The S&P 500 Futures remain on the upside as market sentiment kept improving along with countries and U.S. states easing their coronavirus-induced restrictions. U.S. President Donald Trump said the White House coronavirus task force will wind down as the country moves into a second phase that focuses on the aftermath of the outbreak.

European indices are mixed. Following the German Constitutional Court decision, European Commission spokesman Eric Mamer said: "Notwithstanding the analysis of the decision of the German Constitutional Court today, we reaffirm the primacy of E.U. law." Research firm Markit has published final readings of April Services PMI for the eurozone at 12.0 (vs 11.7 expected), for Germany at 16.2 (vs 15.9 expected) and for France at 10.2 (vs 10.4 expected). The Markit U.K. Construction PMI for April has also been released at 8.2 (vs 21.7 expected). The European Commission has posted March retail sales at -11.2% (vs -10.6% on month expected). The German Federal Statistical Office has reported March factory orders at -15.6% (vs -10.0% on month expected). The European Union is forecasting a 7.7% GDP drop in 2020 before a 6.3% rebound in 2021.

Asian indices closed slightly in the green. Japan is still closed.

WTI Crude Oil Futures are still up after a big rally yesterday. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 8.4 million barrels for week ended May 1. Later today, The U.S. Energy Information Administration (EIA) will release crude oil inventories data for last week.

Gold lost ground while the US dollar climbed to its highest level on more than a week as some countries are trying to ease lockdowns.

Gold fell 4.25 dollars (-0.25%) to 1701.68 dollars. EUR/USD declined 32pips to 1.0808 and GBP/USD dropped 63pips to 1.2372.

US Equity Snapshot

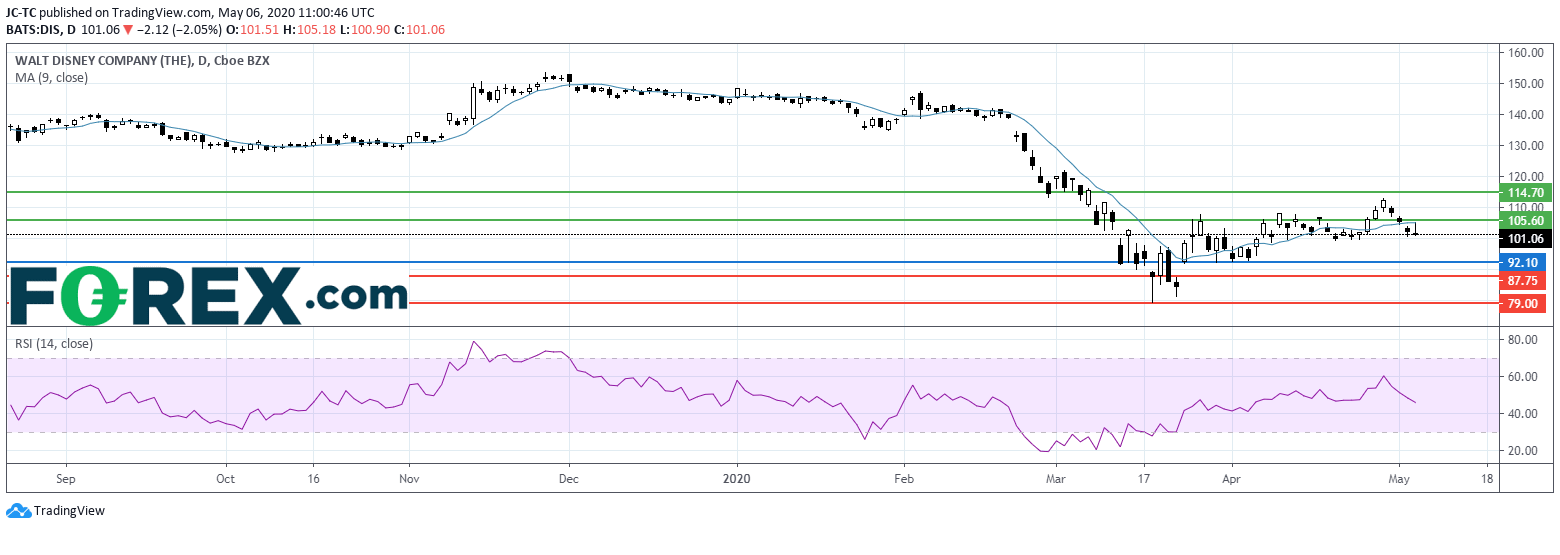

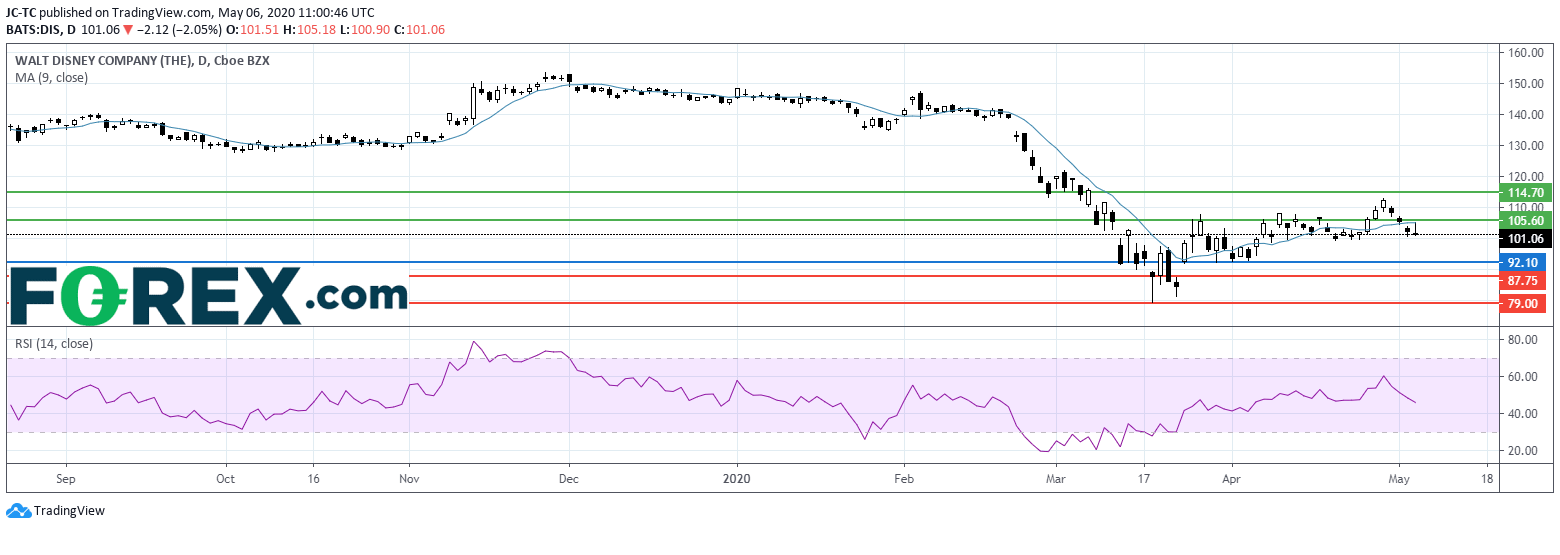

Walt Disney (DIS), the entertainment and media giant, lost some ground in extended trading after releasing second quarter adjusted EPS of down to 0.60 dollar, well below estimates, from 1.61 dollar a year ago on revenue up to 18.0 billion dollars, slightly above consensus, from 14.9 billion dollars last year. The company plans to reopen the Disneyland Park at Shanghai on May 11.

General Motors (GM), is surging before hours after reporting better than expected first quarter EPS of 0.62 dollar vs 1.41 dollar a year earlier. Sales were down 6.2% to 32.7 billion dollars but also beat estimates. Truck sales in the US jumped 27%. Separately, the company may seek a 2 billion dollars additional loan to increase liquidity amid coronavirus pandemic, reported Bloomberg.

Shopify (SHOP), a leading global commerce company, released first quarter sales up 47% to 470 million dollars, above estimates.

CVS (CVS), the pharmacy and healthcare company, is gaining ground before hours after posting better than expected quarterly profit and sales. The company confirmed its full year outlook.

Occidental Petroleum (OXY), the energy exploration and production company, announced first quarter adjusted LPS of 0.52 dollar, lower than expected, vs an EPS of 0.84 dollar a year ago on revenue up to 6.5 billion dollars, better than anticipated, from 4.0 billion dollars in the prior-year period. The company withdraws full year guidance.

Activision Blizzard (ATVI), one of the world's largest video game publishers, posted first quarter adjusted EPS up to 0.58 dollar, exceeding forecasts, from 0.31 dollar a year ago on revenue up to 1.5 billion dollars, higher than expected, from 1.3 billion dollars in the previous year. Those figures send the shares higher after hours.

Source : TradingVIEW, Gain Capital

Source : TradingVIEW, Gain Capital

The Automatic Data Processing (ADP) released April private jobs report at -20.24 million vs -20.55 million expected.

European indices are mixed. Following the German Constitutional Court decision, European Commission spokesman Eric Mamer said: "Notwithstanding the analysis of the decision of the German Constitutional Court today, we reaffirm the primacy of E.U. law." Research firm Markit has published final readings of April Services PMI for the eurozone at 12.0 (vs 11.7 expected), for Germany at 16.2 (vs 15.9 expected) and for France at 10.2 (vs 10.4 expected). The Markit U.K. Construction PMI for April has also been released at 8.2 (vs 21.7 expected). The European Commission has posted March retail sales at -11.2% (vs -10.6% on month expected). The German Federal Statistical Office has reported March factory orders at -15.6% (vs -10.0% on month expected). The European Union is forecasting a 7.7% GDP drop in 2020 before a 6.3% rebound in 2021.

Asian indices closed slightly in the green. Japan is still closed.

WTI Crude Oil Futures are still up after a big rally yesterday. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 8.4 million barrels for week ended May 1. Later today, The U.S. Energy Information Administration (EIA) will release crude oil inventories data for last week.

Gold lost ground while the US dollar climbed to its highest level on more than a week as some countries are trying to ease lockdowns.

Gold fell 4.25 dollars (-0.25%) to 1701.68 dollars. EUR/USD declined 32pips to 1.0808 and GBP/USD dropped 63pips to 1.2372.

US Equity Snapshot

Walt Disney (DIS), the entertainment and media giant, lost some ground in extended trading after releasing second quarter adjusted EPS of down to 0.60 dollar, well below estimates, from 1.61 dollar a year ago on revenue up to 18.0 billion dollars, slightly above consensus, from 14.9 billion dollars last year. The company plans to reopen the Disneyland Park at Shanghai on May 11.

General Motors (GM), is surging before hours after reporting better than expected first quarter EPS of 0.62 dollar vs 1.41 dollar a year earlier. Sales were down 6.2% to 32.7 billion dollars but also beat estimates. Truck sales in the US jumped 27%. Separately, the company may seek a 2 billion dollars additional loan to increase liquidity amid coronavirus pandemic, reported Bloomberg.

Shopify (SHOP), a leading global commerce company, released first quarter sales up 47% to 470 million dollars, above estimates.

CVS (CVS), the pharmacy and healthcare company, is gaining ground before hours after posting better than expected quarterly profit and sales. The company confirmed its full year outlook.

Occidental Petroleum (OXY), the energy exploration and production company, announced first quarter adjusted LPS of 0.52 dollar, lower than expected, vs an EPS of 0.84 dollar a year ago on revenue up to 6.5 billion dollars, better than anticipated, from 4.0 billion dollars in the prior-year period. The company withdraws full year guidance.

Activision Blizzard (ATVI), one of the world's largest video game publishers, posted first quarter adjusted EPS up to 0.58 dollar, exceeding forecasts, from 0.31 dollar a year ago on revenue up to 1.5 billion dollars, higher than expected, from 1.3 billion dollars in the previous year. Those figures send the shares higher after hours.

Source : TradingVIEW, Gain Capital

Source : TradingVIEW, Gain Capital

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM