus delay.

Gold rose 7.89 dollars (+0.42%) to 1886.07.

The dollar index gained 0.06pt to 93.747.

U.S. Equity Snapshot

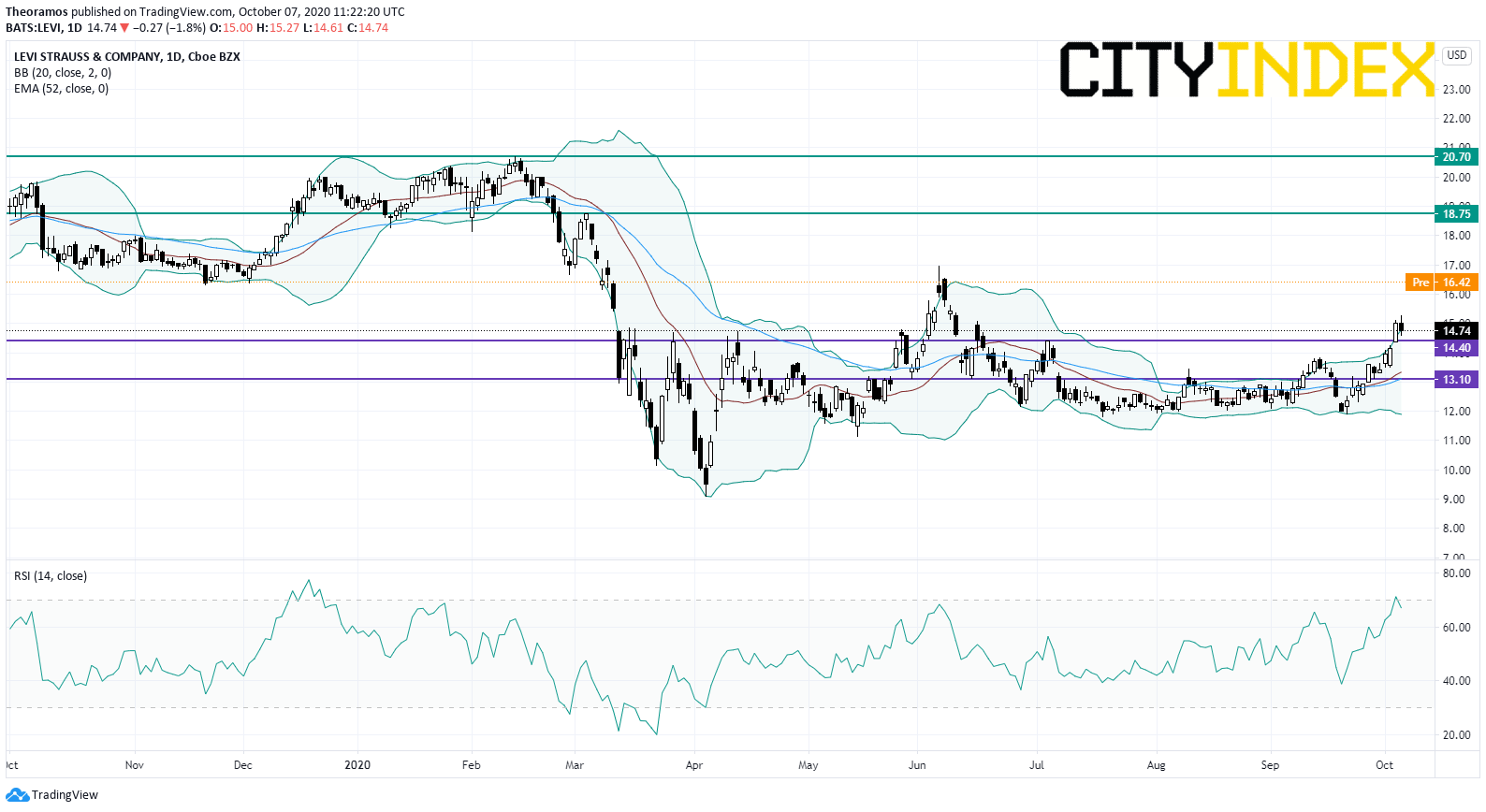

Levi Strauss (LEVI), a designer and seller of a variety of clothing products, reported third quarter adjusted EPS of 0.08 dollar, beating estimates, down from 0.31 dollar a year earlier, on net sales of 1.1 billion dollars, better than expected, down from 1.4 billion dollars a year earlier.

Source: TradingView, GAIN Capital

Tesla (TSLA), the electric-vehicle maker, is in talks with mining company BHP on a nickel-supply deal, according to Bloomberg.

United Airlines (UAL) was upgraded to "overweight" from "neutral" at JPMorgan.

Gap (GPS), an apparel retailer, was upgraded to "overweight" from "underweight" at Barclays.

Foot Locker (FL), a global athletic footwear and apparel retailer, was upgraded to "overweight" from "equal-weight" at Barclays.

Latest market news

Today 08:33 AM