European indices remain strong. July Markit Services PMI (final reading) were released for the Eurozone at 54.7 (vs 55.1 expected), for Germany at 55.6 (vs 56.7 expected), for France at 57.3 (vs 57.8 expected) and for the U.K. at 56.5 (vs 56.6 expected). June European Retail sales were released at +5.7%, vs +5.9% on month expected.

Asian indices closed in dispersed order as Japanese Nikkei and Australian ASX lost ground when Hong Kong HSI and Chinese CSI were up. July Chinese Caixin Services PMI was released at 54.1, below the 56.0 expected.

WTI Crude Oil futures are bullish. The American Petroleum Institute (API) reported that U.S. crude-oil inventories fell 8.6 million barrels last week, the biggest decline since August 2019. Later today, the Energy Information Administration (EIA) will release official crude oil inventories data for the same week (-3.001M bbl expected).

Gold extends record rally as the US dollar weakens and investors bet for new stimulus measures.

Gold rose 20.78 dollars (+1.03%) to 2039.99 dollars while the dollar index declined 0.37pt to 93.014.

U.S. Equity Snapshot

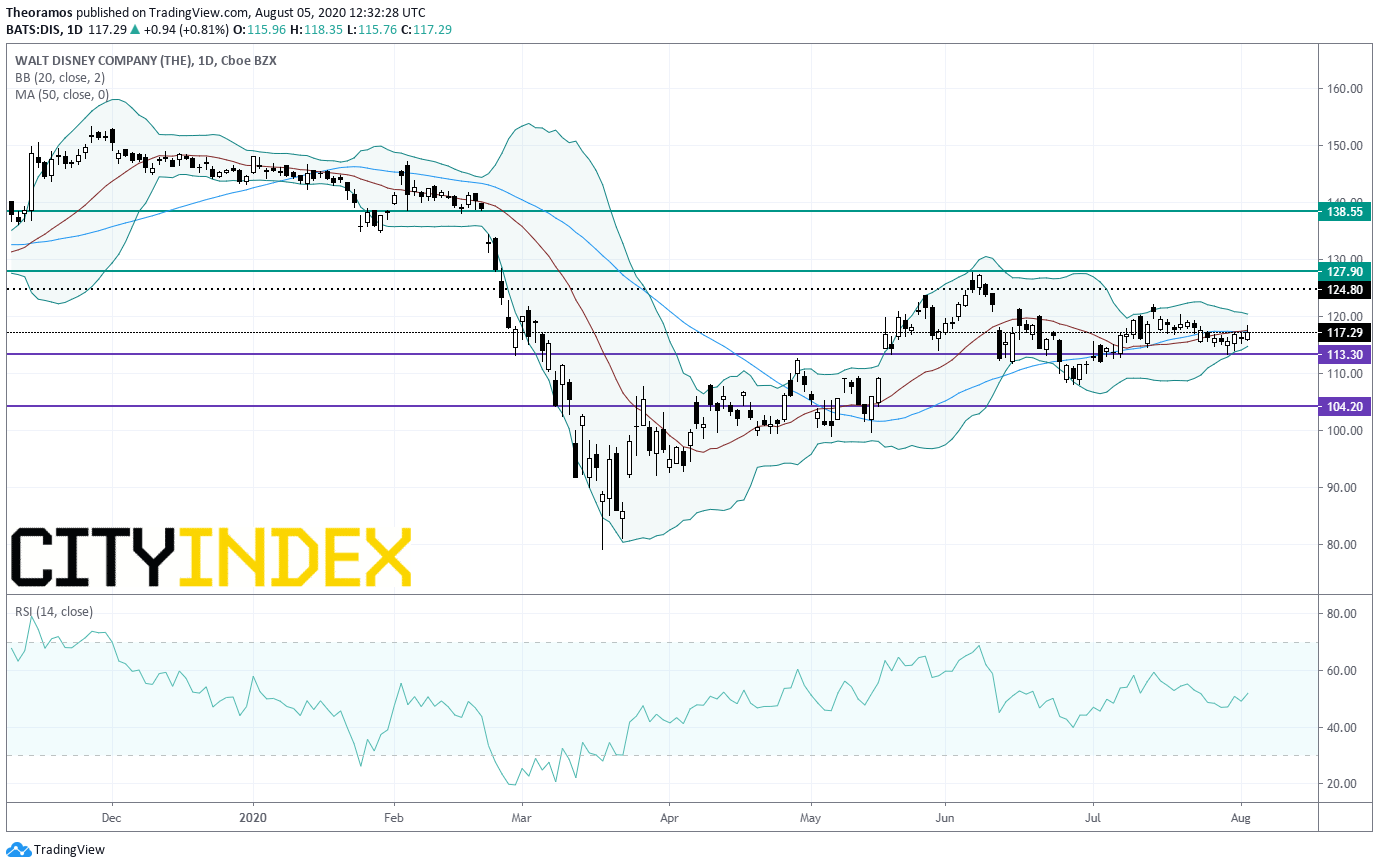

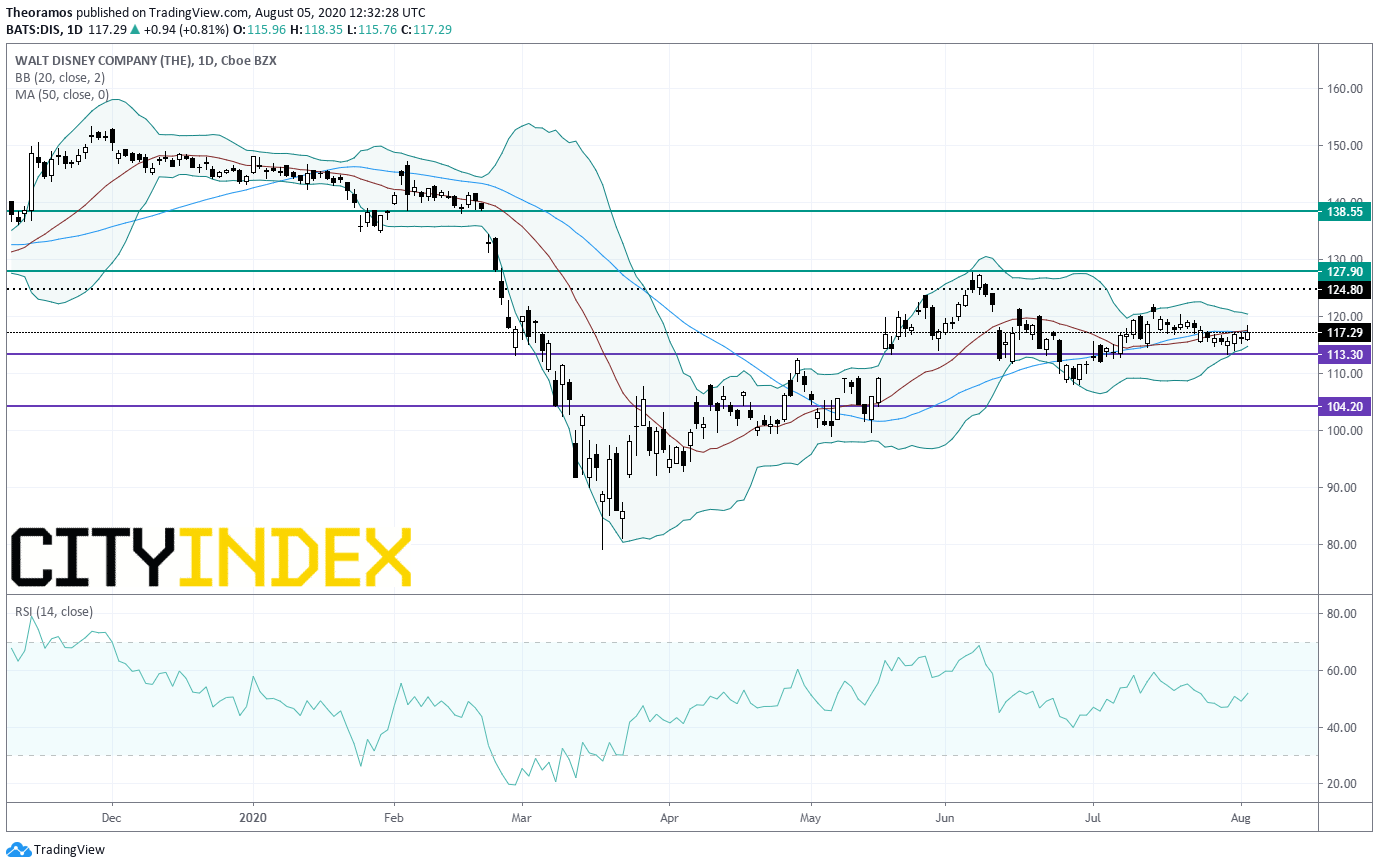

Walt Disney (DIS), the entertainment and media giant, posted third quarter adjusted EPS of 0.08 dollar, beating estimates, vs 1.34 dollar a year earlier. Sales came in down 42% at 11.78 billion dollars, below forecasts. Disney+ subscribers fell short of estimates. The company's theme parks lost 1.96 billion dollars in the quarter compared to a gain of 1.72 billion dollars a year earlier. The stock was upgraded to "outperform" from "neutral" at Credit Suisse.

Source: TradingView, Gain Capital

Apple (AAPL), the tech giant, was downgraded to "neutral" from "buy" at BofA.

CVS Health (CVS), the pharmacy and healthcare company, is surging before hours after reporting quarterly earnings that beat estimates and raising full year forecasts.

Activision Blizzard (ATVI), one of the world's largest video game publishers, lost ground after hours after hitting a record high on Tuesday. The company warned that "economic uncertainty could have an impact on near-term results". Separately, Activision Blizzard reported second quarter adjusted EPS of 0.97 dollar beating estimates, compared to 0.38 dollar a year ago, on revenue of 2.08 billion dollars, beating forecasts, vs 1.2 billion dollars a year earlier. Moreover, the company raised its full-year outlook.

Beyond Meat (BYND), a producer of plant-based meat substitutes, reported a second quarter adjusted LPS of 0.02 dollar, beating estimates, vs an adjusted EPS of 0.05 dollar a year ago. Revenue increased to 113.3 million dollars up from 67.3 million dollars a year earlier. The Co suspended its full-year outlook until further notice.

Tyson Foods (TSN), the largest US producer of processed chicken and beef, was downgraded to "neutral" from "outperform" at Credit Suisse.

Allstate (ALL), the insurance company, released second quarter adjusted EPS of 2.46 dollars, beating estimates, vs 2.08 dollars a year ago.

US Futures pare gains - Watch DIS, AAPL, CVS, ATVI, BYND, TSN

The S&P 500 Futures cut some of their gains after a disappointing ADP Jobs Report. Yesterday, investors were pleased to hear Senate Minority Leader Chuck Schumer (Democrat., N.Y.) saying that negotiations between Democrats and Republicans on new coronavirus relief measures were in the right direction.

Later today, ISM Services Index (49.6 for July expected) will be published.European indices remain strong. July Markit Services PMI (final reading) were released for the Eurozone at 54.7 (vs 55.1 expected), for Germany at 55.6 (vs 56.7 expected), for France at 57.3 (vs 57.8 expected) and for the U.K. at 56.5 (vs 56.6 expected). June European Retail sales were released at +5.7%, vs +5.9% on month expected.

Asian indices closed in dispersed order as Japanese Nikkei and Australian ASX lost ground when Hong Kong HSI and Chinese CSI were up. July Chinese Caixin Services PMI was released at 54.1, below the 56.0 expected.

WTI Crude Oil futures are bullish. The American Petroleum Institute (API) reported that U.S. crude-oil inventories fell 8.6 million barrels last week, the biggest decline since August 2019. Later today, the Energy Information Administration (EIA) will release official crude oil inventories data for the same week (-3.001M bbl expected).

Gold extends record rally as the US dollar weakens and investors bet for new stimulus measures.

Gold rose 20.78 dollars (+1.03%) to 2039.99 dollars while the dollar index declined 0.37pt to 93.014.

U.S. Equity Snapshot

Walt Disney (DIS), the entertainment and media giant, posted third quarter adjusted EPS of 0.08 dollar, beating estimates, vs 1.34 dollar a year earlier. Sales came in down 42% at 11.78 billion dollars, below forecasts. Disney+ subscribers fell short of estimates. The company's theme parks lost 1.96 billion dollars in the quarter compared to a gain of 1.72 billion dollars a year earlier. The stock was upgraded to "outperform" from "neutral" at Credit Suisse.

Source: TradingView, Gain Capital

Apple (AAPL), the tech giant, was downgraded to "neutral" from "buy" at BofA.

CVS Health (CVS), the pharmacy and healthcare company, is surging before hours after reporting quarterly earnings that beat estimates and raising full year forecasts.

Activision Blizzard (ATVI), one of the world's largest video game publishers, lost ground after hours after hitting a record high on Tuesday. The company warned that "economic uncertainty could have an impact on near-term results". Separately, Activision Blizzard reported second quarter adjusted EPS of 0.97 dollar beating estimates, compared to 0.38 dollar a year ago, on revenue of 2.08 billion dollars, beating forecasts, vs 1.2 billion dollars a year earlier. Moreover, the company raised its full-year outlook.

Beyond Meat (BYND), a producer of plant-based meat substitutes, reported a second quarter adjusted LPS of 0.02 dollar, beating estimates, vs an adjusted EPS of 0.05 dollar a year ago. Revenue increased to 113.3 million dollars up from 67.3 million dollars a year earlier. The Co suspended its full-year outlook until further notice.

Tyson Foods (TSN), the largest US producer of processed chicken and beef, was downgraded to "neutral" from "outperform" at Credit Suisse.

Allstate (ALL), the insurance company, released second quarter adjusted EPS of 2.46 dollars, beating estimates, vs 2.08 dollars a year ago.

Latest market news

Today 04:24 AM

Yesterday 10:48 PM

Yesterday 02:00 PM

Yesterday 01:14 PM