US futures contract slightly up, watch Morgan Stanley, Bed Bath & Beyond, Gilead Sciences, Alphabet

The S&P 500 Futures are trying to rebound after they closed lower yesterday, as worse-than-expected economic data showed that effects of the coronavirus pandemic is weighing in.

Later today, initial jobless claims for the week ended April 11 (5.100 million expected) and March housing starts (1.300 million units annualized) will be reported. The Philadelphia Federal Reserve will post its Business Outlook Index for April (-30.0 expected). In Canada, February Manufacturing sales are expected at -0.1% on month.European indices are posting a tentative rebound. The European Commission has reported February industrial production at -0.1% (vs -0.2% on month expected). The German Federal Statistical Office has reported final readings of March CPI at +1.4% on year, as expected.

Asian indices mostly closed in the red. This morning, official data showed that the Australian economy added 5,900 jobs in March (-30,000 jobs expected), while jobless rate edged up to 5.2% (5.4% estimated) from 5.1% in February.

WTI Crude Oil Futures remain under pressure. The U.S. Energy Information Administration (EIA) reported that crude oil stockpiles increased by 19.25 million barrels last week, the largest addition on record.

On the currencies side, the US dollar is consolidating before the release of economic datas

US Equity Snapshot

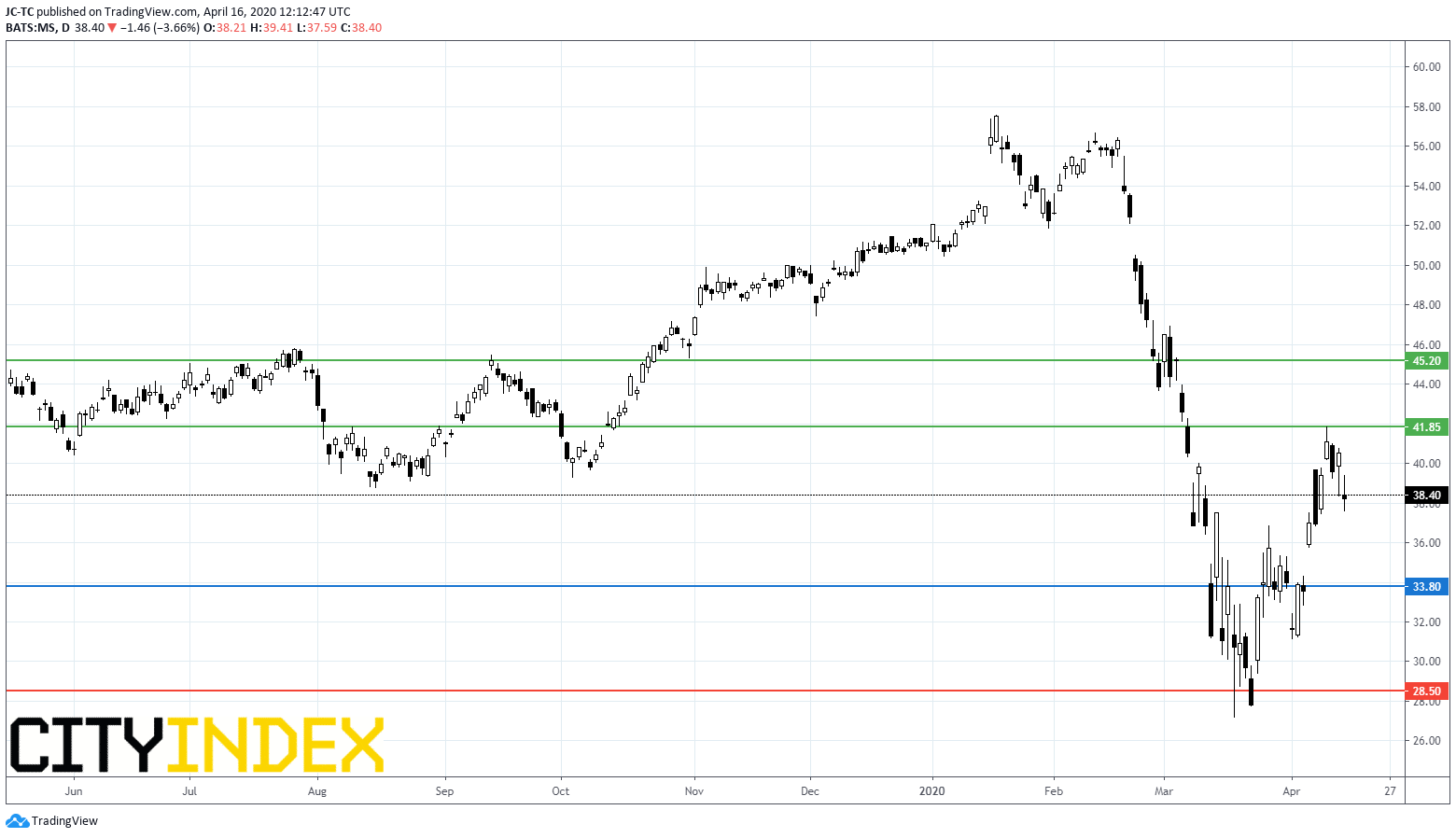

Morgan Stanley (MS), the banking group, unveiled first quarter adjusted EPS down to 0.99 dollar, below estimates, from 1.33 dollar a year earlier. FICC sales & trading revenue jumped 29% to 2.20 billion dollars, beating consensus.

Bed Bath & Beyond (BBBY), the home furnishing retail chain, soared in extended trading after posting fourth quarter adjusted EPS down to 0.38 dollar, above estimates, down from 1.20 dollar a year ago, on net sales down 3.1 billion dollars, but better than expected, from 3.3 billion dollars last year.

Gilead Sciences (GILD), a biotechnology group, is planning to acquire a significant stake in cancer therapies company Arcus Biosciences (RCUS), reported Bloomberg.

Alphabet (GOOGL), a technology conglomerate, will significantly slow down the pace of hiring for the rest of the year, while recalibrating the focus and pace of its investments in areas like data centers and machines, reported Bloomberg citing an internal email.

BlackRock (BLK), the investment management firm, reported first quarter adjusted EPS nearly flat at 6.60 dollars from 6.61 dollars a year earlier, on sales up to 3.71 billion dollars from 3.35 billion dollars a year earlier. Both figures beat estimates. Quarterly dividend is raised 10% to 3.63 dollars per share.

Bank of New York Mellon (BK), the banking group, unveiled better than expected first quarter adjusted EPS up to 1.05 dollar from 0.94 dollar a year earlier.