U.S Futures up – Watch UBER, LYFT, AMD, PRU, ES

The S&P 500 Futures are on the upside after a night of significant volatility due to US presidential election uncertainties.

Later today, in the U.S. the Automatic Data Processing (ADP) will post private jobs for October (+0.65 million jobs expected). The Commerce Department will release September trade balance (63.9 billion dollars deficit expected). The Institute for Supply Management will report its Services Index for October (57.5 expected). Research firm Markit will publish final readings of October Services PMI (56.0 expected).

European indices are mostly trading higher. On the economic data front, Research firm Markit published final readings of October Services PMI better than expected for the Eurozone at 46.9 (46.2 expected), Germany at 49.5 (48.9 expected), and France 46.5 (as expected) but below expectorations for the U.K. at 51.4 (52.3 expected). In the U.K., later today, MPs will vote on introducing a new national lockdown for England. The Prime Minister Boris Johnson is continuing to face a backlash from his own Conservative MPs over the fresh shutdown.

Asian indices closed mixed, with the Japanese Nikkei and the mainland China CSI 300 ending higher while Hong Kong HSI and Australian ASX 200 ended slightly lower.

WTI Crude Oil futures are extending their rebound after the American Petroleum Institute (API) reported that U.S. crude-oil inventories dropped 8.0M barrels in the week ending October 30. Later today, the U.S. Energy Information Administration (EIA)will release official crude oil inventories data for the same period.

US indices closed up on Tuesday, lifted by Commercial & Professional Services (+3.08%), Capital Goods (+2.95%) and Transportation (+2.73%) sectors.

Gold and U.S dollar consolidate on U.S election uncertainty.

Gold fell 5.57 dollars (-0.29%) to 1903.6 dollars.

The dollar index was almost flat at 93.576.

U.S. Equity Snapshot

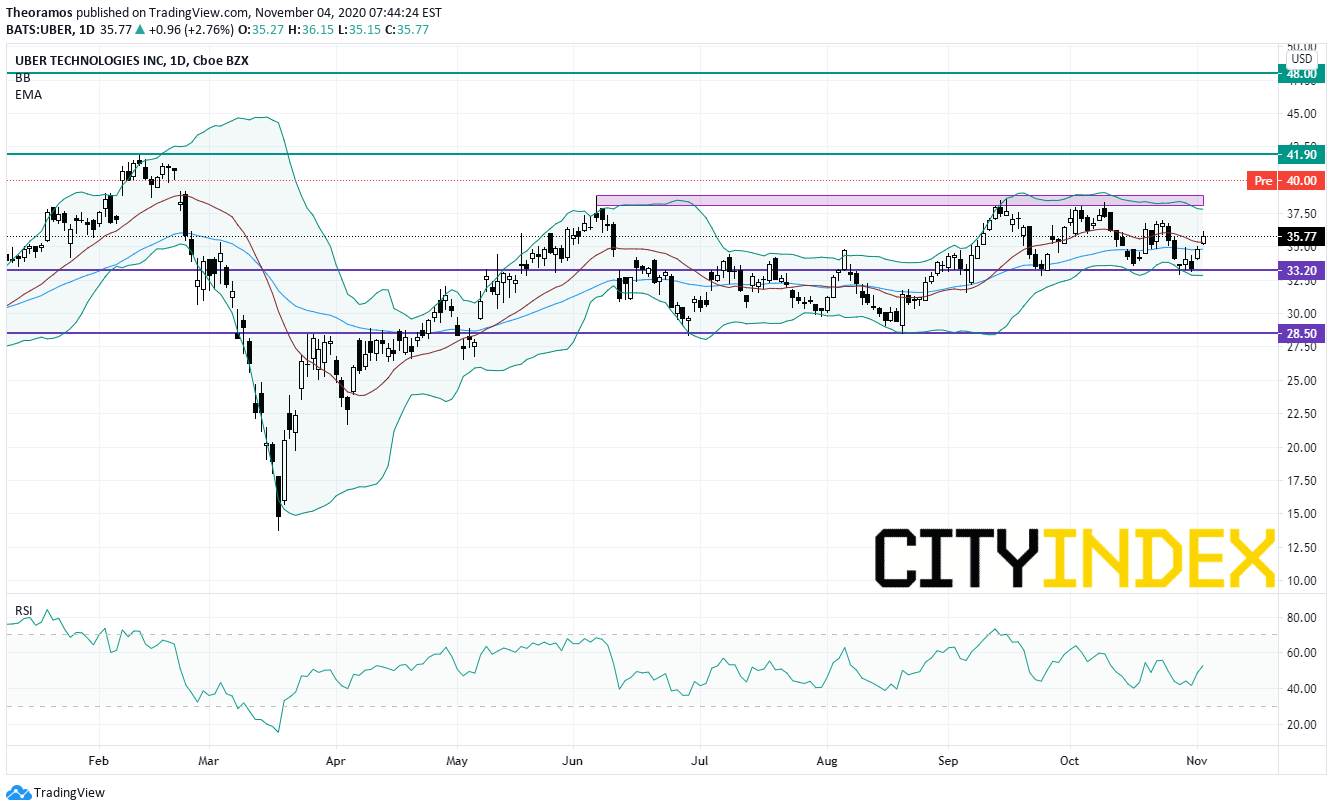

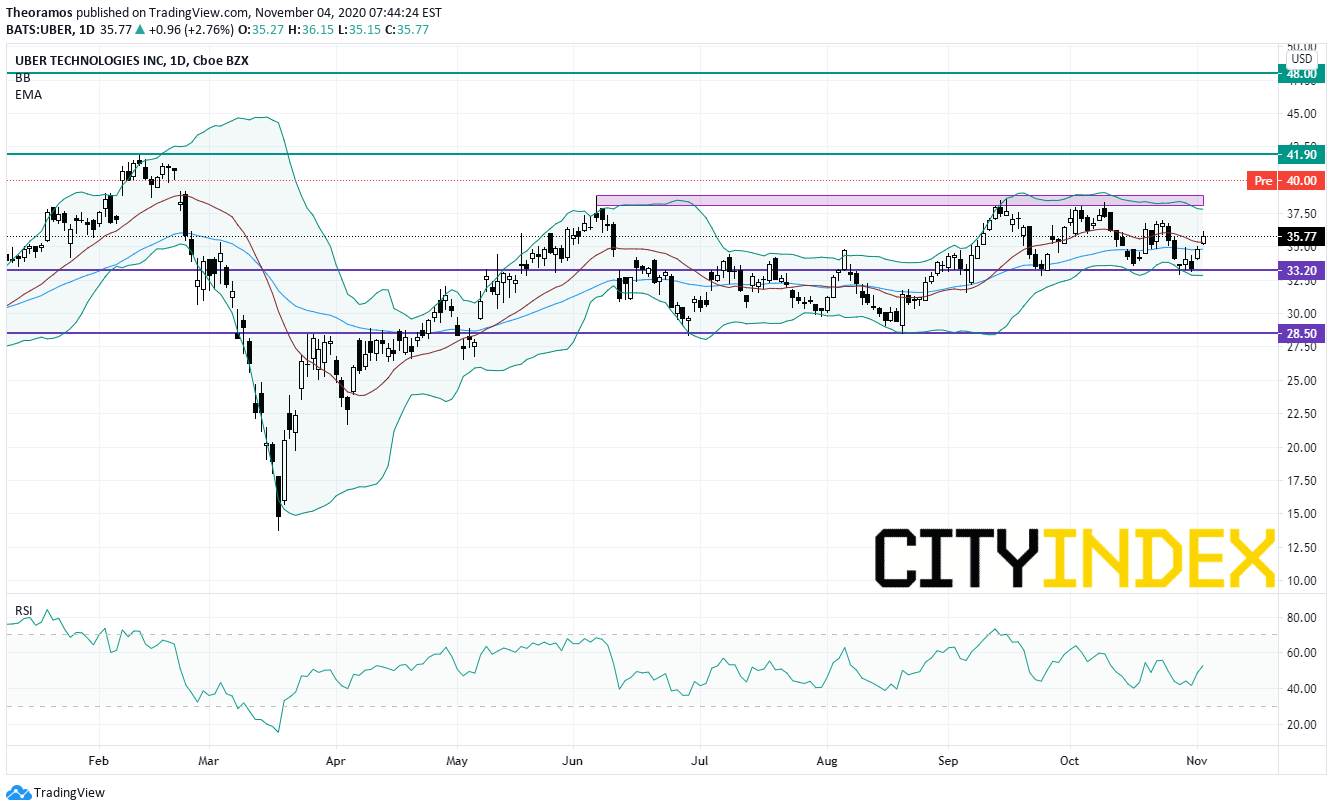

Uber (UBER) and Lyft (LYFT), the ridesharing companies, jump premarket after having won a California vote that exempt them to employ drivers.

Source: TradingView, GAIN Capital

Prudential Financial (PRU), a diversified insurance company, reported third quarter adjusted EPS of 3.21 dollars, exceeding estimates, down from 3.22 dollars a year ago.

Eversource Energy (ES), a holding company for regulated electric, gas and water distribution services, announced third quarter EPS of 1.01 dollar, just shy of forecasts, up from 0.98 dollar a year ago on revenue of 2.3 billion dollars, as expected, up from 2.2 billion dollars a year earlier.

Later today, in the U.S. the Automatic Data Processing (ADP) will post private jobs for October (+0.65 million jobs expected). The Commerce Department will release September trade balance (63.9 billion dollars deficit expected). The Institute for Supply Management will report its Services Index for October (57.5 expected). Research firm Markit will publish final readings of October Services PMI (56.0 expected).

European indices are mostly trading higher. On the economic data front, Research firm Markit published final readings of October Services PMI better than expected for the Eurozone at 46.9 (46.2 expected), Germany at 49.5 (48.9 expected), and France 46.5 (as expected) but below expectorations for the U.K. at 51.4 (52.3 expected). In the U.K., later today, MPs will vote on introducing a new national lockdown for England. The Prime Minister Boris Johnson is continuing to face a backlash from his own Conservative MPs over the fresh shutdown.

Asian indices closed mixed, with the Japanese Nikkei and the mainland China CSI 300 ending higher while Hong Kong HSI and Australian ASX 200 ended slightly lower.

WTI Crude Oil futures are extending their rebound after the American Petroleum Institute (API) reported that U.S. crude-oil inventories dropped 8.0M barrels in the week ending October 30. Later today, the U.S. Energy Information Administration (EIA)will release official crude oil inventories data for the same period.

US indices closed up on Tuesday, lifted by Commercial & Professional Services (+3.08%), Capital Goods (+2.95%) and Transportation (+2.73%) sectors.

Approximately 67% of stocks in the S&P 500 Index were trading above their 200-day moving average and 33% were trading above their 20-day moving average. The VIX Index dropped 1.58pt (-4.26%) to 35.55 and WTI Crude Oil gained $1.05 (+2.85%) to $37.86 at the close.

On the US economic data front, Factory Orders increased 1.1% on month in September (+1.0% expected), compared to a revised +0.6% in August. Finally, Durable Goods Orders rose 1.9% on month in the September final reading (as expected), in line with the September preliminary reading.Gold and U.S dollar consolidate on U.S election uncertainty.

Gold fell 5.57 dollars (-0.29%) to 1903.6 dollars.

The dollar index was almost flat at 93.576.

U.S. Equity Snapshot

Uber (UBER) and Lyft (LYFT), the ridesharing companies, jump premarket after having won a California vote that exempt them to employ drivers.

Source: TradingView, GAIN Capital

Advanced Micro Devices (AMD), a semiconductor company, was upgraded to "buy" from" neutral" at Goldman Sachs.

Prudential Financial (PRU), a diversified insurance company, reported third quarter adjusted EPS of 3.21 dollars, exceeding estimates, down from 3.22 dollars a year ago.

Eversource Energy (ES), a holding company for regulated electric, gas and water distribution services, announced third quarter EPS of 1.01 dollar, just shy of forecasts, up from 0.98 dollar a year ago on revenue of 2.3 billion dollars, as expected, up from 2.2 billion dollars a year earlier.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM