US futures red – watch ABBV, AVGO, KMB, JWN

Later today, the closely watched non-farm payrolls report for August will be released (+1.35 million jobs, jobless rate at 9.8% expected).

European indices are struggling to rebound. Research firm Markit has published August Construction PMI in the U.K. at 54.6 (vs 58.3 expected) and at 48.0 in Germany, vs 49.7 in July. The German Federal Statistical Office has reported July factory orders at +2.8%, below +5.0% on month expected.

Asian indices all closed in the red. This morning, official data showed that Australia's retail sales grew 3.2% on month in July (+3.3% expected).

WTI Crude Oil futures are posting a tentative rebound. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold gains ground as the US dollar consolidates before US jobs data.

Gold rose 8.16 dollars (+0.42%) to 1939.06 dollars.

The dollar index gained 0.05pt to 92.791.

US Equity Snapshot

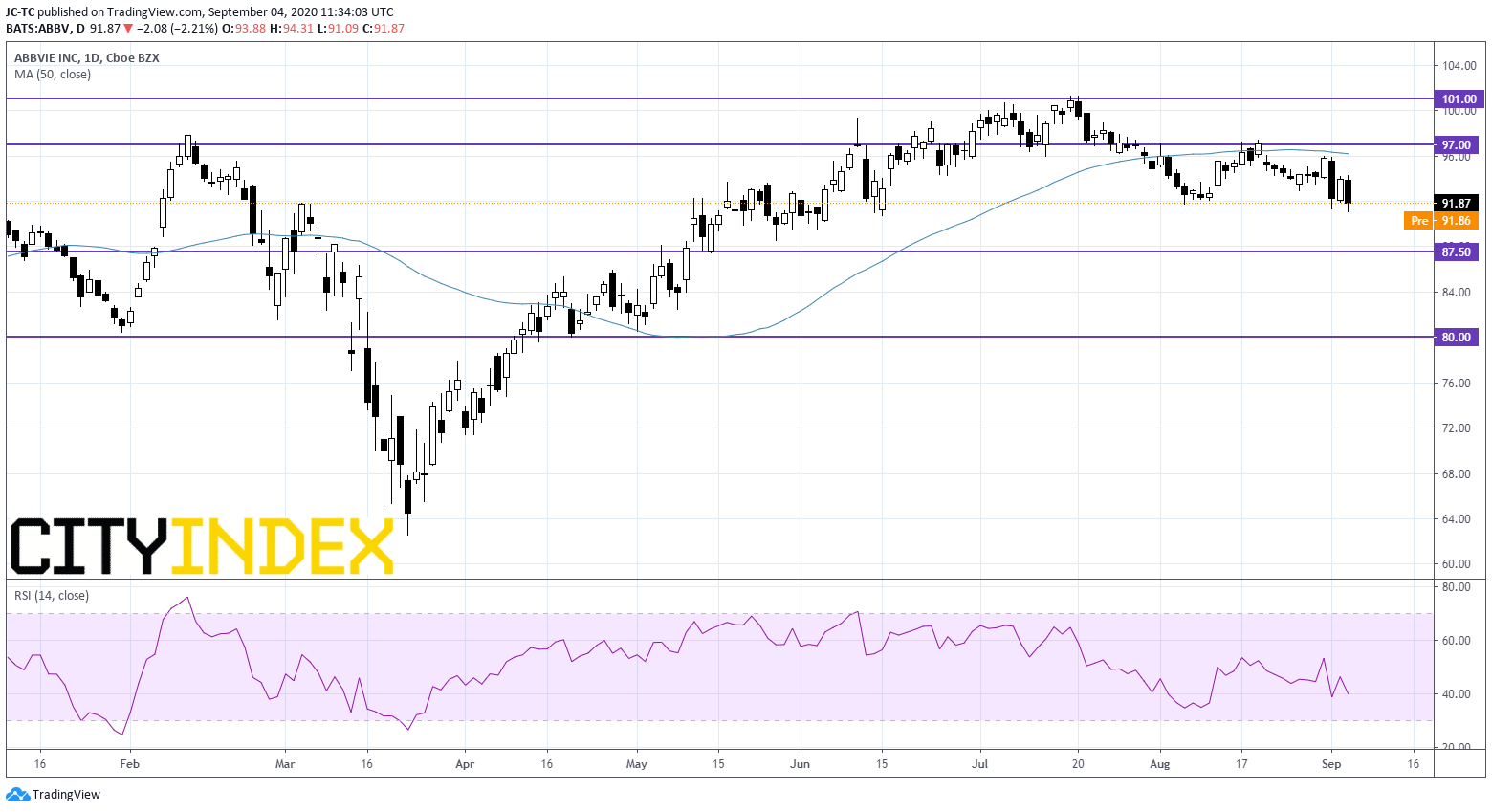

AbbVie (ABBV), a pharmaceutical company, and I-MAB (IMAB) have reached a deal worth 2.9 billion dollars regarding a cancer treatment.

Source : TradingVIEW, Gain Capital

Broadcom (AVGO), a developer of a range of semiconductors, announced third quarter adjusted EPS of 5.40 dollars, beating estimates, up from 5.16 dollars a year earlier, on adjusted net revenue of 5.8 billion dollars, as expected, up from 5.5 billion dollars a year ago.

Kimberly-Clark (KMB), a personal care products manufacturer, announced that it has agreed to acquire Softex Indonesia, "a leader in the fast-growing Indonesian personal care market", in an all-cash transaction for 1.2 billion dollars from a group of shareholders including CVC Capital Partners Asia Pacific.

Nordstrom's (JWN), the fashion retailer, long-term credit rating was downgraded to "BB+", or junk, from "BBB-" by S&P Global Ratings. The outlook remains negative.

Lululemon Athletica (LULU), a designer of athletic accessories and apparel, was downgraded to "neutral" from "buy" at Citi.

Cooper (COO), a medical device company, released third quarter adjusted EPS of 2.28 dollars, exceeding the consensus, down from 3.23 dollars a year ago, on net sales of 578.2 million dollars, better than expected, down from 679.4 million dollars a year earlier.