US Futures sliding - Watch BHC, BMY, MET, AIG, WDC

Later today, the U.S. Labor Department will report Initial Jobless Claims (an increase to 1.4 million for the week ended August 1 expected).

European indices are back in the red after a positive open in a volatile session. June German Factory Orders were released at +27.9%, much better than +10.1% expected. In the U.K., the BoE has kept its interest rates and Quantitative Easing at GBP 745 billion unchanged, as expected.

Asian indices closed in dispersed order as the Japanese Nikkei and the Hong Kong HSI ended in the red whereas the Australian ASX and the Chinese CSI closed on the upside.

WTI Crude Oil futures are on the downside. The U.S. Energy Information Administration reported that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 7.4 million barrels from the previous week to 518.6 million barrels for week ended July 31. Meanwhile, U.S. oil production declined to 11.0 million barrels/day (b/d) from 11.1M b/d.

Gold posts new record highs on pessimistic economic outlook.

Gold jumped 23.62 dollars (+1.16%) to 2061.74 dollars.

GBP/USD gained 39pips to 1.3153 as BoE raised its FY growth outlook.

U.S. Equity Snapshot

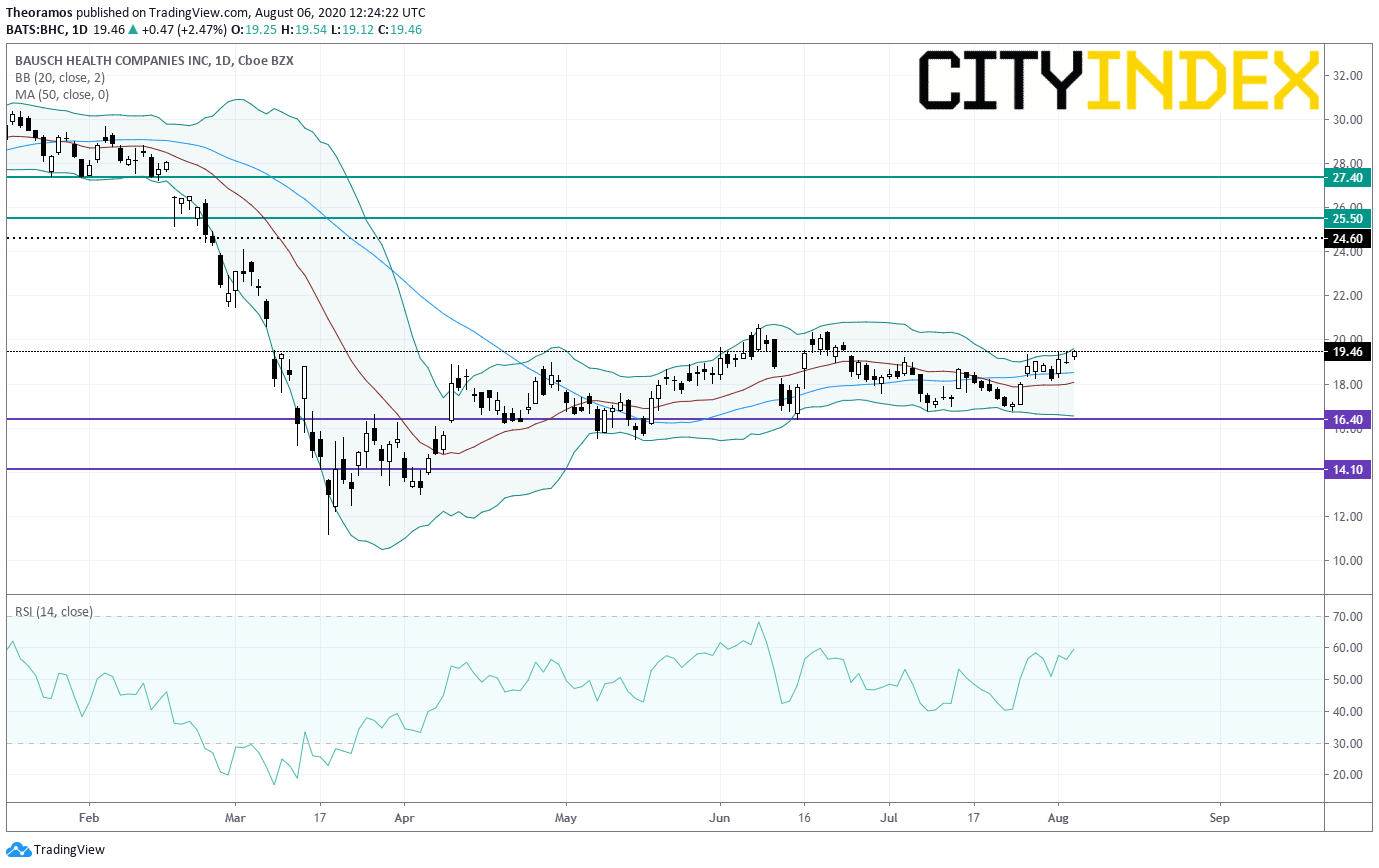

Bausch Health (BHC), the pharma company, is soaring before hours after the Wall Street Journal reported that the company plans to spin off its eye-care business.

Source: TradingView, Gain Capital

Bristol-Myers Squibb (BMY), the biopharma company, is gaining ground before hours after posting quarterly earnings that beat estimates and raising its full year outlook.

Metlife (MET), a global insurance firm, reported second quarter adjusted EPS down to 0.83 dollar, below estimates, vs 1.46 dollar a year ago, on adjusted revenue of 758 million dollars, missing expectations, compared to 1.4 billion dollars a year earlier.

AIG (AIG), the insurer, was upgraded to "buy" from "neutral" at BofA Securities.

Roku (ROKU), the video streaming platform, announced second quarter LPS of 0.35 dollar, narrower than estimated. The company added 3.2 million active accounts totaling 43 million.

Western Digital (WDC), a developer of data storage solutions, reported fourth quarter adjusted EPS of 1.23 dollar on revenue of 4.29 billion dollars, below estimates. The company expects first quarter sales between 3.7 and 3.9 billion dollars and adjusted EPS between 0.45 and 0.65 dollar, below current consensus.