US Futures rebounding on increasing oil, watch DD, FCAU, MPC, SWKS, AIG, LB

Later today, March U.S. Trade Balance (deficit of 44.2 billion dollars expected), April Markit U.S. Services Purchasing Managers' Index (final reading, 27.0 expected) and Institute for Supply Management's (ISM) Non-Manufacturing Index (37.8 expected) will be reported.

European indices are volatile as German judges assessed the ECB’s quantitative easing program, which was introduced in 2015, and said it partially violates the law. But this decision does not concern financial assistance measures taken by the EU or the ECB in the context of the current Covid-19 crisis. Research firm Markit has published final readings of April Services PMI for the U.K. at 13.4 (vs 12.3 expected). The European Commission has posted March PPI at -2.8 (vs -2.6% on year expected).

Asian indices closed on the upside. Japan and China are still closed. The Reserve Bank of Australia has kept its interest rate unchanged at 0.25% this morning.

WTI Crude Oil Futures remain on the upside. Later today, API would release the change of U.S. oil stockpile data for May 1.

Gold eased 4.2 dollars (-0.25%) to 1697.87 dollars per ounce, on some easing lockdown restrictions, but still flirting with the 1700 dollars level.

On the forex front, EUR/USD dropped 70pips to 1.0837, under pressure following the German judges comments. USD/CAD fell 34pips to 1.4053 on bouncing oil.

US Equity Snapshot

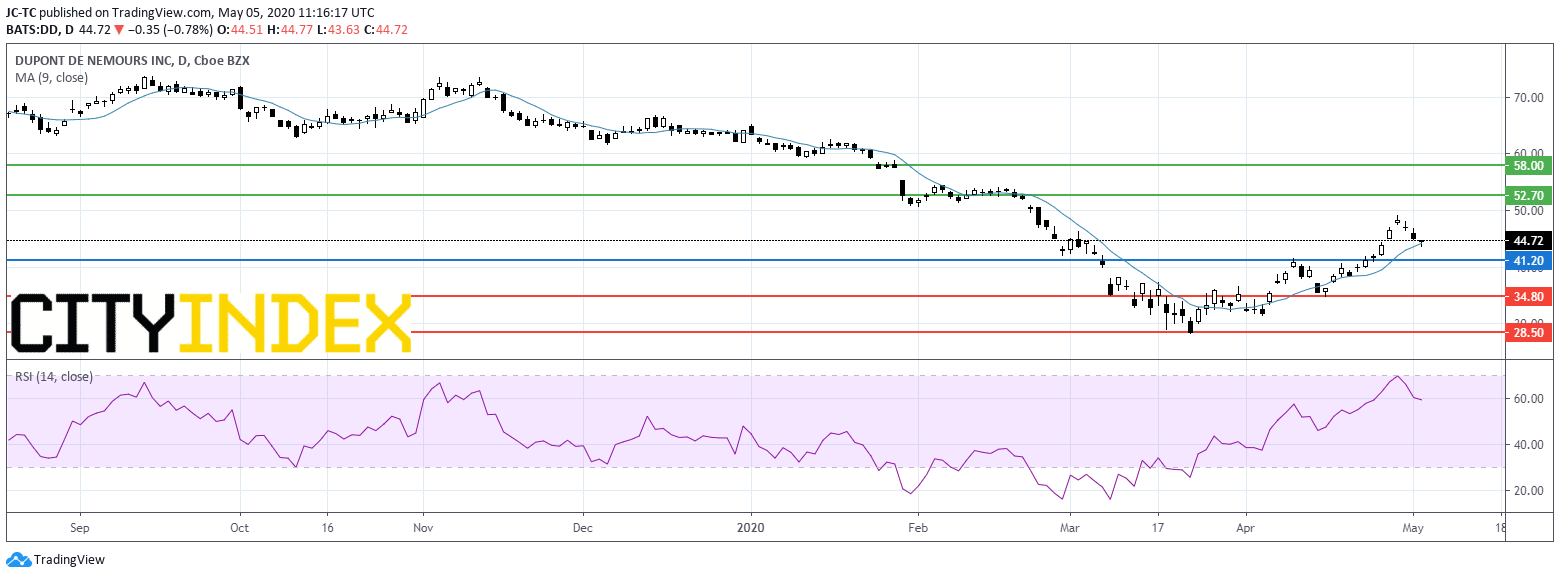

DuPont de Nemours (DD), the diversified specialty chemicals company, reported first quarter adjusted EPS flat at 0.84 dollar, above estimates. Sales were down to 5.22 billion dollars from 5.41 billion dollars a year earlier, but also beat forecasts.

Fiat Chrysler Automobiles (FCAU), the carmaker, unveiled first quarter net loss of 1.69 billion euros vs a net profit of 508 million euros a year earlier. The company withdraws its full year forecasts. It is still committed to completing the 50/50 merger with Peugeot by the end of this year or early 2021.

Marathon Petroleum (MPC), one of the largest U.S. oil refiners, jumps before hours after reporting a smaller than expected first quarter adjusted LPS of 0.16 dollar.

Skyworks Solutions (SWKS), the producer of wireless semiconductors, released second quarter adjusted EPS down to 1.34 dollar, just above the forecast, from 1.47 dollar a year ago on revenue down to 766.1 million dollars, also just ahead of the consensus, from 810.4 million dollars a year earlier.

AIG (AIG), the global insurance and financial services firm, posted first quarter adjusted EPS of 0.11 dollar, significantly missing the consensus, down from 1.58 dollar a year ago. The company is withdrawing previously issued guidance.

Diamondback Energy (FANG), the independent oil and gas producer in the US, disclosed first quarter adjusted EPS of 1.45 dollar, beating estimates, up from 1.39 dollar a year ago on revenue of 899.0 million dollars up from 864.0 million dollars in the prior year.

L Brands (LB), the fashion retailer, reported that it has reached a mutual agreement with private equity firm Sycamore Partners to terminate their previously announced transaction. In April, the company sued to force Sycamore Partners to complete the acquisition of a controlling stake in lingerie brand Victoria's Secret.

Source : TradingVIEW, Gain Capital