US Futures rising, watch UBER, D, INTC, NFLX

European indices are sharply up, gaining more than 1.5% on average. On the statistical front, in the euro-zone, retail sales rebounded in May by 17.8%, more than expected, after falling by 12.1% the previous month (revised from -11.7%). On the other hand, the Sentix Euro-Zone Investor Sentiment Index rose less than expected from -24.8 in June to -18.2 in July. In Germany, industrial orders rebounded by 10.4% in May (less than the +15% expected), after a 26.2% drop in April (revised from -25.8%). On the other hand, the PMI construction index rose to 41.3 in June from 40.1 in May. In Great Britain, the PMI Construction Index rebounded to 55.3 in June after reaching 28.9 in May. It was expected to reach 46.0.

Asian indices traded significantly higher except the Australian ASX 200 losing 0.71 % as the most-populous states decided to close their borders from Tuesday night as authorities take measures to control a coronavirus outbreak in the city of Melbourne. On the other side, the China Mainland CSI 300 recorded its biggest rally since 2015, rocketing 5.67% after closing on Friday at a 5-year high. The Chinese index is now up 14% year to date. The Japanese Nikkei added 1.83% and Hong Kong HSI rose 3.81%.

WTI Crude Oil futures rose during Asian trading hours. Kazakhstan's Energy Ministry said the country produced 5.3M tons of oil in June, with output cut compliance reaching 105%.

Gold remains firms on COVID-19 fears. Gold rose 5.27 dollars (+0.3%) to 1777.32 dollars.

Risk currencies gain ground on rallying equities. EUR/USD gained 66pips to 1.1314 while GBP/USD rose 24pips to 1.2507.

US Equity Snapshot

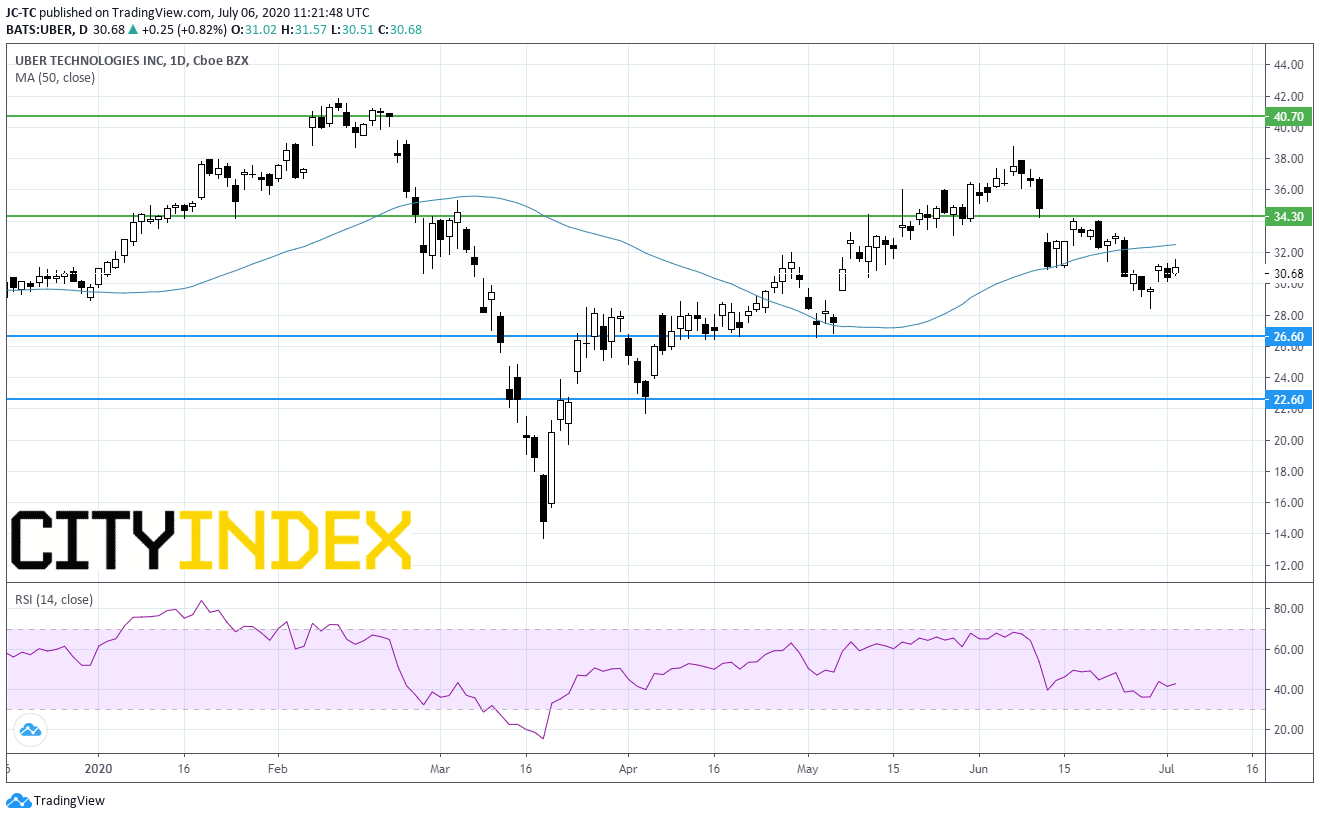

Uber Technologies (UBER), a ride-hailing company, has agreed to buy American food delivery company Postmates in a 2.65 billion dollars deal, reported Bloomberg citing people familiar with the matter.

Dominion Energy (D), an electricity and natural gas supplier, announced that it has agreed to sell all of its Gas Transmission & Storage segment assets to Berkshire Hathaway (BRK-A) in a transaction valued at 9.7 billion dollars. The company said it has authorized a share repurchase of up to 3 billion dollars using after-tax adjusted transaction proceeds. Separately, the company and Duke Energy (DUK) announced the cancellation of the Atlantic Coast Pipeline "due to ongoing delays and increasing cost uncertainty which threaten the economic viability of the project". Separately, Duke Energy announced a 56 billion dollars 5-year capital investment plan, "advancing its ambitious clean energy goals without the Atlantic Coast Pipeline by investing in renewables, battery storage, energy efficiency programs and grid projects".

Intel (INTC), a designer and manufacturer of microprocessors, was downgraded to "sell" from "neutral" at Goldman Sachs.

Netflix (NFLX), the video streaming service, was downgraded to "in-line" from "outperform" at Imperial Capital.

Spotify (SPOT), the music streaming specialist, was downgraded to "underperform" from "market perform" at Bernstein.

Tesla (TSLA)'s, the electric-vehicle maker, price target was raised to 1,500 dollars from 1,050 dollars at JMP Securities.

Source : TradingVIEW, Gain Capital