EU indices mixed | TA focus on Continental

INDICES

Yesterday, European stocks were slightly up. The Stoxx Europe 600 Index closed flat+, Germany's DAX 30 gained 0.61%, France's CAC 40 added 0.48% and the U.K.'s FTSE 100 was up 0.12%.

EUROPE ADVANCE/DECLINE

56% of STOXX 600 constituents traded higher yesterday.

67% of the shares trade above their 20D MA vs 61% Monday (above the 20D moving average).

60% of the shares trade above their 200D MA vs 58% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.06pt to 25.21, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Media

3mths relative low: Energy

Europe Best 3 sectors

3mths relative high: Media, Industrial

3mths relative low: none

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 0bp to -19bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Aug Industrial Production MoM, exp.: 1.2%

FR 07:45: Aug Current Account, exp.: E-6.2B

FR 07:45: Aug Balance of Trade, exp.: E-6.99B

UK 08:30: Sep Halifax House Price Idx MoM, exp.: 1.6%

UK 08:30: Sep Halifax House Price Idx YoY, exp.: 5.2%

EC 09:00: ECB Non-Monetary Policy Meeting

UK 09:30: Q2 Labour Productivity QoQ final, exp.: -1.3%

GE 10:40: 10-Year Bund auction, exp.: -0.5%

EC 13:10: ECB President Lagarde speech

MORNING TRADING

In Asian trading hours, EUR/USD slipped to 1.1730 while GBP/USD remained subdued at 1.2885 USD/JPY was little changed at 105.67.

Spot gold rebounded slightly to $1,881 an ounce.

#UK - IRELAND#

TUI, a travel and tourism company, announced that Sebastian Ebel, currently an executive board member, will succeed Brigit Conix as CFO with effect from January 1, 2021.

BHP Group, a giant metal group, is in talks with Tesla over a nickel supply deal, reported Bloomberg citing people familiar with the matter.

Glencore, a commodity trading and mining company, was upgraded to "neutral" from "underweight" at JPMorgan.

#GERMANY#

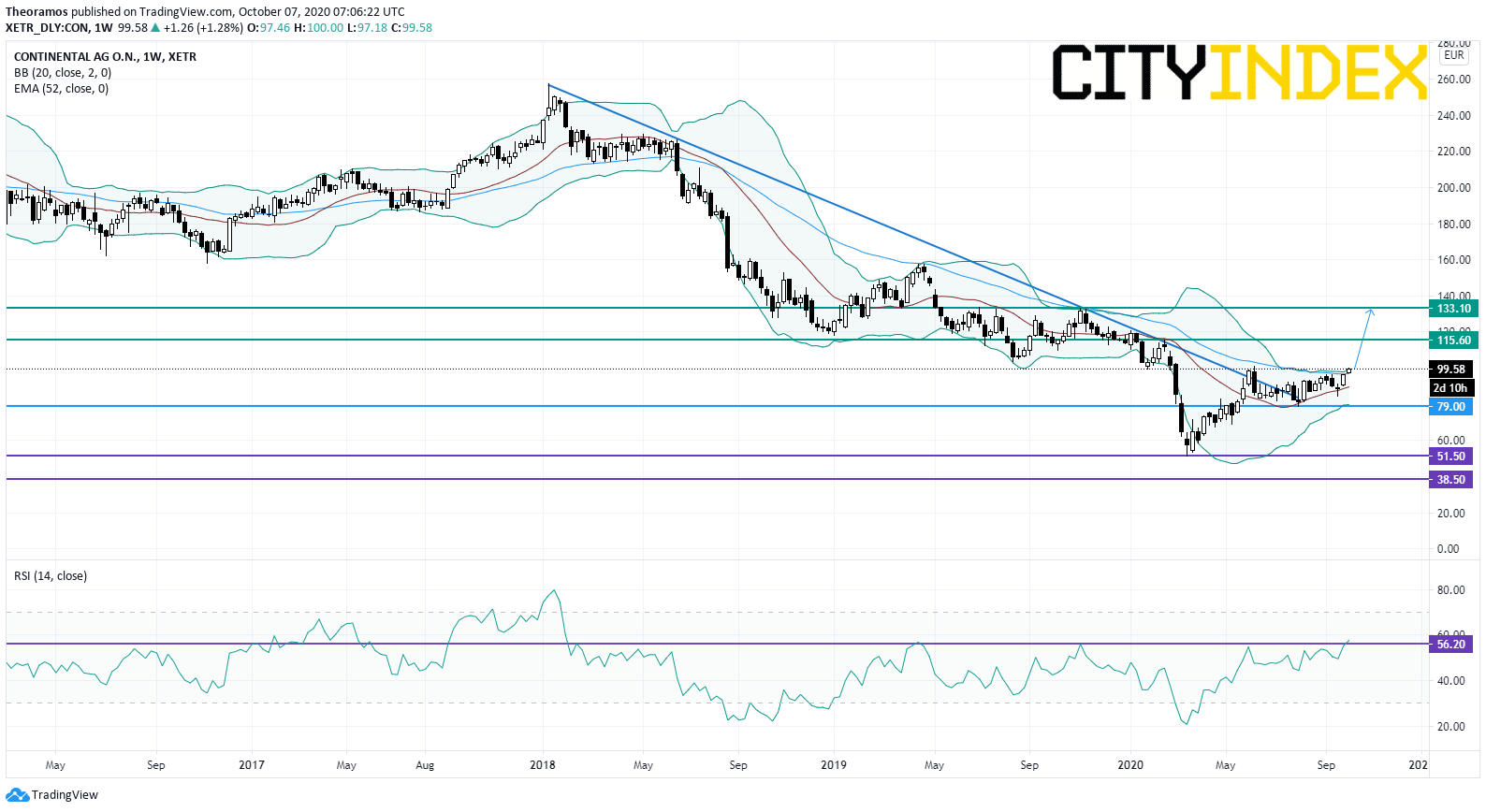

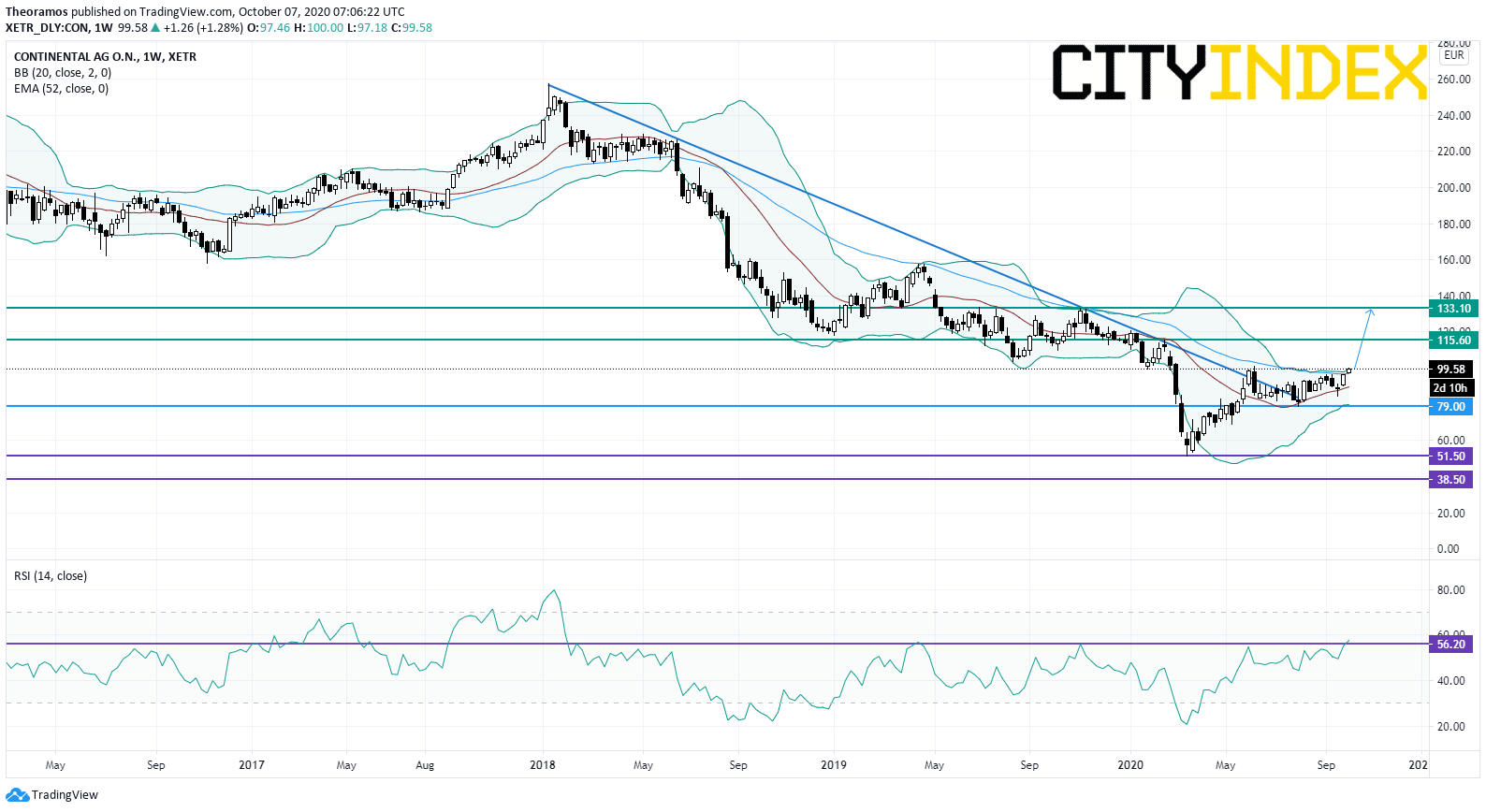

Continental, an automotive parts manufacturer, may sell some of its divisions as part of a restructuring plan, according to newspaper Frankfurter Allgemeine Zeitung.

From a weekly point of view, the stock has broken above a declining trend line drawn since January 2018. In addition, the share is trading above its one-year exponential moving average, while the Relative Strength Index crossed a strong resistance at 56.2%. Above the support at 79E, targets are set at the horizontal resistance at 115.6E and 133.1E in extension.

#SPAIN#

Amadeus, a Spanish IT service provider, was downgraded to "reduce" from "buy" at HSBC.

#ITALY#

Telecom Italia's, a telecommunications group, "BB+" credit rating outlook was revised to "Negative" from "Stable" by S&P Global Ratings. The rating agency said: "We expect lower revenue and earnings at Telecom Italia (TIM) will cause S&P Global Ratings-adjusted leverage to rise to 4.2x in 2020, outside our trigger for the rating."

#SWITZERLAND#

Sika, a specialty chemical company, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Yesterday, European stocks were slightly up. The Stoxx Europe 600 Index closed flat+, Germany's DAX 30 gained 0.61%, France's CAC 40 added 0.48% and the U.K.'s FTSE 100 was up 0.12%.

EUROPE ADVANCE/DECLINE

56% of STOXX 600 constituents traded higher yesterday.

67% of the shares trade above their 20D MA vs 61% Monday (above the 20D moving average).

60% of the shares trade above their 200D MA vs 58% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.06pt to 25.21, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Media

3mths relative low: Energy

Europe Best 3 sectors

3mths relative high: Media, Industrial

3mths relative low: none

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 0bp to -19bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Aug Industrial Production MoM, exp.: 1.2%

FR 07:45: Aug Current Account, exp.: E-6.2B

FR 07:45: Aug Balance of Trade, exp.: E-6.99B

UK 08:30: Sep Halifax House Price Idx MoM, exp.: 1.6%

UK 08:30: Sep Halifax House Price Idx YoY, exp.: 5.2%

EC 09:00: ECB Non-Monetary Policy Meeting

UK 09:30: Q2 Labour Productivity QoQ final, exp.: -1.3%

GE 10:40: 10-Year Bund auction, exp.: -0.5%

EC 13:10: ECB President Lagarde speech

MORNING TRADING

In Asian trading hours, EUR/USD slipped to 1.1730 while GBP/USD remained subdued at 1.2885 USD/JPY was little changed at 105.67.

Spot gold rebounded slightly to $1,881 an ounce.

#UK - IRELAND#

TUI, a travel and tourism company, announced that Sebastian Ebel, currently an executive board member, will succeed Brigit Conix as CFO with effect from January 1, 2021.

BHP Group, a giant metal group, is in talks with Tesla over a nickel supply deal, reported Bloomberg citing people familiar with the matter.

Glencore, a commodity trading and mining company, was upgraded to "neutral" from "underweight" at JPMorgan.

#GERMANY#

Continental, an automotive parts manufacturer, may sell some of its divisions as part of a restructuring plan, according to newspaper Frankfurter Allgemeine Zeitung.

From a weekly point of view, the stock has broken above a declining trend line drawn since January 2018. In addition, the share is trading above its one-year exponential moving average, while the Relative Strength Index crossed a strong resistance at 56.2%. Above the support at 79E, targets are set at the horizontal resistance at 115.6E and 133.1E in extension.

Source: TradingView, GAIN Capital

Hapag-Lloyd, a shipping and container transportation company, was upgraded to "buy" from "hold" at Deutsche Bank.#SPAIN#

Amadeus, a Spanish IT service provider, was downgraded to "reduce" from "buy" at HSBC.

#ITALY#

Telecom Italia's, a telecommunications group, "BB+" credit rating outlook was revised to "Negative" from "Stable" by S&P Global Ratings. The rating agency said: "We expect lower revenue and earnings at Telecom Italia (TIM) will cause S&P Global Ratings-adjusted leverage to rise to 4.2x in 2020, outside our trigger for the rating."

#SWITZERLAND#

Sika, a specialty chemical company, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM